Press release

Philippines Online Car Buying Market 2025 | Projected to Reach USD 15,791.30 Million by 2033

The latest report by IMARC Group, "Philippines Online Car Buying Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Category, and Region, 2025-2033," provides an in-depth analysis of the Philippines online car buying market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines online car buying market size reached USD 7,140.00 million in 2024 and is projected to grow to USD 15,791.30 million by 2033, exhibiting a steady growth rate of 9.22% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 7,140.00 Million

Market Forecast in 2033: USD 15,791.30 Million

Growth Rate (2025-2033): 9.22%

Philippines Online Car Buying Market Overview:

The Philippines online car buying market is experiencing robust growth driven by rising internet penetration, increasing digital adoption, and consumers' growing preference for convenient and transparent purchasing processes. The market demonstrates strong momentum as Filipinos increasingly embrace digital platforms for high-value purchases, with enhanced smartphone accessibility and high-speed broadband connectivity enabling seamless online automotive transactions. Strategic expansion is fueled by the integration of financial technology solutions, secure digital payment methods, and comprehensive online financing options that simplify vehicle purchasing processes. The sector benefits from virtual car showrooms, transparent pricing models, and comprehensive vehicle information availability, while key market drivers include convenience-focused consumer behavior, fintech partnerships with automotive platforms, and the availability of pre-approved loans and flexible financing plans making car ownership accessible to broader population segments.

Request For Sample Report: https://www.imarcgroup.com/philippines-online-car-buying-market/requestsample

Philippines Online Car Buying Market Trends:

• Digital Platform Transformation revolutionizing automotive retail through comprehensive online showrooms, virtual vehicle tours, and interactive features enabling complete car buying experiences without physical dealership visits

• Fintech Integration Expansion streamlining purchase processes through partnerships between automotive platforms and financial technology companies offering pre-approved loans, real-time credit assessments, and flexible financing solutions

• Mobile-First Approach dominating market access as smartphone penetration enables consumers to browse inventories, compare vehicles, and complete transactions through optimized mobile applications and responsive websites

• Transparency Enhancement building consumer trust through detailed vehicle information, comprehensive reviews, price comparisons, and vehicle history reports reducing purchasing hesitation and uncertainty

• Omnichannel Experience Development combining online browsing with offline services including home delivery, scheduled test drives, and flexible return policies creating seamless customer journeys

• AI-Powered Personalization improving user experience through intelligent recommendation systems, customized vehicle suggestions, and automated customer service enhancing engagement and conversion rates

• Secure Payment Evolution expanding digital payment options through secure online methods, digital wallets, and integrated financing platforms reducing traditional banking dependencies and transaction complexities

Philippines Online Car Buying Market Drivers:

• Internet Penetration Growth enabling widespread market access as increasing smartphone adoption and high-speed broadband connectivity facilitate comprehensive online automotive shopping experiences

• Consumer Convenience Preference motivating digital adoption as buyers seek streamlined purchasing processes avoiding traditional dealership negotiations and time-intensive procedures

• Digital Payment Security building consumer confidence through advanced encryption, secure transaction protocols, and trusted digital wallet integration supporting high-value online purchases

• Comprehensive Vehicle Information attracting informed buyers through detailed specifications, transparent pricing, customer reviews, and vehicle history reports enabling confident purchasing decisions

• Financing Accessibility expanding market reach through integrated loan options, flexible payment plans, and simplified credit approval processes making vehicle ownership achievable for diverse income segments

• Urban Lifestyle Changes driving online adoption as busy professionals and urban consumers prioritize time-efficient shopping experiences over traditional dealership visits

• COVID-19 Digital Acceleration establishing long-term behavioral changes as pandemic-driven digital adoption created sustainable preferences for contactless purchasing experiences

Market Challenges:

• Consumer Trust Building requiring continuous efforts to establish confidence in high-value online transactions through reputation management, secure payment systems, and transparent business practices

• Physical Inspection Limitations addressing buyer concerns about vehicle condition assessment without in-person examination through comprehensive photography, virtual tours, and detailed condition reports

• Delivery and Logistics managing complex nationwide vehicle distribution networks ensuring timely delivery, proper handling, and customer satisfaction across diverse geographic locations

• Digital Literacy Gaps accommodating varying technology adoption levels across different demographic segments and regions through user-friendly interfaces and customer support systems

• Regulatory Compliance navigating complex automotive regulations, registration procedures, and documentation requirements while maintaining streamlined online purchasing processes

• After-Sales Service Integration coordinating maintenance, warranty services, and customer support across online and offline touchpoints ensuring comprehensive ownership experiences

