Press release

Global Underground Pipeline Inspection Robots Market 2024 Value USD 1.421 Billion 2031 Forecast USD 3.920 Billion CAGR 15.6% Envirosight and IBAK

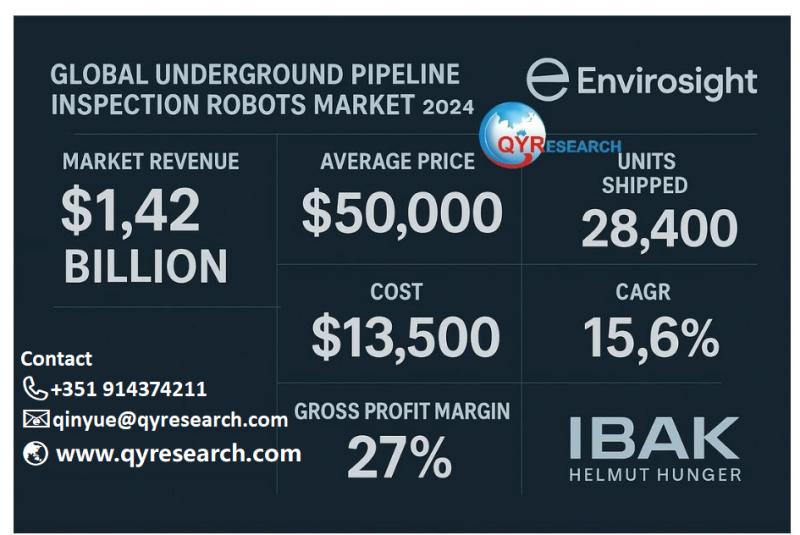

A new industry analysis from QYResearch, "Global Underground Pipeline Inspection Robots Market Research Report 2025," finds that the worldwide market was US$1,421 million in 2024 and is projected to reach US$3,920 million by 2031, reflecting a 15.6% CAGR (2025-2031). In 2024, global output reached ~28,400 units at an average selling price (ASP) of ~US$50,000 per unit. The report segments growth trajectories by region, type, and application, and profiles the competitive landscape.Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4940090

Companies Covered

GE Inspection Robotics

iPEK International GmbH

IBAK Helmut Hunger GmbH & Co. KG

RIEZLER Inspektionssysteme GmbH & Co. KG

Aries Industries Inc.

Mini-Cam Ltd

Envirosight LLC

CUES Inc.

Subsite Electronics

Hach Company

Troglotech UK Ltd

Scanprobe Techniques Ltd

Deep Trekker Inc.

Rausch Electronics USA LLC

Insight Vision Cameras LLC

Vaporooter Global Pty Ltd

Kummert GmbH

RedZone Robotics Inc.

Sewer Robotics

SuperVision Inspection

Camtronics BV

Petrus Technologies

I.S.T. Innovative Sewer Technologies GmbH

Inuktun Services Ltd

Jetter AG

Enduro Pipeline Services Inc.

Hibbard Inshore

Tibbo Technology Inc.

Kanaltechnik Agricola

Eddyfi Technologies

Product profiles for five leading companies:

Envirosight - ROVVER X (RX130 Crawler System)

• Pipe diameter range: 6 in (re-lined) to 84 in with lift/wheel carriage/extra lamps

• Deployment reach: cable reels 984 ft or 1,640 ft; lateral launch module (SAT II) up to 147 ft into laterals

• Mobility: 6-wheel steerable crawler; multiple wheel sets (abrasive, rubber, wide) and elevating lifter

• Imaging options: pan-tilt-zoom (PTZ) camera heads; DigiSewer side-scan module for continuous pipe-wall mapping

• Operations: automated reel feed to reduce crawler load; lightweight Kevlar-reinforced cable (six conductors) for long pulls

• Typical use cases: large-diameter interceptor inspections, long mainline runs, combined MSI/side-scan data collection

IBAK Helmut Hunger GmbH & Co. KG - ORPHEUS HD (Mainline Camera Head)

