Press release

White Vinyl Wrap Market to Reach USD 4,156 Million by 2031 Top 20 Company Globally

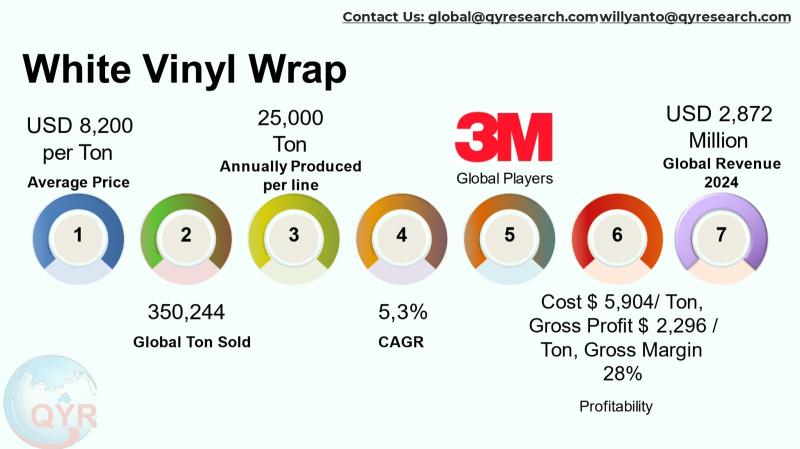

the global white vinyl wrap sector with particular emphasis on structural and demand patterns in Asia and Southeast Asia. White vinyl wrap a cast or calendared PVC film engineered for vehicle and surface graphics, commercial fleet branding, architectural accents and protective overlays serves both aesthetic and protective roles. The industry blends polymer compounding, coating, adhesive lamination and finishing for a category of narrow- to wide-width films that are sold either as commodity rolls or as digitally printable media. This report introduces the core value chain (polymer resins and plasticizers → film extrusion/casting → surface finishing/printing → adhesive/liner integration → distribution and installation) and sets the scene for strategic decisions by manufacturers, converters, distributors and investors operating in Asia and ASEAN markets.The global white vinyl wrap segment is valued at USD 2,872 million in 2024 with a compound annual growth rate of 5.3% projected through 2031 reaching market size USD 4,156 million by 2031. An average selling price is at USD 8,200 per ton implies to roughly 350,244 metric tons sold in 2024. With a factory gross margin at 28%, the factory gross profit per ton is approximately USD 2,296 and cost of goods is at USD 5,904 per ton. A COGS breakdown included raw PVC resin and primary additives, adhesive and liner materials, specialty coatings/inks, direct labor and utilities, and packaging & freight. A single line full machine production capacity is around 25,000 ton per line per year. Downstream demand is concentrated in automotive personalization & aftermarket followed by commercial fleets & advertising, architectural/retail/industrial décor and other industrial uses.

Latest Trends and Technological Developments

Across 2024 to 2025 the sector has shown several noteworthy trends: demand for color-shifting and textured finishes (matte, satin, pearlescent) continues to rise, with suppliers and wrap studios highlighting color and finish trends in industry communications (March 2025). There is increasing interest among installers and end-users in more durable, UV-stable and self-healing top-coats that extend aesthetic life and resist abrasion; manufacturers continue to invest in cast-film and coating upgrades to meet those needs. The packaging/film manufacturing side has seen capacity investments in extrusion and cast-film lines across Asia (announcements about new film-line investments and expansions were visible through 2024 to 2025), which is tightening cost structures and affecting lead times for specialty films. On regional demand drivers, Indonesia and several ASEAN markets are being reshaped by EV manufacturing/assembly investments and fleet growth (for example, automaker/investment news in Indonesia in 2025 highlights new local production and EV plant investments that will affect downstream demand for wrap and film products). Representative items: a color/finish trends piece (TeckWrap, March 2025), and auto-manufacturing/plant investment reporting for Indonesia (BYD plant updates, Jan 2025). These developments underline both aesthetic and industrial drivers shaping white-vinyl demand.

Apex Retail Interiors purchases a bulk order of 3M 1080 Series Satin White vinyl wrap from Grimco, Inc., for a project cost of $45 per linear yard, totaling approximately $12,000 for the initial material order.

The product was installed by the specialized wrapping firm, Urban Shield Wraps, on the entire fleet of 35 delivery vans for "FreshDirect Logistics." The complete application, including material and labor, was billed at a project rate of $3,500 per vehicle, amounting to a total investment of $122,500 to modernize the fleet's branding and protect the original vehicle paint.

