Press release

Themoplastic (TPU) for Consumer Products Market to Reach USD 8,430 Million by 2031 Top 10 Company Globally

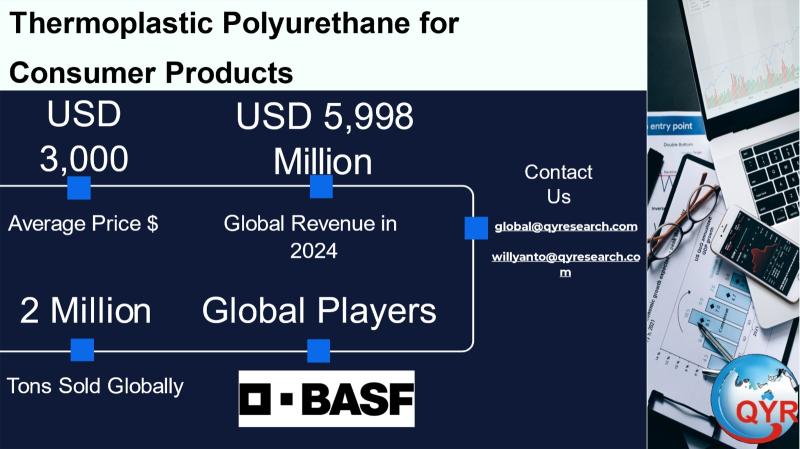

Thermoplastic polyurethane (TPU) is a versatile elastomeric polymer used across consumer products because it blends rubber-like elasticity with thermoplastic processability; it appears in footwear midsoles and outsoles, wearable bands and straps, phone and electronic-device bumpers, consumer appliance gaskets, soft-touch ornamentation, sporting goods and prepared parts for injection molding, extrusion and 3D printing. TPU grades for consumer use vary by hardness (shore A to D), base chemistry (polyether, polyester, polycaprolactone, polycarbonate), and formulation (bio-attributed, recycled-content, flame-retardant, medical-grade). Manufacturers choose TPU for abrasion resistance, chemical and hydrolysis resistance, transparency or colorability, and ease of processing in twin-screw extrusion and injection molding lines; for brands, TPUs appeal is the ability to combine comfort with durability and to enable single-material or easily recyclable product designs when matched to circularity-minded grades.Global Thermoplastic Polyurethane for consumer products market value around USD 5,998 million in 2024 with a strong multi-year growth trajectory. Using these published totals and isolating the consumer-products end-use. Projecting forward under a consumer-focused CAGR modestly below the fastest industrial CAGR but reflecting strong consumer innovation and sustainability adoption, we model an 5,6% CAGR to 2031, which implies a Thermoplastic Polyurethane for consumer products market of roughly USD 8,430 million by 2031. For the Thermoplastic Polyurethane for consumer products market calculation above we use a blended ASP assumption of USD USD 3,000 per ton. Dividing the modeled 2024 consumer-TPU revenue of USD 5,998 million by USD 3,000/ton implies 2 million tons sold in 2024.

Latest Trends and Technological Developments

Material and supply-chain sustainability, circularity and specialty-grade innovation are the dominant trends shaping consumer TPU today. On October 2024 BASF introduced its new Elastollan® 1400 ether-based TPU series offering improved hydrolysis resistance and processing stability, underlining product refreshes geared to demanding consumer and wearable applications. In 2024 to 2025 the major resin makers accelerated circular-TPU developments: BASF has expanded its Elastollan® RC recycled-content grades and shipped its first bio-attributed Elastollan® BMB containers in early 2025, signaling real availability of mass-balanced or recycled TPUs for footwear and consumer goods (BASF announcements, 2024 to 2025). Lubrizol introduced bio-based and higher-bio-content TPU solutions in 2024 (for adhesives and consumer-grade applications), reflecting an industry-wide move toward renewable feedstocks (Lubrizol disclosure, May 2024). Novoloop and other chemical-upcycling innovators announced pilot and commercial-scale activities in 2024 to 2025 to chemically upcycle mixed waste into TPU feedstocks (Novoloop pilot plant news, mid-2024 to 2025). Covestro and other majors also emphasized TPUs role in single-material designs and recyclable product concepts at trade events through 2024 to 2025, supporting brand-level circularity efforts. These dated product introductions and circularity announcements materially change buyer options for branded consumer goods seeking lower-carbon and higher-recycled-content resin sources.

