Press release

Australia Wind Energy Market to Surge to USD 6,698.2 Million During 2025-2033

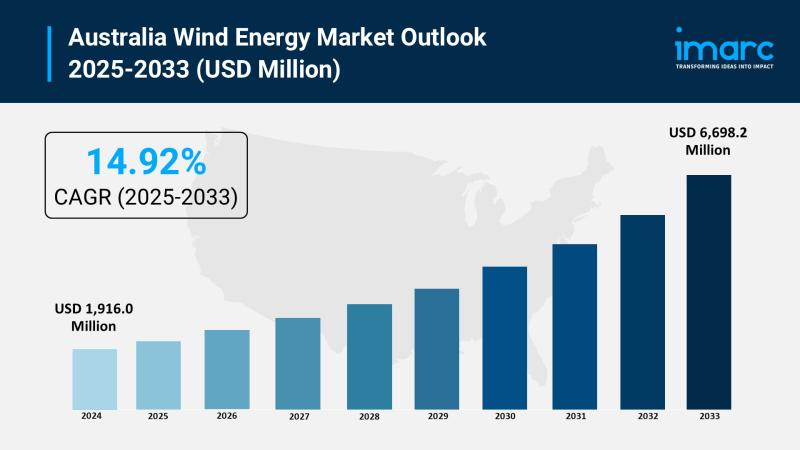

The latest report by IMARC Group, "Australia Wind Energy Market Size, Share, Trends and Forecast by Component, Rating, Installation, Turbine Type, Application, and Region, 2025-2033," provides an in-depth analysis of the Australia wind energy market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia wind energy market size reached USD 1,916.0 million in 2024 and is projected to grow to USD 6,698.2 million by 2033, exhibiting an impressive growth rate of 14.92% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1,916.0 Million

Market Forecast in 2033: USD 6,698.2 Million

Growth Rate (2025-2033): 14.92%

Australia Wind Energy Market Overview:

The Australia wind energy market is experiencing impressive growth driven by favorable government policies including the Renewable Energy Target (RET) and state-level renewable energy goals, continual technological advancements enhancing turbine efficiency and reducing costs, and increasing public and corporate demand for sustainable solutions through ambitious net-zero commitments. The market demonstrates robust momentum fueled by establishment of Renewable Energy Zones (REZs) in Victoria, Queensland, and New South Wales facilitating coordinated infrastructure investment, declining levelized cost of energy (LCOE) making wind competitive with fossil fuels, and rising electricity demand from electrification across electric vehicles, heating, and industrial processes. Strategic expansion is supported by Clean Energy Finance Corporation (CEFC) investments providing long-term, low-cost capital de-risking projects, Capacity Investment Scheme (CIS) offering revenue certainty attracting institutional investors, and state-level reverse auctions securing power purchase agreements reducing market volatility while corporate sustainability goals drive corporate PPAs providing stable revenue streams for wind farms.

Request For Sample Report: https://www.imarcgroup.com/australia-wind-energy-market/requestsample

Australia Wind Energy Market Trends:

• Offshore Wind Development accelerating as extensive coastline and abundant resources in Victoria, Tasmania, and South Australia enable large-capacity turbine deployment near population centers with floating wind technology accessing deeper waters

• Renewable Energy Zones Expansion transforming development landscape as strategically designated areas with high renewable potential receive simplified permitting, coordinated grid infrastructure investment, and stakeholder collaboration platforms

• Green Hydrogen Integration emerging as wind-generated electricity powers electrolysers producing carbon-free hydrogen for hard-to-decarbonize sectors and export markets in Japan and South Korea

• Battery Storage Coupling addressing intermittency challenges as energy storage technologies enable reliable, consistent power supply improving grid stability and wind energy utilization

• Remote Mining Solutions expanding as wind-diesel hybrid systems replace high-emission generators in off-grid mining operations reducing costs while meeting ESG requirements

• Digital Optimization enhancing operations through predictive analytics, remote monitoring, and advanced controls improving maintenance practices, operational reliability, and reducing long-term costs

• Corporate PPA Growth increasing as businesses across mining, manufacturing, and retail sectors commit to renewable energy targets driving long-term power purchase agreements with wind farms

Australia Wind Energy Market Drivers:

• Government Policy Support creating substantial demand through Renewable Energy Target, state-level incentives, feed-in tariffs, and renewable energy certificates providing stable regulatory environment reducing investment risks

• Technological Innovation supporting market expansion as larger, more efficient turbines with lightweight composites and improved aerodynamics generate more electricity at lower wind speeds reducing production costs

