Press release

Industrial Plant Derived Cleaning Ingredients Market to Reach USD 9,939 Million by 2031 Top 20 Company Globally

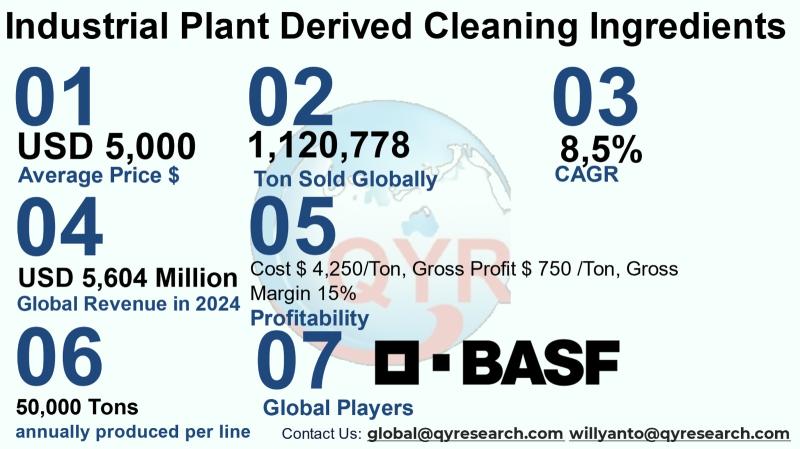

Industrial plant-derived cleaning ingredients are bio-based surfactants, solvents, enzymes and related actives produced from renewable plant feedstocks (oils, sugars, starches and other biomass) and used across household, industrial, institutional and specialty cleaning formulations. These ingredients replace or supplement petrochemical counterparts to deliver cleansing, wetting, foaming and emulsification while meeting increasing regulatory and customer demands for biodegradability, lower aquatic toxicity and reduced lifecycle carbon intensity. The industry combines traditional chemical engineering with advances in bioprocessing and green chemistry to scale formulations that can satisfy industrial performance requirements and sustainability mandates simultaneously.The global market for industrial plant-derived cleaning ingredients in 2024 is valued at USD 5,604 million with a compound annual growth rate of about 8.5% to 2031, reaching market size USD 9,939 million by 2031. An average selling price of USD 5,000 per ton, the industrial plant-derived cleaning ingredients sold roughly 1,120,778 tons globally in 2024. A factory gross margin is 15%, which implies a factory gross profit of USD 750 per ton and cost of goods sold of USD 4,250 per ton. The COGS breakdown is Raw materials 60%; Utilities/energy 10%; Labor 8%; Packaging 6%; Quality control & testing 4%; Maintenance & overhead 7%; Waste & disposal 5%. A single line full machine capacity production is around 50,000 tons per line per year. Downstream demand is concentrated in detergents & household cleaners, industrial & institutional cleaners, and personal care, with smaller but meaningful shares to oil & gas/mining and agricultural applications.

.

Latest Trends and Technological Developments

Industry momentum in 2024 to 2025 has been shaped by investor interest in biosurfactants, partnerships to bring upcycled or microbially-produced surfactants to market, and major chemical producers expanding capacity for sustainable surfactants. In July 2025 Belgian biotech AmphiStar secured €12.5 million to speed commercialisation of upcycled microbial biosurfactants, signaling investor appetite for scale-ready bio-manufacturing platforms (July 9, 2025). In mid-2025 there were strategic distribution and co-development partnerships announced to broaden regional access to novel biosurfactants and upcycled feedstock chemistries. Large incumbents have also signaled investment or pilot activity in sustainable surfactant capacity and applications across personal care and industrial segments, consistent with a broader move within the surfactants complex toward green alternatives. These developments reinforce that commercialization, feedstock sourcing and regulatory alignment are the near-term priorities for the sector.

