Press release

Philippines Consumer Credit Market 2025 | Expected to Reach USD 65.95 Million by 2033

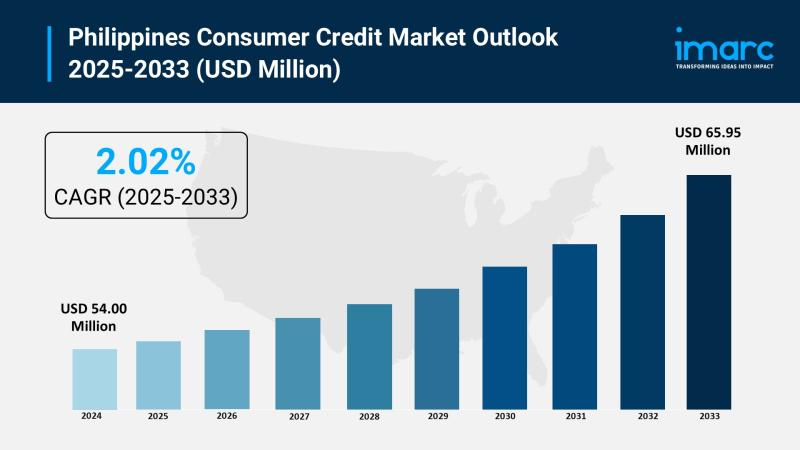

The latest report by IMARC Group, "Philippines Consumer Credit Market Size, Share, Trends and Forecast by Credit Type, Service Type, Issuer, Payment Method, and Region, 2025-2033," provides an in-depth analysis of the Philippines consumer credit market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines consumer credit market size reached USD 54.00 Million in 2024 and is projected to grow to USD 65.95 Million by 2033, exhibiting a steady growth rate of 2.02% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 54.00 Million

Market Forecast in 2033: USD 65.95 Million

Growth Rate (2025-2033): 2.02%

Philippines Consumer Credit Market Overview:

The Philippines consumer credit market is experiencing steady expansion driven by increased financial inclusion through fintech innovations, mobile lending platforms, and Buy Now Pay Later solutions enabling broader access to varied credit options including revolving credit and personal loans. Digital transformation supported by e-wallets, mobile banking, and digital ID frameworks reaching previously underserved urban and rural segments. January 2025 central bank report indicates stable household loan demand with balanced lending standards ensuring sustainable credit environment. Growing consumer confidence positions consumer credit as critical financial inclusion driver.

Request For Sample Report: https://www.imarcgroup.com/philippines-consumer-credit-market/requestsample

Philippines Consumer Credit Market Trends:

Philippines consumer credit market trends include digital lending platform proliferation expanding access through mobile apps and fintech solutions making credit more convenient especially among younger underserved segments. Late 2024 national polls showing increased willingness toward organized lending when terms clear and repayment feasible driven by sustained awareness efforts. Central bank regulatory evolution through sandbox environments and digital-centric licensing ensuring consumer protection. Open finance frameworks and mobile banking enabling urban and rural populations to access credit easily. Households becoming more strategic in borrowing indicating maturing market valuing sustainability.

Philippines Consumer Credit Market Drivers:

Philippines consumer credit market drivers include fintech innovations and digital platforms transforming access through mobile lending apps, Buy Now Pay Later solutions, and e-wallet integration reaching previously excluded segments. Central bank regulatory support through digital-centric licensing, sandbox environments, and responsible lending guidelines fostering safer innovation. January 2025 report confirming stable household loan demand with balanced lending environment. Growing financial literacy shifting perception of credit to strategic financial planning tool. Mobile banking expansion enabling convenient access across urban and rural areas. Competitive landscape between traditional banks and neobanks driving product innovation benefiting consumers.

Market Challenges:

• Credit Risk Management balancing expanded access with maintaining prudent lending standards

• Regulatory Compliance navigating evolving digital finance regulations and licensing requirements

• Financial Literacy Gaps requiring continued consumer education on responsible borrowing

• Digital Divide limiting access for segments lacking smartphone or internet connectivity

• Data Privacy Concerns protecting consumer information in digital lending environment

• Default Risk managing potential increases in non-performing loans amid economic uncertainties

• Competition Pressure from both traditional institutions and emerging fintech players

• Cybersecurity Threats safeguarding digital platforms from fraud and security breaches

Market Opportunities:

• Digital Transformation expanding mobile-first lending solutions and seamless user experiences

• Financial Inclusion reaching unbanked and underbanked populations through innovative products

• AI and Data Analytics enhancing credit scoring models and risk assessment capabilities

• Buy Now Pay Later capturing growing millennial and Gen Z consumer segments

• Partnership Ecosystems collaborating between banks, fintechs, and e-commerce platforms

• Alternative Credit Scoring utilizing non-traditional data for underserved borrower evaluation

• Micro-lending Products developing small-ticket loans for specific consumer needs

• Regional Expansion targeting underserved Visayas and Mindanao markets with tailored solutions

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-consumer-credit-market

Philippines Consumer Credit Market Segmentation:

By Credit Type:

• Revolving Credits

• Non-revolving Credits

By Service Type:

• Credit Services

• Software and IT Support Services

By Issuer:

• Banks and Finance Companies

• Credit Unions

• Others

By Payment Method:

• Direct Deposit

• Debit Card

• Others

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Consumer Credit Market News:

October 2025: Home Credit Philippines conducted first nationwide midnight launch activation for latest generation iPhone partnering with authorized Apple retailers offering flexible financing as low as PHP 61 per day demonstrating commitment to making cutting-edge technology accessible through easy affordable financing solutions expanding digital inclusion nationwide.

