Press release

Saudi Arabia Private Equity Market Set to Surge to USD 13,546.2 Million by 2033 at a 7.10% CAGR

Saudi Arabia Private Equity Market OverviewBase Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 7.10% (2025-2033)

The Kingdom is seeing a surge in investments. This growth comes from economic diversification and bold growth plans. Private capital is key to opening new opportunities in important sectors. According to the latest report by IMARC Group, the Saudi Arabia private equity market size reached USD 7,304.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,546.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/saudi-arabia-private-equity-market/requestsample

Saudi Arabia Private Equity Trends and Drivers:

The private equity market in Saudi Arabia is booming. The Kingdom economic diversification plans fuel this growth. Investors are keen on sectors like technology, healthcare, and renewable energy. Government initiatives have created a strong environment for growth in these areas. Tech startups, especially in fintech and e-commerce, have attracted a lot of money. These sectors fit well with the country's digital transformation goals. The government wants to grow non-oil industries. This has sparked interest in infrastructure and real estate. Private equity firms are crucial in funding large projects. Recent regulatory reforms have made the market more appealing. These changes simplify processes for foreign investors and promote transparency. Sovereign wealth funds play an active role. Their strategic partnerships have increased deal flow. This allows private equity firms to co-invest in promising ventures. Saudi Arabia has a young, tech-savvy crowd. Plus, consumer demand is rising. So, it's turning into a hotspot for new investment opportunities.

The market is also shifting towards sustainable and impact-driven investments. This trend reflects global demands and local priorities. Environmental, social, and governance (ESG) factors are now key in deal evaluations. Companies are targeting businesses that promote sustainability. This includes areas like renewable energy and green technology. The healthcare sector is also a main focus. There is a growing demand for quality medical services and telemedicine innovations. Private equity firms are taking a hands-on approach. They provide capital and operational expertise to help portfolio companies grow. The market gains from family-owned businesses seeking succession plans or funds for growth. This creates valuable opportunities for private equity to enhance value. Saudi Arabia stable economy and key location draw global investors. The private equity world is changing. Local and international firms are working together. This teamwork helps share knowledge and sparks innovation. This confirms Saudi Arabia's position as a key player in regional investments.

Buy Full Report: https://www.imarcgroup.com/checkout?id=20878&method=1315

Saudi Arabia Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Fund Type:

● Buyout

● Venture Capital (VCs)

● Real Estate

● Infrastructure

● Others

Regional Insights:

● Northeast

● Midwest

● South

● West

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=20878&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

● Market Performance (2019-2024)

● Market Outlook (2025-2033)

● COVID-19 Impact on the Market

● Porter's Five Forces Analysis

● Strategic Recommendations

● Historical, Current, and Future Market Trends

● Market Drivers and Success Factors

● SWOT Analysis

● Structure of the Market

● Value Chain Analysis

● Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

Street: Morgan Park QLD 4370

City/Town: Warwick

State/Province/Region: Queensland

Country: Australia

Zip/Postal Code: 4370

Email: sales@imarcgroup.com

Phone Number: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Private Equity Market Set to Surge to USD 13,546.2 Million by 2033 at a 7.10% CAGR here