Asia is both a large demand base and a manufacturing hub for plant-derived cleaning ingredients. Rapid urbanization, rising middle-class consumption, and stricter environmental rules in key markets (China, Japan, South Korea) accelerate adoption of biodegradable and clean formulations. Local feedstock availability (palm/soy/other vegetable oils, sugar/starch streams) lowers raw material costs in parts of Asia versus imports, but also raises sustainability scrutiny particularly in palm-oil sourcing which requires traceability and certification for buyers. Asia is therefore bifurcated: a cost-competitive production and process innovation center, and simultaneously a demanding market for sustainability credentials, which benefits producers who can demonstrate certified supply chains and performance parity with petrochemical alternatives. Regional R&D centers and toll-manufacturing arrangements are common to speed customer qualification and local regulatory registration.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171810

Industrial Plant Derived Cleaning Ingredients by Type:

Organic Ingredients

Inorganic Ingredients

Industrial Plant Derived Cleaning Ingredients by Application:

Healthcare Manufacturing

Food and Beverages Manufacturing

Industrial and Manufacturing

Others

Global Top 20 Key Companies in the Industrial Plant Derived Cleaning Ingredients Market

BASF SE

Procter & Gamble

Dow Inc

Henkel AG & Co KGaA

Sasol

Solvay

Croda International PLC

Stepan Company

Huntsman International LLC

Eastman Chemical Corporation

Clariant AG

Westlake Chemicals Corporation

Albemarle Corporation

Reckitt Benckiser Group plc

Clorox Inc

Kimberly Clark Corporation

3M Company

Kao Corporation

Daqing VICTEX Chemical Co., Ltd.

Shanghai Fine Chemical Co., Ltd.

Regional Insights

Southeast Asia (ASEAN) shows accelerating adoption driven by domestic detergent and household-care manufacturers shifting formulations toward bio-based surfactants, and by multinational brands localizing green SKUs for growth markets. Indonesia, as a major palm oil producer and a large population market, plays a dual role: abundant feedstock potential for plant-derived chemistries and fast growing domestic demand for modern cleaning products. However, buyers increasingly demand certified sustainable sourcing (e.g., RSPO or equivalent traceability) and clear environmental/health claims. Smaller ASEAN producers are also leveraging contract manufacturing and regional distribution partnerships to serve both domestic and export markets across Asia Pacific. Policy moves and consumer campaigns favoring biodegradability are likely to further accelerate adoption in the region over the next five years.

Key challenges include feedstock price volatility (vegetable oil and sugar markets), scaling bioprocesses from pilot to commercial volumes while keeping unit economics competitive with petrochemical surfactants, ensuring consistent performance and shelf stability, navigating diverse regulatory regimes across countries, and satisfying traceability/sustainability verification requirements (which can increase cost). Additional operational challenges relate to process yields, downstream purification costs for biosurfactants, and the capital intensity of new bio-manufacturing facilities. Market entrants must also manage customer risk aversion where procurement teams require extended performance validation and supply security before switching large purchase volumes.

Producers should prioritize feedstock flexibility and traceable sourcing agreements to reduce margin exposure and meet customer sustainability requirements. Investing in modular, scalable production lines or partnering with toll manufacturers decreases time-to-market and capex risk. Value capture is higher when sellers offer formulation know-how (application labs, co-development) because many industrial buyers value performance validation over raw ingredient cost alone. For buyers, long-term supply contracts combined with co-innovation partnerships can secure price stability and faster product qualification. Companies that can demonstrate third-party lifecycle or biodegradability certifications will win faster adoption in regulated markets and among multinational customers.

Product Models

Industrial plant derived cleaning ingredients are substances extracted from plants, such as citric acid from citrus fruits, plant-based surfactants from coconut and corn, and enzymes from food processing by-products.

Organic ingredients which often bring advantages in biodegradability and lower toxicity. Notable products include:

AcmeZyme AG (Acme-Hardesty) an enzyme blend product for breaking down proteins, starches, and organic soils in industrial cleaners.

AHCOHOL 0898 (Acme-Hardesty) a high-purity octyl alcohol (98 %) used as a solvent or emulsifier in detergent systems.

