Press release

Laminated Tubes for Pharmaceuticals Market to Reach CAGR 7.20% by 2031 Top 20 Company Globally

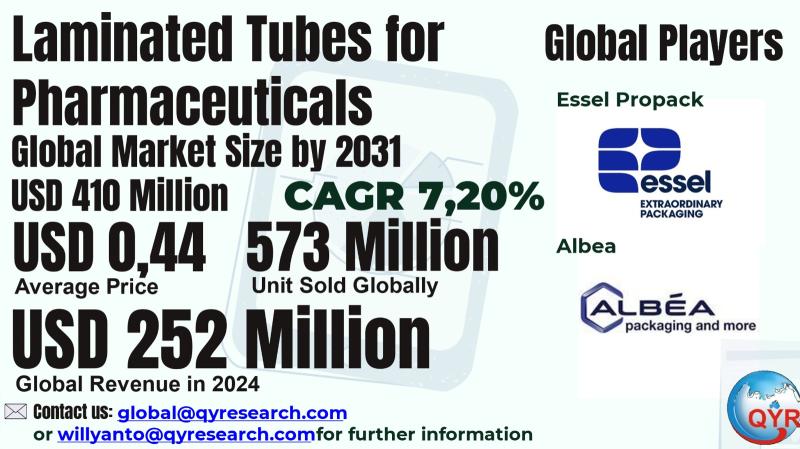

Laminated tubes are flexible, multi-layer packaging tubes made by laminating thin polymer films (with or without an aluminum barrier) to form a lightweight, high-barrier sleeve that is heat-sealed at one end, filled, and sealed/closed with a cap or nozzle; in pharmaceutical use they package ointments, dermatological creams, antibiotic gels, dental pastes, ophthalmic ointments and some topical drug-delivery products where dose integrity, shelf-life, chemical compatibility and tamper evidence matter. Compared with mono-polymer squeeze tubes and aluminium collapsible tubes, laminated tubes (plastic barrier laminate PBL and aluminium barrier laminate ABL) offer a compromise of barrier, printability and cost, and can be engineered into pharma-grade contact layers, child-resistant nozzles and sterile-ready formats that meet regulatory contact-material and extractables/impurities requirements. Manufacturers supply tubes in sizes ranging from small ophthalmic/dermal 35 g mini-tubes to 100+ ml pharmaceutical dispensers; the product sits at the intersection of rigid regulation (pharma contact layers), decorative/brand requirements and the practical needs of hospital and retail dispensing.The laminated-tube for pharmaceuticals estimate of roughly USD 252 million in 2024. Applying a slightly faster adoption rate for pharma, this pharmaceutical laminated-tube subsegment is projected to grow at a CAGR of 7.2% to 2031, producing an approximate market around USD 410 million by 2031. Unit pricing for pharma laminated tubes for pharmaceuticals varies sharply by capacity, barrier construction, decoration, caps, and order quantity/qualification. Average selling price (ASP) of USD 0.44 per tube in 2024 , the USD 252 million revenue implies an implied global shipment of 573 million pharmaceutical laminated tubes in 2024.

Latest Trends and Technological Developments

The laminated-tube sector for pharmaceuticals is being reshaped by two dominant forces: material circularity and pharma contact-layer innovation, and by format/functional improvements (child-resistant micro-nozzles, sterile mini-tubes and mono-material recycle-ready laminates). On June 2024 Hoffmann Neopac won a Tube Council award for a smallest child-resistant polyfoil tube prototype, reflecting product miniaturisation and safety features being engineered specifically with pharma/dental use cases in mind. On the sustainability front, Albéa announced scaled production of its Greenleaf recycle-ready plastic laminate web at its Brampton, Ontario site (publicly reported in late 2024 / early 2025), a commercial move aimed at enabling single-material laminated constructions suitable for mechanical recycling while retaining pharma-grade contact layers. In early 2025 EPL (formerly Essel Propack) continued to publicize capacity expansions and investor disclosures (EPL investor presentation, August 2025) that underline the industrys volume and qualification investments to serve pharma customers with validated lines. In parallel, Neopac and other suppliers introduced aluminum-free mono-material barrier (MMB/Polyfoil) mini-tubes for ophthalmic and dental pharma applications at CPhI-Milan in 20242025, offering a path to reduce ABL dependence while preserving barrier and regulatory compliance. Those dated developments Hoffmann Neopac (June 22024), Albéa Greenleaf production (announced ~20242025), EPL investor updates (Aug 5, 2025), and Neopac MMB rollouts (20242025) represent the most material, recent shifts affecting pharma laminated tubes: migration to recycle-ready laminates, feature innovation for safety/sterility, and capacity/qualification investments to meet pharma quality systems.

