Press release

Jet Fuel Market to Reach USD 320.16 Billion by 2030, Growing at a CAGR of 10.40%

Mordor Intelligence has published a new report on the "Jet Fuel Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

According to Mordor Intelligence's latest research, the global jet fuel market is estimated to be valued at USD 195.21 billion in 2025 and is expected to reach USD 320.16 billion by 2030, growing at a compound annual growth rate (CAGR) of 10.40% during the forecast period. The growth of the market is primarily attributed to the increasing demand for air travel, technological advancements in aircraft, rising defense fuel consumption, and the growing adoption of sustainable aviation fuel (SAF).

Jet fuel, which primarily consists of kerosene-based compounds, is the lifeblood of the aviation sector, serving as a crucial energy source for commercial, military, and general aviation aircraft. With global air traffic on the rise and a transition toward cleaner fuels, the jet fuel market is poised for significant expansion in the coming years.

Report Overview: https://www.mordorintelligence.com/industry-reports/jet-fuel-market?utm_source=openpr

Key Trends in the Jet Fuel Market

1. Growth in Global Air Traffic and Passenger Demand

The jet fuel market is witnessing strong growth due to the expansion of global air traffic. According to the International Air Transport Association (IATA), global passenger numbers are expected to double by 2040. Asia-Pacific, driven by rising middle-class income and increasing flight connectivity, is a key region fueling this expansion. With air travel demand continuing to recover from the pandemic, airlines are increasing their fleets, resulting in higher fuel consumption.

2. Shift Towards Sustainable Aviation Fuels (SAF)

The growing focus on sustainability is a key trend in the aviation sector. Sustainable Aviation Fuel (SAF), which reduces greenhouse gas emissions compared to traditional jet fuel, is receiving increasing attention. SAF production is supported by several government mandates and airline sustainability targets. Europe, through its ReFuelEU Aviation policy, and the United States, with tax incentives under the Inflation Reduction Act, are leading the way in SAF integration. Companies like ExxonMobil, Shell, and BP are investing in SAF technology, promising a cleaner future for the aviation industry.

3. Fluctuating Crude Oil Prices and Supply Chain Challenges

Jet fuel prices are directly influenced by fluctuations in crude oil prices, which can lead to volatility in fuel costs. Geopolitical events, such as conflicts in major oil-producing regions, have the potential to drive up crude oil prices, affecting the cost of jet fuel. Airlines often adopt fuel hedging strategies to mitigate price fluctuations. Supply chain disruptions, particularly in the aftermath of the pandemic, further exacerbate market volatility, making it critical for airlines and fuel suppliers to adapt their procurement strategies.

4. Technological Innovations in Aircraft Efficiency

As airlines continue to modernize their fleets, fuel-efficient aircraft models, such as the Boeing 737 MAX and Airbus A320neo, are reducing fuel consumption per seat. These technological advancements are contributing to a slight reduction in the overall jet fuel demand per aircraft, although the total demand for jet fuel remains robust due to the rising number of flights. Airlines are focused on reducing operating costs, and fuel-efficient aircraft are a key part of their strategy.

5. Military and Defense Aviation Fuel Consumption

Defense aviation is a significant driver of jet fuel demand. Military fleets require substantial amounts of jet fuel for training, operations, and strategic missions. Geopolitical tensions and ongoing military engagements in regions like the Middle East contribute to the steady demand for aviation fuel in the defense sector. As countries continue to invest in their defense infrastructure, military aviation fuel consumption is expected to grow steadily.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/jet-fuel-market?utm_source=openpr

Market Segmentation

The jet fuel market is segmented by fuel type, application, distribution channel, and geography:

By Fuel Type:

Jet A: The most common type of jet fuel used for commercial aviation.

Jet A-1: Primarily used for international flights due to its lower freezing point.

Jet B: A lighter, more volatile fuel used in colder climates and specific regions.

Others: Includes specialized aviation fuels used for certain aircraft types.

By Application:

Commercial Aviation: The largest segment, driven by passenger airlines and cargo flights.

Defense Aviation: Used by military aircraft for defense operations and training.

