Press release

Tax Tech Market Expands as Organizations Seek Scalable Solutions for Direct and Indirect Tax Management

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Tax Tech Market- (By Offering (Solutions (Tax Compliance & Reporting (Corporate tax compliance (direct & indirect taxes), Sales and use tax automation, VAT/GST compliance, E-filing and tax return preparation), Tax Analytics & AI-Driven Solutions (Predictive analytics for tax planning, AI-powered tax audits and risk assessment, Tax data visualization and decision support), Tax Workflow & Document Management (Tax document automation and e-signatures, Tax workflow collaboration platforms, Audit trail and regulatory documentation)), Professional Services (Consulting & Training, Integration & Deployment, Support and Maintenance)), By Deployment Mode (Cloud, On-premises), By Tax Type (Direct Tax (Corporate Income Tax, Capital Gains Tax, Property Tax, Other Direct Taxes), Indirect Tax (Value-Added Tax (VAT) and Goods & Services Tax (GST), Sales & Use Tax, Excise Tax, Customs Duties & Tariffs, Other Indirect Taxes)), By Organization Size (Large Enterprises, SMEs), By Vertical (BFSI, IT & Telecom, Retail & E-commerce, Manufacturing, Energy & Utilities, Healthcare & Life Sciences, Government & Public Sector, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Tax Tech Market is valued at USD 18.3 Bn in 2024 , and it is expected to reach USD 61.9 Bn by the year 2034, with a CAGR of 13.4% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/3005

Tax technology, often referred to as "tax tech," denotes the application of advanced digital tools and automated software to enhance the accuracy, efficiency, and regulatory compliance of tax-related operations. This segment encompasses a broad array of technologies-including blockchain, cloud computing, artificial intelligence (AI), machine learning, and data analytics-that collectively facilitate the automation and optimization of critical tax processes such as filing, reporting, auditing, and regulatory compliance.

The market for tax technology solutions is expected to witness robust growth, primarily driven by the rising complexity of global tax regulations and the shifting dynamics of international trade. As enterprises expand their global footprint, they face increased challenges in complying with diverse tax jurisdictions and evolving regulatory requirements. Consequently, there is a growing demand for intelligent, adaptive, and real-time tax management platforms that can address these complexities and support efficient, compliant operations across multiple regions.

List of Prominent Players in the Tax Tech Market:

• Wolters Kluwer

• H&R Block

• Avalara

• Vertex

• Thomson Reuters

• SAP

• ADP

• SOVOS

• Intuit

• Xero

• TaxBit

• Ryan

• TaxAct

• Anrok

• Corvee

• TaxSlayer

• Fonoa

• Token Tax

• Drake Software

• TaxJar

• Picnic Tax

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The growth of the tax technology (tax tech) market is primarily fueled by escalating regulatory requirements, widespread adoption of cloud-based platforms, and the global rollout of digital tax reform initiatives. Industries such as retail and e-commerce, financial services, and information and communications technology are increasingly implementing tax tech solutions to manage the growing complexity of compliance across diverse tax jurisdictions.

As tax policies become more region-specific and intricate, organizations are increasingly relying on automated systems to improve accuracy, enhance operational efficiency, and ensure timely regulatory compliance. The need to modernize tax functions, minimize manual errors, and keep pace with rapidly evolving legislative environments is significantly contributing to the increased adoption of advanced digital tax solutions.

Challenges:

Despite positive market momentum, growth is tempered by several challenges, particularly in emerging markets where digital infrastructure is underdeveloped and awareness of tax technology remains limited. Small and medium-sized enterprises (SMEs), in particular, often continue to utilize conventional methods such as spreadsheets and manual recordkeeping, due to limited technical capabilities and resistance to digital transformation. Moreover, the dynamic nature of global tax laws necessitates frequent updates to tax technology platforms to reflect changes in tax rates, reporting obligations, and compliance standards. This requirement for ongoing customization and system upgrades adds to the overall complexity and cost of both deployment and maintenance for providers and end users.

