Press release

Food Tub Packaging Market to Reach CAGR 5,15% by 2031 Top 20 Company Globally

Food tub packaging covers a wide set of rigid and semi-rigid containers used to sell and distribute foods such as ice cream, spreads and butters, ready meals, yogurt, sauces, confectionery tubs, and larger food-service tubs; formats include injection-moulded and thermoformed plastic tubs and lids, paperboard/paper-based tubs with barrier treatments, and specialty multilayer tubs (e.g., PCR-filled PP or PE, coated paperboard). The product category sits at the intersection of convenience, branding (large printable surface area), thermal performance for frozen products, resealability for multi-use items, and increasingly sustainability requirements (recyclability, reduced virgin plastic, compostable/paper solutions). Manufacturers and brand owners choose tub format to balance cost, barrier needs, consumer convenience, retail presentation and recycling/collection realities in target markets.The food tub packaging market at approximately USD 629 million in 2024 with a reported CAGR of 5,15% in published forecasts to 2031, making market size USD 898 million in 2031. Global ASP for tubs varies a lot with material, size, decoration, minimum order quantity and whether the tub is custom-printed or a commodity plain container. In 2024 ASP approximate USD $0.30 per unit. Using this ASP gives a reasoned 2 billion units sold globally in 2024.

Latest Trends and Technological Developments

The tub categorys dominant technical and commercial storyline in 2023 to 2025 has been sustainable material innovation and brand trials of paper-based or plastic-reduced tubs. On January 2024, Upfield announced a plastic-free, recyclable paper tub for its plant-butters and spreads aimed at replacing conventional plastic tubs and lowering plastic use across its portfolio, a high-profile example of an FMCG owner moving to paper tubs. In October 2024 Nestlé (Quality Street) trialled a paper tub in selected Tesco stores as part of plastic-reduction trials and Smurfit Westrock / Smurfit Kappa (now combined with WestRock) were named as design/manufacturing partners for that convertible paper tub trial. Throughout 2024 to 2025 leading converters and packaging groups Huhtamaki, Mondi, Amcor/Berry and Smurfit Westrock publicised sustainable tub and paper-based cup launches and higher-barrier functional papers for tubs, while packaging groups promoted compostable or home-compostable ice-cream cups and recyclable paper lid solutions in 2025. These dated announcements illustrate the active shift among brands and converters toward low-plastic and recyclable tubs, and the corresponding R&D and CAPEX decisions at major converters to make paper-based tubs commercially viable in oil/fat-rich and frozen applications.

Asia especially East and South Asia remains both the largest manufacturing base for tub formats and one of the fastest-growing demand pools because of high per-capita consumption growth (frozen desserts, packaged dairy and ready meals), expanding foodservice, and strong converter capacity. Global leaders in tub conversion and paperboard tub innovations have manufacturing sites or partnerships across Asia to serve domestic and export markets; Huhtamaki, for example, actively promotes paper-based ice-cream containers and operates regional plants that support global brand customers. Asias growth is also shaped by diverging national recycling infrastructures: some APAC markets favor lightweight PCR-based plastic tubs because mechanical recycling is available, while other markets Europe-style see rapid rollouts of paper-based tubs where collection streams are mature. Regional supply chains and raw-material availability (PCR, coated papers, barrier treatments) therefore materially influence which tub formats win in each country

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4933997

Food Tub Packaging by Type:

Polyethylene

Polypropylene

Food Tub Packaging by Application:

Ice Cream and Dairy Products

Ready to Eat Products

Frozen Food

Others

Global Top 20 Key Companies in the Food Tub Packaging Market

Amcor Plc

Sonoco Products Company

Huhtamaki Oyj

Berry Global Company

Magnum UK

Polyoak Innovations

Bergen Plastics AS

Pact Group Holdings Ltd

Shalam Packaging

Greiner Packaging

Pakers Packaging

Interpack Ltd

Insta Polypack

Sealed Air Corporation

Pactiv Evergreen Inc

Silgan Holding Inc

Coveris Holdings S.A.

Winpak Ltd

Jiangsu Newamstar Packaging Machinery Co., Ltd.

Shenzhen Prince New Material Co., Ltd.