Asia Pacific is the largest manufacturing hub and a rapidly expanding consumption region for pharmaceutical laminated tubes. India and China are major global production centers India houses EPLs large manufacturing footprint and Chinas OEM base supplies high volumes at competitive ASPs while Japan, Korea and parts of Southeast Asia account for disproportionate high-spec pharma demand (premium ABL tubes and speciality closures). Regional drivers include strong OTC topical markets, growing dermatology product launches originating in Asia, expanding domestic pharmaceutical formulation capabilities that prefer locally qualified packaging, and cost advantages for high-volume laminates produced in Asia. Several global laminates and tube manufacturers have either expanded Asian production or localized laminate web making (for example Albéas Greenleaf expansion for North American/Asia sourcing) to shorten qualification cycles and reduce landed cost for pharma customers. This Asia manufacturing density also compresses lead times for pharmaceutical companies seeking global supply continuity and faster registration support.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4947512

Laminated Tubes for Pharmaceuticals by Type:

Plastic Barrier Laminate (PBL) Tubes

Aluminum Barrier Laminate (ABL) Tubes

Laminated Tubes for Pharmaceuticals by Application:

Ointments

Gels

Others

Global Top 20 Key Companies in the Laminated Tubes for Pharmaceuticals Market

Essel Propack

Colgate Palmolive

Albea

SUNA

Sree rama

Scandolara

Kyodo Printing

Kimpai

Zalesi

Noepac

Tuboplast

Toppan

BeautyStar

Rego

IntraPac

DNP

Plastuni

Montebello

Plastube

Berry

Regional Insights

ASEAN is a high-growth market for pharma laminated tubes as regional pharma production, topical OTC brands and dermocosmetic lines expand. Indonesia, as ASEANs largest population market, shows particular traction: local pharma and consumer health manufacturers increasingly specify laminated tubes for dermatological and topical OTC formulations because they combine brandability with cost efficiency and acceptable barrier performance. Procurement patterns in Indonesia and neighboring ASEAN countries typically bifurcate hospital and export-oriented pharma companies buy higher-spec ABL tubes and child-resistant closures, while domestic OTC and SMEs buy large volumes of low-cost PE-laminate mini-tubes and pre-decorated PBL formats. Regional supply is supplied by a mix of local OEMs and international suppliers (EPL, Neopac, Albéa, Huhtamäki and Chinese tube makers) that operate local distribution and small-batch decoration to service ASEANs fragmented buyer base. Policy and sustainability programs in some ASEAN countries are beginning to nudge buyers toward recyclable solutions; suppliers that can offer validated pharma contact layers in recyclable formats will have an advantage for export-oriented pharma customers in Indonesia and Vietnam.

The laminated-tube for pharma niche faces four principal challenges. First, regulatory compliance and qualification cycles: pharmaceutical customers require validated contact layers, extractables/leachables data, and change-control documentation qualification timelines are long and discourage frequent supplier swaps. Second, circularity and recycling constraints: many ABL (aluminium barrier) laminates are hard to recycle; the industry faces pressure from brand owners and regulators to introduce mono-material or recycle-ready laminates without compromising barrier or regulatory suitability for drugs. Third, pricing pressure from low-cost Asian OEMs competes directly with premium European/Japanese suppliers this compresses margins when projects are competed purely on cost rather than qualification value. Fourth, fragmentation of cap/closure standards (child-resistant, tamper-evident, dosing tips) adds SKU complexity and inventory costs for suppliers, especially when small-batch pharma clients require custom cap solutions. These structural frictions appear in supplier roadmaps, trade-association guidance and procurement briefs across pharma packaging tenders.

