Press release

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis 2028

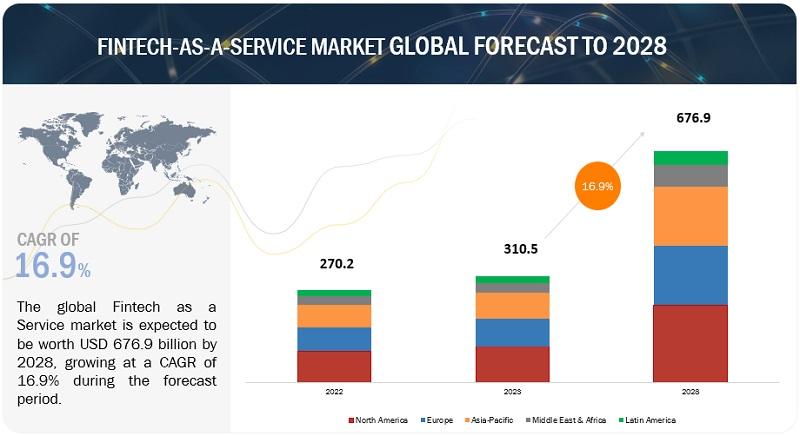

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability for businesses and increasing market demand for efficient compliance and regulatory solutions.

Based on the Fintech as a Service market, the Payment segment is expected to hold the largest market share during the forecasted period

Payments are essential to financial transactions, and virtually every business and individual requires payment capabilities. The payment segment encompasses various services, such as payment processing, digital wallets, peer-to-peer transfers, and mobile payments. The rapid growth of e-commerce, coupled with the increasing digitization of financial transactions, has fueled the demand for payment services. Businesses and consumers increasingly embrace online and mobile payments, driving the expansion of the payment segment within the FaaS market. Fintech companies have introduced innovative payment solutions that challenge traditional payment methods. These disruptive solutions offer improved user experiences, faster transactions, lower costs, and enhanced security. Payment services have a global market reach, as businesses and individuals worldwide engage in cross-border transactions. FaaS providers offering payment solutions can cater to customers globally, expanding their market size and revenue potential.

Inquiry Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=9388805

By Application, Compliance & Regulatory Support to hold a larger market size during the forecast period

Compliance and regulatory support are vital in mitigating risks associated with financial transactions and ensuring the security and integrity of customer data. FaaS providers offer compliance and regulatory support solutions to help financial institutions comply with these regulations more quickly and efficiently. These solutions can include software, services, and data that can help financial institutions to automate compliance processes, identify and mitigate risks, and track compliance status. The use of fintech as a service solution for compliance and regulatory support is growing rapidly as financial institutions are looking for ways to reduce the cost and complexity of compliance. This growth is expected to continue in the coming years as the regulatory environment becomes more complex and financial institutions seek to improve their compliance posture. These benefits create a massive demand for FaaS solutions in the market.

By region, Asia Pacific is to grow at the highest CAGR during the forecast period

In recent years, Asia Pacific has undergone tremendous economic and political changes. Governments in the Asia Pacific are supportive of fintech innovation. This provides a favorable environment for the growth of fintech. Asia Pacific is home to the world's largest and fastest-growing population; hence, Mobile payments are becoming increasingly popular. The rising smartphone penetration and the growing demand for convenient and secure payment methods are driving the growth in this region. The region is experiencing rapid economic growth that increases disposable income and the need for financial services. The FaaS market in Asia Pacific is expected to grow significantly in the coming years. This growth will be driven by the rising demand for financial services, the increasing adoption of new technologies, and the supportive regulatory environment.

Get More Info - https://www.marketsandmarkets.com/Market-Reports/fintech-as-a-service-market-9388805.html

PayPal (US), Mastercard (US), Fiserv (US), Block (US), Rapyd (UK), Envestnet (US), Upstart (US), Solid Financial Technologies (US), FIS (US), Synctera (US), Stripe (US), Adyen (Netherlands), Dwolla (US), Finastra (UK), Revolut (UK), Fispan (Canada), NIUM (SG), Airwallex (AUS), SoFi (US), Marqeta (US), Finix (US), Synapse (US), are the key players and other players in the FaaS market.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

Visit Our Website: https://www.marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are moulded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit MarketsandMarkets™ or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis 2028 here