Regional Insights

Southeast Asia exhibits an active but heterogeneous story. In ASEAN, urbanization, supermarket expansion and quick-service food growth drive tub demand across ice-cream, spreads and prepared meals, while sustainability pressures are stimulating trials of paper tubs and PCR-filled plastic tubs. Indonesia, as the regions largest population market, shows clear volume upside: local dairy and frozen dessert brands, growing modern retail penetration and large food-service procurement demand mean Indonesia accounts for a notable slice of ASEAN tub volumes. Converters and material suppliers are responding regional printers, paperboard mills and local thermoforming partners are increasingly qualified to produce either plastic tubs with higher PCR content or paper tubs adapted for high-fat products. At the same time, major global brands trialing paper tubs in Europe signal potential future ASEAN introductions though the timing depends on local collection and recycling systems and cost parity.

The food tub category faces four enduring challenges. The first is sustainability trade-offs: moving from plastic to paper tubs reduces virgin plastic but often requires new barrier technologies and sometimes increases complexity (laminates, metallized layers) which may reduce ease of recycling. The second is cost and scale: paper tub solutions currently tend to be more expensive at small volumes and require retooling by converters, which slows rapid substitution in price-sensitive markets. The third is regulatory and collection infrastructure: paper tubs that are recyclable only where specific paper-collection streams exist will not deliver circularity in all markets; this mismatch complicates global rollouts for multinational brands. The fourth is product performance: tubs for frozen, oily or wet products require robust barriers and seal integrity; early paper tubs needed R&D to match plastic tubs moisture, grease and freeze-thaw performance, and converters are racing to close that gap. These constraints create near-term adoption friction but also define a clear technical roadmap for suppliers.

For converters and investors the winning posture is multi-track: defend commodity, low-cost plastic tub supply for markets where recycling infrastructure or price sensitivity favors polymers, while simultaneously investing in scalable paper-tub lines and high-barrier functional papers so brands can pilot or migrate premium SKUs. Building repeatable tool-up packages for brands (artwork, re-sealable lids, barrier options) shortens qualification cycles, and vertical integration (access to coated papers or PCR resin) reduces exposure to raw-material swings. In ASEAN, partnering with large local brand owners and food-service distributors accelerates offtake and smooths seasonal demand lulls; in Asia more broadly, converters that can offer easily recyclable or compostable tub systems aligned to local collection rules will win preferred supplier status with sustainability-led buyers.

Product Models

Food tub packaging plays a vital role in protecting, storing, and presenting food products across industries ranging from dairy to ready-to-eat meals.

Polyethylene (PE) Food Tub Packaging are lightweight, durable, and resistant to impact and moisture. They are widely used for dairy, snacks, frozen foods, and chilled products because they stay flexible even at low temperatures. Notable products include:

Huhtamaki PE Dairy Tub Huhtamaki Group: Widely used for yogurt and cream packaging, offering a durable, lightweight design.

Berry Global PE Ice Cream Tub Berry Global: A freezer-safe polyethylene tub designed to resist cracking at low temperatures.

Greiner Packaging PE Food Tub Greiner Packaging: Used for spreads and dips, featuring high-quality printing for branding.

Amcor PE Fresh Food Tub Amcor: Designed for salads and ready meals, balancing safety and recyclability.

Silgan Plastics PE Snack Tub Silgan Holdings: A flexible tub option with tamper-evident lid systems for snacks.

Polypropylene (PP) Food Tub Packaging are rigid, heat-resistant, and lightweight, making them suitable for microwaveable meals, hot-fill foods, dairy, and spreads. Examples include:

RPC Superfos PP Food Tub RPC Superfos: Popular for ice cream and dairy, offering excellent design flexibility.

Huhtamaki PP Microwaveable Tub Huhtamaki Group: Strong polypropylene tubs designed for reheating and ready meals.

Greiner Packaging PP Spoonable Yogurt Tub Greiner Packaging: A rigid PP tub designed with integrated lids or spoon features.

Berry Global PP Spread Tub Berry Global: Widely used for margarine and butter due to its stability under refrigeration.

Sabert PP Deli Tub Sabert Corporation: Clear deli tubs used for salads and grab-and-go meals.

Food tub packaging is a stable, innovation-intensive niche inside the broader food-container universe. Using a tub-focused market anchor of USD 629 million in 2024 and a modeled CAGR 5,15% to 2031 yields a pragmatic, investable picture: modest absolute growth driven by convenience formats and foodservice demand, and disproportionate strategic value from conversion to paper-based tubs and PCR-filled plastics. Asia and ASEAN are particularly important both for global supply and future demand growth, while converters that can offer low-risk, high-barrier, recyclable paper tubs earlier than peers will accelerate adoption by multinational brands.