• Cost Competitiveness motivating adoption as declining LCOE driven by economies of scale, enhanced efficiency, and improved maintenance practices makes wind energy competitive with fossil fuels

• Corporate Sustainability Goals enabling revenue stability as companies setting ambitious carbon reduction targets through CSR initiatives drive corporate power purchase agreements providing long-term, stable income for projects

• CEFC Financing facilitating project development through long-term, low-cost capital supporting large-scale wind farms, grid connections, and storage systems while co-investing alongside commercial lenders

• Capacity Investment Scheme driving investor confidence by underwriting project income providing guaranteed revenue streams managing electricity price volatility and reducing financial risks

• Electrification Demand supporting sector growth as transition to electric vehicles, heating, and industrial processes significantly increases electricity demand requiring large-scale renewable generation

Market Challenges:

• Grid Transmission Constraints affecting deployment efficiency as limited capacity in wind-rich regions like South Australia and Tasmania restricts electricity transport to demand centers causing curtailment and revenue loss

• Community Opposition constraining project development as concerns about visual intrusion, noise, shadow flicker, and wildlife impacts lead to local resistance, protests, and legal action delaying timelines

• Lengthy Approval Processes hindering timely deployment as navigating multiple layers of environmental assessments, planning permits, and regulatory approvals across federal, state, and local levels takes several years

• Land Use Conflicts creating development challenges as projects in rural or scenic areas face objections from landowners and communities particularly when perceived consultation or benefit-sharing proves inadequate

• Infrastructure Investment Requirements increasing project costs as developers must invest in costly grid upgrades or face connection delays due to insufficient transmission lines in high-potential areas

• Regulatory Complexity complicating compliance as navigating environmental standards, planning regulations, and approval procedures across different government levels creates procedural inconsistencies and delays

• Stakeholder Coordination requiring extensive engagement as balancing interests of governments, communities, landowners, and environmental groups throughout project development and approval stages proves time-intensive

Market Opportunities:

• Offshore Wind Expansion capitalizing on extensive coastline enabling large-scale projects in Victoria, Tasmania, and South Australia with floating technology accessing deeper waters and stronger, consistent wind speeds

• Green Hydrogen Production integrating wind farms with electrolysers creating carbon-free hydrogen fuel for steelmaking, heavy transport, and industrial heating while serving export markets in Asia-Pacific region

• Remote Region Development powering off-grid mining operations and isolated communities through wind-diesel hybrid systems reducing fuel costs, lowering emissions, and improving energy security

• REZ Development leveraging strategically designated zones offering simplified permitting, coordinated infrastructure investment, and collaborative platforms unlocking high-quality wind sites

• State Auction Programs participating in reverse auction schemes in Victoria, Queensland, and New South Wales securing long-term PPAs with price guarantees reducing market volatility and enhancing bankability

• Storage Integration co-developing firming technologies including battery storage systems ensuring grid stability, managing intermittency, and providing dispatchable renewable energy supporting grid resilience

• Regional Job Creation supporting rural development through project construction, operations, and maintenance creating local employment opportunities and economic benefits encouraging community support

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/australia-wind-energy-market

Australia Wind Energy Market Segmentation:

By Component:

• Turbine

• Support Structure

• Electrical Infrastructure

• Others

By Rating:

• ≤ 2 MW

• 2 ≤ 5 MW

• 5 ≤ 8 MW

• 8 ≤ 10 MW

• 10 ≤ 12 MW

• 12 MW

By Installation:

• Offshore

• Onshore

By Turbine Type:

• Horizontal Axis

• Vertical Axis

By Application:

• Utility

• Industrial

• Commercial

• Residential

By Regional Distribution:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Wind Energy Market News:

September 2025: Victoria announced plans to open offshore wind auction in September 2025, advancing toward state targets of 2 GW offshore wind capacity by 2032, 4 GW by 2035, and 9 GW by 2040, demonstrating continued commitment to renewable energy expansion.

June 2025: The Draft 2025 Victorian Transmission Plan proposed a shoreline Renewable Energy Zone (REZ) in Gippsland to enable offshore wind development, with infrastructure planning supporting grid integration and transmission capacity for emerging offshore projects.

July 2025: Australia Wind Energy 2025 conference held in Melbourne brought together over 8,000 industry professionals and 1,500+ decision-makers, serving as the largest onshore and offshore wind energy event facilitating collaboration and innovation across the Asia-Pacific region.

