Press release

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debts for Tax Payers

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax debt doesn't have to be a daunting process," said Jason Delatorre, CFO of Legal Tax Defense. "Our goal is to arm our clients with the knowledge and resources they need to successfully navigate these obstacles."

The company offers a multitude of strategies for settling tax debts, including Installment Agreements, which facilitate payments in manageable monthly installments; Offers in Compromise (OIC), allowing debts to be settled for less than the total amount owed under financial hardship; and Currently Not Collectible Status, which halts collection efforts temporarily if paying the debt impedes basic living expenses.

Legal Tax Defense also aids clients in fully understanding their financial situations, crucial for negotiating effectively with the IRS. This includes preparing detailed financial analyses that are essential for proposing viable payment plans or settlements. "We guide our clients in selecting the appropriate IRS forms and making realistic offers that reflect their financial capabilities," added Robert Cohen, an experienced tax debt attorney [https://www.legaltaxdefense.com/].

The process of settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] involves proactive communication and skilled negotiation. Legal Tax Defense ensures clients are prepared for these discussions, emphasizing the importance of compliance with agreement terms and continuous monitoring of financial status to adapt to any changes affecting the ability to meet these terms.

For those seeking help, Legal Tax Defense offers a beacon of hope for taxpayers facing IRS tax debt, providing expert guidance and support throughout the debt settlement process. With their assistance, individuals can achieve financial freedom and regain control of their financial futures. "Navigating the process of how to settle your tax debt with the IRS [https://www.legaltaxdefense.com/how-to-settle-your-tax-debt-with-the-irs/] can be straightforward with proper guidance and a strategic approach," concluded Delatorre.

For more information on resolving IRS tax debts, visit Legal Tax Defense [https://www.legaltaxdefense.com/].

Media Contact

Company Name: Legal Tax Defense, Inc

Contact Person: Jason Delatorre, CFO

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=legal-tax-defense-offers-tax-relief-services-to-successfully-settle-irs-tax-debts-for-tax-payers]

Address:2677 N Main St

City: Santa Ana

State: Ca 92705

Country: United States

Website: http://www.legaltaxdefense.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debts for Tax Payers here

News-ID: 3486072 • Views: …

More Releases from ABNewswire

SEO Agency Dubai: How Data-Driven Search Strategies Are Shaping Digital Growth

Explore how a data-driven SEO agency in Dubai helps businesses grow online through advanced search strategies, analytics, and performance-based SEO. Visit us today!

Dubai's digital economy is moving fast, and visibility has become a decisive factor in growth. Businesses competing in saturated markets can no longer rely solely on paid ads. They need organic authority, credibility, and long-term discoverability. This is where an SEO agency Dubai [https://www.google.com/search?SEO+agency+Dubai&kgmid=/g/11v3f6wqbl] businesses trust becomes essential,…

The Life and Loves of an Artist Illuminates the Remarkable Journey Behind a Life …

Authors Paul and Gail King present The Life and Loves of an Artist. This sweeping biographical narrative traces the extraordinary story of a family whose lives were intertwined with art, resilience, and history.

Rooted in meticulous research and personal reflection, the book offers a moving portrait of two generations shaped by both hardship and inspiration.

Purpose of the Book

What started as an attempt to remember family memories became a vivid journey of…

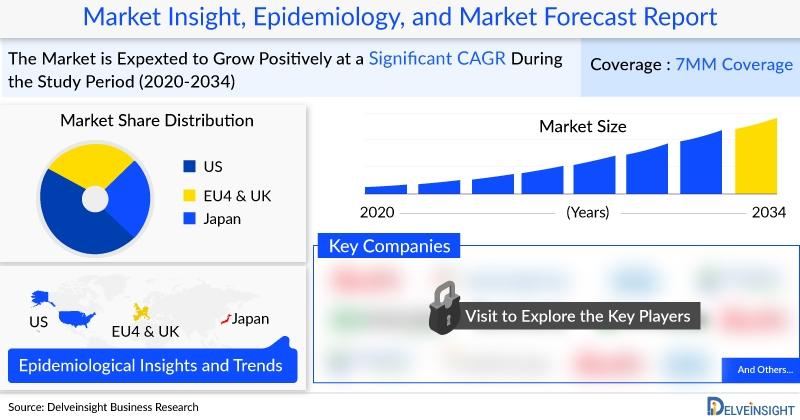

Alzheimer's Disease Market in the 7MM is projected to reach USD 34 Billion by 20 …

Key players operating in the Alzheimer's disease market include Eisai, Biogen, Changchun Huayang High-tech Co. Ltd., Hoffmann-La Roche, vTv Therapeutics, AZTherapies, Cerecin, Neurotrope, Lyndra, AC Immune, INmune Bio, Cassava Sciences, EIP Pharma, Neuraly, AB Science, Cortexyme, Anavex Life Sciences, Athira Pharma, Time Therapeutics, Prilenia Therapeutics, Denali Therapeutics Inc., Stemedica Cell Technologies, Inc., along with several other emerging and established companies.

The Alzheimer's disease market was valued at approximately USD 3,610 million…

Glaucoma Market Forecast 2034: USD 4,073 Million Market Size, 30+ Companies, and …

Major Glaucoma players include Allergan (AbbVie), Sun Pharma Advanced Research Company Limited, Santen Pharmaceutical Co., Ltd., Alcon, D. Western Therapeutics Institute (DWTI), Kowa Ltd., Senju Pharmaceuticals, Otsuka Pharmaceuticals, Bausch and Lomb, Novartis, Merck & Co., Aerie Pharmaceuticals, Nicox Ophthalmics, Sylentis, Envisia Therapeutics, Ocuphire Pharma, TearClear, Peregrine Ophthalmic, and others.

The Glaucoma Market across the seven major markets (7MM) - the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom,…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

United Tax Group Announces Effective Tax Negotiators

United States (June 2011) – United Tax Group announces effective tax negotiators for clients. Tax negotiators work directly with the IRS so tax payers do not. The expertise of tax negotiators helps save clients thousands.

Tax negotiators from United Tax Group are assigned individual clients. This means tax negotiators are working on particular cases assigned. Therefore, clients receive individualized attention for their case.

This individualized attention by United Tax Group gets results.…