Press release

Plant Fiber Molded Products Market to Reach USD 4,112 Million by 2031 Top 20 Company Globally

Plant fiber molded products often called molded fiber or molded pulp are packaging and product solutions formed from cellulose fibers such as recycled paper, bagasse, bamboo and other agricultural residues. They are used widely in egg cartons and drink carriers, electronics protective packaging, quick-service and foodservice containers and increasingly in specialty formats like fiber lids, trays, clamshells and pharmaceutical blister components. The category sits at the intersection of cost-effective protective packaging and low-carbon alternatives to plastics and foams. Two core process families define the industry: traditional wet molded fiber (thermoformed or transfer molded) and emerging dry molded fiber which uses minimal water and faster cycle times to form precise, thin-walled parts, opening routes to higher volumes and new applications. Adoption is propelled by retailer and brand decarbonization targets, plastic-waste regulation, PFAS restrictions affecting some fiber coatings, and the surge in e-commerce that needs protective but sustainable dunnage and inner packs.The global Plant fiber molded products market size in 2024 is approximately USD 2,499 million indicating steady mid-single-digit growth. Looking ahead, multiple outlooks point to a medium-term expansion rate in the CAGR of about 7,33% through 2031, implying the market reaches roughly USD 4,112 million by 2031. These growth dynamics are underpinned by brand sustainability mandates, regulatory curbs on single-use plastics, and technical progress in forming, barrier systems and machine throughput.

Latest Trends and Technological Developments

The most visible technology storyline is the commercial rollout of Dry Molded Fiber (DMF), which lowers water and energy use and increases cycle speeds compared with traditional wet processes. On April 2025, Nippon Molding in Japan completed site acceptance of a PulPac Modula DMF machine, signaling acceleration of DMF in Asia and a push toward high-precision, thin-wall applications such as lids and cutlery. In February 2025, Huhtamaki announced the separation of its Fiber Foodservice Europe-Asia-Oceania business into two segments Fiber Packaging and Foodservice Europe-Asia-Oceania a move effective April 2025 intended to sharpen strategic focus and capital allocation for fiber technologies including molded fiber. In July 2025, the European Investment Bank approved financing to scale Sweden-based PulPac and its DMF platform, citing substantially lower environmental impact versus wet molding and plastics and enabling faster industrialization between 2025 and 2029. Together these events underscore a trend toward capital deepening, IP-led platforms and local Asia deployments for high-volume, plastic-replacement SKUs. April 2025 (Nippon Molding DMF), February 2025 and April 2025 (Huhtamaki re-segmentation), July 2025 (EIB financing for PulPac).

Asia Pacific is the engine of global demand and supply, accounting for the largest regional share in 2024 and outpacing other regions in growth, supported by consumer electronics manufacturing, rising packaged food penetration and policy pressure on plastics in markets like China and India. Independent analyses put Asia Pacific at roughly 41% share in 2024 and forecast it as the fastest-growing region, while country-level work shows India expanding at about 910% CAGR to 2030 from a 2023 base of USD ~252 million, driven by plastic-reduction policies and foodservice adoption. China remains the largest single contributor inside Asia Pacific, supported by its electronics and home-appliance supply chains and tightening environmental standards. On the supply side, Asia is also seeing the earliest in-region rollouts of DMF with licensees and partners forming around platforms like PulPac, pointing to a localization of advanced fiber forming.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4927593

Plant Fiber Molded Products by Type:

Ordinary Waste Paper Pulp Molding

Sugarcane Pulp Pulp Molding

Wheat Straw Pulp Pulp Molding

Bamboo Pulp Pulp Molding

Other

Plant Fiber Molded Products by Application:

Packaging

Agriculture

Cultural and Creative Products and Home

Others

Global Top 30 Key Companies in the Plant Fiber Molded Products Market

Huhtamaki

Genpak

Hrfty

Get Bio Pak Co., Ltd

Quit Plastic

Tellus Products, Inc.

Pakka

Eco-Products, Inc.