Asia Pacific is the dominant regional center for TPU production and consumption, accounting for the majority of global TPU resin volumes and hosting large converter and brand ecosystems. Analysts report APAC market share commonly above 50 to 58% of global TPU demand, driven by Chinas massive footwear and electronics manufacturing base, South Korea and Taiwans advanced polymer and film-processing capabilities, and Southeast Asias growing contract-manufacturing clusters. Regional evidence includes major resin plants and TPU investments by multinational suppliers in China, Taiwan and Southeast Asia, plus close customer clusters footwear brands in China and Vietnam, wearable-device suppliers in Taiwan and Korea and consumer-electronics OEMs across Asia that translate into high regional TPU demand. For consumer products, Asia combines both high-volume low-cost supply (Chinese pellet producers and regional compounders) and high-value specialty demand (premium footwear and wearable OEMs in Japan, Korea, Taiwan). These dynamics support the faster growth and earlier adoption of recycled- and bio-attributed TPU grades in APAC because of scale and proximity to brands piloting circular products.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5032104

Themoplastic (TPU) for Consumer Products by Type:

Polyester TPU

Polyether TPU

Others

Themoplastic (TPU) for Consumer Products by Application:

Shoes

Bags

Apparel

Others

Global Top 10 Key Companies in the Themoplastic (TPU) for Consumer Products Market

BASF SE

Huntsman

Covestro

Lubrizol

Wanhua Chemical

Miracul Chemicals

Huaton Group

Dawn Group

Shandong Yinuowei Polyurethane Co., Ltd

Hexpol

Regional Insights

Within Southeast Asia, growth is heterogeneous: Indonesia, Vietnam, Thailand and the Philippines are sizable manufacture-and-assembly centers for footwear, apparel accessories and certain consumer electronics parts where TPU is consumed as pellets and converted locally. Indonesia because of population scale and domestic footwear and sports-good assembly shows rapidly growing TPU demand, but much of the specialty, bio-attributed or recycled TPU supply is imported until local compounding capacity expands; pilot chemical-upcycling and recycling ventures (including partnerships by Novoloop and local converters) are beginning to localize feedstock availability. Singapore and Malaysia skew toward higher-margin, low-volume specialty TPU applications (e.g., medical wearables, premium device housings) while Vietnam and Indonesia absorb large volumes of commodity and mid-grade TPU used in footwear components and accessories. ASEANs growth over 20242031 will be driven both by continued garment and footwear near-shoring and by rising domestic consumer demand for TPU-containing goods and for more sustainable product options in urban markets.

The TPU-for-consumer-products market faces five structural constraints. First, feedstock and raw-material volatility (MDI/diisocyanate, polyol and chain-extender cost swings) cause spot price and margin volatility that can compress converter profitability in thin-margin consumer segments. Second, scaling recycled and bio-attributed TPU to meaningful volumes remains technically and economically challenging: chemical upcycling pilots are nascent and mechanical recycling can degrade molecular weight and require reblending strategies. Third, regulatory and brand-driven requirements for PFAS-free, low-emissions and verified recycled content create certification friction that small converters struggle to meet quickly. Fourth, competition from lower-cost elastomers (TPE-S, EVA blends, PVC-free soft compounds) constrains price pass-through in mass-market items. Fifth, design-for-recyclability at the article level requires coordination across brands, converters and recyclers without coordinated takeback and feedstock flows, circular TPU solutions remain limited in scale. These frictions are visible in supplier R&D plans and in public industry commentary about scaling Elastollan® RC and other recycled grades.

Market leaders and fast followers will combine three strategic moves: securing circular feedstock either through investments in chemical upcycling or long-term recycled-TPU offtake, partnering with brand customers to develop single-material product systems that simplify recycling, and localizing compounding and finishing capacity close to major apparel and electronics OEM clusters in APAC and ASEAN. For consumer-focused investors, the highest-return niche is often in value-added converting and finish (digital printing, TPU foaming for midsoles, 3D-print TPU architectures) or in licensing differentiated TPU grades (bio-attributed, RC, food-contact capable) to brand partners. For ASEAN market entry, joint ventures with local compounders that can blend recycled feedstock and supply converters fast often beat greenfield resin-plant investments in near-term payback. Lastly, products and grades that lower processing energy (fast-melt, low-temperature grades) reduce total-cost-of-ownership for contract manufacturers and improve competitiveness in price-sensitive consumer segments.

Product Models

Thermoplastic polyurethane (TPU) is a versatile polymer widely used in consumer products thanks to its flexibility, abrasion resistance, and durability.

Polyester TPU known for toughness, chemical resistance, and wear performance. Notable products include:

Desmopan® 9370A Covestro: High-performance polyester TPU used in electronics and durable wear parts.

Pearlbond® 12 Series Lubrizol: Specialty TPU for hot-melt adhesives in consumer footwear and apparel.

Elastollan® 1185A BASF: Polyester TPU with high tensile strength, suitable for protective phone cases.

Utechllan® 7000 Series Huntsman: Durable polyester TPU used in sports equipment and fashion accessories.