Asia is a production hotspot for polymer film manufacturing and also a leading consumption region for vinyl wraps, due to its dense urban vehicle fleets, active signage industries and a strong converter/installer ecosystem. China remains the largest raw-film producer and hosts numerous OEM and private-label cast/calendared film manufacturers; India is expanding packaging and film capacity and adding lines that can be adapted to specialty film production; Southeast Asia (notably Indonesia, Thailand and Vietnam) has rising end-market demand driven by growing vehicle ownership, expanding commercial fleets and rising retail/architectural retrofit activity. The regions strengths include relatively low-cost raw material feedstock, an abundant conversion/manufacturing supply base and proximity to rapidly growing installation networks. At the same time, regional variability in vehicle ownership (Indonesias per-capita car ownership is lower than some ASEAN peers but rising) means addressable per-capita demand differs substantially across markets, creating focused growth pockets in urban centers and logistic corridors.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5444892

White Vinyl Wrap by Type:

Gloss White Wrap

Satin White Wrap

Matte White Wrap

Pearl White Wrap

Others

White Vinyl Wrap by Product Category:

Standard (23 mil)

Premium (46 mil)

White Vinyl Wrap by Market Segment:

Calendered Vinyl

Cast Vinyl

White Vinyl Wrap by Material:

PVC

Bio Based Films

Polyurethane and Hybrid Films

Others

White Vinyl Wrap by Features:

UV Resistant

Bubble Free Adhesive

Removable Adhesive

Heat Stretchable and Conformable

Others

White Vinyl Wrap by Application:

Automotive

Marine

Architectural

Commercial

Others

Global Top 20 Key Companies in the White Vinyl Wrap Market

3M Company

Avery Dennison

ORAFOL

Arlon Graphics

HEXIS

KPMF

Mactac

Fedrigoni

Grafityp

LX Hausys

ASLAN Vinyls

POLI-TAPE Group

Nekoosa

Kernow Coatings

Coverstyl

X-Film

RENOLIT

LINTEC

Vvivid

TeckWrap

Regional Insights

Within ASEAN, Indonesia stands out as the largest single-country automotive market in the subregion and a rapidly expanding EV production/assembly hub, which creates upside for vinyl wrap demand both via new car owners seeking customization and via commercial fleets and OEM-adjacent aftermarket services. Estimates from regional market analyses suggest Indonesias automotive wrap films revenues were in a low-double-digit to mid-double-digit million USD range in 2024 with a higher CAGR than global averages (regional analysts project sizeable growth to 2030), reflecting strong adoption in passenger cars plus commercial vehicle applications. Across ASEAN, the major demand buckets are vehicle personalization for private owners, branded fleet graphics for logistics and delivery fleets, and signage/architectural applications that leverage printed vinyl. Growth drivers include rising disposable income in urban centers, fleet advertising budgets, and EV-related industrial investment that stimulates local supply chains.

The sector faces several structural and operational challenges: volatility in PVC resin and plasticizer feedstock prices, which directly compresses converter margins; competition from alternative surface-finishing systems such as color PPF (paint protection film) and direct-to-surface low-VOC paints; fragmentation among installers (skill and quality variance affects end-customer perception and warranty claims); environmental and regulatory pressure to reduce PVC lifecycle impacts (which can increase R&D and capex needs); and supply-chain lead times for specialty adhesive liners and printable topcoats. Additionally, the risk of commodity pricing pressure from lower-cost, lower-quality imports can squeeze reputable brands and installers who emphasize quality and warranty. Recent market signals indicate some manufacturers are responding by emphasizing durability, eco-formulations, and product differentiation.

Manufacturers should prioritize investments that reduce per-ton COGS (e.g., energy efficiency, higher-line yields, lower waste rates) while selectively investing in premium surface-coatings and adhesive technologies that command premium pricing. Converters and install shops will benefit from stronger training programs and warranty-backed installation standards that protect brand reputation and encourage repeat business. Distributors focused on ASEAN should pursue tighter logistics partnerships, local stocking programs and value-added services (cut-to-length, digital-print prepress) to capture fast-turn fleet business. Across the chain, product differentiation (texture, durability, eco-credentials) and reliable lead-times are decisive competitive advantages in Asia and ASEAN markets. Market participants should track raw-material spreads closely and model scenarios where resin price changes move margins by several percentage points.

Product Models

White vinyl wraps are specialized adhesive films used for vehicle customization, interior design, and product decoration. They provide a durable, protective, and aesthetic layer over surfaces without permanent alteration.

Gloss White Wrap features a high-shine finish that mimics the look of freshly polished paint. It reflects light vividly, creating a clean and sophisticated appearance while offering protection against UV rays, dirt, and minor scratches. Notable products include:

3M 2080-G10 Gloss White - 3M: Known for its exceptional conformability and self-healing surface, ideal for full vehicle wraps.

