Press release

Australia Fertility Services Market Projected to Reach USD 3.68 Billion by 2033

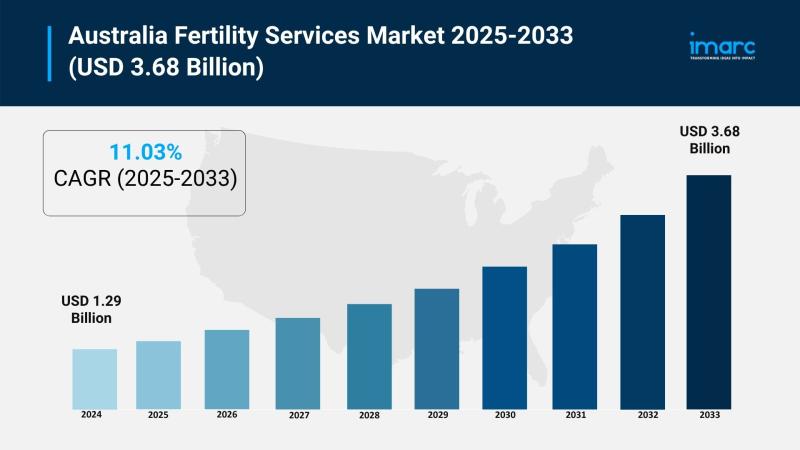

The latest report by IMARC Group, titled "Australia Fertility Services Market Report by Cause of Infertility (Male Infertility, Female Infertility), Procedure (In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI), Surrogacy, In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI), Intrauterine Insemination (IUI), Others), Service (Fresh Non-Donor, Frozen Non-Donor, Egg and Embryo Banking, Fresh Donor, Frozen Donor), End User (Fertility Clinics, Hospitals, Surgical Centers, Clinical Research Institutes, Cryobanks), and Region 2025-2033," offers a comprehensive analysis of the Australia fertility services market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia fertility services market size reached USD 1.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.68 Billion by 2033, exhibiting a CAGR of 11.03% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1.29 Billion

Market Forecast in 2033: USD 3.68 Billion

Market Growth Rate (2025-2033): 11.03%

Australia Fertility Services Market Overview

The Australia fertility services market is experiencing robust growth driven by delayed parenthood trends, increasing infertility diagnoses, broader treatment awareness, technological advances in assisted reproductive technologies, and growing adoption of fertility preservation options. The market expansion is supported by technological innovations in genetic screening, embryo selection technologies, artificial intelligence integration, and increasing recognition of comprehensive reproductive healthcare capabilities. Advanced fertility solutions are transforming Australia's reproductive healthcare landscape through improved success rates, personalized treatment protocols, enhanced patient support services, and expanding accessibility positioning the country as a progressive market for innovative fertility treatment development and comprehensive reproductive care delivery.

Australia's fertility services foundation demonstrates strong healthcare fundamentals across diverse applications including in vitro fertilization procedures, intrauterine insemination, surrogacy arrangements, egg and embryo banking, and fertility preservation for medical conditions. The country's aging maternal demographics, changing social structures, supportive healthcare policies, and commitment to reproductive healthcare accessibility create substantial demand for fertility services capable of addressing diverse patient needs while delivering successful outcomes. The proliferation of specialized fertility clinics, public hospital fertility programs, advanced diagnostic capabilities, and integrated counseling services is creating favorable market conditions, requiring significant investments in clinical infrastructure, technology platforms, staff training, and patient education initiatives. Australia's progressive regulatory framework, combined with comprehensive Medicare support and growing public funding commitments, makes it an increasingly attractive market for innovative fertility technology adoption and specialized reproductive healthcare service expansion.

Request For Sample Report:

https://www.imarcgroup.com/australia-fertility-services-market/requestsample

Australia Fertility Services Market Trends

• Delayed parenthood patterns: Growing trend of couples postponing childbearing due to career priorities, educational pursuits, financial planning, and lifestyle choices increasing demand for assisted reproductive technologies as maternal age advances and natural fertility declines.