Regional Trends:

North America is anticipated to retain a leading position in the global tax tech market, supported by an established digital tax infrastructure, regulatory mandates for electronic filing, and strong adoption of automation technologies. The region continues to prioritize compliance and operational efficiency, driving sustained innovation in the tax technology space. Furthermore, substantial investments in emerging technologies, such as blockchain and cloud-based platforms, are reinforcing North America's position as a key hub for tax tech advancement.

In contrast, the Asia Pacific region is forecasted to witness the fastest growth during the projected period. Accelerated digital transformation, evolving regulatory structures, and growing acceptance of cloud technologies are propelling the demand for tax tech solutions. Government-led initiatives, including mandates for e-invoicing and digital tax reporting, are prompting enterprises of all sizes to modernize their tax operations. These developments are creating a conducive environment for rapid market expansion across major economies in the region.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/3005

Recent Development:

• March 2025: Parolla and Xero collaborated to provide Irish users with free VAT3 return and SEPA payment options. With SEPA-compliant files, the Parolla Plugins made it easier to pay suppliers and allowed direct VAT3 filings to Revenue Online Services (ROS).

• December 2024: Avalara expanded its global e-invoicing capabilities by acquiring Oobj Tecnologia da Informação Ltda, a Brazilian software company. Through this acquisition, Avalara's e-invoicing reach is extended to six Latin American nations, and its endpoint connection in Brazil has been improved.

Segmentation of Tax Tech Market-

By Offering-

• Solutions

o Tax Compliance & Reporting

Corporate tax compliance (direct & indirect taxes)

Sales and use tax automation

VAT/GST compliance

E-filing and tax return preparation

o Tax Analytics & AI-Driven Solutions

Predictive analytics for tax planning

Al-powered tax audits and risk assessment

Tax data visualization and decision support

o Tax Workflow & Document Management

Tax document automation and e-signatures

Tax workflow collaboration platforms

Audit trail and regulatory documentation

• Professional Services

o Consulting & Training

o Integration & Deployment

o Support and Maintenance

By Deployment mode-

• Cloud

• On-premises

By Tax type-

• Direct Tax

o Corporate Income Tax

o Capital Gains Tax

o Property Tax

o Other Direct Taxes

• Indirect Tax

o Value-Added Tax (VAT) And Goods & Services Tax (GST)

o Sales & Use Tax

o Excise Tax

o Customs Duties & Tariffs

o Other Indirect Taxes

By Organization Size-

• Large Enterprises

• SMEs

By Vertical-

• BFSI

• IT & Telecom

• Retail & E-commerce

• Manufacturing

• Energy & Utilities

• Healthcare & Life Sciences

• Government & Public Sector

• Other Verticals

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/tax-tech-market/3005

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Tech Market Expands as Organizations Seek Scalable Solutions for Direct and Indirect Tax Management here