• Pipe diameter range: ≥ 6 in mainlines

• Resolution & optics: Full HD 1920×1080p, 10× optical + 12× digital zoom; autofocus

• Illumination: 10+2 high-power LEDs (two dedicated to illuminate joint gaps)

• Measurement: optional laser profiling to determine inner pipe profile/diameter and quantify defects

• Pairing: typically mounted on IBAK mainline crawlers (e.g., T-series) with elevating lifters for centered imaging

• Notes: designed for larger mains where high lumen output and long-range zoom preserve detail in big pipes

iPEK International GmbH - ROVION RX130 (Crawler Platform)

• Pipe diameter range: DN150-DN1000 (with carrier & elevator); modular kits to match pipe size/material

• Drive & control: steerable 6-wheel drive, independently controlled sides; electrically controlled clutch

• Sensing & safety: back-eye camera, roll & pitch sensors, pressure monitoring, sonde/transmitter

• Cable & reach: armoured cable; typical system travel up to ~200 m (platform), and complete ROVION family options up to ~300 m mainlines

• Setup efficiency: tool-less component swaps; automatic height compensation on uneven pipe floors (newer RX130 variants)

• Applications: municipal mainlines with diameter changes, long pushes, and high traction requirements

CUES Inc. - flexitrax C550c (Portable Modular Crawler System)

• Pipe diameter range: 4 in to 60 in (with appropriate crawler/wheel kits and lifter)

• Ingress protection: IP68, rated to 100 m water depth

• Controller: integrated joysticks, internal battery, 128 GB storage, USB/Ethernet I/O

• Cable system: powered drum with 1,000 ft cable, automated cable assist & layering; swivel connector

• Modularity: portable, truck-optional package with interchangeable crawlers/cameras for small to large mains

• Indicative package pricing (public distributor listing): ~US$55,000 for standard configurations (price varies by kit/sensors)

Deep Trekker Inc. - DT340 (Battery-Powered Pipe Crawler)

• Minimum pipe diameter: 8 in (203 mm); typical viewing/inspection up to ~36 in (900 mm) with accessories

• Power & autonomy: onboard battery (no generator or CCTV truck required); handheld controller with recording

• Dimensions & mass (DT340 "S" crawler): L 710 mm × W 141 mm × H 151 mm; 16.6 kg

• Depth rating: 50 m (164 ft) submergence

• Mobility: 4-wheel base with optional tracks; multiple wheel diameters (8/10/12 in) for traction and clearance

• Use cases: rapid, portable municipal inspections where truck logistics are constrained; quick mobilization jobs

Applications

• Municipal Drainage Pipeline Inspection

• Industrial Pipeline Internal Inspection

• Cable Duct Inspection

• Stormwater Drainage System Check

• Others

Types / Classification

• Crawling Robots

• Wheeled Robots

• Tracked Robots

• Flying Robots

• Others

Latest Market Data

• Base Year: 2024

• Market Size (2024): US$1,421 million

• Forecast (2031): US$3,920 million

• CAGR (2025-2031): 15.6%

• Global Production (2024): ~28,400 units

• Average Global Market Price (2024): ~US$50,000 per unit

• Regional Coverage: North America; Europe; Asia Pacific; South America; Middle East & Africa

• Forecast Units: USD million (value) & Units (volume)

Cost, Gross Profit, and Gross Margin - Snapshot

• Representative manufacturer example (Mini-Cam Ltd, statutory filings, GBP): Turnover ~£27.1m; Cost of Sales ~£13.6m; Gross Profit ~£13.5m ⇒ Gross Margin ≈ 50%.

• Market pricing reality (USD): Common crawler packages range ~US$20,000-$40,000; fully loaded multi-sensor bundles can approach ~US$90,000. Against the sector's ~US$50,000 ASP, this pricing mix is consistent with a blended gross margin near 40-50% for established brands, varying by configuration, channel, and service content.