September 2025: TransUnion Q2 2025 CEO Economic Pulse report indicated Philippines credit market expanding amid economic upswing with credit inquiries surging 49% in first half 2025 led by personal loans (75%) and credit cards (50%). Credit Perception Index stood at 73 out of 100 with more Filipinos intending to borrow through formal channels including traditional banks (+15 percentage points) and virtual banks (+9 ppt) reflecting stable consumer confidence and growing credit openness.

August 2025: Home Credit Philippines reached 12 million customers ahead of 12th anniversary having disbursed close to PHP 500 billion in total sales across credit products. Company financed 2.5 million smartphones since start of 2024 averaging 5,000 devices per day as of August 2025 with iPhone financing reaching PHP 10 billion in 2024 expected to hit PHP 20 billion by end 2025 demonstrating strong consumer finance demand.

Key Highlights of the Report:

• Market analysis projecting growth from USD 54.00 million (2024) to USD 65.95 million (2033) with 2.02% CAGR

• Digital transformation driving financial inclusion through fintech innovations and mobile platforms

• January 2025 central bank report confirming stable household loan demand with balanced lending standards

• Consumer perception shift with increased confidence in formal credit as strategic planning tool

• Regulatory support through digital-centric licensing and sandbox environments fostering innovation

• Mobile banking expansion enabling credit access across urban and rural populations

• Revolving credits and non-revolving credits dominating credit type segments

• Luzon leading regional distribution with highest market concentration

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines consumer credit market growth to USD 65.95 million by 2033?

A1: The market is driven by fintech innovations and digital platforms transforming access through mobile lending apps and Buy Now Pay Later solutions reaching previously excluded segments, central bank regulatory support through digital-centric licensing and sandbox environments fostering safer innovation, and January 2025 report confirming stable household loan demand. Growing financial literacy shifting consumer perception of credit to strategic planning tool, mobile banking expansion enabling convenient access, and competitive landscape between traditional banks and neobanks driving innovation support the 2.02% growth rate.

Q2: How are digital innovation and regulatory frameworks transforming the Philippines consumer credit landscape?

A2: Digital innovation through mobile lending platforms, e-wallets, digital ID frameworks, and open finance systems is expanding access especially among younger and underserved segments making credit more convenient and transparent. Central bank playing vital role crafting guidelines leveling playing field among digital-ready institutions through sandbox environments and digital-centric licensing ensuring consumer protection while supporting safer innovation. Late 2024 national polls showing increased consumer willingness toward organized lending driven by sustained awareness efforts and improved lending practices. These developments position digital transformation and regulatory support as fundamental drivers supporting financial inclusion and responsible lending objectives.

Q3: What opportunities exist for consumer credit stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on digital transformation expanding mobile-first lending solutions and seamless user experiences, financial inclusion reaching unbanked and underbanked populations through innovative products, and AI and data analytics enhancing credit scoring models and risk assessment capabilities. Buy Now Pay Later capturing growing millennial and Gen Z segments, partnership ecosystems collaborating between banks fintechs and e-commerce platforms, and alternative credit scoring utilizing non-traditional data represent significant opportunities alongside micro-lending products development and regional expansion targeting underserved Visayas and Mindanao markets with tailored solutions supporting economic growth and financial inclusion objectives.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=42056&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Consumer Credit Market 2025 | Expected to Reach USD 65.95 Million by 2033 here

News-ID: 4232165 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Philippines

Philippines Contact Cement Market

Market Overview

Contact cement is a flexible acrylic adhesive that may be used on rubber, wood, bond tile, leather, metal, Formica, and most plastics. It stays flexible after curing and makes an excellent shoe glue. Contact cement may be applied to almost anything, although it works best on nonporous materials that conventional adhesives cannot adhere together.

Plastics, veneers, rubber, glass, metal, and leather all react well to contact cement. It is…

Philippines Quick Service Restaurants Market Size Is Likely To Reach Around $7.9 …

The Philippines quick service restaurants market has been continuously improvising in terms of product offerings, number of outlets, hospitality and other perks regarding prices that attracts a higher number of customers. Over the years, the Filipinos, specifically the millennials, have been open to different types of innovative food products due to increase in influence of westernization among the target customers. Considering this customer perception, some of the key players in…

Major Players in Philippines Auto Finance Market | Auto Loan Market Philippines …

Rising Innovation: Innovative digital startups such as iChoose.ph are reshaping the challenging car shopping and financing process into a quick and easy experience for customers in Philippines. It is expected that these will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process. Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing…

Philippines E-Commerce Logistics Market | Competitors in E-Commerce Logistics Ph …

Key Findings

Singapore-headquartered e-commerce player Shopee launched an in-app, live-streaming platform in the Philippines through which sellers can build a following to promote their products and offer discounts to viewers. This platform proved to be a success during the pandemic as it recorded 30m live stream views in April 2020.

E-commerce players can look forward to collaborate with brick-and-mortar retailers to provide consumers low-cost delivery options, as has been done in other…

Philippines Used Car Market

Philippines Used Car Market is expected to Gain Momentum from the Emergence of more Organized Players in the future along with Covid incited Surge in Demand: Ken Research

The used car market structure in Philippines is expected to be consolidated in the future as the market share of players selling vehicles via organized channel is expected to surge. This will be mainly on account of transparent and fair used car dealings/trading…

Philippines Quick Service Restaurants Market Booming Segments; Investors Seeking …

Philippines Quick Service Restaurants Market by Food Type, and Nature: Philippines Opportunity Analysis and Industry Forecast, 2019–2026,” The Philippines quick service restaurants market size was valued at $4.6 billion in 2018, and is expected to reach $7.9 billion by 2026, registering a CAGR of 6.9% from 2019 to 2026.The burger/sandwich segment was the highest contributor to the market, with $1.7billion in 2018, and is estimated grow at a CAGR of…