Winning suppliers will combine three capabilities: proven pharma-grade contact layers and extractables testing (to shorten customer qualification), scalable low-cost manufacturing with localized decoration/secondary packaging for regional markets, and credible sustainability roadmaps (recycle-ready laminates, take-back pilots or industrial recycling partnerships such as Neopacs Saperatec agreement). For global pharmaceutical customers, single-source qualified suppliers with multiple regional plants reduce regulatory risk and speed time to market; for regional OTC/dermocosmetic brands, agile decoration and short lead times are the priority. From a product perspective, mono-material barrier mini-tubes and child-resistant micro-nozzle options represent high-value innovation pockets where suppliers can command premium pricing. For suppliers targeting ASEAN, offering bundled services artwork management, small-batch serialization and regulatory data packs can differentiate in procurement rounds dominated by tendered price comparisons.

Product Models

Laminated tubes for pharmaceuticals are widely used packaging solutions that combine durability, barrier protection, and patient convenience. They help protect sensitive pharmaceutical formulations from moisture, oxygen, and contamination while offering easy dispensing.

Plastic Barrier Laminate (PBL) tubes which use multiple plastic layers for excellent aesthetics and flexibility. Notable products include:

Essel Propack PBL Pharma Tube Essel Propack (EPL Limited): High-quality laminated tube with strong barrier and printability for pharma gels.

Huhtamaki PBL Tube Huhtamaki Group: Durable plastic laminate tubes for ointments and topical medications.

Montebello PBL Pharma Tube Montebello Packaging: Offers flexibility and smooth finish for pharmaceutical creams.

Berry Global PBL Tube Berry Global Inc.: Multi-layer plastic tube designed for drug formulations requiring protection.

Tuboplast PBL Tube Albea Group (Tuboplast Hispania): Elegant laminated plastic tubes designed for dermatology and pharma use.

Aluminum Barrier Laminate (ABL) tubes which include an aluminum layer for superior barrier protection against light, oxygen, and moisture. Examples include:

Essel Propack ABL Tube Essel Propack (EPL Limited): Aluminum laminate with strong barrier, ideal for semi-solid pharma formulations.

Huhtamaki ABL Tube Huhtamaki Group: Combines aluminum foil with laminate layers for superior protection.

Albea ABL Tube Albea Group: Lightweight laminated tube with aluminum foil barrier for extended shelf life.

Neopac Polyfoil ABL Tube Hoffmann Neopac AG: Enhanced barrier tube for high-value and sensitive pharma formulations.

Amcor ABL Tube Amcor Flexibles: Strong laminated tube with aluminum foil core for superior moisture resistance.

Pharmaceutical laminated tubes are a durable packaging category that blends regulatory complexity with high unit volumes, brand importance and growing sustainability pressure. Using a reconciled approach midpoint global laminated-tube market we estimate a 2024 pharma laminated-tube market of USD 252 million, with an estimated CAGR 7.20% to 2031 and an implied 573 million tubes shipped in 2024 at an ASP of USD 0.44. Growth will be driven by OTC topical and dermatology product launches, expanding pharma production in Asia, product innovations that combine child safety and sterile miniaturisation, and supplier moves toward recycle-ready laminates while capacity and qualification investments by major players will be decisive in securing long multi-year pharma offtakes.

