Press release

LPG Prices Q3 2025 | Trend, Forecast & Regional Analysis

North America LPG Price Index Analysis - Q3 2025 OverviewLPG Prices in the United States:

In the USA, the average LPG price stood at USD 673/MT during Q3 2025. The market observed stable demand from the residential and industrial sectors, supported by steady crude oil prices. According to the LPG Price Forecast 2025, prices are expected to remain moderately firm due to increased consumption during the colder months and limited supply in key production regions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/liquified-petroleum-gas-pricing-report/requestsample

Note: The analysis can be customized to meet the specific requirements of the customer.

APAC LPG Price Index Analysis - Q3 2025 Overview

LPG Prices in China:

In China, the LPG price averaged USD 664/MT in Q3 2025, reflecting consistent domestic demand and fluctuating import costs. The LPG Price Trend Report highlights that rising petrochemical sector activity and strong transportation fuel usage influenced price stability. Analysts anticipate a gradual increase in upcoming quarters, supported by economic recovery and seasonal energy demand.

LPG Prices in India:

India recorded an average LPG price of USD 1043/MT in Q3 2025, marking one of the highest in the Asia-Pacific region. The LPG Price Forecast 2025 attributes this rise to high import dependence, transportation costs, and robust household consumption. However, government subsidies and steady crude supply may help stabilize prices in the near term.

LPG Prices in Japan:

Japan's LPG prices averaged USD 583/MT during Q3 2025, influenced by moderate demand from the industrial and commercial sectors. The LPG Price Trend Report indicates that lower global oil prices and stable LNG imports contributed to controlled price fluctuations. Future projections suggest steady pricing as Japan maintains balanced inventory levels and energy diversification efforts.

LPG Prices in South Korea:

In South Korea, LPG prices averaged USD 534/MT in Q3 2025, showing minimal volatility across the quarter. The LPG Price Forecast 2025 points to stable consumption from refineries and petrochemical industries. Additionally, improved domestic supply and favourable import conditions helped maintain market equilibrium throughout the period.

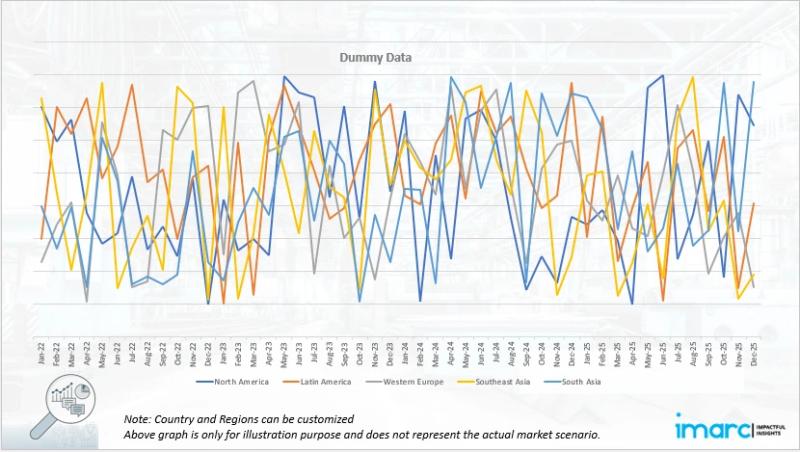

Regional Analysis: The price analysis can be extended to provide detailed LPG price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Latest News & Recent Developments: LPG Prices Trend, Index, History & Forecast:

The global Liquefied Petroleum Gas (LPG) market in late 2025 displays a largely stable to soft pricing trend, shaped by declining industrial consumption, consistent refinery output, and subdued crude oil benchmarks. However, regional variations persist, with Asian and Middle Eastern markets showing increased export flexibility while Western markets experience demand moderation amid mild seasonal conditions.

Regional Price Highlights

• United States: LPG prices dropped to USD 673/MT in September 2025, pressured by steady domestic output, rising inventories, and lower winter heating demand. Crude price weakness further weighed on overall LPG valuations.