News-ID: 4041666 • Views: …

More Releases from IMARC Group

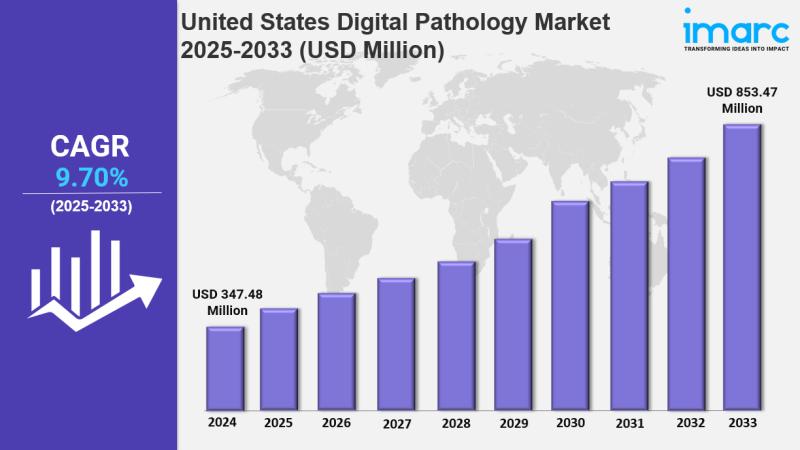

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

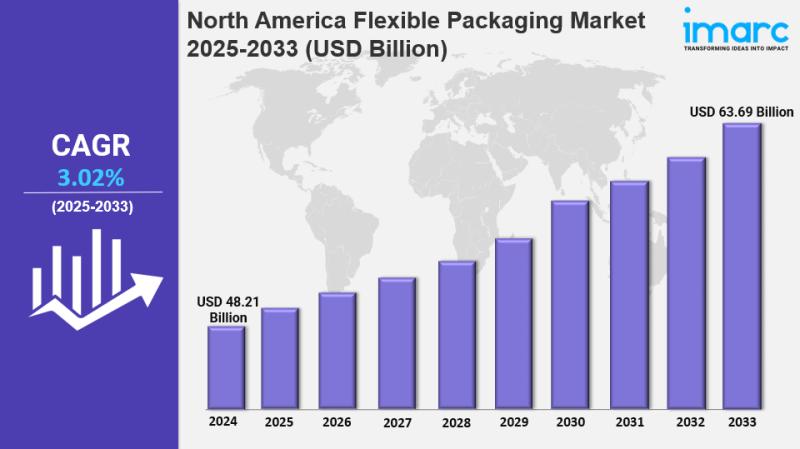

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

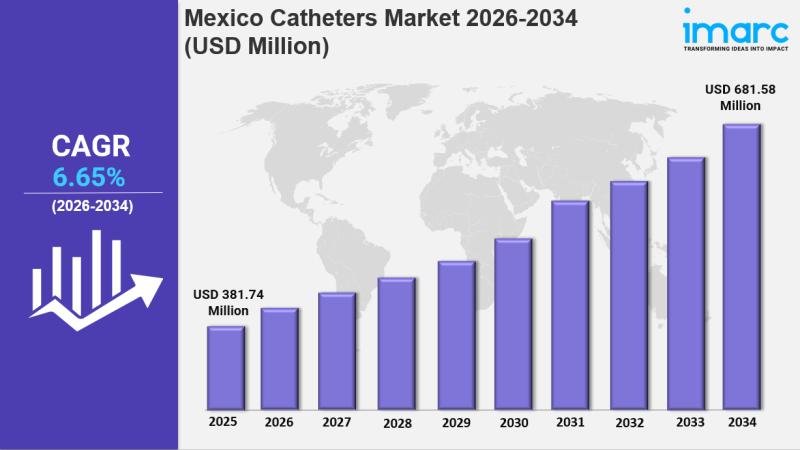

Mexico Catheters Market Size, Growth, Latest Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled "Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58…

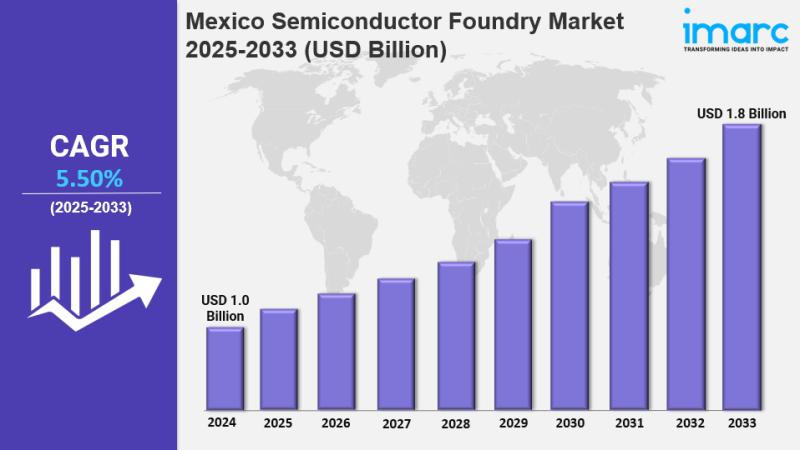

Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 20 …

IMARC Group has recently released a new research study titled "Mexico Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico semiconductor foundry market size reached USD 1.0 Billion in 2024. It is projected to grow to USD…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…