• Technological innovation acceleration: Increasing implementation of artificial intelligence for embryo selection, time-lapse imaging systems, preimplantation genetic testing, and advanced cryopreservation techniques enhancing treatment success rates and patient outcomes across fertility clinics.

• Public funding expansion: Rising government investment in fertility treatment accessibility through expanded Pharmaceutical Benefits Scheme listings, state-funded IVF programs, and subsidized reproductive healthcare services reducing financial barriers for eligible patients.

• Fertility preservation growth: Growing adoption of egg freezing, sperm banking, and embryo cryopreservation driven by cancer treatment requirements, delayed parenthood choices, and occupational risk factors supporting long-term reproductive planning options.

• Integrated care models: Expanding provision of comprehensive fertility services combining medical treatments, psychological counseling, nutritional guidance, and emotional support addressing holistic patient needs throughout treatment journeys.

• Single and LGBTQ+ access: Strengthening inclusivity in fertility services with specialized treatment pathways, donor programs, surrogacy arrangements, and supportive care models catering to diverse family structures and relationship configurations.

Market Drivers

• Rising infertility prevalence: Growing incidence of male and female infertility conditions attributed to lifestyle factors, environmental exposures, medical conditions, and delayed childbearing creating sustained demand for comprehensive fertility evaluation and treatment services.

• Advanced maternal age trends: Implementation of assisted reproductive technologies addressing age-related fertility challenges as women increasingly pursue parenthood in their mid-to-late thirties and forties requiring specialized medical interventions.

• Medical condition impacts: Increasing need for fertility preservation services among cancer patients, individuals with chronic illnesses, and those undergoing medical treatments potentially affecting reproductive capacity driving proactive fertility management approaches.

• Healthcare policy support: Growing government commitment to reproductive healthcare accessibility through Medicare rebates, state funding initiatives, pharmaceutical subsidies, and public hospital fertility programs reducing treatment cost barriers.

• Awareness and education: Rising public awareness about fertility treatment options, success rates, available technologies, and financial assistance programs encouraging earlier consultation and treatment commencement improving overall outcomes.

• Technology advancement: Increasing availability of sophisticated diagnostic tools, embryo screening capabilities, genetic testing technologies, and improved success protocols making fertility treatments more effective and accessible across patient populations.

Challenges and Opportunities

Challenges:

• High treatment costs and financial burden despite Medicare rebates and public funding creating accessibility barriers particularly for multiple treatment cycles, advanced procedures, and patients without adequate private health insurance coverage

• Emotional and psychological stress associated with fertility treatment journeys including treatment failures, relationship pressures, social stigma, and mental health impacts requiring comprehensive support services and counseling interventions

• Regional accessibility disparities with specialized fertility clinics predominantly concentrated in major metropolitan areas creating travel burdens, accommodation costs, and treatment access challenges for regional and remote community residents

• Age-related success rate limitations particularly for women over 40 years requiring realistic expectation management, alternative treatment pathway discussions, and comprehensive counseling about outcome probabilities and options

• Regulatory complexity and ethical considerations surrounding surrogacy arrangements, donor conception, genetic screening applications, and embryo disposition requiring careful navigation of legal frameworks and ethical guidelines

Opportunities:

• Artificial intelligence integration advancing embryo selection accuracy, treatment protocol optimization, outcome prediction modeling, and personalized care pathway development improving success rates and patient satisfaction across fertility services

• Telemedicine expansion enabling remote consultations, monitoring support, psychological counseling, and treatment coordination reducing travel requirements and improving accessibility for regional patients throughout treatment journeys

• Corporate fertility benefits growth with employers increasingly offering fertility treatment coverage, egg freezing support, and family building assistance as employee retention and diversity initiatives creating new patient segments

