Press release

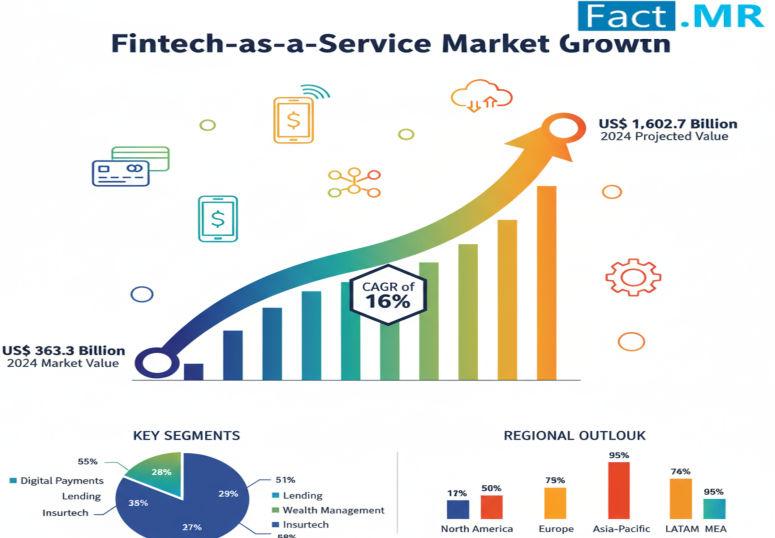

Fintech-as-a-Service Market is Projected to Reach USD 1,602.7 Billion by 2034

The global fintech-as-a-service (FaaS) market is valued at USD 363.3 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 16%, reaching USD 1,602.7 billion by 2034. FaaS encompasses integrated financial services such as payments, fund transfers, loans, KYC verification, fraud monitoring, and compliance support, delivered through scalable APIs. This model enables non-financial businesses to embed financial capabilities seamlessly, reducing infrastructure costs and accelerating time-to-market.The market's growth is underpinned by the digital transformation of financial services, rising online transactions, and the democratization of banking through open APIs and cloud technologies.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7594

Market Segmentation and Trends:

The FaaS market is segmented by type, technology, application, end-use, and region. By type, it includes payments, funds transfers, and loans, with payments holding a 46% share in 2024, valued at USD 167.1 billion and projected to reach USD 705.2 billion by 2034 at a 15.5% CAGR. Technologies comprise API-based, AI-based, RPA-based, and blockchain-based solutions, with AI and blockchain gaining prominence for enhanced security and automation. Applications cover KYC verification, fraud monitoring, and compliance & regulatory support, addressing critical needs in digital finance. End-uses include banks, financial lending companies, and insurance, with banks valued at USD 152.6 billion in 2024, expected to grow to USD 609 billion by 2034 at 14.8% CAGR.

Regionally, North America holds 24.3% of the market by 2034, while East Asia is projected to reach USD 370.2 billion. Trends include the rise of embedded finance, AI-driven personalization, and blockchain for secure transactions, alongside increasing adoption of BaaS models for collaborative innovation.

Driving Factors Behind Market Growth:

The FaaS market is driven by surging digital transactions, venture capital investments, and technological advancements. Global online payments are expected to exceed 8 billion transactions annually, fueling demand for seamless FaaS integrations. Government initiatives, like USAID's Digital Invest program, mobilize private capital for digital finance in underserved areas. Regulatory support in regions like China and the US promotes open banking, enabling fintech expansion.

The integration of AI, blockchain, and big data analytics reduces costs, enhances processing speeds, and improves customer experiences through personalized services. The shift to mobile and online banking, accelerated by e-commerce growth, further propels FaaS adoption, allowing businesses to offer financial products without traditional banking infrastructure.

Recent Developments and Key Players:

The FaaS market is highly competitive, with players focusing on partnerships, acquisitions, and technological enhancements. In 2023, Fiserv allied with Equifax to launch analytics-driven products for corporate authentication and risk assessment. Mastercard acquired Baffin Bay Networks in 2023 to bolster cybersecurity amid rising threats. More recently, in 2025, according to a BCG report, fintech revenues grew 21% in 2024 as funding stabilized, highlighting scaled winners in FaaS. KPMG's H1'2025 Pulse of Fintech noted $44.7 billion in global investments, the lowest since H1'2020, yet signaling resilience.