• China: Prices averaged USD 664/MT, reflecting soft industrial usage and sufficient supply from both domestic refineries and imports. Exchange rate stability and efficient storage management helped restrain market volatility.

• India: Prices stood around USD 1,043/MT, slightly lower than the previous quarter due to stable refinery operations, improved logistics, and government-led fuel inflation controls. Seasonal moderation in residential demand kept markets balanced.

• Japan & South Korea: Prices ranged between USD 534-583/MT, tracking downward amid weaker petrochemical demand and steady supply inflows from the Middle East. Energy price stabilization policies further supported moderation.

• Middle East: Saudi Aramco cut its August 2025 contract prices for propane and butane by USD 55/ton each, reflecting poor Asian demand and excess cargo availability. Strong export flows to Asia continued despite limited local consumption fluctuations.

Market Developments

• Feedstock Economics: LPG traded at an increasing discount to naphtha in Asia (averaging USD 51/ton lower) in mid-2025, leading to higher LPG consumption in ethylene crackers and sustained feedstock switching.

• Supply Chain Patterns: Consistent export volumes from the U.S. and Middle East have kept the global market adequately supplied despite logistical adjustments following tariff and freight cost shifts.

• Industrial Outlook: Petrochemical demand remained weak as propylene margins waned, yet residential and transportation sectors-maintained baseline consumption. Asia-Pacific continued to dominate global LPG consumption, driven by expanding domestic use in China and India.

Forecast & Market Outlook (2025-2026)

• Price Projections: LPG is forecast to trade between USD 650-720/MT through the remainder of 2025, with minor price rebounds likely in early 2026 amid seasonal heating and global restocking cycles.

• Growth Drivers: Increased LPG adoption as a cleaner energy alternative, policy-led incentives for residential usage, and expansion of LPG infrastructure in developing economies will sustain long-term demand.

• Challenges: Persistent supply surplus, flattening petrochemical consumption, and weaker crude oil benchmarks could cap any significant price gain through 2026.

The LPG market is expected to maintain a balanced yet cautious outlook as producers and traders align strategies around feedstock economics, supply resilience, and environmental policy frameworks.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22509&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "LPG Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of LPG price trend, offering key insights into global LPG market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines LPG demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release LPG Prices Q3 2025 | Trend, Forecast & Regional Analysis here

News-ID: 4232674 • Views: …

More Releases from IMARC Group

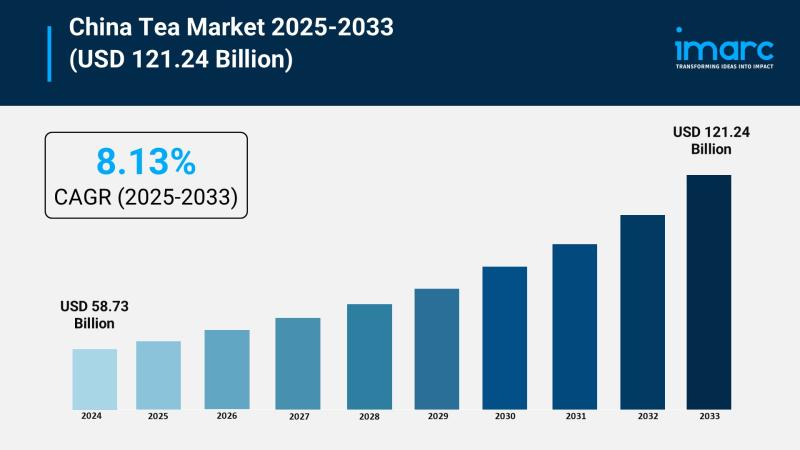

China Tea Market Forecast CAGR of 8.13%, Innovation Trends, and Strategic Insigh …

