Press release

Transparent Fresh Meat Packaging Film Market to Reach USD 5,150 Million by 2031 Top 15 Company Globally

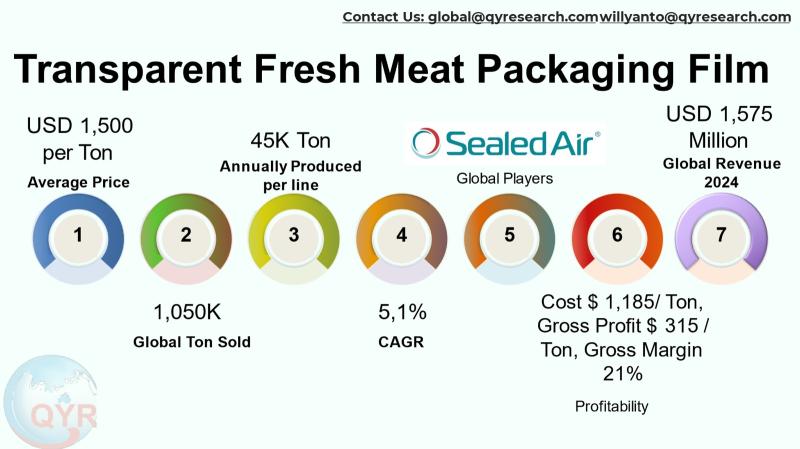

This report examines the market for transparent fresh meat packaging film with a special focus on Asia and Southeast Asia (ASEAN, including Indonesia). It introduces the industry from the point of view of product function and value: transparent fresh meat films are multi-layer flexible films engineered to extend shelf life, present product color and texture attractively at retail, and meet processing-line requirements (vacuum skin, overwrap, MAP/shrink and rollstock applications). The research emphasizes the commercial and operational factors that matter to buyers and processors barrier performance, anti-fog and anti-microbial options, recyclability/PCR content, machinability on thermoform and flow-wrapping lines, and procurement drivers in branded retail versus industrial meat processing.The global market size of transparent fresh meat packaging film in 2024 is USD 1,575 million and an assumed CAGR of 5.1% to 2031 reaching market size USD 2,216 million by 2031. With an average selling price at USD 1,500 per ton implies to a total of 1,050K ton sold in 2024. A factory gross margin of 21% the factory gross profit is at USD 315 per ton and cost of goods is at USD 1,185 per ton. A COGS breakdown is resin/raw materials, extrusion and lamination processing, labor and utilities and plant overhead expressed as percentages of total production cost. A single line full machine capacity production is around 46K tons per line per. Downstream demand is concentrated in retail-ready overwrap, MAP, and vacuum-skin packaging applications, followed by industrial rollstock for large meat processors and the growing foodservice/e-commerce chilled-meat segment.

Latest Trends and Technological Developments

Innovation in the transparent fresh-meat film space remains concentrated on three themes: sustainability (recyclable mono-materials, higher PCR content, and paper-film hybrids), shelf-life extension (vacuum skin films and advanced barrier laminates to support MAP), and conversion efficiency (films engineered for faster sealing and reduced down-time on high-speed thermoform and flow-wrap lines). Recent, market-moving news items that illustrate these trends include Amcors high-profile M&A and capacity moves Amcors acquisition of Berry Global was a transformational consolidation announced in November 2024 and continues to re-shape global supply footprints and ongoing investments in protein-focused capacities in late 2025 as key players bolster converting and barrier film capabilities. Sealed Airs CRYOVAC® product family continues to extend into PCR and barrier shrink/vacuum skin innovations that are being adopted by major processors to reduce waste and extend retail shelf life. Also notable for downstream demand dynamics, large protein processors expanded presence in Southeast Asia during 2025 (for example, JBS announced investments in Vietnam in March 2025), increasing regional requirement for case-ready film formats. These items are recent touchpoints that underline how consolidation, sustainability and regional protein investment are moving demand and technical specification requirements.

Tyson Foods, a leading global protein provider, is actively seeking suppliers for high-clarity, anti-fog modified atmosphere packaging (MAP) film for its fresh beef and pork lines. The purchasing department at Tyson has issued a tender for a multi-layer co-extruded film that extends shelf life by maintaining a consistent gas flush. The initial annual contract is for approximately 500 metric tons, with a target price point of $4,800 per metric ton, as they aim to reduce case-ready meat spoilage and enhance product appeal in retail displays like Walmart and Kroger.