• Medical tourism potential attracting international patients seeking high-quality fertility treatments, advanced technologies, experienced specialists, and competitive pricing compared to home countries generating additional revenue opportunities

• Research collaboration advancement between fertility clinics, universities, pharmaceutical companies, and technology developers driving innovation in treatment protocols, success optimization, and new therapy development

Australia Fertility Services Market Segmentation

By Cause of Infertility:

• Male Infertility

o Low Sperm Count

o Poor Sperm Motility

o Abnormal Sperm Morphology

o Hormonal Disorders

o Genetic Conditions

o Lifestyle Factors

• Female Infertility

o Ovulation Disorders

o Endometriosis

o Tubal Blockage

o Uterine Abnormalities

o Age-Related Factors

By Procedure:

• In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)

o Standard ICSI Protocol

o Micro-ICSI Techniques

o Assisted Hatching

o Preimplantation Genetic Testing

• Surrogacy

o Gestational Surrogacy

o Traditional Surrogacy

o Domestic Arrangements

o International Programs

• In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI)

o Conventional IVF

o Natural Cycle IVF

o Mild Stimulation IVF

o Mini IVF Protocol

• Intrauterine Insemination (IUI)

o Natural Cycle IUI

o Stimulated Cycle IUI

o Donor Sperm IUI

o Partner Sperm IUI

• Others

o Ovulation Induction

o Fertility Surgery

o Reproductive Immunology

o Alternative Therapies

By Service:

• Fresh Non-Donor

o Fresh Embryo Transfer

o Fresh Egg Collection

o Same-Cycle Procedures

o Immediate Fertilization

• Frozen Non-Donor

o Frozen Embryo Transfer (FET)

o Vitrification Techniques

o Extended Culture

o Delayed Transfer Cycles

• Egg and Embryo Banking

o Elective Egg Freezing

o Medical Egg Preservation

o Embryo Cryopreservation

o Long-Term Storage

• Fresh Donor

o Fresh Donor Egg Cycles

o Fresh Donor Sperm

o Synchronized Cycles

o Known Donor Programs

• Frozen Donor

o Frozen Donor Eggs

o Frozen Donor Sperm

o Frozen Donor Embryos

o Anonymous Donor Programs

By End User:

• Fertility Clinics

o Standalone Clinics

o Boutique Facilities

o Chain Networks

o Specialized Centers

• Hospitals

o Public Hospital Programs

o Private Hospital Services

o Teaching Hospitals

o Regional Hospitals

• Surgical Centers

o Day Surgery Units

o Outpatient Facilities

o Procedure Centers

o Specialized Surgical Units

• Clinical Research Institutes

o Academic Research Centers

o Clinical Trial Facilities

o Innovation Hubs

o Translational Research Units

• Cryobanks

o Sperm Banks

o Egg Banks

o Embryo Storage Facilities

o Tissue Banking Services

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-fertility-services-market

Australia Fertility Services Market News (2024-2025)

• September 2025: Research data revealed 20,417 babies born in Australia and New Zealand through IVF in 2023, demonstrating continued effectiveness and growing diversity of families utilizing assisted reproductive technologies across demographic segments.

• August 2025: International expert forum established policy consensus for improving fertility treatment accessibility and optimizing patient care across global markets, emphasizing need for comprehensive healthcare system integration and affordability initiatives.

• March 2025: Australian Government expanded Pharmaceutical Benefits Scheme listings including Slinda (progestogen-only contraceptive), Ryeqo (endometriosis treatment), and broader Pergoveris access (IVF hormone therapy) improving affordability and treatment accessibility.

• February 2025: Fertility Treatment Rebate eligibility criteria modifications implemented affecting access parameters and financial support structures for Australian patients seeking assisted reproductive technology services through Medicare system.

• March 2024: Queensland Government unveiled $42.3 million public funding package expanding fertility treatment access for residents affected by serious illnesses including cancer, providing subsidized assisted reproductive technology and integrated counseling services.