Investor Analysis

For investors the what is a recurring-volume, regulated packaging niche with attractive unit economics and high switching costs for established pharma customers. The how is by backing companies (or M&A targets) that combine validated pharma contact-layer testing, multiple regional plants (to shorten qualification and reduce logistics risk), and a credible sustainability route toward recycle-ready webs (which large global pharma buyers are beginning to demand). The why is that pharma contracts tend to be long and volume-predictable (multi-year offtakes for topical drug families and OTC relaunches), providing stable cash flow and the potential to upsell higher-margin features (child-resistant caps, sterile kits, decorated runs). Key investment due diligence should validate a targets extractables/leachables dossiers, regional certification footprint (FDA/EMA/PMDA supporting documents where required), customer concentration risk, and the suppliers roadmap for mono-material or MMB solutions that preserve barrier. Successful plays include equity stakes in vertically integrated tube houses, investments in regional contract converters that serve large pharma clusters in India/China/ASEAN, or minority positions in technology suppliers that enable recycling or novel child-resistant closures.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4947512

5 Reasons to Buy This Report

It reconciles multiple syndicated market estimates into a defensible 2024 base for pharmaceutical laminated tubes and a clear CAGR to 2031, allowing investors and procurement teams to model revenue and unit scenarios.

It translates dollars into units with a transparent ASP methodology and a wide sensitivity range, critical for capacity planning and capex decisions.

It documents dated, material industry moves that directly affect product strategy and buyer procurement.

It gives region-level go-to-market insight for Asia and ASEAN. enabling prioritisation of local assembly, decoration capacity and regulatory dossiers.

It profiles the leading players and strategic levers so M&A, supplier selection and joint-venture decisions can be executed quickly.

5 Key Questions Answered

What is the best-supported 2024 market size for laminated tubes used in pharmaceuticals and the reasonable CAGR to 2031?

What is the likely global shipment volume in 2024 given realistic ASP bands, and how sensitive is volume to changes in ASP and pack mix?

Which dated industry developments in 20242025 materially change supplier competitiveness capacity expansions?

How should suppliers and investors prioritise Asia and ASEAN markets in build-out, and what local capabilities matter most for pharma qualification?

Who are the top suppliers, what differentiates them and which capabilities drive premium pricing and stickier contracts?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +

86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Laminated Tubes for Pharmaceuticals Market to Reach CAGR 7.20% by 2031 Top 20 Company Globally here

News-ID: 4170874 • Views: …

More Releases from QY Research

Top 30 Indonesian Coal Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Alamtri Resources Indonesia Tbk (formerly Adaro Energy)

PT Bumi Resources Tbk

PT Bayan Resources Tbk

PT Indo Tambangraya Megah Tbk

PT Bukit Asam Tbk (PTBA)

PT Golden Energy Mines Tbk (GEMS)

PT Dian Swastatika Sentosa Tbk (DSSA)

PT Indika Energy Tbk (INDY)

PT Akbar Indo Makmur Stimec Tbk (AIMS)

PT Atlas Resources Tbk (ARII)

PT Borneo Olah Sarana Sukses Tbk (BOSS)

PT Baramulti…

From Sugar to Profit: Economics of the Global Ready-to-Roll Icings Industry

Ready-to-roll icings (also known as rolled fondant or sugar paste) are pre-formulated sugar-based sheets used for cake covering, decorative modeling, and bakery finishing in commercial and artisan baking.

Products are supplied in bulk slabs, sheets, and blocks and are valued for: Consistent elasticity, Reduced preparation time, Uniform finish, Extended shelf stability.

Industrial buyers include industrial bakeries, frozen dessert processors, QSR chains, supermarkets, and cake studios.

Growing demand for celebration cakes, premium bakery products,…

Sustainable Staples: Why Investors Are Targeting Organic Pulse Processing

Organic dry pulses include organically cultivated lentils, chickpeas, peas, mung beans, pigeon peas, and dry beans produced without synthetic pesticides, fertilizers, or GMOs.

Industry benefits from: Rising plant-protein adoption, Gluten-free and clean-label trends, Soil-friendly nitrogen-fixing crop rotation, Government organic agriculture subsidies across Asia.

Global trade dominated by exporters in India, Australia, Canada, and Turkey

Growing consumption in China, Japan, Indonesia, and Vietnam.