Note: Figures above synthesize audited accounts and publicly listed package prices to illustrate typical unit economics; actual margins vary by product mix, accessory loadout, and support contracts.

Downstream companies:

DC Water

City of Laredo Utilities Department

Roseburg Urban Sanitary Authority

Bedford City Utilities

United Utilities

Severn Trent Water

Sydney Water

Fairfax County Department of Public Works and Environmental Services

Metropolitan Sewer District of Greater Cincinnati

Thames Water

Anglian Water

Hong Kong Drainage Services Department

PUB (Singapore's National Water Agency)

2025 Trendline & Company Milestones

AI-rich multi-sensor inspection becomes the standard.

In 2025, the most visible shift is the normalization of multi-sensor inspection (MSI) paired with on-board and near-edge AI. Vendors are shipping crawlers that combine ultra-high-definition video with laser profiling, sonar, and inertial sensing to produce quantitative 3D condition models in a single pass. RedZone Robotics' Profiler3D is emblematic: it fuses imagery with geometric profiling for real-time mapping and automated condition coding. For utilities, MSI compresses field time (fewer re-runs), raises data fidelity (measurable ovality, joint offsets, corrosion signatures), and speeds rehab decision-making because analytics are built into the workflow rather than bolted on afterward. The pattern across 2025 is clear: asset owners are procuring not just hardware but inspection outcomes-meters covered, defects classified, and capital plans prioritized.

Autonomy moves from "assist" to "action."

The EU-backed PIPEON initiative highlights where autonomy is headed: robots that navigate complex geometries, tolerate surcharge, and perform mission-aware tasks such as sensor placement or light obstruction handling. While many municipal fleets still rely on tethered ROVs, pilots in 2025 demonstrate more decision support at the edge-from auto-centering and speed control for stable data capture, to onboard flagging of significant defects. The practical impact is a rising meters-per-shift metric and a step-change in operator productivity, especially in large-diameter interceptors and siphons where long deployments previously demanded heavy manual intervention.

Ruggedization for extremes, including heat and surcharge.

End-users continue to demand platforms that survive debris, abrasion, immersion, and temperature shocks. Industrial and district energy contexts push temperatures well above typical municipal ranges, so vendors are showcasing high-temperature desilting and inspection missions near ~80 °C. On the municipal side, add-on flotation, crawler lifts, and heavy-duty traction kits address surcharged reaches and long interceptors, maintaining sensor stability under turbulent flow. The commercial logic is straightforward: resilience drives utilization, and utilization underpins ROI on fleets that can cost six figures per truck plus multi-tens-of-thousands per crawler.

Tight integration with asset management.

A decisive trend in 2025 is the grafting of robotic data flows into asset management and work-order systems. Large municipal programs now expect inspection outputs to populate GIS feature layers, automatically generate PACP/MACP condition codes, and trigger rule-based rehab recommendations. RedZone and other platform vendors cite cumulative inspection footprints measured in tens of millions of feet and tens of thousands of manholes, reflecting not only hardware proliferation but also software adoption. The economic upshot is durable service and software revenue atop hardware, which helps explain why leading players can sustain healthy gross margins while continuing to reinvest in AI and sensor R&D.

Cross-pollination from energy pipelines and NDT.

Adjacent innovations in energy pipeline integrity are bleeding into underground municipal inspection. The 2025 release of Eddyfi's WeldXprtTM-an integrated solution for pipeline girth-weld integrity-illustrates a broader move toward guided workflows, automated analysis, and code-compliant reporting. While girth-weld AUT is not a municipal sewer task, the building blocks-high-channel ultrasonics, motion-controlled scanners, validated procedures, and report automation-map neatly onto the municipal need for repeatable, defensible condition assessments. Expect more municipal platforms to embed assisted interpretation and templated reporting, shrinking the interval from field to board-ready rehab plans.

Pricing realism and disciplined margins.