• 2024: IVF Australia opened new Bella Vista clinic offering comprehensive fertility consultations, IVF monitoring services, and IVF Lite programs expanding service accessibility for local families in growing suburban markets.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Cause of Infertility, Procedure, Service, and End User Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=42069&flag=F

Q&A Section

Q1: What drives growth in the Australia fertility services market?

A1: Market growth is driven by rising infertility prevalence attributed to lifestyle factors and environmental exposures requiring medical intervention, advanced maternal age trends as women increasingly delay childbearing into their mid-to-late thirties requiring assisted reproductive technologies, medical condition impacts among cancer patients and chronically ill individuals necessitating fertility preservation services, healthcare policy support through Medicare rebates and state funding initiatives reducing cost barriers, awareness and education improvements encouraging earlier treatment commencement, and technology advancement delivering sophisticated diagnostic tools and improved success protocols.

Q2: What are the latest trends in this market?

A2: Key trends include delayed parenthood patterns increasing demand for assisted reproductive technologies as couples postpone childbearing, technological innovation acceleration featuring artificial intelligence embryo selection and preimplantation genetic testing capabilities, public funding expansion through government investment in accessibility programs, fertility preservation growth driven by cancer treatments and lifestyle choices, integrated care models combining medical treatments with psychological and emotional support, and single and LGBTQ+ access improvements with specialized treatment pathways catering to diverse family structures.

Q3: What challenges do companies face?

A3: Major challenges include high treatment costs and financial burden despite Medicare rebates creating accessibility barriers for multiple treatment cycles, emotional and psychological stress associated with treatment journeys requiring comprehensive support services, regional accessibility disparities with specialized clinics concentrated in metropolitan areas creating travel burdens, age-related success rate limitations particularly for women over 40 requiring realistic expectation management, and regulatory complexity surrounding surrogacy arrangements and genetic screening applications requiring careful legal framework navigation.

Q4: What opportunities are emerging?

A4: Emerging opportunities include artificial intelligence integration advancing embryo selection accuracy and outcome prediction modeling improving success rates, telemedicine expansion enabling remote consultations and monitoring support reducing travel requirements for regional patients, corporate fertility benefits growth with employers offering treatment coverage as employee retention initiatives, medical tourism potential attracting international patients seeking high-quality treatments and competitive pricing, and research collaboration advancement between clinics and universities driving innovation in treatment protocols and new therapy development.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Fertility Services Market Projected to Reach USD 3.68 Billion by 2033 here

News-ID: 4203520 • Views: …

More Releases from IMARC Group

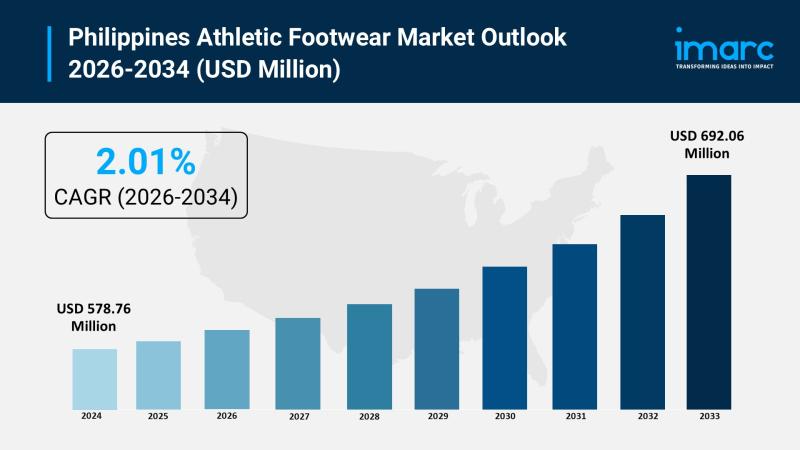

Philippines Athletic Footwear Market 2026 to Reach USD 692.06 Million by 2034 Am …