Avery Dennison SW900 Gloss White - Avery Dennison: Delivers a smooth, mirror-like finish with easy installation and long durability.

Oracal 970RA Gloss White - Orafol: A professional-grade cast film with RapidAir® technology for bubble-free application.

VViViD+ Gloss White Premium - VViViD Vinyls: Offers long-term outdoor performance and a deep reflective finish.

KPMF K75400 Gloss White - Kay Premium Marking Films: Engineered for consistent gloss and color retention over time.

Satin White Wrap offers a semi-gloss finish that balance between matte and gloss, giving a smooth, silky surface with soft reflections. Its often chosen for a refined yet understated appearance. Examples include:

HEXIS Satin White HX30 - Hexis: Offers a balanced satin tone with excellent conformability and adhesive strength.

KPMF K75500 Satin White - KPMF: Delivers even light diffusion and subtle reflection for a classy finish.

Inozetek Satin White - Inozetek: Known for smooth tactile texture and luxurious sheen, ideal for premium vehicles.

Rwraps Satin White Vinyl Film - Rvinyl: Great for interior trims and partial wraps with easy DIY installation.

Arlon Satin White Wrap - Arlon: Combines smoothness and flexibility for wrapping irregular curves with minimal effort.

Matte White Wrap has a flat, non-reflective finish that provides a modern, stealthy look. It minimizes glare and surface imperfections, making it ideal for minimalistic and sleek aesthetics. Notable products include:

3M 2080-M10 Matte White - 3M: Offers clean matte texture with advanced air-release technology for precision wrapping.

Avery Dennison SW900 Matte White - Avery Dennison: Ensures superior durability and scratch resistance for long-term applications.

Oracal 970RA Matte White - Orafol: Combines smooth matte look with high flexibility and easy installation.

TeckWrap Matte White - TeckWrap: UV-stable matte finish suitable for both indoor and outdoor projects.

VViViD Matte White Premium - VViViD Vinyls: A DIY-friendly wrap with self-healing and repositionable adhesive.

Pearl White Wrap features a shimmering finish that reflects light with subtle color shifts, giving a luxurious, iridescent appearance. Its popular for adding sophistication to vehicle exteriors and premium branding. Notable products include:

TeckWrap Pearl Crystal White - TeckWrap: Offers deep luster and color-shifting highlights under sunlight.

HEXIS HX30000 Pearl White - Hexis: Features micro-pearl pigments for elegant shimmer and easy application.

KPMF K75404 Pearl White - KPMF: Renowned for its fine metallic-pearl particles that enhance dimensional appearance.

Arlon Premium Pearl White - Arlon: Provides consistent pearlescent finish with reliable adhesion.

Rwraps Pearl White Vinyl - Rvinyl: DIY-friendly wrap that creates a luxurious pearl-like appearance at an affordable cost.

White vinyl wrap sits at the intersection of polymer film manufacturing and downstream brand/display/vehicle personalization markets. The products mix of protective functionality and aesthetic flexibility makes it valuable for vehicle owners, fleet operators, retailers and interior specifiers. Asia and ASEAN are strategic growth zones both because of their strong production capabilities (raw film and converting capacity) and because of rising vehicle fleet activities, retail modernization and regional automotive investments. Manufacturers and converters who combine dependable supply, improved product durability (UV/abrasion resistance), and installer quality will capture disproportionate share as demand expands. Continued attention to feedstock cost volatility and environmental positioning (recyclability and lower-VOC technologies) will be necessary to sustain margins and licensing relationships with premium channel partners.

Investor Analysis

What investors should take away: the market size and projected growth together with a per-ton price baseline indicate a material, mid-scale commodity-plus specialty market with recurring demand. How to use the report: investors should prioritize targets that have (1) established access to resin feedstock or hedging strategies to limit input-price volatility; (2) differentiated product IP e.g., advanced coatings or adhesive technologies that command premium prices and reduce customer churn; (3) lean local conversion networks in Asia/ASEAN that reduce logistics cost and accelerate time-to-market for fleet programs. Why it matters: the sectors dual nature (commodity resin economics + premium finish premiums) means strong operational execution (capex-efficient lines and yield control) can unlock margin expansion; in growth markets like Indonesia and other ASEAN countries, tailwinds from automotive expansion, fleet advertising, and EV manufacturing provide multi-year structural demand uplift. For private-equity or corporate investors, this sector offers a mix of defensive repeat-purchase cash flows and selective upside from premiumization and product innovation.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5444892

5 Reasons to Buy This Report

It converts headline revenue into practical volume and per-ton economics so you can size supply and inventory needs quickly.

It combines global brand intelligence with Asia/ASEAN regional insights to support targeted M&A or distributor expansion.