Observed package pricing in 2025 spans ~US$20k to ~US$90k depending on payload and reach. The report's ~US$50k ASP sits in the middle of that band and aligns with the prevalence of mid-range crawlers equipped with essential profiling and lighting. On the cost side, statutory accounts from established manufacturers (e.g., Mini-Cam Ltd) indicate gross margins near 50%, reflecting a blend of precision electromechanical COGS with higher-margin software, analytics, and service. This structure is likely to persist as vendors productize AI features and offer robotics-as-a-service (RaaS) bundles that smooth capex for smaller municipalities while preserving vendor margins via standardized deliverables.

Consolidation and channel expansion.

Corporate parents continue to bolt on inspection tech to broaden portfolios and deepen channel coverage. Earlier acquisitions of sewer CCTV and crawler brands by diversified industrials are still expanding service footprints and SKU breadth in 2025. The practical effects for buyers are improved parts availability, regional service, and end-to-end packages spanning small laterals to extra-large interceptors-reducing the need to juggle multiple vendors for a single district program.

Tariff uncertainty and supply resilience.

The report underscores that 2025 U.S. tariff policies add volatility to costs and lead times for components such as cameras, optics, sensors, and high-precision machining. Vendors are mitigating with modular designs, dual-sourcing, and increased regional assembly, aiming to protect delivery schedules for capital projects. Despite these headwinds, secular drivers-aging infrastructure, climate-driven stormwater stress, environmental compliance-continue to anchor demand through 2031.

What to watch (2025-2027):

• Autonomous navigation across diameter transitions, bends, and verticals with minimal operator input.

• Expanded sensor fusion in compact platforms: ultrasonic thickness, acoustic leak detection, and profiling sonar as standard options.

• Edge analytics with real-time defect detection and automated PACP/MACP coding to compress reporting cycles.

• Stronger digital-twin integration, stitching multi-year inspections into deterioration models for targeted lining and replacement.

• More robust power and sealing for hot, abrasive, or chemically aggressive environments.

• Growth of RaaS and outcome-based contracts that align vendor incentives with inspection meters, data quality, and actionable rehab plans.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4940090

Bottom line: 2025 is the inflection where underground pipeline inspection robots become AI-enabled, multi-sensor, and workflow-native. Vendors that combine durable platforms with analytics-first software and service integration are capturing share, even as tariff and supply pressures persist. The priority for asset owners is shifting from raw hardware specs to coverage, reliability, and decision-ready data-and the market's growth trajectory reflects that focus.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 ; +351 914374211(Tel & Whatsapp); +86-1082945717

Email: qinyue@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

Related Report:

Global Underground Pipeline Inspection Robots Market Outlook, In‐Depth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4940092/underground-pipeline-inspection-robots

Underground Pipeline Inspection Robots - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4940091/underground-pipeline-inspection-robots

2025-2031全球与中国地下管网智能巡检机器人市场现状及未来发展趋势

https://www.qyresearch.com.cn/reports/5750113/underground-pipeline-inspection-robots

2025年全球地下管网智能巡检机器人行业总体规模、主要企业国内外市场占有率及排名

https://www.qyresearch.com.cn/reports/5750112/underground-pipeline-inspection-robots

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Underground Pipeline Inspection Robots Market 2024 Value USD 1.421 Billion 2031 Forecast USD 3.920 Billion CAGR 15.6% Envirosight and IBAK here

