Press release

Australia Retail Automation Market Projected to Reach USD 1,411.84 Million by 2033

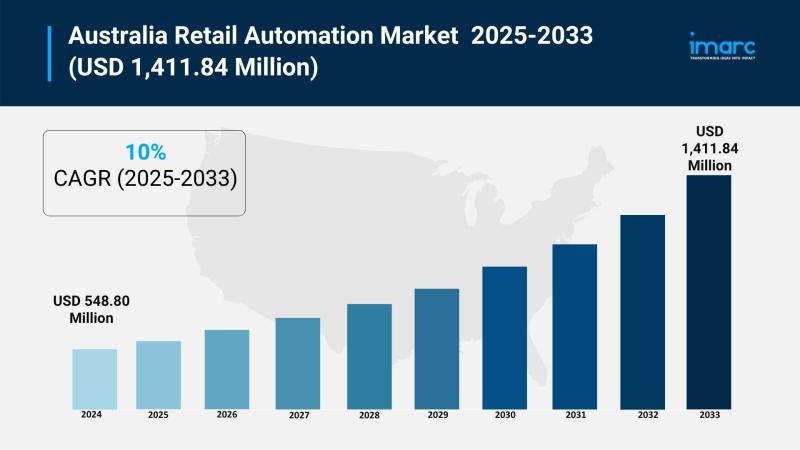

The latest report by IMARC Group, titled "Australia Retail Automation Market Report by Type (Point of Sale (POS), Barcode and RFID, Electronic Shelf Label (ESL), Camera, Autonomous Guided Vehicle (AGV), Others), Implementation (In-Store, Warehouse), End User (Supermarkets and Hypermarkets, Single Item Stores, Fuel Stations, Retail Pharmacies), and Region 2025-2033," offers a comprehensive analysis of the Australia retail automation market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia retail automation market size reached USD 548.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,411.84 Million by 2033, exhibiting a CAGR of 10% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 548.80 Million

Market Forecast in 2033: USD 1,411.84 Million

Market Growth Rate (2025-2033): 10%

Australia Retail Automation Market Overview

The Australia retail automation market is experiencing robust growth driven by rising labor costs, strong demand for contactless shopping experiences, rapid adoption of AI-powered checkout systems, e-commerce expansion, and increasing digital payment penetration across consumer segments. The market expansion is supported by technological advancements in artificial intelligence integration, robotics deployment, computer vision systems, and increasing recognition of automation capabilities for enhancing operational efficiency while improving customer satisfaction levels. Advanced retail automation solutions are transforming Australia's retail landscape through streamlined checkout processes, optimized inventory management, enhanced supply chain efficiency, and personalized customer experiences positioning retailers as competitive market participants adopting innovative technology solutions and customer-centric operational models.

Australia's retail automation foundation demonstrates strong commercial fundamentals across diverse applications including point-of-sale systems, self-checkout terminals, warehouse robotics, inventory tracking technologies, and automated supply chain management solutions. The country's high labor costs, urbanization patterns, sophisticated consumer expectations, and commitment to operational excellence create substantial demand for automation technologies capable of reducing operational expenses while delivering enhanced shopping experiences. The proliferation of e-commerce platforms, omnichannel retail strategies, contactless payment preferences, and data-driven decision-making approaches is creating favorable market conditions, requiring significant investments in technology infrastructure, system integration, staff training, and digital transformation initiatives. Australia's progressive retail sector, combined with government support for digital transformation and growing focus on sustainability through operational efficiency, makes it an increasingly attractive market for innovative retail automation technology deployment and commercial expansion.

Request For Sample Report:

https://www.imarcgroup.com/australia-retail-automation-market/requestsample

Australia Retail Automation Market Trends

• AI-driven customer experiences: Growing adoption of artificial intelligence-powered systems including smart self-checkout terminals, personalized recommendation engines, natural language chatbots, and computer vision technologies enhancing customer engagement while reducing operational costs and improving shopping convenience.

• Back-end automation acceleration: Increasing implementation of warehouse robotics, automated storage and retrieval systems (ASRS), autonomous mobile robots (AMRs), and predictive analytics tools optimizing inventory management, demand forecasting, and supply chain operations throughout retail distribution networks.

• Contactless shopping expansion: Rising deployment of touchless payment systems, mobile checkout applications, scan-and-go technologies, and cashierless store concepts responding to consumer preferences for hygiene, convenience, and speed in retail transaction processes.