2025: Tasmania committed $5 million to develop a Renewable Energy Services Hub at Bell Bay supporting the state's goal of achieving 200% renewable energy target by 2040, focusing on manufacturing and services for offshore wind industry development.

Key Highlights of the Report:

• Comprehensive market analysis projecting impressive growth from USD 1,916.0 million in 2024 to USD 6,698.2 million by 2033 with 14.92% CAGR

• Detailed examination of Renewable Energy Zones establishment in Victoria, Queensland, and New South Wales facilitating simplified permitting and coordinated grid infrastructure investment

• Strategic assessment of offshore wind potential leveraging extensive coastline with 12 projects granted feasibility licenses in Gippsland Offshore Wind Zone enabling 25 GW generation capacity

• In-depth analysis of declining cost competitiveness as technological improvements and economies of scale reduce levelized cost of energy making wind competitive with fossil fuels

• Regional market evaluation covering Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia

• Green hydrogen integration insights highlighting synergy between wind energy and carbon-free hydrogen production serving export markets and hard-to-decarbonize sectors

• Corporate sustainability assessment revealing growing power purchase agreements as businesses commit to net-zero targets providing stable, long-term revenue streams for wind projects

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's wind energy market growth to USD 6,698.2 million by 2033?

A1: The market is driven by favorable government policies including the Renewable Energy Target and state-level incentives creating stable regulatory environments, declining levelized cost of energy making wind competitive with fossil fuels, and increasing corporate sustainability commitments driving power purchase agreements. Establishment of Renewable Energy Zones facilitating coordinated development, Clean Energy Finance Corporation providing long-term low-cost capital, and rising electricity demand from electrification across vehicles, heating, and industrial processes contribute to the impressive 14.92% growth rate during the forecast period.

Q2: How are Renewable Energy Zones supporting wind energy development?

A2: Renewable Energy Zones established in Victoria, Queensland, and New South Wales are strategically designated areas with high renewable resource potential receiving government planning support, simplified permitting processes, and coordinated grid infrastructure investment. These zones minimize development risk and expenses by ensuring transmission capacity where new generation is constructed, facilitate stakeholder collaboration among governments, communities, and industry, and provide certainty for wind project developers enabling large-scale deployment supporting Australia's clean energy transition.

Q3: What opportunities exist in offshore and emerging wind energy applications?

A3: Offshore wind development in Victoria, Tasmania, and South Australia offers major opportunities leveraging extensive coastline and abundant resources with floating technology accessing deeper waters and stronger wind speeds. Green hydrogen integration enables carbon-free fuel production for export markets and hard-to-decarbonize sectors, while remote mining region expansion provides clean alternatives to diesel generators meeting ESG requirements. State auction programs securing long-term PPAs, battery storage co-development ensuring grid stability, and regional job creation supporting community engagement represent significant growth opportunities across diverse market segments.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24691&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Wind Energy Market to Surge to USD 6,698.2 Million During 2025-2033 here

News-ID: 4203509 • Views: …

More Releases from IMARC Group

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

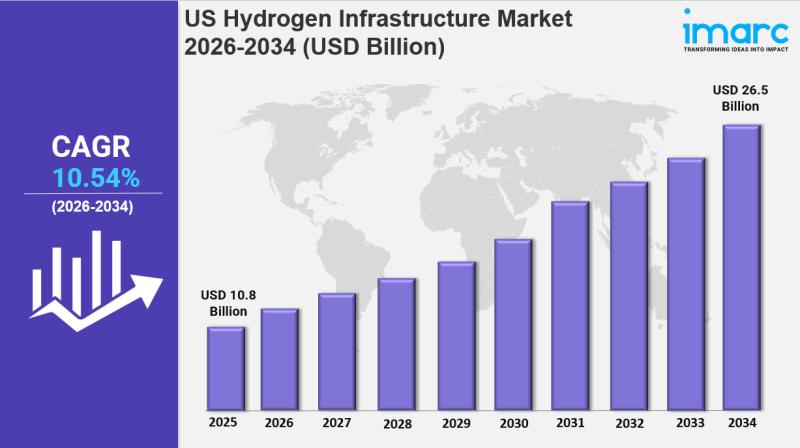

US Hydrogen Infrastructure Market Size, Growth, Latest Trends and Forecast 2026- …

IMARC Group has recently released a new research study titled "US Hydrogen Infrastructure Market Report by Production (Steam Methane Reforming, Coal Gasification, Electrolysis, and Others), Storage (Compression, Liquefaction, Material Based), Delivery (Transportation, Refinery, Power Generation, Hydrogen Refueling Stations), and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. hydrogen infrastructure market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…