Press release

Philippines Car Rental Market 2025 | Worth USD 564.81 Million by 2033

The latest report by IMARC Group, "Philippines Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End-User, and Region, 2025-2033," provides an in-depth analysis of the Philippines car rental market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines car rental market size reached USD 377.55 million in 2024 and is projected to grow to USD 564.81 million by 2033, exhibiting a steady growth rate of 4.11% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 377.55 Million

Market Forecast in 2033: USD 564.81 Million

Growth Rate (2025-2033): 4.11%

Philippines Car Rental Market Overview:

The Philippines car rental market is experiencing notable development driven by expanding tourism, urban mobility needs, and demand for seamless travel experiences. The market demonstrates consistent momentum with digital booking platforms, flexible rental durations, and a diverse fleet of vehicle types shaping consumer preferences. Strategic developments include international tourist arrivals being exceptionally strong in March 2024, reinforcing robust demand for rental mobility across the country. The sector benefits from operators emphasizing service quality and regional outreach to strengthen market positioning, while collaboration with travel partners and enhanced customer support further enhance accessibility across key Philippine destinations, collectively influencing market growth dynamics.

Request For Sample Report: https://www.imarcgroup.com/philippines-car-rental-market/requestsample

Philippines Car Rental Market Trends:

• Influence of Tourism and Fleet Diversification expanding through rising visitor numbers seeking flexible transportation options with demand for diverse fleet including sedans for urban trips and SUVs for mixed terrains

• Expansion of Online Booking and App-Based Rentals accelerating through digital channels adoption as central source of customer satisfaction with online reservation processes, mobile apps, and comparison functionalities streamlining rental experience

• Growth of Sustainable Options and Regulatory Support advancing through environmental objectives and government transport modernization programs compelling operators to update fleets for efficiency and emission compliance

• Island-Hopping and Regional Travel Demand strengthening appeal for vehicles capable of handling varied road conditions as tourists explore multiple islands and rural areas requiring versatile transportation solutions

• Digital Platform Integration gaining traction through increased confidence in cashless and app-based transactions enabling operators to understand usage patterns and implement dynamic pricing models

• Public Utility Vehicle Modernization Program Impact encouraging rental operators to consider hybrid and low-emission vehicles as part of long-term fleet strategies aligning with sustainability goals

• Seasonal Travel Pattern Adaptation responding to domestic traveler demand during long weekends and festive seasons with operators aligning supply with seasonal travel patterns

Philippines Car Rental Market Drivers:

• Expanding Tourism Industry creating robust demand for flexible and reliable transportation options across various destinations with island-hopping, heritage tours, and regional travel driving fleet diversification needs

• Urban Mobility Requirements supporting market growth through increasing need for convenient transportation solutions in metropolitan areas and provincial regions with improved road connectivity and airport access

• Digital Transformation Adoption enabling streamlined rental experiences through online booking platforms, mobile applications, and digital payment systems aligned with consumer behavior changes toward convenience and transparency

• Seamless Travel Experience Demand motivating consumers to seek integrated transportation solutions that complement tourism activities and business travel requirements across the Philippine archipelago

• Infrastructure Development facilitating broader expansion of rental services through better road connectivity, airport access improvements, and enhanced regional transportation networks

• Fleet Modernization Requirements driving operators to diversify vehicle offerings with sedans, SUVs, multi-purpose vehicles, and sustainable options meeting varied customer preferences and regulatory standards

• Corporate and Recreational Customer Growth expanding market base through increased business travel, leisure tourism, and domestic travel activities requiring reliable rental vehicle access

Market Challenges:

• Island Geography and Logistics Complexity creating operational challenges for fleet distribution and maintenance across the 7,641 islands requiring efficient inter-island transportation and regional service networks

• Infrastructure Limitations constraining service expansion in remote areas with inadequate road conditions, limited fuel stations, and variable telecommunications coverage affecting fleet management and customer support

• Seasonal Demand Fluctuations requiring efficient fleet utilization management during peak tourist seasons and slower periods affecting revenue stability and operational planning