• Omnichannel integration advancement: Expanding connectivity between physical stores, e-commerce platforms, mobile applications, and automated fulfillment centers creating seamless shopping experiences and enabling efficient inventory visibility across multiple retail channels.

• Robotics-as-a-Service (RaaS) adoption: Growing utilization of subscription-based robotic solutions providing flexible, scalable automation capabilities without substantial upfront capital investments particularly attractive for small-to-medium retail enterprises seeking competitive advantages.

• Sustainability-focused automation: Strengthening implementation of automated systems optimizing energy consumption, reducing waste generation, minimizing carbon footprints through efficient transport routing, and supporting retailers' environmental sustainability commitments and corporate responsibility objectives.

Market Drivers

• Rising labor costs: Growing wage pressures and workforce availability challenges driving retailers toward automation solutions capable of reducing staffing requirements, improving productivity, and maintaining service quality while controlling operational expenses.

• E-commerce growth impact: Implementation of sophisticated warehouse automation, order fulfillment systems, and last-mile delivery solutions supporting rapid e-commerce expansion and meeting consumer expectations for fast, accurate order processing and delivery.

• Consumer convenience demands: Increasing shopper preferences for speed, efficiency, personalized experiences, and minimal friction during shopping journeys compelling retailers to adopt automation technologies improving checkout processes and customer satisfaction.

• Digital payment penetration: Growing adoption of contactless payments, mobile wallets, digital currencies, and integrated payment platforms requiring advanced point-of-sale systems and automated transaction processing capabilities across retail environments.

• Operational efficiency pressures: Rising competitive intensity, margin pressures, and profitability challenges motivating retailers to implement automation solutions optimizing inventory turnover, reducing shrinkage, and improving space utilization throughout operations.

• Government digital transformation support: Increasing policy initiatives, technology adoption incentives, and infrastructure investments encouraging retail sector modernization through automation adoption and digital capability enhancement supporting economic competitiveness.

Challenges and Opportunities

Challenges:

• High initial capital investment requirements for automation technology deployment, system integration, and infrastructure upgrades creating financial barriers particularly for independent retailers and small-to-medium enterprises with limited budgets

• Integration complexity challenges connecting legacy systems, diverse technology platforms, and multiple vendor solutions requiring specialized expertise, careful planning, and ongoing technical support throughout implementation processes

• Workforce transition concerns including employee displacement fears, skill retraining requirements, resistance to technology adoption, and organizational change management needs requiring comprehensive communication strategies and support programs

• Cybersecurity and data privacy risks associated with interconnected retail systems, customer data collection, payment processing, and cloud-based platforms requiring robust security measures and compliance with evolving regulatory requirements

• Technology reliability dependencies where system failures, technical glitches, or connectivity issues can disrupt retail operations, impact customer experiences, and generate negative publicity requiring comprehensive backup systems and contingency planning

Opportunities:

• Artificial intelligence advancement enabling sophisticated customer behavior analysis, predictive demand forecasting, dynamic pricing optimization, and personalized marketing strategies creating competitive differentiation and revenue enhancement opportunities

• Small retailer democratization through affordable, scalable automation solutions including cloud-based systems, subscription models, and modular technologies reducing entry barriers and enabling competitive positioning against larger retail chains

• Data analytics monetization leveraging automated systems generating valuable consumer insights, shopping pattern intelligence, and operational performance metrics informing strategic decision-making and creating additional revenue streams

• Sustainability competitive advantage utilizing automation technologies reducing energy consumption, optimizing resource utilization, minimizing waste generation, and supporting environmental credentials appealing to conscious consumers and corporate stakeholders

• Innovation ecosystem development fostering partnerships between retailers, technology providers, research institutions, and government agencies accelerating automation adoption, best practice sharing, and collaborative solution development

Australia Retail Automation Market Segmentation

By Type:

• Point of Sale (POS)

o Traditional POS Systems

o Cloud-Based POS

o Mobile POS

o Self-Service Kiosks

• Barcode and RFID

o Barcode Scanners

o RFID Tags

o RFID Readers

o Inventory Tracking Systems

• Electronic Shelf Label (ESL)

o Digital Price Tags

o E-Paper Displays

o LCD Electronic Labels

o Dynamic Pricing Systems

• Camera

o Computer Vision Systems

o Security Cameras

o Customer Analytics Cameras

o Heat Mapping Systems

• Autonomous Guided Vehicle (AGV)

o Warehouse AGVs

o In-Store AGVs

o Delivery Robots

o Material Handling AGVs

• Others

o Smart Shelves

o Automated Storage Systems

o Conveyor Systems

o Robotic Arms

By Implementation:

