Press release

Digital Payment Market: Emerging Trends, Capital Allocation, and Outlook

The digital payment market continues to evolve as a core pillar of the global financial ecosystem, driving the transition from cash-based to cashless economies. With an estimated market size of USD 122 billion in 2025, the industry is projected to reach USD 755.3 billion by 2035, marking a robust growth forecast of 20% between 2026 and 2035. This remarkable expansion reflects the increasing adoption of mobile wallets, QR-based transactions, and contactless payment solutions across both developed and emerging economies.The global shift toward financial inclusion, enhanced security standards, and the proliferation of smartphones has fundamentally reshaped consumer expectations and payment behavior. Governments and regulatory bodies are also actively supporting the digitalization of payments to promote transparency, economic efficiency, and accessibility. Businesses across sectors-from retail and hospitality to education and transportation-are adopting digital payment systems to streamline transactions and improve customer experience.

As a result, the Digital Payment Market stands at the intersection of fintech innovation, evolving consumer demand, and policy-driven modernization, serving as a critical enabler of the digital economy worldwide.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8097

Regional Performance Highlights

North America remains a global frontrunner, accounting for 39.2% of the Digital Payment Market share. The region's dominance is driven by early technology adoption, the rise of contactless cards, and growing trust in fintech platforms. The U.S. and Canada have established advanced payment infrastructures with wide acceptance of mobile wallets such as Apple Pay, Google Pay, and PayPal. The rapid expansion of real-time payment networks and regulatory support for open banking are further strengthening market maturity in this region.

Europe is expected to register significant growth from 2026 to 2035, fueled by strong government initiatives promoting digital banking and seamless cross-border payments. The region's focus on interoperability and standardization has accelerated innovation in B2B, B2C, and P2P payments. The European Central Bank's commitment to advancing the Digital Euro highlights the region's dedication to a unified digital finance ecosystem.

Asia Pacific, on the other hand, is emerging as the fastest-growing region, projected to record a CAGR of 18% from 2026 to 2035. With countries like India, China, and Indonesia leading in mobile payment adoption, Asia Pacific is redefining the global payments landscape. Initiatives such as India's Unified Payments Interface (UPI), China's Alipay ecosystem, and Southeast Asia's digital wallet boom are driving financial inclusion and cross-border digital commerce. The rapid rise in internet penetration and smartphone usage continues to propel regional expansion.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Digital Payment Market Report Overview here: https://www.researchnester.com/reports/digital-payment-market/8097

Segmental Insights

The Point of Sale (POS) segment dominates the Digital Payment Market, commanding a 59% market share in 2025. The POS ecosystem has evolved from traditional hardware to cloud-based and mobile POS solutions, offering merchants enhanced flexibility, data analytics, and omnichannel integration. Retailers, restaurants, and small businesses are increasingly adopting contactless POS terminals to meet consumer expectations for fast, safe, and touch-free transactions.

Meanwhile, the solutions segment is projected to account for 64.5% of the market share through 2035. This segment includes software platforms, payment gateways, APIs, and fraud detection tools that support seamless and secure digital transactions. Businesses are leveraging AI-powered analytics and blockchain-based platforms to enhance transaction transparency, reduce fraud, and improve operational efficiency.

Together, these segments reflect the broader evolution toward a fully integrated digital payment infrastructure-where convenience, security, and scalability define competitive advantage.

➤ Discover how the Digital Payment Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-8097

Top Market Trends

1. Rise of Contactless and Mobile Payments

The post-pandemic shift toward hygiene-focused transactions has permanently boosted the adoption of contactless and mobile payments. Consumers now prefer tap-to-pay cards, QR-based systems, and NFC-enabled smartphones over traditional cash or card swipes. Platforms like Apple Pay, Google Wallet, and Samsung Pay are leading this transformation, supported by global merchants who continue to upgrade POS infrastructure to accept digital payments. Contactless payments are also being integrated into public transport systems and microtransactions, expanding their daily use cases.

2. Integration of Blockchain and AI for Secure Transactions

As digital payments expand, security and transparency have become top priorities. Blockchain technology is being utilized to reduce fraud, enable faster settlements, and provide tamper-proof transaction records. Meanwhile, artificial intelligence (AI) and machine learning algorithms are improving fraud detection, enabling banks and fintechs to identify anomalies in real time. Companies are increasingly adopting AI-driven risk scoring models and behavioral biometrics to safeguard customer data and maintain compliance with global data protection standards.