Market Overview

The China tea market was valued at USD 58.73 Billion in 2024 and is projected to reach USD 121.24 Billion by 2033, growing at a CAGR of 8.13% during 2025-2033. Growth is driven by rising health consciousness, premium product trends, government support, and expanding online retail. Innovation in flavors and packaging attracts younger consumers and global buyers, expanding the market.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

China Tea…

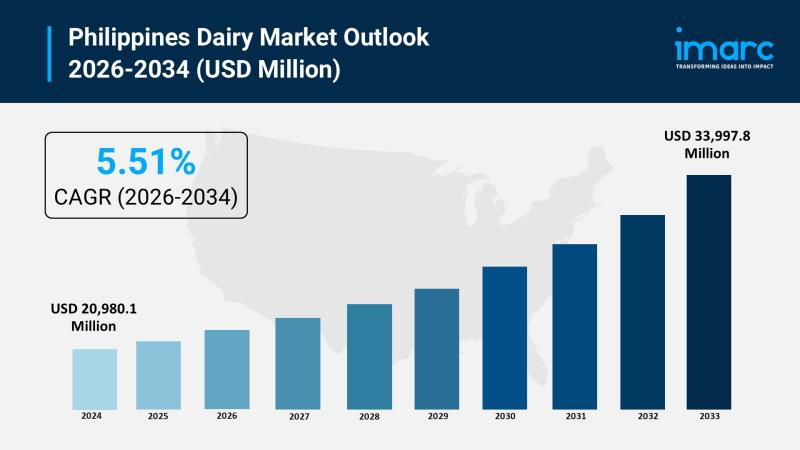

Philippines Dairy Market 2026: Expected to Reach USD 33,997.8 Million by 2034

Market Overview

The Philippines dairy market reached a size of USD 20,980.1 Million and is anticipated to grow to USD 33,997.8 Million by 2034 with a significant growth rate of 5.51%. This expansion is driven by rising demand for nutritious and diverse dairy products, rapid urbanization, increased disposable incomes, improved retail infrastructure, and strong government initiatives promoting local dairy production. Health-conscious consumers and expanding food service sectors further fuel this growth…

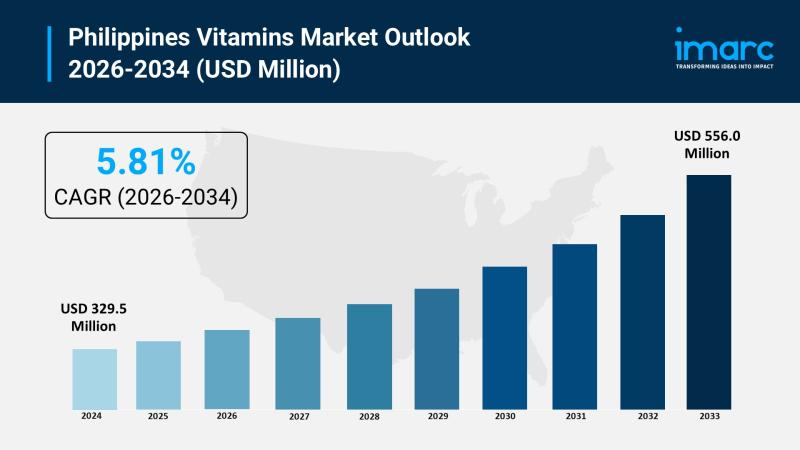

Philippines Vitamins Market 2026 | Projected to Reach USD 556.0 Million by 2034

Market Overview

The Philippines vitamins market was valued at USD 329.5 Million in 2025 and is projected to reach USD 556.0 Million by 2034, growing steadily over the forecast period. The market's growth is driven by increasing health consciousness, a rising geriatric population, and escalating demand for supplements that support immunity, energy, and overall wellness due to proactive health measures. The forecast period for this expansion is 2026-2034, with a CAGR…

