Press release

Brazil Carbon Credits Market Size, Share, Growth, Trends, Report 2025-2033

Brazil Carbon Credits Market OverviewMarket Size in 2024: USD 2.11 Billion

Market Forecast in 2033: USD 24.84 Billion

Market Growth Rate: 28.4% (2025-2033)

According to the latest report by IMARC Group, the Brazil carbon credits market size was valued at USD 2.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.84 Billion by 2033, exhibiting a CAGR of 28.4% from 2025-2033.

Brazil Carbon Credits Industry Trends and Drivers:

Expanding Market Dynamics in the Brazil Carbon Credits Landscape

The Brazil carbon credits market is continuing to showcase strong momentum as organizations, investors, and policymakers are actively pursuing climate-focused initiatives and sustainable development pathways. The increasing emphasis on environmental responsibility is aligning with the country's vast biodiversity, which is serving as a natural foundation for robust carbon offset projects.

Local businesses are integrating carbon-neutral strategies to enhance brand reputation, meet compliance standards, and attract eco-conscious stakeholders, thereby driving market expansion. At the same time, international corporations are investing in Brazil's ecosystem-based carbon projects as part of their global net-zero commitments, stimulating both domestic and cross-border demand. Energy-intensive industries are transitioning towards renewable sources and cleaner technologies, creating fresh opportunities for the deployment of carbon credits as complementary instruments in emissions reduction frameworks.

The rapid development of voluntary carbon markets is reinforcing this trend, as companies across multiple sectors are leveraging credits to demonstrate sustainability leadership and strengthen their environmental, social, and governance (ESG) positioning. Furthermore, technological innovations are continuously improving monitoring, reporting, and verification systems, ensuring transparency and building trust among participants. The alignment of economic incentives with climate goals is strengthening investor confidence and positioning Brazil as a regional leader in green finance.

With financial institutions increasingly supporting carbon-focused investments, the market is sustaining a favorable environment for growth. As a result, the integration of sustainability strategies across agriculture, forestry, energy, and industrial operations is continuing to expand the adoption of carbon credits, reinforcing Brazil's role as a cornerstone of the global low-carbon transition.

According to the [Brazil Carbon Credits Market Size, Share, Trends and Forecast by Type, Project Type, End-Use Industry, and Region, 2025-2033], the country is witnessing strong development supported by national policy frameworks and corporate sustainability strategies, thereby confirming its pivotal role in advancing climate commitments at both domestic and global levels.

Regulatory Advancements and Corporate Adoption Driving Market Expansion

The ongoing regulatory advancements in Brazil are serving as powerful catalysts in shaping the carbon credits market and ensuring a structured pathway toward long-term sustainability.

The government is implementing mechanisms that are encouraging companies to participate in compliance markets while also supporting the growth of voluntary initiatives. These developments are fostering an enabling environment where carbon pricing, transparency in credit validation, and robust governance frameworks are working together to stimulate wider adoption.

Businesses across Brazil are integrating carbon credit strategies into their operational and financial planning to comply with environmental policies and to strengthen investor relations. This proactive adoption is enhancing competitiveness in both domestic and international markets, as sustainability performance is becoming a decisive factor for trade partnerships, financing opportunities, and consumer preference.

Key sectors such as forestry, agriculture, and renewable energy are demonstrating leadership by adopting large-scale carbon sequestration and clean energy projects that are generating high-quality credits. These credits are then being utilized to offset emissions and support global supply chains that are increasingly valuing climate-conscious practices. Moreover, multinational companies with significant operations in Brazil are aligning with local carbon reduction policies to meet both national and global reporting standards, thereby reinforcing corporate responsibility.

The interaction between regulatory bodies, private enterprises, and non-governmental organizations is creating a collaborative ecosystem that is driving innovation and strengthening accountability. Enhanced monitoring systems are further enabling reliable tracking of carbon reductions, ensuring that credits remain credible in international markets.

The regulatory clarity is also attracting foreign investors who are recognizing Brazil's potential as a scalable hub for nature-based solutions. Consequently, the country is positioning itself as a global leader in advancing climate finance while offering businesses and investors a profitable yet responsible path to long-term growth.