It provides manufacturing-level KPIs (COGS breakdown, per-ton gross profit, capacity-per-line range) that help underwrite capex and pro-forma models.

It highlights near-term trends and dated industry news so you can time product launches or branding bets (color/finish and coating upgrades).

It frames practical investor actions (feedstock hedges, premium product development, local converter partnerships) to protect and grow margins.

5 Key Questions Answered

What is the implied global tonnage behind the quoted 2024 revenue baseline?

Which downstream end uses drive demand for white vinyl wrap?

What does a typical per-ton COGS and factory gross profit look like given a price of USD 8,200/ton and 28% gross margin?

What per-line production capacity range should project planners use when sizing new cast/cast-calendared film lines?

Which major suppliers and regional dynamics (China, India, ASEAN) will shape supply, pricing and lead times over the next 35 years?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global White Vinyl Wrap Market Research Report 2025

https://www.qyresearch.com/reports/5444892/white-vinyl-wrap

Global White Vinyl Wrap Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5444893/white-vinyl-wrap

White Vinyl Wrap - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5444894/white-vinyl-wrap

Global White Vinyl Wrap Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5444891/white-vinyl-wrap

Global Car Wrap Vinyl Film Market Research Report 2025

https://www.qyresearch.com/reports/3782102/car-wrap-vinyl-film

Global Vehicle Vinyl Wrap Films Market Research Report 2025

https://www.qyresearch.com/reports/4369554/vehicle-vinyl-wrap-films

Global Carbon Fiber Vinyl Wraps Market Research Report 2025

https://www.qyresearch.com/reports/3556966/carbon-fiber-vinyl-wraps

Global Vinyl Wrap Air Release Pen Market Research Report 2025

https://www.qyresearch.com/reports/4355165/vinyl-wrap-air-release-pen

Global Car Vinyl Film Market Research Report 2025

https://www.qyresearch.com/reports/3455658/car-vinyl-film

Global Car Wrap Film Market Research Report 2025

https://www.qyresearch.com/reports/3995674/car-wrap-film

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release White Vinyl Wrap Market to Reach USD 4,156 Million by 2031 Top 20 Company Globally here

News-ID: 4267092 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for White

White Chocolate Market Segmented By, Candies, White Chocolate Coating Nuts, and …

The demand for white chocolate is increasing considerably due to its varied use in several applications, but is utilized in food and beverage industry on a large scale. Exceptional oil-based color is being combined with white chocolate for the purpose of making different confectionery foods such as modelling paste, icing, etc. Furthermore, white chocolate has major usage in the cosmetics industry for manufacturing nail enamel, oil and wax. The global…

Masonry White Cement Market is Going to Boom | LafargeHolcim, Federal White Ceme …

Latest Study on Industrial Growth of Global Masonry White Cement Market 2021-2027. A detailed study accumulated to offer Latest insights about acute features of the Masonry White Cement market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future…

White Cement Market Upto 2025 By The Top Players : Union Corporation, CBR Heidel …

The White Cement Market is continuously growing in the global scenario at significant pace. White cement is typically used in combination with white aggregates to produce white concrete for decorative work and prestige construction projects. White cement allows a wide range of color options for producing structural and architectural concrete as well as masonry and cementitious building project. Increasing demand from construction activities and rising applications of white cement for…

Masonry White Cement Market 2025 Growth, Trends, Size & Forecasts| Cementir Hold …

Get Free sample at https://www.reportsnreports.com/contacts/requestsample.aspx?name=1927313

The market research report, Masonry White Cement market has been prepared based on a deep market analysis with inputs from industry experts. The report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this Global market.

This report researches the worldwide Masonry White Cement market size (value, capacity, production and consumption)…

White Cement Market By Top Players : Birla White (UltraTech), Cementir Holding, …

Industry Overview of White Cement Market :

According to a new report published by Reports Monitor titled, “Global White Cement Market, Growth Opportunities, Innovations, and Forecast, 2018-2025,” the global White Cement Market is growing rapidly from 2018 to 2025.

White cement is a white colour construction material having properties like aesthetic, decorative and hydraulic binding. It is as durable and strong as grey cement; however, it differs in its colour and fineness. The applications of white cement…

Global White Masonry Cement Market 2017 - Cementir Holding, LafargeHolcim, Feder …

Global White Masonry Cement Market 2017, presents a professional and in-depth study on the current state of the White Masonry Cement market globally, providing basic overview of White Masonry Cement market including definitions, classifications, applications and industry chain structure, White Masonry Cement Market report provides development policies and plans are discussed as well as manufacturing processes and cost structures. White Masonry Cement market size, share and end users are analyzed…