Press release

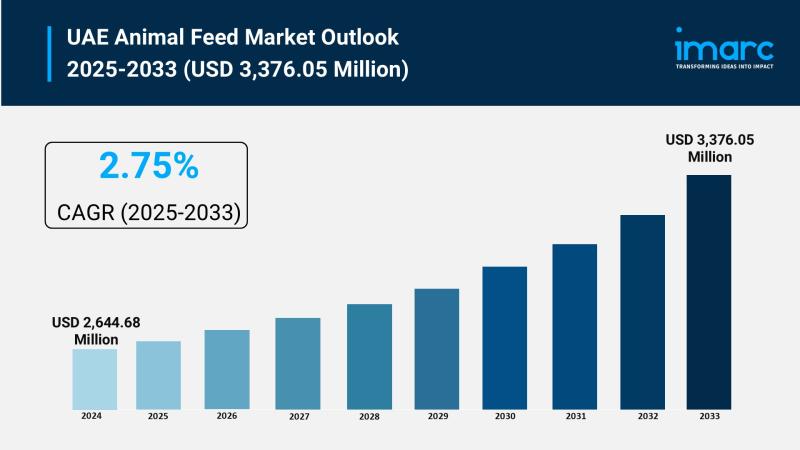

UAE Animal Feed Market Size is Expected to Reach USD 3,376.05 Million By 2033 | CAGR: 2.75%

UAE Animal Feed Market OverviewMarket Size in 2024: USD 2,644.68 Million

Market Size in 2033: USD 3,376.05 Million

Market Growth Rate 2025-2033: 2.75%

According to IMARC Group's latest research publication, "UAE Animal Feed Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE animal feed market size was valued at USD 2,644.68 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,376.05 Million by 2033, exhibiting a CAGR of 2.75% during 2025-2033.

How Sustainability and Innovation are Reshaping the Future of UAE Animal Feed Market

● Turning Food Waste into Feed: Australian agri-tech company núaFEEDs opened a factory in the UAE in July 2025, converting surplus bread waste into premium animal feed, offering a cost-effective and sustainable alternative while reducing landfill waste.

● Boosting Local Production Capacity: Al Ain Farms Group consolidated five major UAE food brands in May 2025, including Al Ain Farms, Marmum Dairy, and Al Ajban Chicken, creating a unified platform to strengthen local protein production and reduce import dependency.

● Advancing Feed Efficiency Technology: Agthia Group launched four specialized camel feed products, leveraging precision nutrition technology from Trouw Nutrition's NutriOpt platform to optimize animal performance and meet regional livestock needs.

● Meeting Growing Consumption Demand: The UAE currently consumes 3.00 million tonnes of animal feed annually, driven by rising demand for broiler meat production, with Abu Dhabi facilities like Agthia and Al Ghurair Foods producing 10,000 MT of poultry feed each year.

● Strengthening Regulatory Standards: The Ministry of Climate Change and Environment mandates that over 85% of feed imports undergo strict inspection at key ports like Jebel Ali and KIZAD, with mandatory GMO-free declarations ensuring quality and safety.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-animal-feed-market/requestsample

UAE Animal Feed Market Trends & Drivers:

The UAE's animal feed sector is experiencing a major transformation driven by the push for sustainability and local production. Food waste conversion has become a game-changer, with innovative companies like núaFEEDs setting up operations to transform surplus bread into high-quality livestock feed. This approach tackles two challenges at once-reducing the environmental burden of food waste while creating locally-produced feed alternatives. The government's decision back in 2006 to ban alfalfa cultivation to preserve underground water has made feed importation critical, with the country now bringing in around 2.5 million tonnes of hay annually. Dubai Municipality collects approximately 4,000 tonnes of food waste each year and repurposes it into organic fertilizers and animal feed, demonstrating how waste-to-feed initiatives support both sustainability goals and food security objectives.

Industry consolidation is reshaping the market landscape and driving production efficiency. The launch of Al Ain Farms Group in May 2025 brought together five iconic UAE food brands under one umbrella, backed by major investors Ghitha Holding and Yas Holding. This strategic merger aligns with the UAE's National Food Security Strategy 2051, creating a unified platform that operates across the entire farm-to-shelf value chain. The group ensures product freshness within 24 hours, supporting the country's aim to become regionally self-sufficient in protein production. Additionally, SEDCO Holding and Bugshan Investment completed the sale of Arabian Farms to AAFG, further strengthening the group's capacity. This consolidation trend isn't just about scale-it's about building resilient, integrated food systems that can adapt to market demands while supporting local farmers through long-term commitments and technical assistance.

Technology and precision nutrition are revolutionizing how feed is formulated and delivered across the Emirates. Leading producers like Agthia have partnered with global nutrition specialists such as Trouw Nutrition to deploy advanced feed optimization systems like NutriOpt. These platforms use real-time analysis and modeling to enhance animal performance while controlling costs. Agthia's introduction of four specialized camel feed products demonstrates the shift toward species-specific nutrition that addresses the unique requirements of regional livestock. The company's Agrivita brand holds a 42% market share in the UAE feed segment, operating state-of-the-art facilities that combine over 50 types of animal feed with innovative nutritional services. Major players like Al Dahra Holding, National Feed, and Gulf Feed Company are investing in automated production facilities and research partnerships with international centers to ensure feed quality meets both local regulations and global standards.