Opportunities for Growth Across Sectors and Global Influence

Brazil is continuing to establish itself as a central player in the international carbon market by leveraging its natural assets, regulatory initiatives, and growing corporate participation.

Multiple industries are finding opportunities to integrate carbon credits into their growth strategies, creating a diverse and resilient ecosystem for long-term market expansion. The agriculture sector is innovating with sustainable practices that are simultaneously improving productivity and generating verified carbon offsets. Forestry projects are focusing on reforestation, afforestation, and conservation activities that are directly contributing to climate goals while also supporting local communities.

The energy sector is accelerating its shift toward renewables, thereby expanding the pool of credits generated from clean energy initiatives. In parallel, technology-driven companies are investing in advanced digital tools to measure, validate, and trade credits with higher efficiency, ensuring transparency and enhancing global credibility. International demand is further reinforcing this trajectory, as corporations across Europe, North America, and Asia are purchasing Brazilian credits to meet stringent climate targets and ESG commitments.

This growing global appetite is highlighting Brazil's role as a strategic exporter of carbon credits and strengthening its geopolitical influence in sustainability diplomacy. Furthermore, the integration of local communities into carbon offset projects is delivering socioeconomic benefits such as job creation, capacity building, and rural development, thereby increasing the overall impact of these initiatives. The synergy between environmental stewardship and economic growth is positioning Brazil as a benchmark for other emerging economies seeking to balance development with sustainability.

With supportive regulations, expanding technological capabilities, and rising international collaboration, the Brazil carbon credits market is continuing to evolve as a dynamic and opportunity-rich landscape that is aligning environmental responsibility with long-term profitability.

Download sample copy of the Report:

https://www.imarcgroup.com/brazil-carbon-credits-market/requestsample

Brazil Carbon Credits Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Compliance

● Voluntary

Project Type Insights:

● Avoidance/Reduction Projects

● Removal/Sequestration Projects

● Nature-based

● Technology-based

End-Use Industry Insights:

● Power

● Energy

● Aviation

● Transportation

● Buildings

● Industrial

● Others

Regional Insights:

● Southeast

● South

● Northeast

● North

● Central-West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

● Market Performance (2019-2024)

● Market Outlook (2025-2033)

● COVID-19 Impact on the Market

● Porter's Five Forces Analysis

● Strategic Recommendations

● Historical, Current and Future Market Trends

● Market Drivers and Success Factors

● SWOT Analysis

● Structure of the Market

● Value Chain Analysis

● Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32567&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Carbon Credits Market Size, Share, Growth, Trends, Report 2025-2033 here

News-ID: 4169544 • Views: …

More Releases from IMARC Group

Latin America Online Grocery Industry Analysis 2025-2033: Market Trends, Segment …

The Latin America Online Grocery Market reached a valuation of USD 3.8 Billion in 2024. The market is projected to expand to USD 10.1 Billion by 2033, exhibiting a CAGR of 10.95% during the forecast period of 2025-2033. Growth is driven by rising digital connectivity, evolving consumer lifestyles, urbanization, competitive pricing, the effects of the COVID-19 pandemic, and expanding logistics infrastructure. Online grocery shopping caters to consumers seeking convenience, flexibility,…

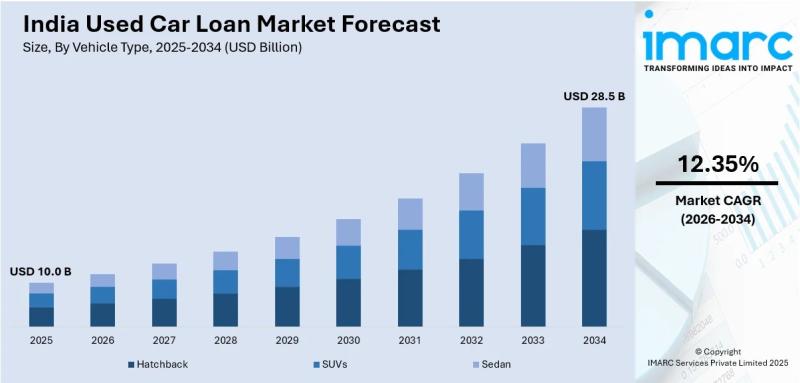

India Used Car Loan Market Outlook 2026-2034: Size, Share, Growth, Trends Analys …

According to IMARC Group's report titled "India Used Car Loan Market Size, Share, Trends and Forecast by Vehicle Type, Financier, Percentage of Amount Sanctioned, Tenure, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

What is the Size of India's Used Car Loan Market?