Market Overview

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034. The market is expanding rapidly, driven by increasing health consciousness, fitness trends, and demand for stylish yet functional shoes. With a growing middle class and a focus on performance and comfort, the Philippines athletic…

IMARC Group: Philippines Lingerie Market 2026 | Poised for Rapid Growth at 6.70% …

Market Overview

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns…

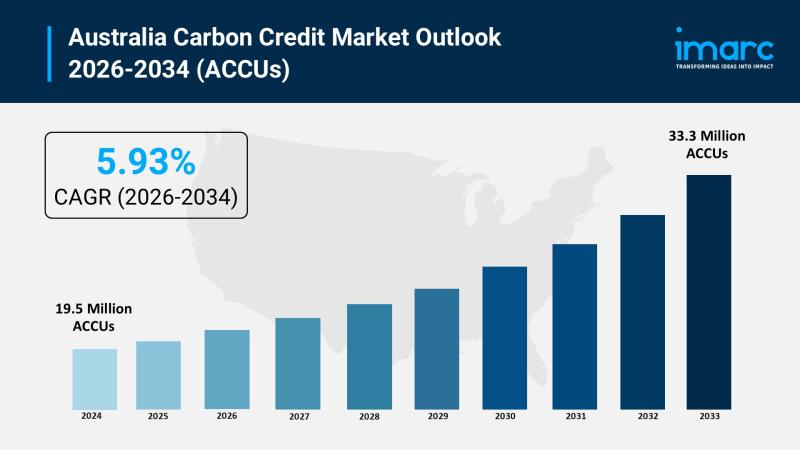

Australia Carbon Credit Market 2026 | Worth 33.3 Million ACCUs by 2034

Market Overview

The Australia carbon credit market size reached 19.5 Million ACCUs in 2025 and is projected to reach 33.3 Million ACCUs by 2034, exhibiting a CAGR of 5.93% during the forecast period 2026-2034. The industry is expanding significantly due to favorable government policies and regulations, increased dedication to corporate social responsibility, expanded international trade prospects, and significant expansion in renewable energy projects.

Request a Sample Report: https://www.imarcgroup.com/australia-carbon-credit-market/requestsample

How AI is Reshaping the…

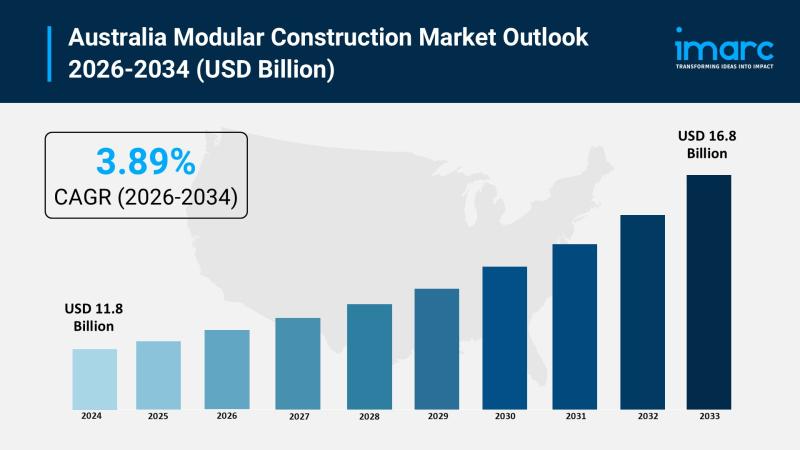

Australia Modular Construction Market 2026 | USD 16.8 Billion by 2034

Market Overview

The Australia modular construction market size reached USD 11.8 Billion in 2025 and is projected to reach USD 16.8 Billion by 2034, exhibiting a CAGR of 3.89% during the forecast period 2026-2034. The market is primarily driven by government infrastructure support, increasing housing demand, environmental considerations, and technological advances addressing the rising demand for efficient, adaptable housing solutions in urban and remote areas across the country.

Request a Sample Report:…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…