BioSol Citrus (Vertec BioSolvents) a citrus-derived solvent blend for removing coatings, resins, adhesives in industrial cleaning.

VertecBio Citrus family (Vertec BioSolvents) a line of biodegradable solvents derived from citrus terpenes, used in degreasing or paint stripping.

Green chelates / sustainable chelating agents (Nouryon) renewable chelating molecules used to bind metal ions and enhance cleaning performance.

Inorganic ingredients which contribute powerful cleaning, pH control, corrosion, or oxidation functions. Examples include:

Sodium hypochlorite (Tsuruchlon, Aron Clean Toagosei) a widely used oxidizing bleach for disinfecting, bleaching, and sanitization.

Caustic soda / sodium hydroxide (liquid caustic soda Toagosei) a strong base used in many alkaline cleaners, degreasers, and pH adjustment towers.

Hydrochloric acid (synthetic HCl Toagosei or other inorganics lines) aggressive acidic agent for scale removal, cleaning metal surfaces, etching.

Ferric chloride solution (iron perchloride solution Toagosei) a metal salt used in etching, flocculation, or cleaning of metal surfaces.

Sulfuric acid (inorganic acids BASF / inorganics lines) strong acid used for pH control, descaling, passivation, or cleaning systems

The industrial plant-derived cleaning ingredients market is at a growth inflection where performance expectations, sustainability demands, and improved bio-manufacturing technologies converge. Given the USD 5.604 billion market size in 2024 and the projected growth profile, companies that can bridge cost competitiveness with verified sustainability and scale reliably will capture the largest share of value. The Asia and ASEAN regions are central to both supply and demand dynamics, making regional strategies, feedstock partnerships, and certification programs critical to success.

Investor Analysis

For investors the most critical elements are technology readiness level, feedstock security, customer validation, and route to scale. What investors should watch: financing rounds and strategic partnerships of biotech players (signals of commercial readiness), capex plans by incumbents to expand sustainable surfactant capacity, and long-term offtake agreements with major detergent or personal care manufacturers. How investors use the report: to prioritize targets (e.g., upstream feedstock processors, toll manufacturers with regional presence, or biotech firms with scalable fermentation/purification IP), to size required investment for scale (given per-line capacities and expected volumes), and to stress-test returns under feedstock price swings. Why it matters: the combination of strong market growth, supportive consumer/regulatory trends, and a still-fragmented supply base provides multiple avenues for value creation (equity stakes in high-growth tech providers, strategic M&A by incumbents, or financing of regional capacity expansions). Investors focused on ESG will find this subsector aligned with both sustainability narratives and tangible commercial adoption paths.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4745842

5 Reasons to Buy This Report

It provides a quantified market baseline for 2024 with unit volumes and per-ton economics for scenario modelling.

It translates market value into production volume and factory economics useful for valuation and capex planning.

It delivers regionally focused insights for Asia and ASEAN, including Indonesia, where feedstock and demand dynamics diverge from Western markets.

It highlights near-term technological and commercial signals (funding, partnerships, incumbent investments) that indicate which subsegments are investable.

It supplies actionable strategic takeaways for producers, buyers and investors seeking to enter or scale in the plant-derived cleaning ingredients value chain.

5 Key Questions Answered

What was the 2024 market size and implied global volume at a benchmark price?

What are the per-ton factory economics (price, COGS, gross profit) and the aggregate COGS/gross profit for the market?

How is COGS typically broken down across raw materials, utilities, labor and other components?

What is the regional outlook and the specific implications for Asia and ASEAN (including Indonesia) on feedstock and demand?