• Regulatory Compliance Across Regions navigating diverse local government requirements, licensing procedures, and transportation regulations across different provinces and municipalities throughout the Philippines

• Competition from Alternative Transportation facing challenges from ride-sharing services, traditional taxi operators, and emerging mobility solutions competing for the same customer segments

• Vehicle Maintenance and Safety Standards ensuring consistent service quality across diverse road conditions and climate variations while maintaining fleet safety and reliability standards

• Economic Sensitivity and Price Competition managing cost pressures from fuel price volatility, vehicle acquisition costs, and competitive pricing requirements affecting profitability margins

Market Opportunities:

• Tourism Recovery and Growth capitalizing on Philippines' position as a premier Asian destination with government initiatives promoting sustainable tourism and improved destination marketing

• Corporate Travel Expansion targeting growing business travel segment through partnerships with companies, hotels, and conference centers requiring reliable transportation solutions

• Electric and Hybrid Vehicle Integration pioneering sustainable fleet options aligned with government environmental initiatives and growing consumer consciousness about carbon footprint reduction

• Digital Platform Enhancement developing advanced booking systems, loyalty programs, and integrated travel packages combining car rental with accommodation and tourism services

• Regional Expansion into Underserved Areas establishing services in emerging tourist destinations and secondary cities with growing business activities and infrastructure development

• Partnership Development collaborating with airlines, hotels, travel agencies, and tourism boards to create comprehensive travel packages and enhance customer acquisition

• Specialized Vehicle Services offering niche solutions including luxury vehicles, adventure-ready SUVs, and customized transportation for special events and corporate functions

Browse the Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-car-rental-market

Philippines Car Rental Market Segmentation:

By Booking Type:

• Offline Booking

• Online Booking

By Rental Length:

• Short Term

• Long Term

By Vehicle Type:

• Luxury

• Executive

• Economy

• SUVs

• Others

By Application:

• Leisure/Tourism

• Business

By End-User:

• Self-Driven

• Chauffeur-Driven

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Car Rental Market News:

September 2025: IMARC Group reports continued growth in Philippines car rental market driven by tourism expansion, digital platform adoption, and sustainable fleet modernization initiatives.

August 2025: Industry analysis shows increasing adoption of digital car rental platforms with consumers gaining confidence in cashless and app-based transaction systems.

2025: Digital car rental sites continued gaining traction as people became increasingly confident using cashless and app-based transactions for rental services.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from $377.55 million in 2024 to $564.81 million by 2033

• Detailed examination of tourism impact with exceptionally strong international tourist arrivals in March 2024 driving rental mobility demand across the country

• Strategic assessment of digital transformation through online booking platforms, mobile apps, and cashless transaction adoption enhancing customer experience

• In-depth analysis of sustainability trends through Public Utility Vehicle Modernization Program influencing private sector fleet modernization decisions

• Regional market evaluation covering Luzon, Visayas, and Mindanao with diverse tourism patterns and infrastructure development levels

• Vehicle type segmentation insights highlighting opportunities across luxury, executive, economy, SUVs, and specialized vehicle categories

• Application analysis revealing growth potential across leisure/tourism and business segments with varied rental duration preferences

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines' car rental market growth to $564.81 million by 2033?

A1: The market is driven by expanding tourism, urban mobility needs, and demand for seamless travel experiences. Exceptionally strong international tourist arrivals in March 2024 reinforced robust demand for rental mobility. Digital booking platforms, flexible rental durations, and diverse fleet options are shaping consumer preferences, while operators emphasize service quality and regional outreach supporting the steady 4.11% growth rate during the forecast period.

Q2: How is digital transformation impacting the car rental industry in the Philippines?

A2: Digital transformation is reshaping the industry through online booking platforms, mobile apps, and comparison functionalities that streamline the rental experience. In 2025, adoption of digital car rental sites continued gaining traction as consumers became increasingly confident in cashless and app-based transactions. This digitization enables operators to understand usage patterns better, implement dynamic pricing models, and enhance service delivery for both corporate and recreational customers.