• Competition Intensification managing market saturation as traditional dealers, new entrants, and international platforms compete for market share through pricing and service differentiation

Market Opportunities:

• Rural Market Penetration expanding services to underserved regional areas where traditional dealership access remains limited through mobile-optimized platforms and flexible delivery solutions

• Electric Vehicle Integration capitalizing on growing environmental consciousness by featuring electric and hybrid vehicles with specialized financing and charging infrastructure information

• B2B Fleet Solutions developing corporate sales platforms targeting businesses requiring multiple vehicles through bulk purchasing options, fleet management services, and customized financing arrangements

• Subscription and Leasing Models introducing flexible ownership alternatives including vehicle subscriptions, long-term rentals, and lease-to-own programs appealing to changing mobility preferences

• Advanced Technology Integration implementing augmented reality vehicle viewing, AI-powered recommendations, and blockchain-based ownership verification enhancing customer experience and security

• Partnership Ecosystem Development creating comprehensive automotive ecosystems through insurance integration, maintenance scheduling, and value-added services increasing customer lifetime value

• Cross-Border Expansion leveraging digital infrastructure to explore regional market opportunities and imported vehicle sales with international dealer partnerships

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-online-car-buying-market

Philippines Online Car Buying Market Segmentation:

By Vehicle Type:

• Hatchback

• Sedan

• SUV

• Others

By Propulsion Type:

• Petrol

• Diesel

• Others

By Category:

• Pre-Owned Vehicle

• New Vehicle

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Online Car Buying Market News:

August 2025: Philippines online car buying market reached USD 7,140.00 million in 2024 with steady growth projected at 9.22% CAGR through 2033, driven by increasing internet penetration and digital adoption across automotive retail channels.

May 2025: Financial technology integration accelerated in Philippine automotive platforms with fintech companies partnering to offer pre-approved loans, flexible financing plans, and real-time credit assessments simplifying high-value vehicle purchases.

February 2025: Consumer preference for convenience and transparency drove significant adoption of online car buying platforms offering streamlined experiences, transparent pricing, and comprehensive vehicle information reducing traditional dealership dependencies.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from USD 7,140.00 million in 2024 to USD 15,791.30 million by 2033 with 9.22% CAGR

• Detailed examination of rising internet penetration and digital adoption enabling widespread online automotive purchasing across Philippine consumer segments

• Strategic assessment of fintech integration through partnerships offering secure payment methods, digital wallets, and comprehensive financing solutions

• In-depth analysis of convenience and transparency preferences driving consumer shift from traditional dealership models to digital platforms

• Regional market evaluation covering Luzon, Visayas, and Mindanao with diverse connectivity levels and automotive market maturity

• Technology integration insights highlighting virtual showrooms, AI-powered personalization, and mobile-first approaches enhancing user experience

• Consumer behavior assessment revealing digital payment security, comprehensive vehicle information, and financing accessibility as primary adoption drivers

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines' online car buying market growth to USD 15,791.30 million by 2033?

A1: The market is driven by rising internet penetration and digital adoption as more Filipinos access smartphones and high-speed broadband. Consumer preferences for convenience and transparency, along with fintech integration offering secure payment methods and flexible financing options, contribute to the steady 9.22% growth rate, while virtual showrooms and comprehensive vehicle information enhance purchasing confidence.

Q2: How is fintech integration impacting the Philippine online car buying market?

A2: Fintech integration is significantly transforming the market through partnerships between automotive platforms and financial technology companies. These collaborations provide consumers with pre-approved loans, flexible financing plans, real-time credit assessments, and secure digital payment methods, making car ownership accessible to broader population segments while reducing dependence on traditional banking processes.

Q3: What role does convenience and transparency play in market expansion?

A3: Convenience and transparency are fundamental drivers as they address traditional car buying pain points including lengthy negotiations, multiple dealership visits, and complex processes. Online platforms offer streamlined experiences with transparent pricing, comprehensive vehicle information, customer reviews, and additional services like home delivery and scheduled test drives, creating compelling alternatives to conventional automotive retail approaches.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=41996&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Online Car Buying Market 2025 | Projected to Reach USD 15,791.30 Million by 2033 here