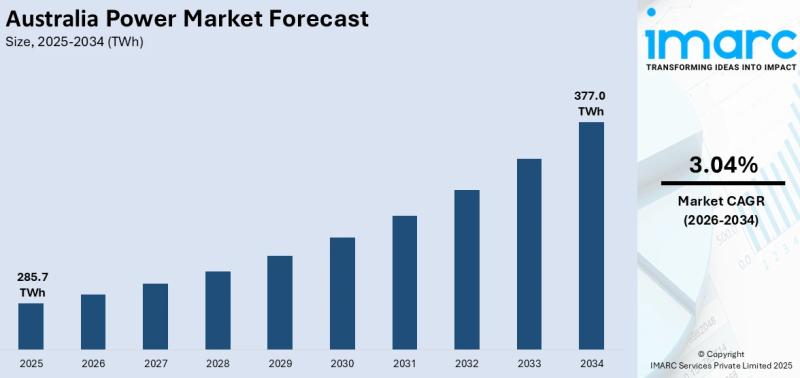

Australia Power Market Projected to Reach TWH 377 by 2034

Market Overview

The Australia power market size reached 285.7 TWh in 2025 and is projected to grow to 377.0 TWh by 2034, with a CAGR of 3.04% during the forecast period of 2026-2034. This growth is driven by rising renewable energy adoption, increased electricity demand, grid modernization, battery storage expansion, transition from coal plants, and government incentives for clean power. Key strategies such as virtual power plant integration and investments in…

More Releases for LPG

Aluminium LPG Cylinder Market

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲-

The aluminium LPG cylinder market is experiencing significant growth due to various factors that enhance its adoption across residential, commercial, and industrial sectors. One of the main growth drivers is the increasing demand for liquefied petroleum gas (LPG) as an energy source due to its efficiency and cleanliness compared to traditional fuels like wood and coal. Aluminium cylinders are particularly preferred in the storage and transportation of…

LPG Price Trend: Comprehensive Market Insights

Liquefied Petroleum Gas (LPG), a versatile and efficient energy source, is widely used for residential, industrial, and transportation purposes. Understanding the LPG Price Trend is essential for businesses, suppliers, and consumers to optimise procurement strategies, manage energy costs, and anticipate market fluctuations. This article explores the factors influencing LPG prices, historical data, market dynamics, forecasts, regional insights, and procurement resource strategies.

Latest LPG Price Trends

The LPG market has experienced significant price…

Global LPG Tanker Market Expected to Reach US$ 289.72 Mn. by 2030: Rising Demand …

The LPG tanker market, valued at US$ 201.82 million in 2023, is anticipated to witness substantial growth, with total revenue projected to reach nearly US$ 289.72 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. This growth is driven by several factors, including the increasing demand for LPG as a clean and efficient fuel source, particularly in residential, commercial, and industrial applications. Additionally, the expanding use…

LPG Tanker Market May See a Big Move | Major Giants Dorian LPG, Pertamina, Navig …

The latest study released on the Global LPG Tanker Market by AMA Research evaluates market size, trend, and forecast to 2027. The LPG Tanker market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

France LPG Market Growth Driven by Low Upfront Cost of LPG Boilers

A number of factors such as the low upfront cost and less storage space required by LPG boilers and the massive government support toward new energy vehicles will help the French LPG market demonstrate a CAGR of 2.1% between 2020 and 2030. According to P&S Intelligence, the market was valued at $7,691.2 million in 2020, and it will generate $9,480.3 million revenue by 2030. Additionally, the rising public awareness regarding…

Global Bio LPG Market Poised to Offer Sustainable Solution for Soaring Demand fo …

The global Bio LPG demand is expected to rise during the forecast period as it is an ideal energy solution that helps in reducing the emissions of CO2 by 80%. Consumers are increasingly adopting it as it is derived from plant and vegetable residues and municipal waste. A recent report published by Fairfield Market Research predicts that the global Bio LPG market is expected to reach US$1,020.32 Mn by 2025…