UAE Animal Feed Industry Segmentation:

The report has segmented the market into the following categories:

Form Insights:

● Pellets

● Crumbles

● Mash

● Others

Animal Type Insights:

● Swine (Starter, Finisher, and Grower)

● Ruminants (Calves, Dairy Cattle, Beef Cattle, and Others)

● Poultry (Broilers, Layers, Turkeys, and Others)

● Aquaculture (Carps, Crustaceans, Mackeral, Milkfish, Mollusks, Salmon, and Others)

● Others

Ingredient Insights:

● Cereals

● Oilseed Meal

● Molasses

● Fish Oil and Fish Meal

● Additives (Antibiotics, Vitamins, Antioxidants, Amino Acids, ● Feed Enzymes, Feed Acidifiers, and Others)

● Others

Breakup by Region:

● Dubai

● Abu Dhabi

● Sharjah

● Others

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=40388&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Animal Feed Market

● May 2025: Al Ain Farms Group was officially launched at the "Make it in the Emirates" Forum 2025, uniting five major UAE food brands including Al Ain Farms, Marmum Dairy, and Al Ajban Chicken, backed by Ghitha Holding and Yas Holding to strengthen local protein production capacity.

● July 2025: Australian agri-tech company núaFEEDs opened its factory in the UAE, converting surplus bread waste into premium animal feed, providing a sustainable and cost-effective alternative while addressing food waste challenges and supporting circular economy goals.

● February 2025: Agthia Group launched four new specialized camel feed products leveraging precision nutrition technology from Trouw Nutrition's NutriOpt platform, designed to enhance camel nutrition for racing and cultural activities while supporting regional livestock needs.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE Animal Feed Market Size is Expected to Reach USD 3,376.05 Million By 2033 | CAGR: 2.75% here

News-ID: 4256670 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

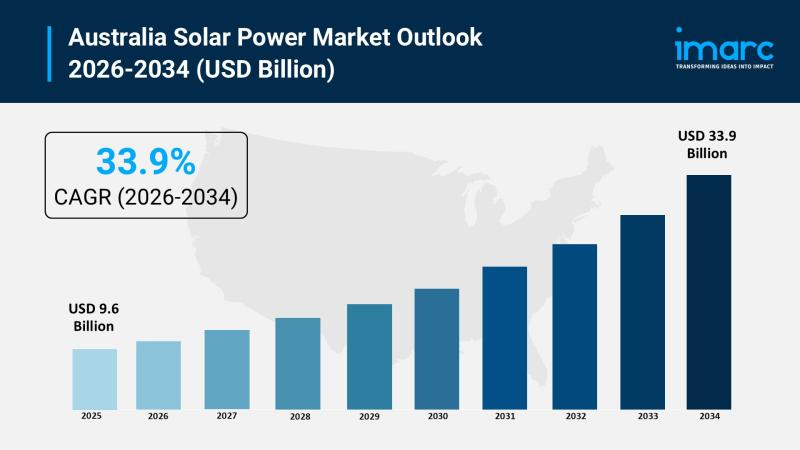

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

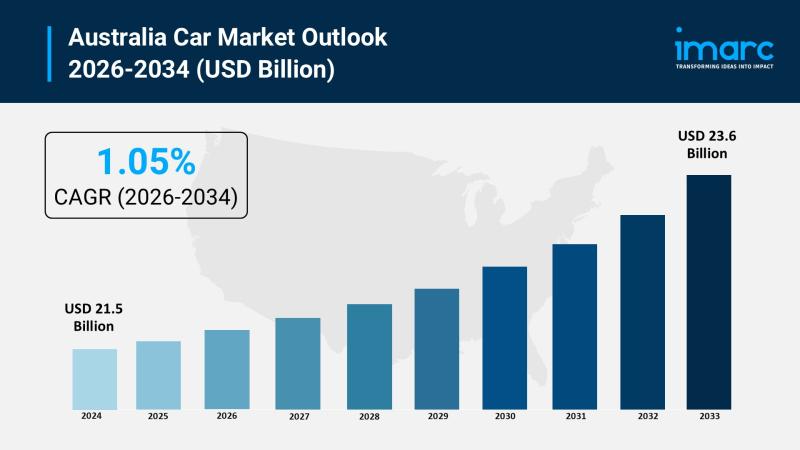

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

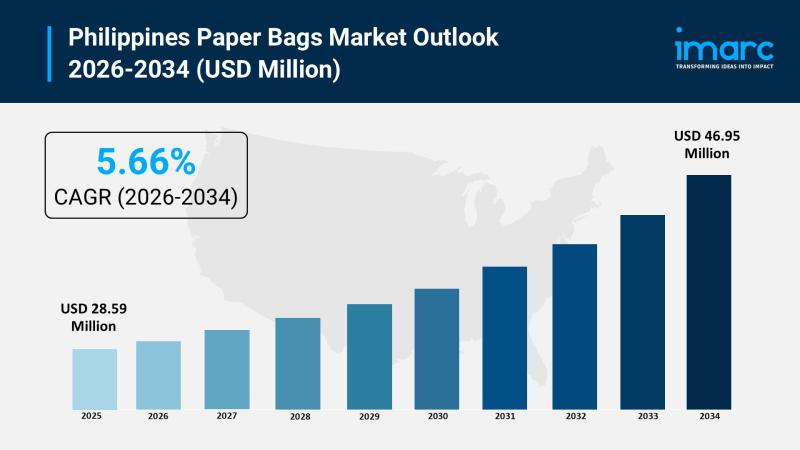

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…