News-ID: 4197159 • Views: …

More Releases from IMARC Group

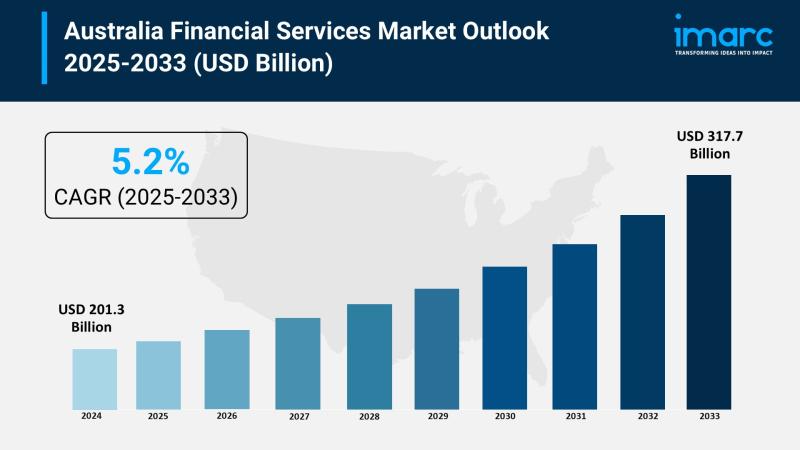

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

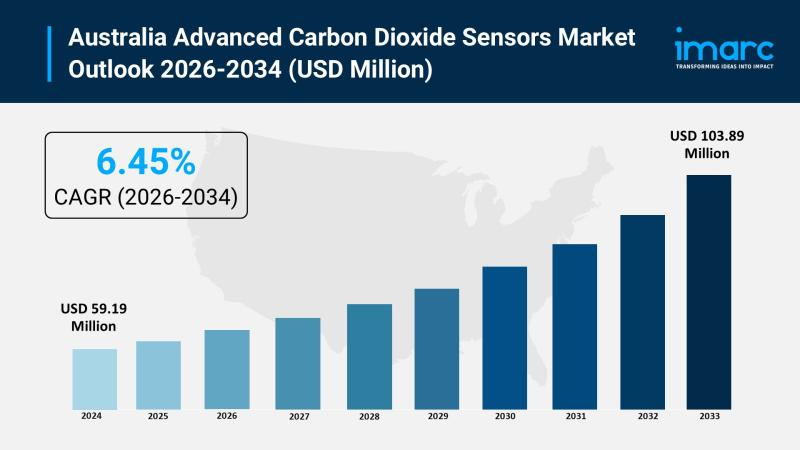

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

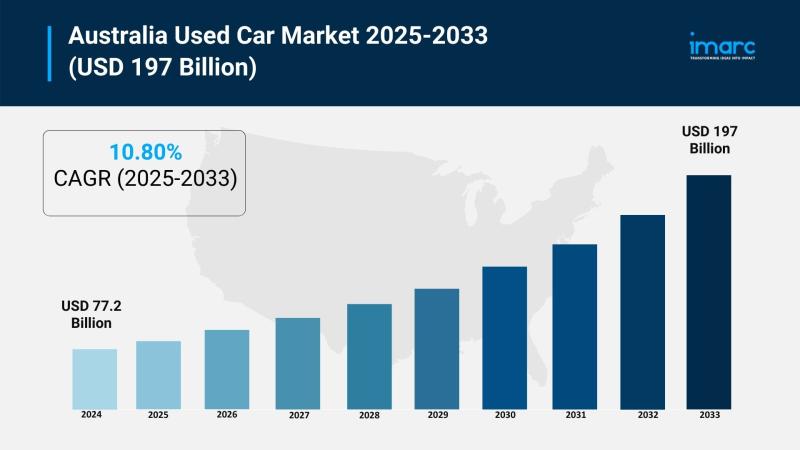

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

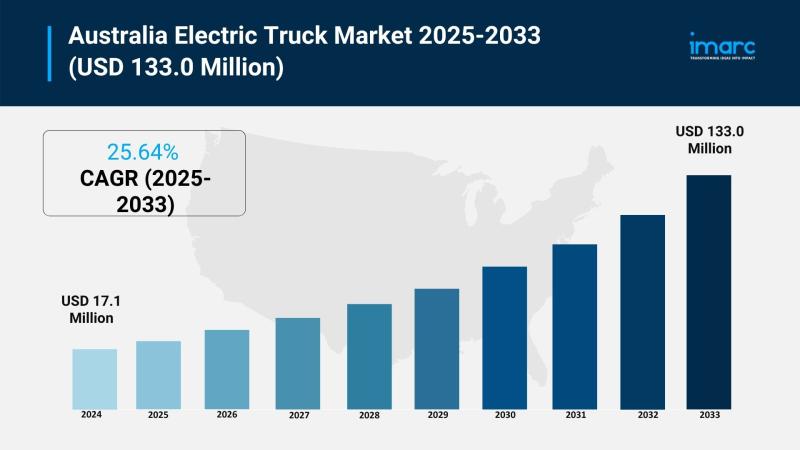

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…