The India used car loan market size reached USD 10.0 Billion in 2025. The market is expected…

Latin America Carbon Credit Market Size to Surge by 2034 Driven by Net-Zero Goal …

The Latin America carbon credit market was valued at USD 63.05 Billion in 2025 and is expected to reach USD 824.52 Billion by 2034, growing at a CAGR of 33.06% during 2026-2034. This growth is propelled by rising environmental awareness, stringent legislative carbon pricing mechanisms, and corporate sustainability goals. The region's extensive forests enhance its leadership in nature-based carbon credit generation.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period: 2026-2034

Latin…

Energy Meter Manufacturing Plant DPR & Unit Setup Cost 2026: Business Plan, ROI …

Setting up an energy meter manufacturing plant positions investors in one of the most stable and essential segments of the smart grid infrastructure and energy management value chain, backed by sustained global growth driven by the global shift toward smart grid infrastructure, rising electricity consumption, regulatory mandates for accurate billing, and the growing adoption of smart and prepaid metering systems. As utilities worldwide modernize their power distribution networks, governments mandate…

More Releases for Brazil

Brazil Clinical Trials Market ANVISA Brazil Guidelines Brazil Clinical Trials Re …

Brazil Cancer Drugs Clinical Trials Insight 2024 Report Offering:

• Brazil Clinical Trials Market Opportunity 2024 and 2030 (In US$ Billion)

• Clinical Trials Regulatory Framework In Brazil

• Total Number of Cancer Drugs In Clinical Trials In Brazil

• Total Number Of Cancer Drugs Approved In Brazil

• 400 Pages Clinical Trials Insight On All Cancer Drugs In Clinical Trials By Company, Indication and Phase

• 80 Pages Clinical Insight On All Cancer Drugs Approved in Market By Company and Indication

• Insight…

South East Brazil growing with major share in the Brazil Professional Hair Care …

In the Report “Brazil Professional Hair Care Market: By Categories (Coloring, Perming & Straightening, Shampoo & Conditioning & Styling); Sales Channel (Back Bar and Take Home) & By Company - (2018-2023)“ published by IndustryARC, the market is driven by the growing awareness of special functionalities of products, boosting the sales of treatment and hair conditioning market.

South East Brazil growing with major share in the Brazil Professional Hair Care Market

The Northern…

ATM Machine Market is Booming (18% CAGR)| NCR Brazil, Diebold Brazil, Wincor Nix …

HTF MI recently introduced ATM Machine Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Itautec S/A, NCR Brazil, Diebold Brazil, Wincor Nixdorf Brazil,…

Brazil: Country Intelligence Report 2018 By Claro, Sky Brazil, Oi, Vivo, TIM Bra …

"Brazil: Country Intelligence Report", by GlobalData provides an executive-level overview of the telecommunications market in Brazil today, with detailed forecasts of key indicators up to 2021. Published annually, the report provides detailed analysis of the near-term opportunities, competitive dynamics and evolution of demand by service type and technology/platform across the fixed telephony, broadband, and mobile, as well as a review of key regulatory trends. …

Agrochemicals Market in Brazil

ReportsWorldwide has announced the addition of a new report title Brazil: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Brazil: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

ATM Machine Market in Brazil 2015-2019: Competitive analysis of key vendors, inc …

Albany, NY, Feb 23, 2017: This report segments the ATM machine market in Brazil by revenue generated and the unit shipment. It also includes the competitive analysis of key vendors, including Itautec S/A, NCR Brazil, Diebold Brazil and Wincor Nixdorf Brazil.

Market scope of the ATM machine market in Brazil

Technavios market research analyst predict that the ATM machine market in Brazil will continue to grow at CAGR of 18.72%. The key…