The product is successfully applied by Cargill Protein North America at its Wyalusing, PA, processing facility. Cargill uses a specific high-barrier, transparent packaging film from Sealed Air Corporation (Cryovac® brand) for its premium grass-fed beef steaks. This specialized film is installed on automated vertical form-fill-seal machines, where it is thermoformed into trays and sealed, creating a protective atmosphere around the product. This application has been crucial in reducing purge (liquid) loss and maintaining the bright red color of the meat, for which Cargill has a standing quarterly purchase order of over 200 metric tons at a cost of $5,200 per metric ton.

Asia is the single largest consumption zone for meat and meat-packaging films when measured by tonnage and manufacturing activity. Growth in Asia is powered by expanding retail cold chains, an increasingly modern retail environment (hypermarkets, quick commerce and e-grocery), and rising per-capita protein intake in many markets. Manufacturers in Asia are responding by moving beyond commodity overwrap into higher-value rollstock, vacuum skin and MAP films that command premium pricing and tighter quality controls. Local specialty producers (Indias UFlex and several Chinese converters and co-extrusion houses) are winning regional share by pairing lower cost bases with investments in barrier and anti-fog technologies, while global majors maintain technical leadership and customer relationships with multinational processors and retail chains. For buyers and investors, Asia presents a two-speed market: large industrial processors require high-volume, consistent barrier film supplied via long contracts, while fragmented retail channels in some countries create opportunities for smaller, niche film formats.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5431102

Transparent Fresh Meat Packaging Film by Type:

PET

PP

PE

Others

Transparent Fresh Meat Packaging Film by Product Category:

Blown-Film Co-Extruded

Cast-Film Co-Extruded

Biaxially Oriented (BOPET/BOPP)

Laminated Multilayer

Others

Transparent Fresh Meat Packaging Film by Market Sgement:

High-Barrier

Shrinkable

Vacuum-Skin Compatible

Breathable/Skinpack

Others

Transparent Fresh Meat Packaging Film by Product Division:

Rollstock for FFS (Form-Fill-Seal)

Pre-Made Pouches

Lidding/Peelable Films

Overwrap Films (Flow-Wrap)

Others

Transparent Fresh Meat Packaging Film by Shape:

Tray and Top Film

Pouch Format

Top Sealed Rigid Trays

Others

Transparent Fresh Meat Packaging Film by Application:

Meat Producer

Supermarket

Others

Global Top 15 Key Companies in the Transparent Fresh Meat Packaging Film Market

Berry Global

Bemis Company

Sealed Air

Amcor / Bemis Company

Covertech Flexible Packaging Inc

Mondi

Winpak

Atlantis Pak

Cosmo Film Ltd

Accredo Packaging

Coveris Holdings

Taghleef Industries Group

RKW SE

Polyplex Corporation Ltd

Huhtamaki

Regional Insights

Within ASEAN the dynamics are driven by rapid cold-chain expansion, foodservice growth, and an increasing role for foreign processors and logistics investors. Indonesia, as the regions largest economy, shows accelerating demand for flexible film formats tied to packaged chilled meat and ready-to-cook products, and its flexible-packaging market growth supports higher local consumption of meat film rollstock. Multinational packers establishing or expanding plants in Vietnam, Thailand and Indonesia are explicit demand drivers for transparent meat films that meet export and retail presentation standards. Local converters in ASEAN often partner with global rollstock suppliers for lamination and slitting services; this creates attractive opportunities for converting investments or for entrants offering on-site slitting and service models to reduce freight of finished rolls. Research houses and market vendors report ASEAN and Asia Pacific as priority growth regions for fresh-meat packaging, with processors investing in both capacity and upgraded packaging lines to enable MAP and vacuum skin formats.

The industry faces a set of persistent challenges: regulatory pressure and extended producer responsibility policies are increasing the cost and complexity of film design (bi-layer/tri-layer constructions with recyclability and food safety in balance); feedstock price volatility (resins and barrier resins) creates margin unpredictability for converters; and equipment compatibility issues slow adoption of new mono-material solutions on existing lines. Logistical challenges freight costs and availability of slitting/laminating capacity in target markets add to lead times. Finally, consolidation among global film and converter suppliers concentrates supplier power and raises the bar for new entrants seeking scale-economy pricing; this is compounded by buyers increasingly consolidating purchasing with fewer global partners.

Manufacturers should accelerate investments in recyclable mono-materials and PCR integration where feasible, while protecting margin via value-added services like pre-slitting, on-site inventory management and color/printing capabilities for retailers. Converters and packers should prioritize machine-friendly film formulations (to reduce changeover losses) and establish supply agreements that hedge resin cost volatility. Investors should look for businesses that combine technical barrier expertise with flexible converting assets in Asia/ASEAN (to capture both local demand and export opportunities). For processors, shifting part of procurement to regional converters with just-in-time service reduces finished-goods roll shipping cost and shortens lead times. Lastly, packaging R&D partnerships (for example, barrier film + molded fiber lidding) are a practical way to meet retailer sustainability targets without sacrificing shelf life.