Vegware

Sadho

Hefei Sumkoka Environmental Technology Co.,Ltd

Green Olive Environmental Technology Co., Ltd.

GeoTegrity

Deluxe

Zhejiang Zhongxin Environmental Protection Technology Group Co., Ltd.

World Centric

Bambu

Guangxi Fineshine ECO Technology Co., Ltd.

Yutong Environmental Protection Technology Co., Ltd.

Foshan Mida Friendly Products

Shaoneng Group Guangdong Luzhou ECO Technology Co., Ltd.

Zhejiang Kingsun Eco-Pack Co., Ltd.

Jiangsu Youpak Packaging Technology Co., Ltd.

Zhiben Environmental Protection Technology Group

EKO Enterprise Limited

Nanya Pulp

Sadler Paper Company

Guangxi Qiaowang Pulp Packing Products Co.,Ltd.

Regional Insights

Southeast Asias growth narrative combines export-oriented manufacturing, a fast-formalizing retail/foodservice sector and governments steering toward plastic reduction. emerged as an early DMF node via HZ Green Pulp, PulPacs first Malaysian licensee, targeting items such as fiber lids, trays and cutlery, while regional electronics and small-appliance supply bases in Vietnam and Thailand continue to substitute molded fiber for foams in protective inner packs. While market sizing at the sub-regional level varies by source, the direction of travel is clear: new capacity and licensing in ASEAN, plus multinational brand requirements for compostable or recyclable formats, are accelerating commercial adoption and local content.

Plant Fiber Molded Products by Region:

North America

Europe

China

Japan

India

South East Asia

Despite momentum, producers face four execution hurdles. First, coating systems and barriers: the shift away from PFAS toward alternative barriers for grease and moisture has created formulation and certification cycles that lengthen time-to-market for hot/fatty foods and medical packs. Second, capex and yield: high-speed lines and thermoformers require upfront investment and process control to achieve precision, surface finish and de-dusting comparable to plastics. Third, cost volatility: recovered fiber quality and prices vary by region, complicating pricing in export-heavy supply chains. Fourth, standardization and end-of-life: compostability claims increasingly require verified conditions and labeling; in some markets, industrial composting infrastructure lags policy ambition, leading brands to emphasize recyclability in paper streams and design-for-recycling.

For global and regional players, the winning strategies emphasize hybrid portfolios that mix cost-optimized transfer-molded protective packaging for electronics and eggs with higher-margin, design-led thermoformed and dry-molded SKUs in foodservice and health & beauty. In Asia and Southeast Asia, securing localized fiber supply and barrier chemistry partners, plus licensing or JV access to dry-molding IP, helps compress ramp-up timelines. Brand owners can capture Scope 3 benefits by switching from EPS/EPE to molded fiber dunnage in e-commerce and brown-box programs, while foodservice networks can standardize on PFAS-free coatings to future-proof menus and comply with city and national bans.

Product Models

Plant fiber molded products represent a sustainable innovation in manufacturing, transforming agricultural residues and recycled paper into versatile, eco-friendly items.

Ordinary waste-paper pulp molding which repurposes recycled paper into everyday packaging. Notable products include:

Recycled Egg Trays Pulp-Tec: Made from recycled cardboard and paper, these molded trays are durable and cost-effective for large-scale egg transport.

Protective Cushion Inserts Molded Fiber (IMFA): Uses wastepaper-based molded fiber to protect food, horticultural, or medical items, fully recyclable and biodegradable

Custom Biodegradable Packaging Otarapack: Utilizing low-cost waste paper pulp (e.g. recycled A4, cartons), Otarapack produces trays and protective packaging that are cost-effective and eco-conscious.

EcoTray 100® by GreenPack Co.: A durable molded pulp tray for electronics packaging.

PaperGuard Inserts by Flatz GmbH: Protective molded pulp inserts for fragile goods

Sugarcane pulp molding which uses sugarcane residue to form sturdy, compostable tableware. Examples include:

Bagasse Lunch Trays Golden West Packaging: Custom-molded from sugarcane and recycled paper, these trays are biodegradable yet sturdy and brandable via silkscreen.