3. Growth of Buy Now, Pay Later (BNPL) and Embedded Finance

The growing popularity of Buy Now, Pay Later (BNPL) solutions represents one of the most disruptive trends in the Digital Payment Market. Consumers are attracted to flexible payment options without interest charges, while retailers benefit from increased conversion rates. Fintech innovators like Klarna, Afterpay, and Affirm are expanding their global presence, integrating BNPL services directly into e-commerce checkout systems. Additionally, embedded finance-where payment functionalities are seamlessly integrated into non-financial platforms-continues to blur the lines between banking, retail, and technology ecosystems.

➤ Stay ahead of the curve with the latest Digital Payment Market trends. Claim your sample report → https://www.researchnester.com/sample-request-8097

Recent Company Developments

1. PayPal Holdings Inc. - PayPal expanded its "Pay Later" services across multiple regions and introduced advanced AI-based fraud management tools in 2024 to improve transaction security and personalization.

2. Visa Inc. - Visa launched new cross-border payment APIs aimed at facilitating real-time international remittances. The company also strengthened its partnerships with fintech startups to accelerate innovation in mobile payment infrastructure.

3. Mastercard Incorporated - Mastercard enhanced its digital identity and cybersecurity frameworks through strategic collaborations. The company also advanced its tokenization technology, enabling safer online transactions.

4. Square Inc. (Block) - Block invested heavily in its Cash App ecosystem, integrating cryptocurrency payments and expanding merchant services. The company's new "Tap to Pay" feature supports contactless transactions on iPhones and Android devices.

5. Stripe Inc. - Stripe extended its services into Africa and Southeast Asia, focusing on developer-friendly payment solutions. The firm launched new fraud prevention APIs and advanced billing features for subscription-based businesses.

Other notable players such as Adyen, Alipay (Ant Group), Amazon Pay, Worldline, and FIS Global have also been instrumental in advancing digital infrastructure through partnerships, new product rollouts, and policy advocacy for inclusive financial ecosystems.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8097

➤ Related News -

https://www.linkedin.com/pulse/how-iot-solutions-services-transforming-way-rujff/

https://www.linkedin.com/pulse/what-strategies-shaping-next-wave-iot-monetization-zvzbf/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market: Emerging Trends, Capital Allocation, and Outlook here

News-ID: 4257714 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

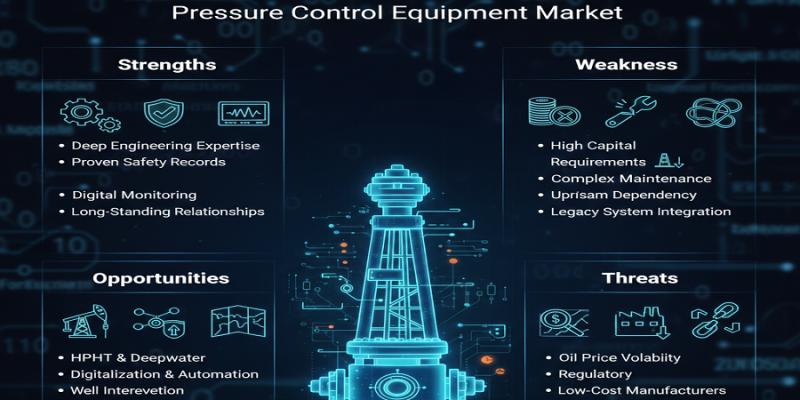

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

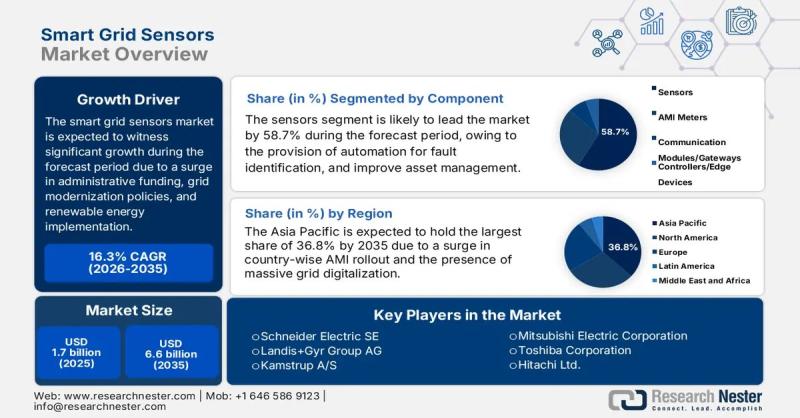

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…