General Aviation: Includes private jets and chartered flights.

By Distribution Channel:

Into-Plane Supply: Jet fuel delivered directly to aircraft at the airport.

Bulk Supply to Fixed-Base Operators (FBOs): Fuel provided to smaller airports for general and private aviation use.

By Geography:

North America: The largest market, driven by high fuel demand from airlines and military fleets.

Asia-Pacific: The fastest-growing market, with rising air travel and expanding aviation infrastructure.

Europe: A significant market, especially with the EU's SAF mandates.

South America: Steady growth as air travel recovers in the region.

Middle East and Africa: A key hub for global air traffic and defense fuel consumption.

Explore Our Full Library of Oil and Gas Research Industry Reports: https://www.mordorintelligence.com/market-analysis/oil-and-gas?utm_source=openpr

Key Players

The jet fuel market features several prominent players in the oil and gas industry, providing fuel to both commercial and military aviation sectors. Leading companies include:

Shell PLC: Supplies both conventional jet fuel and sustainable aviation fuels, with strong distribution networks across key regions.

Exxon Mobil Corporation: A major player in global jet fuel supply, actively expanding its SAF production capabilities.

BP PLC: Invests heavily in sustainable fuel initiatives and partners with airlines to supply jet fuel.

Chevron Corporation: Provides jet fuel for commercial and military aviation and is investing in SAF technology.

TotalEnergies SE: A key supplier of aviation fuels, focusing on expanding SAF production and distribution.

These companies are at the forefront of addressing the growing demand for both traditional jet fuel and alternative fuels, ensuring they meet regulatory requirements and sustainability goals.

Explore more insight on Jet Fuel Market competitive landscape: https://www.mordorintelligence.com/industry-reports/jet-fuel-market/companies?utm_source=openpr

Conclusion

The jet fuel market is poised for significant growth over the next decade, driven by a recovery in air travel, rising demand for military aviation fuel, and the growing push toward sustainable aviation fuels. While the traditional jet fuel market remains strong, the shift toward SAF is expected to be one of the defining trends in the industry. The demand for jet fuel will continue to be influenced by geopolitical events, technological advancements, and regional expansions. As global air traffic increases and the industry adapts to new sustainability goals, the market is on track to reach USD 320.16 billion by 2030.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/jet-fuel-market?utm_source=openpr

Industry Related Reports

Oil And Gas CAPEX Market: The Oil and Gas CAPEX Market Report is Segmented by Sector (Upstream, Midstream, and Downstream), Location (Onshore and Offshore), Asset Type (Exploration, Development and Production, Maintenance and Turn-Around, and Decommissioning), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-oil-and-gas-capex-industry?utm_source=openpr

Oil Refining Market: The Oil Refining Market is Segmented by Product Slate (Light Distillates, Middle Distillates, Fuel Oil and Residuals, and Petro-Chemical Feed-Stocks), Ownership (National Oil Companies, Integrated Oil Companies, and Independent/Merchant Refiners), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/oil-refining-market?utm_source=openpr

India Natural Gas Market: The India Natural Gas Market Report is Segment by Type (Compressed Natural Gas, Piped Natural Gas, and Liquefied Natural Gas ), Source (Domestic Production - Onshore, Domestic Production - Offshore, and LNG Imports), and End-Use Sector (Fertilizer Production, City Gas Distribution, Transportation, Petrochemical Feedstock, and Others).

Get more insights: https://www.mordorintelligence.com/industry-reports/india-natural-gas-market?utm_source=openpr

Gas Turbine Market: The Gas Turbine Market Report is Segmented by Capacity (Below 30 MW, 31 To 120 MW, Above 120 MW), Operating Cycle (Combined Cycle, Simple/Open Cycle, and Cogeneration/CHP), Fuel Type (Natural Gas, Liquid Fuels, and Other Fuel Types), Service (OEM and MRO), End-User Industry (Power, Oil and Gas, and Other End-User Industries), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-gas-turbine-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Jet Fuel Market to Reach USD 320.16 Billion by 2030, Growing at a CAGR of 10.40% here