Investor Analysis

What matters is where durable margin pools live: short term, commodity plastic tubs still generate volume and steady cash; medium term, premium paper-tub and barrier-paper solutions carry pricing power as brands pay for demonstrably lower-impact packaging. How value accrues is through scale (automation and tool standardization), vertical linkage to coated paper and PCR supply, and winning strategic multilocation contracts with major food brands rolling out sustainability roadmaps. Why now is compelling is the simultaneous timing of three forces brand ESG deadlines, converter R&D that has made paper tubs commercially credible (e.g., Upfields Jan 2024 launch), and active M&A/industry consolidation among converters that together lower execution risk for successful players and create acquisition and partnership opportunities for investors. Due diligence should focus on converters installed converting capacity, cost to retool for paper tubs, barrier-paper suppliers, and regional logistics economics in ASEAN and Asia where the next growth volumes are likeliest.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4933997

5 Reasons to Buy This Report

It reconciles tub-specific market estimates (a defensible 2024 narrow-segment baseline) with broader container market context so you can build realistic revenue and unit models.

It translates observed supplier/wholesale pricing ranges into implied unit volumes for 2024 to support capex and unit-economics sensitivity testing.

It documents dated, high-impact product launches and trials such as Upfields Jan 9, 2024 plastic-free tub and Nestlés Oct 2024 Quality Street paper-tub trial that act as early adoption signals.

It provides Asia and ASEAN routing for demand and supply with an emphasis on Indonesias volume potential and converter readiness helping prioritize market entry and offtake targets.

It profiles leading players and identifies the technical and commercial levers (barriers, recyclable paper, PCR pipelines) that create defensible supplier positions for investors and strategic buyers.

5 Key Questions Answered

What is a defensible 2024 market size for narrowly-defined food tub packaging and what CAGR should financial models use through 2031?

What realistic price-per-unit bands exist across plastic, paper and premium tubs and what do those prices imply for global unit volumes in 2024?

Which dated real-world product trials and launches in 20242025 indicate the speed of migration to paper or plastic-reduced tubs?

Where in Asia and ASEAN will tub demand expand fastest, and what commercial levers should converters and investors prioritize to capture Indonesia/ASEAN growth?

Who are the most important global converters and platform owners in tub formats, and what capabilities separate the leaders from the rest?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Food Tub Packaging Market to Reach CAGR 5,15% by 2031 Top 20 Company Globally here

News-ID: 4158994 • Views: …

More Releases from QY Research

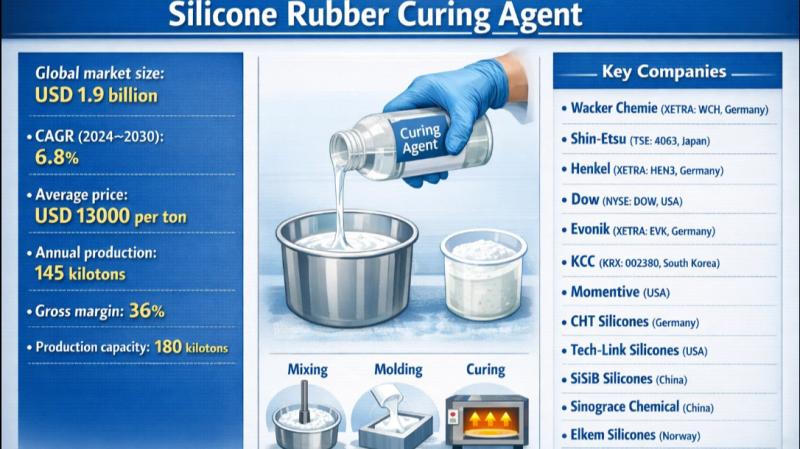

Silicone Rubber Curing Agents: From Slow Cure to Precision Performance

Problem

Cardinal Health using conventional curing systems for silicone rubber often faced slow curing speed, inconsistent crosslinking, and limited control over mechanical properties. Inadequate curing could lead to uneven hardness, poor tensile strength, surface tackiness, or reduced thermal and chemical resistance. These issues increased defect rates, extended production cycles, and constrained performance in demanding applications such as electronics, automotive, medical, and industrial sealing.