Product Models

Transparent fresh meat packaging films are specialized polymer-based materials designed to preserve meat freshness, enhance visual appeal, and extend shelf life by preventing moisture loss and contamination.

PET is a strong, transparent, and lightweight plastic known for its excellent gas and moisture barrier properties. Notable products include:

Mylar® PET Meat Wrap DuPont Teijin Films: Offers high clarity and excellent gas barrier for extended shelf life of fresh meat products.

Melinex® 800 DuPont Teijin Films: Heat-stable PET film designed for fresh meat trays requiring durable and clear sealing layers.

Hostaphan® RN Film Mitsubishi Polyester Film: High-gloss PET film with excellent dimensional stability suitable for chilled meat packaging.

Skyrol® PET Film SKC Inc.: Provides strong optical transparency and good stiffness for thermoformed meat packaging applications.

Polestar® PET Film Jindal Poly Films: Offers high barrier protection and transparency for display meat packs.

PP is a versatile and cost-effective plastic with good moisture resistance, high clarity, and stiffness. It is commonly used in overwrap or tray-lidding films for fresh meats, offering a balance between transparency, strength, and recyclability while maintaining freshness under chilled conditions. Examples include:

BOPP 1020 Clear Taghleef Industries: Transparent BOPP film offering moisture resistance ideal for meat overwrap.

Torayfan® F63B Toray Plastics: Heat-sealable transparent PP film suited for vacuum or flow wrap meat applications.

FlexoPack PP 220 Flex Films (UFlex): Multi-layer PP film combining clarity and puncture resistance for protein packaging.

Sumitomo BOPP 300 Series Sumitomo Chemical: Clear polypropylene film with high oxygen barrier and easy thermoforming.

Borealis Borpact PP Film Borealis AG: Food-safe polypropylene film combining rigidity and optical brightness.

PE is a flexible, clear, and food-safe plastic widely used for its strong sealing and moisture barrier capabilities. It is suitable for vacuum-sealed or flow-wrapped meat packaging. Notable products include:

SABIC LDPE 200 Series SABIC: Transparent film suitable for vacuum packs and high-speed wrapping lines.

Novexx PE Barrier Film Amcor Plc: Multi-layer PE with oxygen barrier for extending meat shelf life.

Luban PE Film Borouge: Flexible and clear film ideal for skin packaging of fresh meats.

PolyStar PE FreshPack Inteplast Group: Lightweight PE film providing transparency and strong moisture control.

Kuraray Eval PE Blend Kuraray Co., Ltd.: PE-based barrier film incorporating EVOH for enhanced freshness retention.

Transparent fresh meat packaging film is a technically demanding, mid-value packaging segment that sits at the intersection of shelf-life science, retail merchandising and sustainability regulation. Asia and ASEAN are central to the markets near-term growth story because of rising protein consumption, cold-chain investments and the presence of both global and large regional converters. Consolidation among global players and ongoing investment in barrier and PCR technologies shape supplier structure and create opportunities for converters that can deliver localized service, technical consistency and sustainability credentials.

Investor Analysis

This research highlights three investor-relevant takeaways. First, scale with technical differentiation wins: companies that combine co-extrusion barrier expertise with regional converting scale capture premium margins and long-term contracts. Second, geography matters assets located inside Asia/ASEAN lower landed cost for regional processors and reduce lead times, creating higher utilization rates and faster paybacks. Third, sustainability-aligned product portfolios unlock retailer contracts and can command price premia as regulations tighten. Investors should prioritize targets with stable raw-material sourcing, demonstrated converting uptime (machine availability and line speed compatibility with VSP/MAP lines) and customer contracts across retail and industrial processors. The why is simple: predictable throughput on high-utilization converting lines with differentiated barrier products and local service creates repeatable EBITDA and defensible margins in a market that is otherwise exposed to resin price swings.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5431102

5 Reasons to Buy This Report

The report combines a region-focused view with operational production metrics useful for project finance and plant planning.

It aggregates recent, relevant industry news and product developments (M&A, capacity builds, new barrier/PCR products) that impact supply and pricing.

The study translates market price, margin and capacity assumptions into actionable factory benchmarks for investors and managers.

It identifies strategic supplier and converter profiles to guide partnership, JV or acquisition targets in Asia.

The report highlights downstream demand segmentation and practical levers for margin improvement (service models, pre-slitting, on-site inventory).