Mirathane® TP 340 Series Miracll Chemicals: Versatile TPU designed for film, sheet, and everyday consumer packaging

Polyether TPU recognized for hydrolysis resistance, low-temperature flexibility, and long-term stability. Examples include:

Elastollan® 1180A BASF: Polyether TPU providing hydrolysis resistance for outdoor gear.

Mirathane® TP 250 Series Miracll Chemicals: Polyether TPU used in films and medical-grade consumer accessories.

Huntsman Irogran® A 85 P 4394 Huntsman: Polyether TPU with hydrolysis resistance, ideal for water sports goods.

Wanhua Wanthane® TPU E Series Wanhua Chemical: Provides good weather resistance for electronics and outdoor products.

Epaflex Epaflex® Polyether TPU Epaflex Polyurethanes: Consumer-grade TPU for bags, fashion products, and soft grips.

TPU for consumer products is a high-value, innovation-rich subset of the global TPU market. Our reconciled estimate places the consumer-TPU segment at about USD 5,998 million in 2024, with an assumed blended ASP of USD 3,000 per ton and implied 2 million tons consumed in consumer applications in 2024; modeling an 5,6% CAGR to 2031 projects a near-doubling of consumer TPU value by 2031 as brands push for higher-performance, recyclable and bio-attributed materials. Asia-Pacific will remain the dominant production and consumption engine, and ASEAN (including Indonesia) will be an important growth corridor for volume demand and eventual local compounding and pack-integration. Success in the next five years will hinge on circularity proof points, resilient feedstock security and value-added conversion capabilities.

Investor Analysis

what, how and why this matters. For investors, the what is exposure to a material that sits at the intersection of consumer trends (sustainable footwear and electronics, wearables growth, and premium product differentiation). The how is concrete: invest in tier-one TPU producers with proven recycled/bio-attributed offerings (reduces feedstock and regulatory risk), buy or partner with value-added converters in ASEAN to capture margin in finishing and branding, or back chemical-upcycling ventures that can provide lower-carbon feedstock to compounders at scale. The why is timing and defensibility: circular TPU adoption and single-material product concepts are already being piloted by major brands, and early access to verified recycled/bio TPU confers procurement advantages and price elasticity in premium channels. Key diligence for investors should focus on feedstock contracts, third-party recycled-content verification, local compounding and finishing capacity near brand clusters, and proven performance (mechanical and color stability) of recycled/bio TPUs at scale.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5032104

5 Reasons to Buy This Report

It reconciles public TPU market estimates into a consumer-products-specific 2024 baseline and provides a transparent CAGR to 2031 for scenario modeling.

It converts revenue into physical volume using blended price-per-kg assumptions and supplies an explicit sensitivity framework.

It documents dated, strategic industry moves and product launches that materially affect feedstock and grade availability.

It delivers actionable Asia & ASEAN go-to-market intelligence to prioritize localization, compounding JV targets and distribution partnerships.

It profiles top suppliers and strategic plays circular feedstock, localized compounding, and value-added conversion that determine which assets will expand margins and scale sustainably.

5 Key Questions Answered

What is a defensible global market size for TPU used specifically in consumer products in 2024, and what CAGR should analysts model to 2031?

What are realistic price-per-kg ranges for consumer TPU grades and what total kilogram/tonnage volumes did the 2024 consumer-TPU market imply?

Which dated product and circularity developments in 20242025 materially change supply availability and cost?

How will Asia-Pacific and ASEAN dynamics shape feedstock sourcing, compounding localization and converter margins for consumer TPU products?

Which companies and strategic plays best position investors and brands for premium, circular TPU adoption?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Themoplastic (TPU) for Consumer Products Market to Reach USD 8,430 Million by 2031 Top 10 Company Globally here

News-ID: 4174634 • Views: …

More Releases from QY Research

Top 30 Indonesian Coal Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Alamtri Resources Indonesia Tbk (formerly Adaro Energy)

PT Bumi Resources Tbk

PT Bayan Resources Tbk

PT Indo Tambangraya Megah Tbk

PT Bukit Asam Tbk (PTBA)

PT Golden Energy Mines Tbk (GEMS)

PT Dian Swastatika Sentosa Tbk (DSSA)

PT Indika Energy Tbk (INDY)

PT Akbar Indo Makmur Stimec Tbk (AIMS)

PT Atlas Resources Tbk (ARII)

PT Borneo Olah Sarana Sukses Tbk (BOSS)

PT Baramulti…

From Sugar to Profit: Economics of the Global Ready-to-Roll Icings Industry

Ready-to-roll icings (also known as rolled fondant or sugar paste) are pre-formulated sugar-based sheets used for cake covering, decorative modeling, and bakery finishing in commercial and artisan baking.