News-ID: 4101436 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

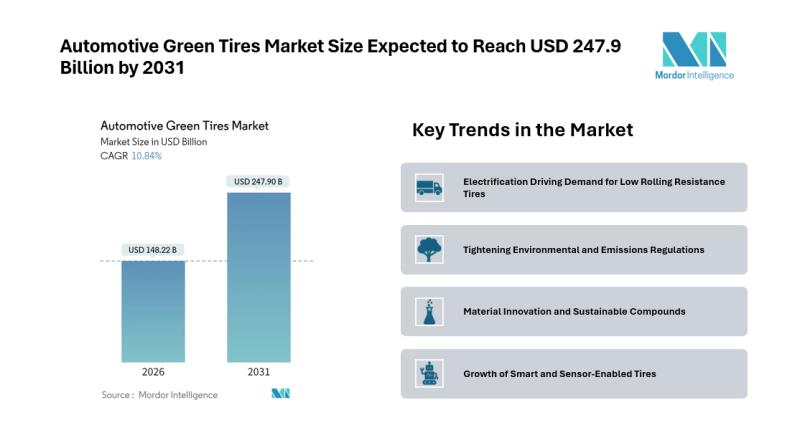

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Fuel

Fuel Cell Market to Expand Significantly by 2024 | Horizon Fuel Cell Technologie …

The "Fuel Cell Market" intelligence report, just published by USD Analytics, covers insurers' micro-level study of important market niches, product offers, and sales channels. In order to determine market size, potential, growth trends, and competitive environment, the Fuel Cell Market provides dynamic views. Both primary and secondary sources of data were used to generate the research, which has both qualitative and quantitative depth. Several of the major figures the study…

Electronic Fuel Management System Market Share and Future Forecast 2022 to 2028 …

The global Electronic Fuel Management System market revenue is expected to register a CAGR of 8.8% during the forecast period.

Latest Study on Industrial Growth of Electronic Fuel Management System Market 2022-2028. A detailed study accumulated to offer current insights about important features of the Electronic Fuel Management System market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, value chain optimization, price, and other substantial factors. While emphasizing…

Marine Gensets Market: Information by Vessel Type (Commercial Vessel, Defense Ve …

A marine genset is a power unit generator that supplies electricity to ships. It offers reliable and fuel-efficient electric power generation for onboard power, emergency gensets, and diesel-electric propulsion. It can be fueled by gas, diesel, hybrid fuel, and others. It has application in offshore commercial vessels, defense vessels, and offshore vessels, among others. Nowadays, most of the marine gensets are fueled by diesel. However, the introduction of alternative fuels…

Fuel Card Market to 2027 - Global Analysis and Forecasts By Type (Branded Fuel C …

The global fuel card market is estimated to account US$ 6.29 Bn in 2018 and is expected to grow at a CAGR of 5.8% during the forecast period 2019 – 2027, to account to US$ 10.39 Bn by 2027.

Request Sample Pages of “Fuel Card Market” Research Report @ www.theinsightpartners.com/sample/TIPRE00003099/?utm_source=openpr&utm_medium=10387

Fuel Card Market: Key Insights

Fuel Card Market Size 2021, by manufacturer, region, types, and application, forecast till 2028 is analyzed and researched on…

Clean Fuel Technology Market – Development Assessment 2025 | Clean Fuel Develo …

Global Clean Fuel Technology Market: Overview

Clean technology in general implies the use of any service, product, or system that has as little of a negative impact on the environment as possible. Aspects of clean technology include the conservation of energy, sustainable resources, and clean sources of fuels. Clean fuels can refer to the use of renewable fuels such as biogas, or also blended fuels such as fossil fuels with renewable…

Fuel Cell Interconnectors Market By Product Type Ceramic based, Metal based; By …

Global Fuel Cell Interconnectors Market Introduction

A fuel cell is a battery that generates electricity through an electrochemical reaction where the fuel cell interconnector is a layer made up of either ceramic or metallic material, which combines the electricity generated by each individual cell. Fuel cell interconnectors are placed between each individual cell to connect the cells in the series. Ceramic fuel cell interconnectors are more suitable for high-temperature working conditions…