Solution

Shin-Etsu Chemical adopted Silicone Rubber Curing Agents, specialized additives…

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

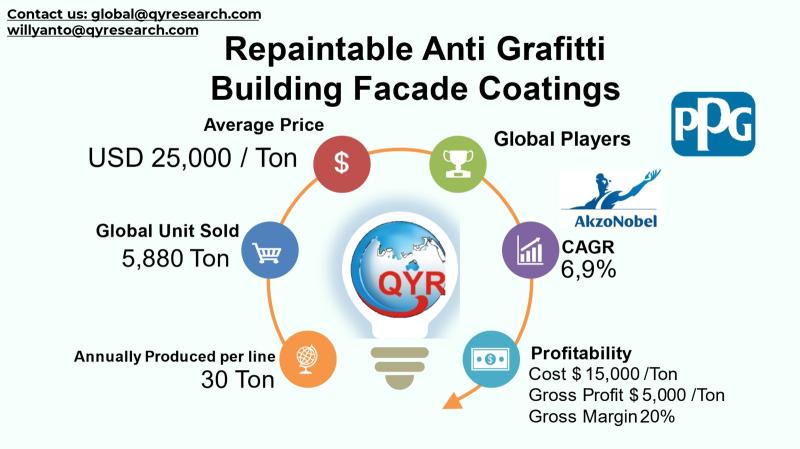

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

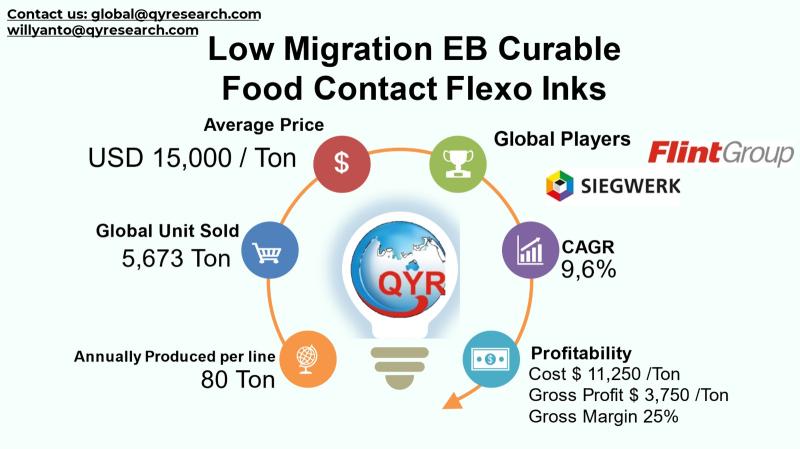

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

More Releases for Tub

Tub Coaters Explains How Modern Bonding Primes Have Evolved and Improved Tub Ref …

Tub refinishing looks simple on the surface. A worn tub gets cleaned, repaired, and coated so it looks new again. What most homeowners never see is the layer that makes or breaks the entire job. Bonding primer sits between the original tub surface and the new finish. This layer decides whether the coating stays smooth for years or starts peeling months later. The way bonding primers work today looks very…

Wellness Surge Drives Black Friday Hot Tub Rush

As the wellness market hits $7.4 trillion by 2025, consumers grab early holiday deals on home spas for stress relief and health benefits, with North Carolina's Epic Hot Tubs leading the trend in smart, affordable self-care.

As the global wellness economy barrels toward $7.4 trillion by 2025, up from $6.3 trillion in 2023 [https://www.forbes.com/sites/ronaberg/2023/11/20/the-future-of-wellness-new-data-on-wellness-travel-mental-wellness/], everyday folks are jumping on Black Friday sales early to score home spa gear that promises stress…

Tub Refinishing Services Market Set for Dynamic Growth with Key PlayersTub Docto …

Worldwide Market Reports has added a new research study on the Global "Tub Refinishing Services Market" 2025 by Size, Growth, Trends, and Dynamics, Forecast to 2032 which is a result of an extensive examination of the market patterns. This report covers a comprehensive investigation of the information that influences the market regarding fabricates, business providers, market players, and clients. The report provides data about the aspects which drive the expansion…

EpicHotTubs.com Launches Spring Hot Tub Deals

Save up to $10,000 on hot tubs and swim spas this spring at EpicHotTubs.com, with free delivery and open houses at Raleigh, Durham, and Charlotte showrooms throughout April 2025.

As spring arrives, Epic Hot Tubs [https://epichottubs.com/] is heating things up with incredible discounts on a variety of hot tubs and swim spas, available at all four of their North Carolina locations.

To celebrate the season, EpicHotTubs.com is hosting open houses at each…

Hot Tub Market Will Generate Record Revenue by 2028

The hot tub market is expected to grow at a cagr of 5% from 2022 to 2028. A hot tub is a large,round or oval shaped bath filled with heated water that sits on a platform. People use hot tubs to relax and soak in water.

Market experts do detailed market study about entire market from several angles to depict the most updated and key market data to form this detailed…

Tub Drains Market to Witness Robust Expansion by 2025

LP INFORMATION recently released a research report on the Tub Drains market analysis, which studies the Tub Drains's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global "Tub Drains Market 2020-2025" Research Report categorizes the global Tub Drains market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share, growth…