Q3: What role does sustainability play in market development?

A3: Sustainability is becoming increasingly important with environmental objectives and government transport modernization programs compelling rental operators to update their fleets for efficiency and emission compliance. The 2024 enforcement of the Public Utility Vehicle Modernization Program is encouraging operators to consider hybrid and low-emission vehicles as part of long-term fleet strategies, aligning with national sustainability goals and customer demand for greener transportation options.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=41915&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Car Rental Market 2025 | Worth USD 564.81 Million by 2033 here

News-ID: 4195174 • Views: …

More Releases from IMARC Group

Potassium Silicate Prices, Trend, and Demand Insights 2025

North America Potassium Silicate Prices Movement Q3:

In Q3 2025, Potassium Silicate Prices in the USA reached USD 2,645/MT, reflecting firm demand from construction, coatings, and detergent industries. Strong industrial activity and steady raw material costs supported pricing stability. Infrastructure projects and specialty chemical applications further contributed to sustained market momentum.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/potassium-silicate-pricing-report/requestsample

China Potassium Silicate Prices Movement Q3:

China recorded Potassium Silicate prices at USD 1,662/MT during Q3 2025.…

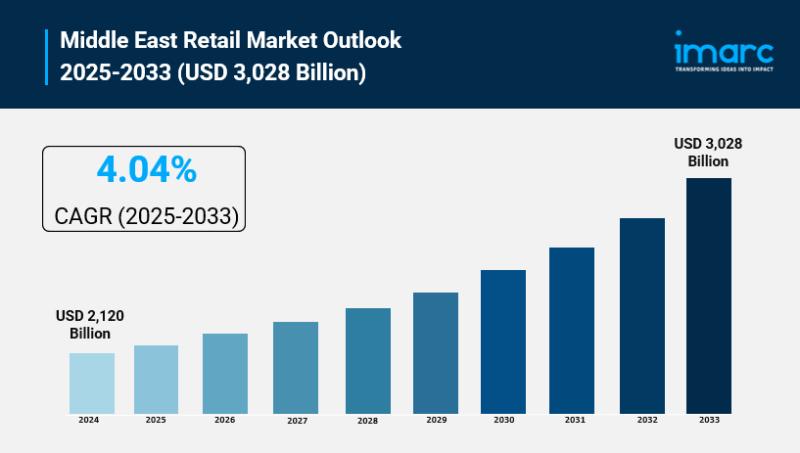

Middle East Retail Market Size to Surpass USD 3,028 Billion by 2033 | With a 4.0 …

Middle East Retail Market Overview

Market Size in 2024: USD 2,120 Billion

Market Size in 2033: USD 3,028 Billion

Market Growth Rate 2025-2033: 4.04%

According to IMARC Group's latest research publication, "Middle East Retail Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Middle East retail market size was valued at USD 2,120 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,028 Billion by 2033, exhibiting a…

Potassium Nitrate Prices 2025, Latest Trend, Demand, Index & Uses

Northeast Asia Potassium Nitrate Prices Movement August 2025:

In August 2025, Potassium Nitrate Prices in Northeast Asia settled at USD 0.64/KG, reflecting a 6.2% decline. Softer agricultural demand and improved regional supply availability weighed on pricing. Stable raw material input costs and comfortable inventories further contributed to the downward market adjustment.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/potassium-nitrate-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Europe Potassium Nitrate Prices…

Saudi Arabia Kitchen Furniture Market Set to Surge to USD 3.8 Billion by 2033 at …

Saudi Arabia Kitchen Furniture Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.8 Billion

Market Growth Rate 2025-2033: 5.9%

According to IMARC Group's latest research publication, "Saudi Arabia Kitchen Furniture Market Report by Furniture Type (Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, E-Commerce, and Others), and Region 2025-2033", The Saudi Arabia kitchen furniture market size reached USD 2.2 Billion in…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…