Global Overview

Market size (2025): USD 5,266 million

Market size (2032): USD 8,231 million

CAGR…

Baby Care Boom: USD 9.1B Global Bath & Shower Market Driven by Asia Growth

Baby bath and shower products include liquid cleansers, tear-free shampoos, head-to-toe washes, soaps, bath oils, foam washes, and sensitive-skin dermatological formulations designed specifically for infants and toddlers.

Products emphasize mild surfactants, hypoallergenic formulations, pH-balanced systems (5.56.0), and natural/plant-derived ingredients to minimize irritation and comply with pediatric dermatology standards.

Demand is driven by rising hygiene awareness, premiumization of infant care, urban middle-class expansion, and increased birth rates in emerging Asia.

Strong shift from bar…

More Releases for Tube

Gastrostomy Feeding Tube (G-tube) Market Size, Share, Research Report 2026

LP information released the report titled "Global Gastrostomy Feeding Tube (G-tube) Market Growth 2026-2032" This report provides a comprehensive analysis of the global Gastrostomy Feeding Tube (G-tube) landscape, with a focus on key trends related to product segmentation, Gastrostomy Feeding Tube (G-tube) top 10 manufacturers' revenue and market share, Gastrostomy Feeding Tube (G-tube) report also provides insights into the strategies of the world's leading companies, focusing on their market share,…

Tube Swaging Service Market Size 2025, Trends, and Insights, Growth Forecast to …

NEW YORK, (UNITED STATES) - The global Tube Swaging Service Market has emerged as a pivotal sector, driving innovation and economic growth across industries. This in-depth market analysis delves into the evolving landscape of the Tube Swaging Service industry, highlighting key trends, growth drivers, challenges, and opportunities shaping its future. The report provides a holistic view of market dynamics, competitive strategies, and regional insights, offering stakeholders a comprehensive understanding of…

Large Honing Tube/Cylinder Tube/Hydraulic Steel Tube

Honed tube [https://www.jinyoindustry.com/] is usually a CDS (Cold drawn seamless) steel tube or DOM (Drawn Over Mandrel) steel tube with inside diameter honed or skived &roller burnished, so honed tubing is with extremely precise ID dimensions and smoothly ID surface.

Honed tubes are broadly utilized to produce and repair hydraulic cylinders and pneumatic cylinders. So in many fields, the honed tube is called cylinder tube also.

Honed tube usually is produced by…

Tube Packaging Market: Tube Packaging Market Developments: Shaping the Future of …

Market Overview:

Tube packaging refers to lightweight, flexible packaging solutions that are used for containing and transporting a variety of products like pharmaceuticals, cosmetics, dental products, and food. Tube packaging provides products protection, tampering evidence, and product shelf life extension.

Get Sample Report with Global Industry Analysis @ https://www.coherentmarketinsights.com/insight/request-sample/571

Major Players Are:

✤ Albea S.A.

✤ Amcor Limited

✤ Essel Propack Limited

✤ Sonoco Products Company

✤ World Wide Packaging Inc.

✤ Montebello Packaging Inc.

✤ VisiPak Inc.

✤ Intrapac International…

Carbon steel seamless tube vs Stainless steel seamless tube

The difference between carbon steel seamless tube and stainless steel seamless tube mainly refers to the difference in design rules between carbon steel and stainless steel, which means that the design rules of these two types of steel cannot be used in common. These differences are summarized as follows:

Carbon steel

1. Ordinary steel is carbon steel, that is, iron-carbon alloy. According to the level of carbon content, it is divided into…

Tube-in-tube Sterilizer Market Growth 2020-2025

Global Tube-in-tube Sterilizer�Market Overview:

The latest report on the global Tube-in-tube Sterilizer�market�suggests a positive growth rate in the coming years. Analysts have studied the historical data and compared it with the current market scenario to determine the trajectory this market will take in the coming years. The investigative approach taken to understand the various aspects of the market is aimed at giving the readers a holistic view of the global Tube-in-tube…