Products are supplied in bulk slabs, sheets, and blocks and are valued for: Consistent elasticity, Reduced preparation time, Uniform finish, Extended shelf stability.

Industrial buyers include industrial bakeries, frozen dessert processors, QSR chains, supermarkets, and cake studios.

Growing demand for celebration cakes, premium bakery products,…

Sustainable Staples: Why Investors Are Targeting Organic Pulse Processing

Organic dry pulses include organically cultivated lentils, chickpeas, peas, mung beans, pigeon peas, and dry beans produced without synthetic pesticides, fertilizers, or GMOs.

Industry benefits from: Rising plant-protein adoption, Gluten-free and clean-label trends, Soil-friendly nitrogen-fixing crop rotation, Government organic agriculture subsidies across Asia.

Global trade dominated by exporters in India, Australia, Canada, and Turkey

Growing consumption in China, Japan, Indonesia, and Vietnam.

Global Overview

Market size (2025): USD 5,266 million

Market size (2032): USD 8,231 million

CAGR…

Baby Care Boom: USD 9.1B Global Bath & Shower Market Driven by Asia Growth

Baby bath and shower products include liquid cleansers, tear-free shampoos, head-to-toe washes, soaps, bath oils, foam washes, and sensitive-skin dermatological formulations designed specifically for infants and toddlers.

Products emphasize mild surfactants, hypoallergenic formulations, pH-balanced systems (5.56.0), and natural/plant-derived ingredients to minimize irritation and comply with pediatric dermatology standards.

Demand is driven by rising hygiene awareness, premiumization of infant care, urban middle-class expansion, and increased birth rates in emerging Asia.

Strong shift from bar…

More Releases for TPU

High-Performance Soft TPU Modifier for Matte TPU Films | Soft-Touch, Non-Sticky, …

You've adjusted the formulation, slowed the cooling rate, and even changed the resin grade - but the TPU film still ends up sticky, not soft enough, and prone to color loss after aging. These persistent drawbacks limit design freedom, reduce visual appeal, and undermine performance stability. What if the solution didn't require redesigning your entire process, and instead came from enhancing the TPU material itself? SILIKE Soft TPU Modifier particles(https://www.si-tpv.com/soft-modified-tpu-particle-series/)…

Global Demand for TPU Filament From China Spurs New TPU Filament Manufacturer In …

The global movement towards additive manufacturing is revolutionizing supply chains and product development cycles across multiple industrial sectors, leading to rapid adoption of high-performance materials like Thermoplastic Polyurethane (TPU). TPU filament in particular is notable for its combination of elasticity, durability and chemical resistance - something which Chinese producers are taking advantage of by investing heavily and diversifying into flexible polymers manufacturing as part of a competitive edge they possess…

Application of TPU Material in Humanoid Robots

TPU (Thermoplastic Polyurethane) [https://www.ytlinghua.com/polyether-tpu/] has outstanding properties such as flexibility, elasticity, and wear resistance, making it widely used in key components of humanoid robots like exterior covers, robotic hands, and tactile sensors. Below are detailed English materials sorted out from authoritative academic papers and technical reports:

1. Design and Development of an Anthropomorphic Robotic Hand Using TPU Material [https://www.ytlinghua.com/polyether-tpu/]The paper presented here approaches to solve the complexity of an anthropomorphic robotic…

TPU (Thermoplastic Polyurethane) Main Industry Applications

TPU (Thermoplastic Polyurethane [https://www.ytlinghua.com/t3-series-tpu/]) is a versatile material with excellent elasticity, wear resistance, and chemical resistance. Here are its main applications :

1. Footwear Industry - Used in shoe soles, heels, and upper parts for high elasticity and durability. - Commonly seen in sports shoes, outdoor footwear, and casual shoes to enhance shock absorption and grip.

2. Automotive Sector [https://www.ytlinghua.com/polyester-type-tpu-h3-series-product/] - Manufactures seals, gaskets, and weather strips for their flexibility and resistance…

Addressing the Limitations of Traditional TPU and Innovations for EV Charging Ca …

TPU is a versatile material known for its hardness and elasticity, making it popular in various applications. However, traditional TPU faces challenges in meeting the specific performance demands of industries such as automotive, consumer goods, and medical devices. These challenges include inadequate surface quality, high hardness levels limiting flexibility, and a lack of desirable tactile properties, which can impact user experience and product longevity.

Solutions: Modified TPU Technology

The modification of TPU…

Professional 3d printing manufacturer for TPU

What is TPU

TPU is a stands for Thermoplastic Polyurethane. It is a subset of TPE and is a soft polyether type polyurethane that comes in a range of hardness grades. At the same time, TPU also as the one of material be commonly used in injection industry. But today we want to show you another craft to process TPU, that is 3D Printing. Have you ever thought about 3D…