Key players include PayPal Holdings Inc., Stripe Inc., Adyen N.V., Fiserv Inc., Mastercard Inc., Block Inc. (Square), Revolut Ltd., Rapyd Financial Network Ltd., Upstart Holdings Inc., and Plaid Inc., investing in AI and blockchain to enhance offerings.

Competitor analysis reveals a focus on scalability and security. Companies like Stripe and Plaid are leading in API integrations for payments and KYC, while Mastercard and Fiserv emphasize fraud monitoring and compliance. Strategic moves, such as acquisitions and alliances, help firms expand globally and innovate, with startups like Rapyd targeting emerging markets. Established players leverage regulatory expertise, while challengers disrupt with agile, cost-effective solutions.

Regional Insights and Opportunities:

North America dominates the FaaS market, projected to hold 24.3% share by 2034, driven by tech hubs in the US and Canada (16.5% CAGR). East Asia, led by China (USD 175.9 billion by 2034) and South Korea (16.8% CAGR), grows at 16.4% CAGR, fueled by digital payments and government support. Europe benefits from open banking regulations, while South Asia & Oceania and Latin America offer opportunities in underserved populations.

The Middle East & Africa is emerging with increasing mobile banking adoption. Opportunities include expanding into APAC's high-growth markets through localized solutions and partnerships, capitalizing on regulatory incentives for financial inclusion.

Browse Full Report: https://www.factmr.com/report/fintech-as-a-service-market

Challenges and Future Outlook:

The FaaS market faces challenges like regulatory complexity, cybersecurity threats, and integration hurdles with legacy systems. Data breaches and varying global laws hinder adoption, while high innovation costs and consumer trust issues pose risks. However, the future is optimistic, with opportunities in AI-driven automation and embedded finance. Advancements in blockchain and open banking will drive efficiency, while emerging markets offer untapped potential. By 2034, the FaaS market is set to transform financial services, enabling inclusive, innovative ecosystems through scalable, tech-enabled solutions.

Check out More Related Studies Published by Fact.MR:

Wearable Payment Device Market https://www.factmr.com/report/wearable-payment-devices-market

Real-Time Payment Market https://www.factmr.com/report/real-time-payments-market

Consumer Mobile Payment Market https://www.factmr.com/report/consumer-mobile-payment-market

Biometric Payment Market https://www.factmr.com/report/1850/biometric-payment-market

Mobile Payment Market https://www.factmr.com/report/mobile-payment-market

Payment Gateway Market https://www.factmr.com/report/payment-gateway-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech-as-a-Service Market is Projected to Reach USD 1,602.7 Billion by 2034 here

News-ID: 4177671 • Views: …

More Releases from Fact.MR

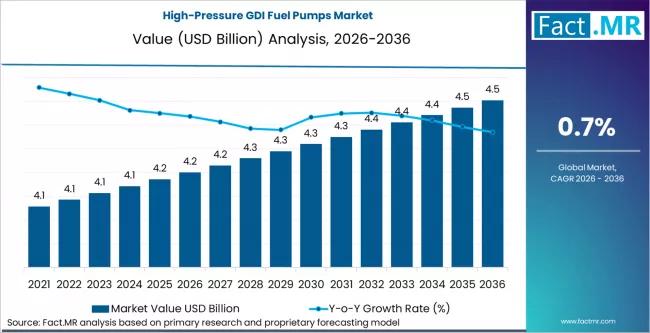

High-Pressure GDI Fuel Pumps Market Study to 2036: Technology Evolution, Regiona …

The global high-pressure Gasoline Direct Injection (GDI) fuel pumps market is poised for significant expansion, with its valuation projected to rise from USD 5.5 billion in 2026 to approximately USD 10.9 billion by 2036. This growth reflects an absolute increase of USD 5.4 billion over the forecast period, expanding at a compound annual growth rate (CAGR) of 7.1%. As automotive manufacturers face increasingly stringent emission targets, high-pressure GDI systems have…