News-ID: 4130825 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

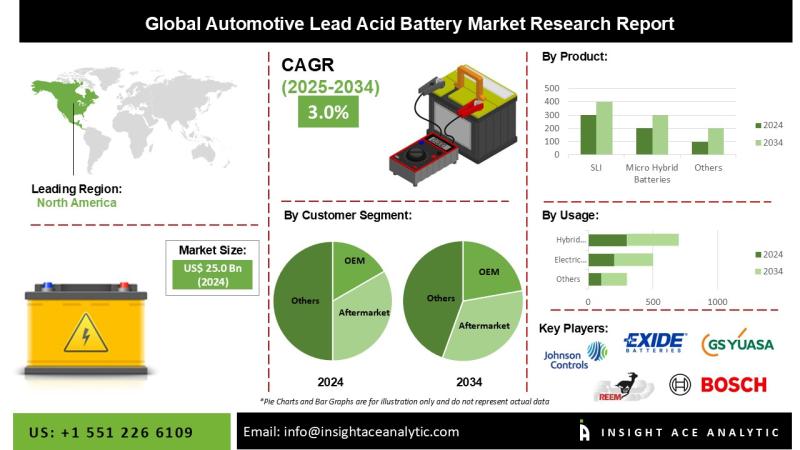

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

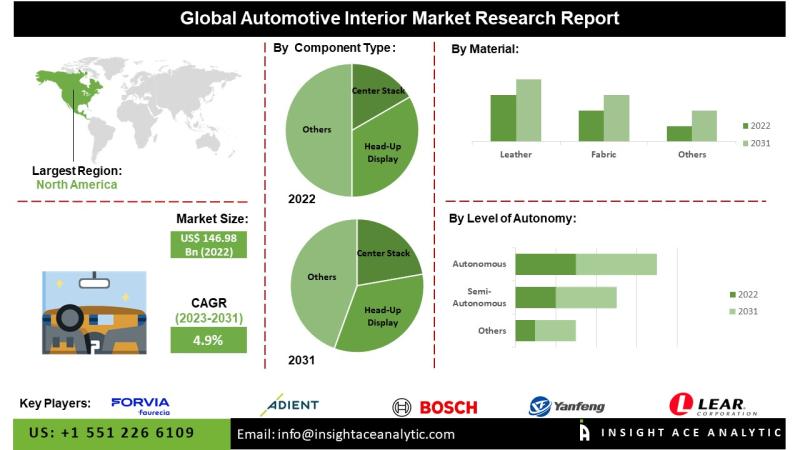

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

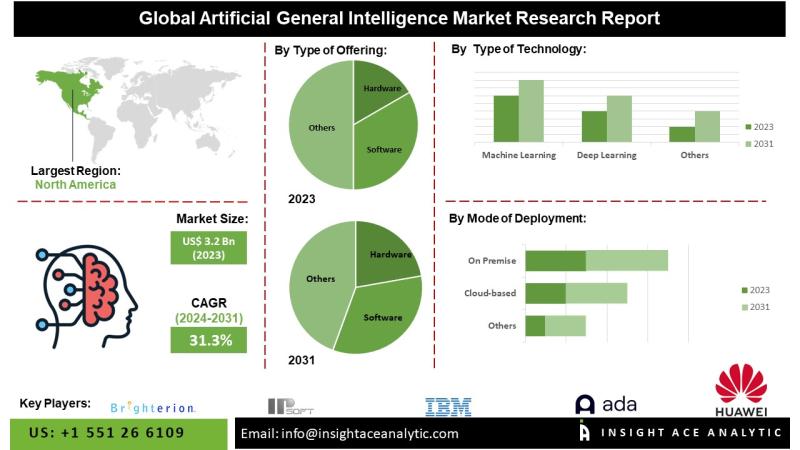

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

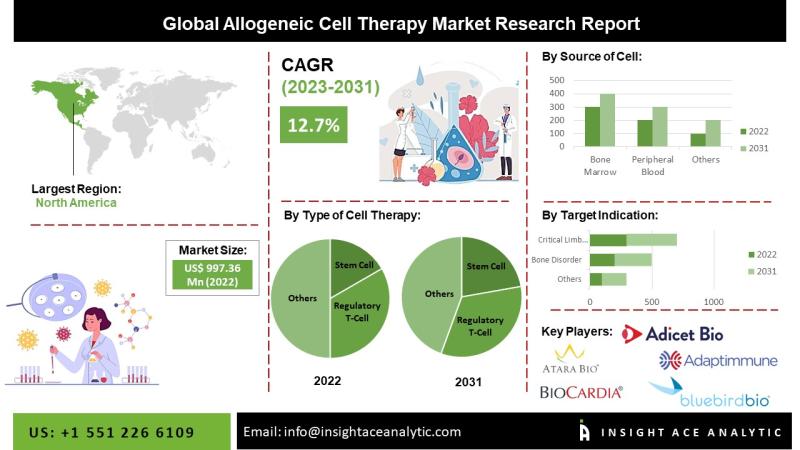

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…