News-ID: 4208117 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

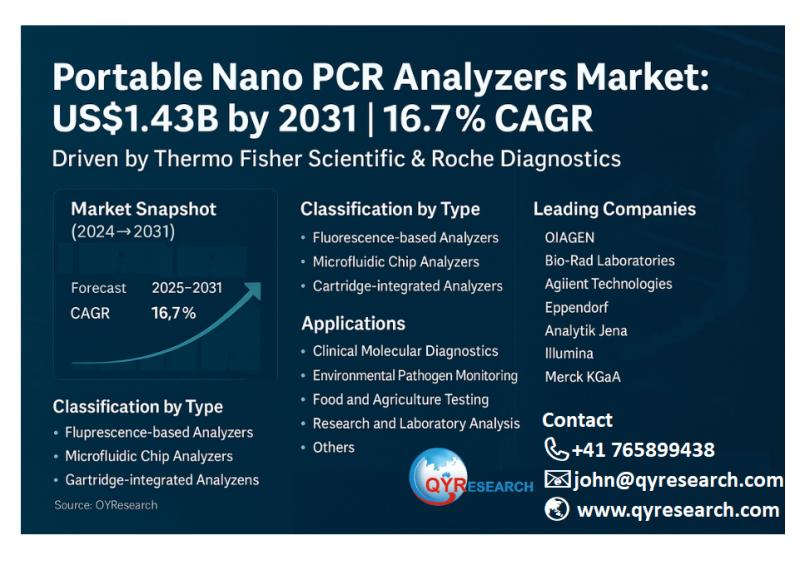

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Pipe

How to choose Seamless Pipe vs Welded Pipe vs Spiral Welded Pipe

Seamless pipe, welded pipe, and spiral welded pipe are the three most common types. They may appear similar in appearance, but the differences are profound in essence, with the core distinction indeed stemming from manufacturing processes.

Comparison Table

FEATURE DIMENSION

SEAMLESS STEEL PIPE

LONGITUDINALLY WELDED PIPE

SPIRAL WELDED PIPE

Manufacturing Process

Solid billet piercing and rolling, no weld seam.

Steel plate/sheet is curved and welded along a longitudinal straight seam.

Steel strip is coiled at a spiral angle, forming…

Seamless casing pipe vs ERW casing pipe

Seamless steel casing pipes-casing made of seamless steel pipe as raw material

Seamless pipe refers to a steel pipe manufactured by four methods: hot rolling, cold rolling, hot drawing, and cold drawing. There is no weld seam on the pipe body itself.

ERW casing pipe-casing made of electric welded pipe as raw material

ERW pipe refers to a straight seam welded pipe manufactured through a high-frequency resistance welding process. The raw material steel…

Comparison of ERW Welded Pipe and Seamless Steel Pipe (tested by PetroChina Pipe …

1. Outer diameter tolerance

ERW steel pipe: It is cold-formed and sizing is completed by reducing the diameter by 0.6%. The process temperature is basically constant at room temperature. Therefore, the outer diameter is controlled accurately and the fluctuation range is small, which is helpful to eliminate black leather buckles.

Seamless steel tube: The hot-rolling forming process is used, and its sizing is completed at about 8000C. The raw material composition, cooling…

HDPE Pipes Market Current Trends and Detailed Study with Forecast to 2028 | Oil …

Global HDPE Pipes Market: Overview

The application of high density polyethylene (HDPE) pipes has increased in industry like chemical, electronics, and gas distribution. As a result of this extensive application, the global HDPE pipes market is witnessing a substantial growth in the forecast period of 2018 to 2028. Moreover, the growing demand for HDPE pipes in drainage and sewerage industry is another factor that is responsible for the growth of…

Global HDPE 100 Pipe Market 2017 LESSO, Cangzhou Mingzhu, Junxing Pipe, Ginde Pi …

In this report, the global HDPE 100 Pipe market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Global Market Report HDPE 100 Pipe Market Size, Status and Forecast 2022 provides Market information about Manufacturers, Countries, Type and Application.This HDPE 100 Pipe Industry report also states Company Profile, sales,…

Anti-corrosion Steel Pipe and Coating Steel Pipe

Anti-corrosion steel pipe refers to do anti-corruption treatment for the ordinary steel pipe with special technology, making the steel pipe equipped certain corrosion resistance.Generally used in waterproof, anti-rust, acid and alkali proof, anti-oxidation and so on.Different needs, different inside and outside wall corresponding anti-corrosion measures.Common are: epoxy coal tar anti-corrosion, anti-corrosion epoxy coatings, urethane paint anti-corrosion, IPN8710 water pipeline corrosion protection, non-toxic paint anti corrosion,anti-corrosion polymer coating, steel pipe lining…