5 Key Questions Answered

What is the 2024 market baseline and what does the CAGR to 2031 imply for tonnage demand and capital needs?

Which technologies and product formats (vacuum skin, MAP, overwrap, rollstock) are driving price premia and why?

How do Asia and ASEAN differ in demand patterns and what local capabilities are needed to serve each sub-market?

Who are the global and regional supply leaders, and what supplier actions (M&A, capacity expansions) are reshaping competition?

What factory economics (price per ton, COGS breakdown, gross margin and per-line capacity) should investors use to model new conversions or greenfield lines?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Transparent Fresh Meat Packaging Film Market Research Report 2025

https://www.qyresearch.com/reports/5431102/transparent-fresh-meat-packaging-film

Transparent Fresh Meat Packaging Film - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5431954/transparent-fresh-meat-packaging-film

Global Transparent Fresh Meat Packaging Film Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5432806/transparent-fresh-meat-packaging-film

Global Transparent Fresh Meat Packaging Film Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5433658/transparent-fresh-meat-packaging-film

Global Transparent Barrier Packaging Film Market Research Report 2025

https://www.qyresearch.com/reports/4342107/transparent-barrier-packaging-film

Global Transparent PET Barrier Packaging Films Market Research Report 2025

https://www.qyresearch.com/reports/4506185/transparent-pet-barrier-packaging-films

Global Transparent High Barrier Packaging Film Market Research Report 2025

https://www.qyresearch.com/reports/3662530/transparent-high-barrier-packaging-film

Global Transparent Barrier Packaging Film for Food Market Research Report 2025

https://www.qyresearch.com/reports/3555734/transparent-barrier-packaging-film-for-food

Global Medical Packaging Transparent Deposition Film Market Research Report 2025

https://www.qyresearch.com/reports/3451241/medical-packaging-transparent-deposition-film

Global Food & Beverage Packaging Transparent Deposition Film Market Research Report 2025

https://www.qyresearch.com/reports/3451242/food---beverage-packaging-transparent-deposition-film

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transparent Fresh Meat Packaging Film Market to Reach USD 5,150 Million by 2031 Top 15 Company Globally here

News-ID: 4271926 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Film

Introducing heat sealable bopp film: Cloud Film Unveils Revolutionary Heat Seala …

Qingdao Cloud Film Packaging Materials Co., Ltd., a leading innovator in the packaging industry, is thrilled to announce the launch of heat sealable bopp film, a breakthrough heat sealable BOPP film set to revolutionize flexible packaging and labeling applications globally. This exciting development represents a significant advancement in packaging technology and underscores Qingdao Cloud Film's commitment to delivering cutting-edge solutions to its customers worldwide.

In a world where packaging integrity and…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

Winter Film Awards International Film Festival Returns for 10th Annual Celebrati …

New York City's Winter Film Awards showcases films from emerging filmmakers from around the world in all genres, with a special emphasis on highlighting the work of women and under-represented filmmakers. The 10th annual Festival runs September 23-October 2 in New York City. The lineup includes 91 fantastic films from 28 countries, 7 free education sessions and amazing parties.

Winter Film Awards International Film Festival, which was one of NYC's last…

Global Film Capacitors Market 2021 Applications, Leading Manufacturers, Analysis …

Syndicate Market Research recently launched a study report on the global Film Capacitors market project light on the significant drifts and vigorous cannon into the evolution of the trade, which includes the restraints, market drivers, and opportunities. The report talks about the competitive environment prevailing in the Film Capacitors market worldwide. The report lists the key players in the market and also provides insightful information about them such as their…

Biaxially Oriented Polyester (BoPET) Market Share: Key players, Application, Foc …

Biaxially Oriented Polyester (BoPET) Market report provides Six-Year forecast 2019-2025 with Overview, Classification, Industry Value, Price, Cost and Gross Profit. The prime objective of this report is to help the user understand the market in terms of its definition, segmentation, market potential, influential trends, and the challenges that the market is facing. It also covers types, enterprises and applications. To start with, analytical view to complete information of Biaxially Oriented Polyester (BoPET) market. It offers market view…

Global Polyester Film (PET Film) Market Growth 2017-2022 Mitsubishi Polyester Fi …

PET or polyethylene terephthalate film is a thermoplastic polymer commonly referred to as polyester film. Like most thermoplastics, PET films can be biaxially oriented or bubble extruded. Polyester film is one of the most common substrates used in the converting industry because of its balance of properties in relation to other thermoplastic polymers.

Ask For Sample Copy of Report : http://bit.ly/2toHtBg

This report provides detailed analysis of worldwide markets for Polyester Film…