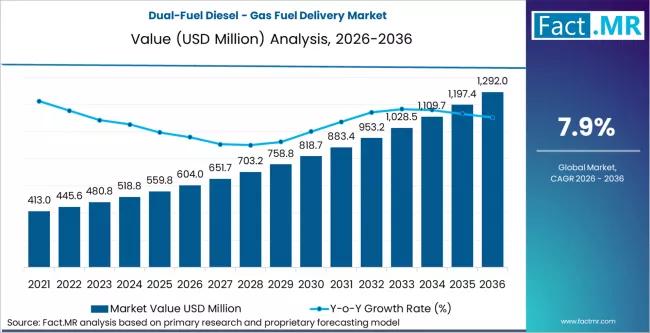

Dual-Fuel Diesel - Gas Fuel Delivery Market Deep-Dive 2026-2036: Entry Strategie …

The global Dual Fuel Diesel-Gas Fuel Delivery Market is projected to grow significantly over the next decade as industrial operators, power generators, and marine fleets increasingly adopt dual-fuel technologies to balance energy costs, reduce emissions, and enhance operational flexibility. Market research assessments estimate that the market will expand from approximately USD 12.5 billion in 2025 to nearly USD 21.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of…

Anti-Blocking Agents for Packaging Films Market Transformation Outlook 2036: Inn …

The global anti-blocking agents for packaging films market is projected to grow from USD 970.0 million in 2024 to approximately USD 1,595.1 million by 2034. This expansion represents a total value increase of USD 625.1 million over the ten-year forecast period. The market is set to expand at a compound annual growth rate (CAGR) of 5.1% between 2024 and 2034, driven by the intensifying demand for high-efficiency film production in…

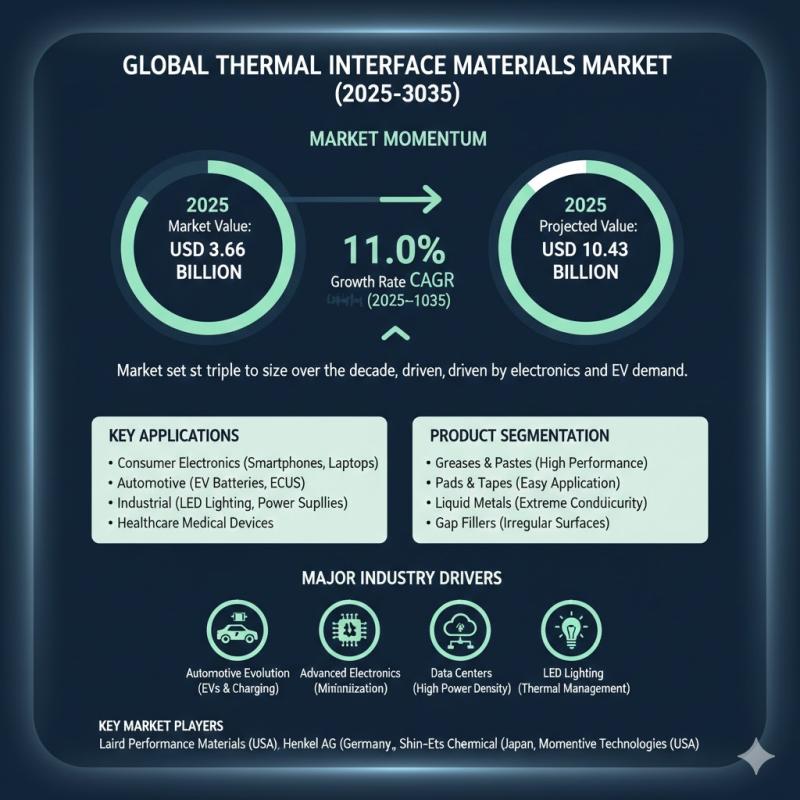

Global Thermal Interface Materials Market Size, Share & Forecast: High-Growth Se …

Thermal Interface Materials Market to Surpass USD 10.43 Billion by 2035 at 11.0% CAGR. The global Thermal Interface Materials Market is valued at USD 3.66 billion in 2025 and is projected to reach USD 10.43 billion by 2035. This expansion, representing a compound annual growth rate (CAGR) of 11.0%, is driven by the critical need for efficient heat management in electric vehicles, 5G infrastructure, and high-performance consumer electronics.

Request for Sample…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…