Who are the principal incumbents and what recent industry news (funding, partnerships, capacity moves) signal near-term change?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Reports Recommendation

Global Industrial Plant Derived Cleaning Ingredients Market Research Report 2025

https://www.qyresearch.com/reports/5171808/industrial-plant-derived-cleaning-ingredients

Global Industrial Plant Derived Cleaning Ingredients Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5171807/industrial-plant-derived-cleaning-ingredients

Industrial Plant Derived Cleaning Ingredients - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171810/industrial-plant-derived-cleaning-ingredients

Global Industrial Plant Derived Cleaning Ingredients Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5171809/industrial-plant-derived-cleaning-ingredients

Global Plant Derived Cleaning Ingredient Market Research Report 2023

https://www.qyresearch.com/reports/503530/plant-derived-cleaning-ingredient

Global Plant Derived Cleaning Ingredient Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4215616/plant-derived-cleaning-ingredient

Plant Derived Cleaning Ingredient- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4208966/plant-derived-cleaning-ingredient

Global Plant Derived Cleaning Ingredient Market Report, History and Forecast 2018-2029, Breakdown Data by Manufacturers, Key Regions, Types and Application

https://www.qyresearch.com/reports/1296669/plant-derived-cleaning-ingredient

Global Plant Derived Cleaning Ingredient Market Insights, Forecast to 2030

https://www.qyresearch.com/reports/3112490/plant-derived-cleaning-ingredient

Global Plant Derived Cleaning Ingredient Market Research Report 2025

https://www.qyresearch.com/reports/4203223/plant-derived-cleaning-ingredient

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Industrial Plant Derived Cleaning Ingredients Market to Reach USD 9,939 Million by 2031 Top 20 Company Globally here

News-ID: 4210677 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Ingredient

Cliff McCrary Brings Decades of Ingredient Industry Sales Leadership to TrueSour …

DALLAS, TEXAS, 30th December 2025, ZEX PR WIRE, Cliff McCrary has spent his career inside the ingredient and food manufacturing sector, working at the intersection of sales strategy, customer development, and operational execution. As Founder and Principal of TrueSource Ingredient Advisors, LLC, McCrary applies more than three decades of hands on commercial experience to help ingredient suppliers and food manufacturers navigate increasingly complex markets with discipline and clarity.

McCrary's professional background…

Ceteth Ingredient Sales Market Size Analysis by Application, Type, and Region: F …

According to Market Research Intellect, the global Ceteth Ingredient Sales market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The market for ceteth ingredient sales is steadily expanding as a result of growing demand in the…

Microbial Food Ingredient Market Harvesting the Power of Microbes: The Booming M …

Microbial Food Ingredient Market Worth 4.97 Bn 2031- Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Microbial Food Ingredient Market"- By Microorganism (Bacteria, Yeast, Mold), Product Type (Starter Cultures, Protective Cultures, Probiotic Cultures), Strain (Single-Strain Culture, Multi-Strain Culture, Multi-Strain Mixed Culture) End User (Food and Beverage Manufacturers, Animal Feed Additives), Industry Trends, and Global Forecasts, 2022-2035 And…

Rice Flour as Versatile Ingredient

The global rice flour market size is expected to be valued at USD 814.22 million in 2024 and reach USD 1014.35 million by 2029, growing at a CAGR of 4.50% from 2024 to 2029.

Rice flour market Report Scope:

• Market Size (2029): USD 814.22 million

• Market Size (2024): USD 1014.35 million

• CAGR (2024 to 2029): 4.50%

• Base Year: 2023

• Forecast Period: 2024 to 2029

• Segments Analysed: Product type, Application &…

Global Egg Replacement Ingredient Market: Snapshot By Ingredient

XploreMR compiled a report on opportunity assessment analysis of egg replacement ingredients market for the forecast period of 2018–2028. This report provides an elaborated and detailed analysis, both from qualitative and quantitative slants, and is backed with market dynamics, market size estimations and futuristic trends in the egg replacement ingredients market. The cutting-edge insights included in the report will aid the decision makers and key stakeholders of egg replacement ingredients…

Feed Ingredient Market || Worldwide, 2030

The "Feed Ingredient Market Analysis to 2030" is a specialized and in-depth study of the Feed Ingredient industry with a focus on the Feed Ingredient market trend. The report aims to provide an overview of the Feed Ingredient market with detailed market segmentation by component, application, end-user, and geography. The Feed Ingredient market is expected to witness high growth during the forecast period. The report includes key statistics on the…