Sugarcane Takeaway Containers Biogreenpak: Includes compostable burger boxes and clamshell lunch boxes, ideal for eco-aware food packaging.

Cosmetics Packaging Mountain-Bio / Nanhya: Eco-friendly cosmetic trays and holders made from 100 % sugarcane pulp; smooth, strong, and biodegradable.

Gracz Simple Containers by BPE: Cream-colored tableware using a blend of bagasse and bamboo.

BioBowl Deluxe by BioLeader Pack: Premium compostable bowls for takeout

Wheat straw pulp molding utilizing leftover straw to create firm, smooth-surface products. Notable products include:

Seedling Trays InNature Pack: Made from wheat straw pulp, these stiff, unbleached trays support seedlings and are cost-effective for agricultural use.

Fruit Trays InNature Pack: Smooth-surfaced, sturdy wheat straw pulp trays designed for transporting produce with minimal fibre length flexibility.

StrawBowl by NanYa Disposable bowls crafted for hot foods.

EcoTray by Hubei Wheat Straw Env. Tech: Multipurpose trays for food and seedling use.

StrawCup by Hubei Wheat Straw Env. Tech: Compostable cups made from wheat straw pulp

Bamboo pulp molding which leverages fast-renewing bamboo fibers for premium packaging and tableware solutions. Examples include:

High-End Tableware InNature Pack: Bamboo pulp offers strong, smooth-surfaced products ideal for premium disposable dining items.

Custom Packaging Inserts Otarapack: Bamboo-based molded pulp trays with tailored shapes, offering strength, biodegradability, and aesthetic appeal.

BambooFiber Tableware by NanYa: Stylish, eco-friendly tableware made entirely from bamboo pulp.

Bamboo Tray by Hunan Lead Goal: High-quality bamboo fiber trays for food service.

EcoBoard Clamshell by BambooPack Solutions: Bamboo pulp clamshell packaging with premium feel.

Plant fiber molded products are shifting from niche to mainstream as policy, retailer mandates and consumer sentiment align around plastic reduction and circularity. With a 2024 global market around USD 2,499 million and a modeled CAGR near 7.33% to 2031, the categorys risk-reward skew is favorable where producers can secure IP-backed process advantages, validated PFAS-free barriers, and local supply of consistent fiber. Asia and within it, Southeast Asia offers a compelling blend of demand pull from electronics and foodservice, talent pools for advanced machinery, and policy impetus, while Europe and North America continue to shape standards, barrier chemistries and financing models that de-risk scaling.

Investor Analysis

For investors, molded fiber sits inside a durable compounding theme: sustainable materials replacing legacy plastics. What matters is exposure to segments with defensible moats, namely DMF IP, precision thermoforming and barrier know-how. How value accrues is through operating leverage on modern lines (higher OEE and yield), SKU migration into higher-ASP lids/trays/blisters, and long-term offtakes with QSR and electronics brands that prefer single-material, curbside-recyclable packaging. Why now is attractive stems from visible catalysts in 20242026: corporate plastic-reduction deadlines, PFAS transitions that favor certified fiber systems, and fresh capital and organizational focus (e.g., Huhtamakis re-segmentation and EIB financing for PulPac) that accelerate commercialization, particularly across Asia and Southeast Asia. Sensible diligence includes site-level OEE benchmarking, coating supplier audits for PFAS-free compliance, and scenario testing recovered-fiber costs versus pricing power.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4927593

5 Reasons to Buy This Report

It provides a reconciled 2024 global market size and a defensible CAGR outlook to 2031 derived from multiple high-quality sources and a transparent modeling approach.

It offers granular Asia and Southeast Asia insights, including the latest licensing and investment signals that affect local capacity and timing.

It captures dated, verifiable whats new items corporate restructuring, capital financing and factory deployments that change the competitive map.