• In-Store

o Self-Checkout Systems

o Smart Shelving

o Digital Signage

o Customer Service Robots

o Queue Management Systems

o Interactive Kiosks

• Warehouse

o Automated Storage and Retrieval Systems (ASRS)

o Autonomous Mobile Robots (AMRs)

o Conveyor Systems

o Robotic Pick and Pack

o Inventory Management Systems

o Sortation Systems

By End User:

• Supermarkets and Hypermarkets

o Large Format Stores

o Regional Supermarkets

o Discount Supermarkets

o Specialty Food Retailers

• Single Item Stores

o Convenience Stores

o Specialty Retailers

o Pop-Up Stores

o Boutique Outlets

• Fuel Stations

o Petrol Station Convenience

o Highway Service Stations

o Urban Fuel Retailers

o Truck Stop Facilities

• Retail Pharmacies

o Chain Pharmacies

o Independent Pharmacies

o Hospital Pharmacies

o Online Pharmacy Fulfillment

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-retail-automation-market

Australia Retail Automation Market News (2024-2025)

• August 2025: National AI Centre's AI Adoption Tracker revealed small and medium Australian businesses continue embracing artificial intelligence in operations with significant growth in responsible AI practices and automation technology integration across retail sectors.

• April 2025: Salesforce research indicated 77% of Australian and New Zealand retailers believe AI agents will be essential for competition, with 82% currently piloting or deploying AI automation solutions within business operations.

• March 2025: Industry analysis highlighted warehouse automation trends featuring Automated Storage and Retrieval Systems (ASRS) and Autonomous Mobile Robots (AMRs) transforming dynamic warehouse operations across Australian retail distribution networks.

• February 2025: Swisslog announced warehouse automation trends for 2025 emphasizing flexible infrastructure technologies including mobile robotics and AGVs enabling small-to-medium enterprises to achieve competitive operational efficiency advantages.

• 2024: Coles and Woolworths accelerated warehouse automation deployments leveraging robotic technology and artificial intelligence across supply chains, reshaping industrial property development landscape and setting new operational efficiency standards.

• 2024: Robots-as-a-Service (RaaS) emerged as transformative model for Australian retailers offering scalable, subscription-based automation integration without substantial upfront capital investments enabling broader technology adoption across enterprise sizes.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type, Implementation, and End User Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=42107&flag=F

Q&A Section

Q1: What drives growth in the Australia retail automation market?

A1: Market growth is driven by rising labor costs and workforce availability challenges compelling retailers toward productivity-enhancing automation solutions, e-commerce growth impact requiring sophisticated warehouse automation and order fulfillment capabilities, consumer convenience demands for speed and personalized shopping experiences, digital payment penetration necessitating advanced point-of-sale systems, operational efficiency pressures motivating inventory optimization and cost reduction initiatives, and government digital transformation support through policy initiatives and technology adoption incentives encouraging retail sector modernization.

Q2: What are the latest trends in this market?

A2: Key trends include AI-driven customer experiences featuring smart checkout systems and personalized recommendation engines enhancing engagement, back-end automation acceleration utilizing warehouse robotics and predictive analytics optimizing supply chains, contactless shopping expansion responding to hygiene and convenience preferences, omnichannel integration advancement creating seamless experiences across retail channels, Robotics-as-a-Service (RaaS) adoption providing flexible automation without substantial capital investments, and sustainability-focused automation optimizing energy consumption and supporting environmental commitments.

Q3: What challenges do companies face?

A3: Major challenges include high initial capital investment requirements for technology deployment creating financial barriers for smaller retailers, integration complexity challenges connecting legacy systems and diverse platforms requiring specialized expertise, workforce transition concerns including employee displacement fears and retraining requirements, cybersecurity and data privacy risks associated with interconnected systems requiring robust security measures, and technology reliability dependencies where system failures can disrupt operations requiring comprehensive backup systems and contingency planning.

Q4: What opportunities are emerging?

A4: Emerging opportunities include artificial intelligence advancement enabling sophisticated customer behavior analysis and predictive forecasting creating competitive differentiation, small retailer democratization through affordable scalable automation solutions reducing entry barriers, data analytics monetization leveraging automated systems generating valuable consumer insights informing strategic decisions, sustainability competitive advantage utilizing automation reducing environmental impact appealing to conscious consumers, and innovation ecosystem development fostering partnerships accelerating adoption and collaborative solution development.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Retail Automation Market Projected to Reach USD 1,411.84 Million by 2033 here

News-ID: 4203490 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…