News-ID: 3097039 • Views: …

More Releases from Markets and Markets

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

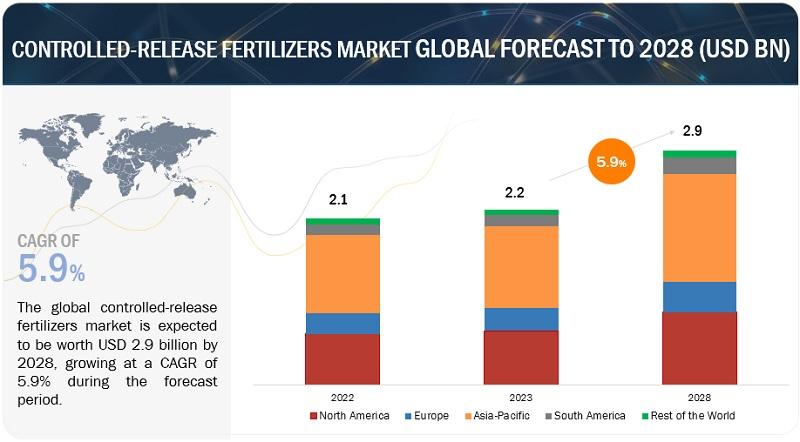

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

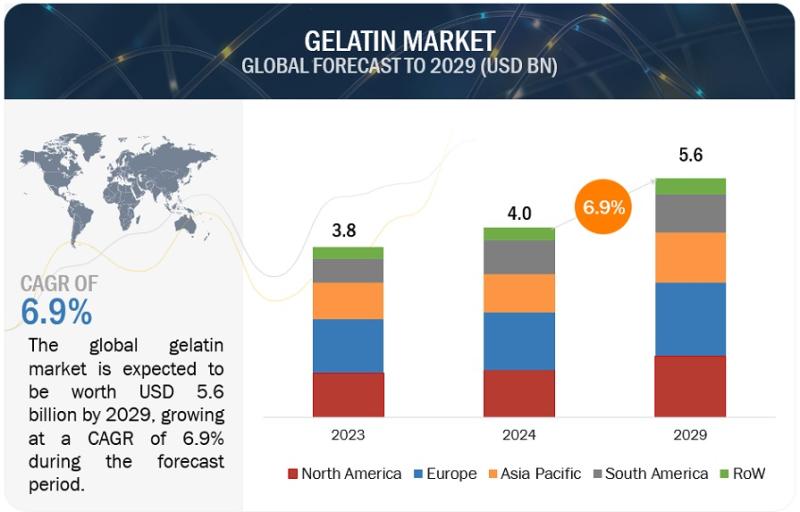

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

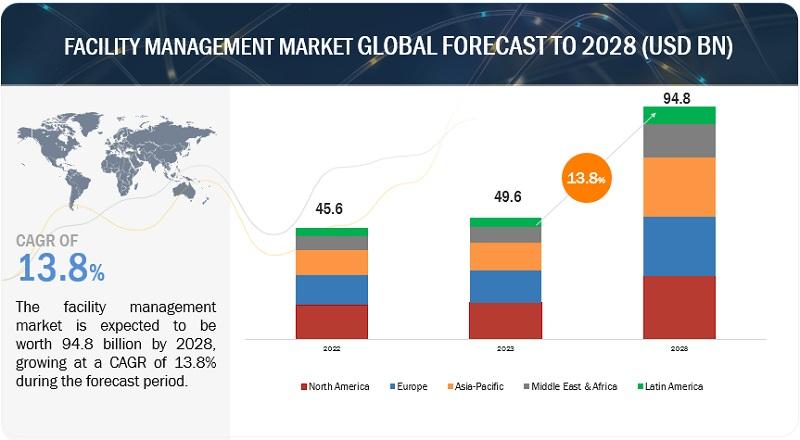

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…

Affle launches its fraud detection platform – mTraction | FaaS

1st Jun, 2017

Singapore | 1st June, 2017

Affle a Singapore HQ mobile audience intelligence and analytics platforms company today announced the launch of its Fraud Analytics As a Service Platform – “mTraction FaaS” to help the marketers globally to fight mobile ad fraud. According to industry data sources close to USD 16.4B is lost globally due to ad fraud. mTraction FaaS or mFaaS aims to help marketers detect fraud, not at…