It highlights regulatory and technology inflection points such as PFAS-free barriers and DMF, helping investors and operators de-risk product roadmaps.

It names leading players and explains how and where value is likely to accrue, enabling faster screening of targets and partners.

5 Key Questions Answered

What is the best-supported estimate of the global molded fiber market size in 2024 and the CAGR through 2031, and how does it reconcile across sources?

Which Asia and Southeast Asia developments licensing, capex or policy will move the needle on capacity and demand over 20252031?

How will dry molded fiber and PFAS-free barrier systems reallocate margin pools within foodservice and electronics protective packaging?

Which companies hold the most strategically advantaged positions and why, given recent reorganizations and financing?

Where are the key execution risks in Asia and ASEAN fiber supply quality, coating certification, capex intensity and how can they be mitigated through partnerships and IP access?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Plant Fiber Molded Products Market to Reach USD 4,112 Million by 2031 Top 20 Company Globally here

News-ID: 4146652 • Views: …

More Releases from QY Research

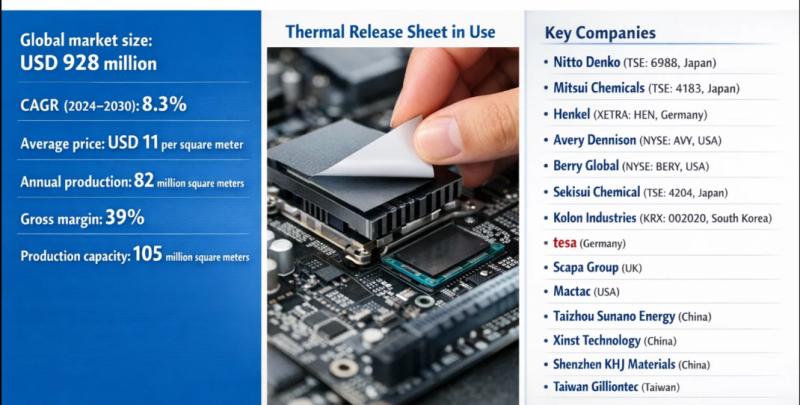

Thermal Release Sheets: An USD 928 Million Market Powering High-Yield Semiconduc …

Problem

Manufacturers using conventional adhesive films or mechanical separation methods faced challenges in precision bonding and debonding processes. These materials often required high peel force, left adhesive residue, or caused substrate damage during removal. In electronics, semiconductor packaging, and display manufacturing, such limitations resulted in lower yield rates, longer cycle times, and increased risk of component breakage-especially for thin wafers, fragile glass, and fine-pitch assemblies.

Solution

Producers adopted Thermal Release Sheet, a functional…

Global and U.S. AI Chips for Self-Driving Market Report, Published by QY Researc …

QY Research has released a comprehensive new market report on AI Chips for Self-Driving, high-performance computing processors designed to handle perception, sensor fusion, decision-making, and vehicle control in autonomous and advanced driver-assistance systems (ADAS). These chips integrate CPU, GPU, NPU/AI accelerators, and safety subsystems to process massive data streams from cameras, LiDAR, radar, and ultrasonic sensors in real time. As global automakers accelerate toward Level 2+ to Level 4 autonomy,…

Global and U.S. Access Control Security Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Access Control Security, refers to systems and technologies used to regulate who can enter or use physical spaces, digital resources, or systems by verifying identity and granting or denying permissions based on predefined rules; it commonly includes methods such as key cards, PIN codes, biometric authentication (fingerprint, facial recognition), and software-based authorization to enhance security, prevent unauthorized access, and ensure…

Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

Indonesias electronics sectorspanning electronic manufacturing services (EMS), distribution, components, and systems integration saw mixed performance in Q3 2025. Broadly, established firms with diversified offerings performed steadily, while smaller pure-play electronics names faced variable demand amid global supply chain pressures and moderate domestic demand. Overall revenue and profitability growth was modest with notable outliers outperforming peers thanks to data-center services and enterprise solutions.

PT Metrodata Electronics…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…