Press release

Brazil Neobanking Market 2025 Edition : Industry Size to Reach USD 118.05 Billion by 2033, At a CAGR of 44.80%

Attributes and Key Statistics of the Brazil Neobanking Market Report by IMARC Group:Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Units: USD Billion

Market Size in 2024: USD 4.20 Billion

Market Forecast in 2033: USD 118.05 Billion

Market Compound Annual Growth Rate 2025-2033: 44.80%

As indicated in the latest market research report published by IMARC Group, titled "Brazil Neobanking Market Size, Share, Trends, and Forecast by Account Type, Application, and Region, 2025-2033," this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

Brazil Neobanking Market Size & Future Growth Potential:

The Brazil neobanking market size was valued USD 4.20 Billion in 2024. By 2033, this figure is projected to reach around USD 118.05 Billion, with a compound annual growth rate (CAGR) of 44.80% over the forecast period (2025-2033).

Core Factors Driving Market Trends:

The Brazil Neobanking market is observing rapid change, inspired by the increasing demand for digital adoption and spontaneous financial solutions. One of the major trends is the rise of mobile-first banking platforms, which is food for technology-loving consumers who prefer convenience on traditional banking. Neobanks are taking advantage of individual financial services, such as automatic savings, real -time spending analysis and artificial intelligence and machine learning to offer customized debt offerings. Additionally, the integration of blockchain technology is increasing safety and transparency, giving more boost to the consumer trust. Another remarkable trend is the expansion of neobank in the undertrial segment, including freelancers, gig workers and small businesses, which provides them financial equipment.

In addition, the partnership between neobanks and fintech firms is intensifying innovation, which enables immediate payment and multi-currency accounts. Changes towards cashless transactions supported by government initiatives like Pix, are also fueling the adoption of Neobank. In addition, environment, social, and governance (ESG) principles are receiving tractions, sustainable banking options with many neobanks, such as carbon footprint tracking and green investment portfolio. These trends collectively highlight the dynamic growth of the Brazilian neobanking region, keeping it in the Latin America's Digital Finance scenario as a leader.

Request Free Sample Report: https://www.imarcgroup.com/brazil-neobanking-market/requestsample

Brazil Neobanking Market Scope and Growth Analysis:

The Brazil Neobanking market offers a large unbank population and the huge growth capability supported by the growing smartphone penetration. Neobanks are gaining rapid market share by providing low cost, user friendly options for traditional banks, especially between young demographics. The scope of services is expanding beyond basic banking, with Neobanks now providing investment platforms, insurance products and credit facilities. Additionally, regulatory support from the Central Bank of Brazil, including the open banking framework, is promoting a competitive environment that encourages innovation.

In addition, the increasing acceptance of digital wallets and contactless payments is acquiring customer for neobanks. Another significant development driver has the ability to reduce operational costs through automation, allowing them to offer higher interest rates and low fees than traditional banks. In addition, strategic cooperation with e-commerce platforms and Gig Economy App is increasing customer engagement and retention. The increase in the market is also looking at the increased enterprise capital investment, indicating strong belief in its long -term capacity. In addition, focus on financial inclusion is opening new opportunities in rural and semi-urban areas, where traditional banking infrastructure is limited. With continuous technological progress and transfer of consumer preferences, the Brazil Neobanking market is ready for continuous expansion in the coming years.

Comprehensive Market Report Highlights & Segmentation Analysis:

Account Type Insights:

• Business Account

• Savings Account

Application Insights:

• Enterprises

• Personal

• Others

Country Insights:

• Southeast

• South

• Northeast

• North

• Central-West

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

• Historical Market Performance

• Future Market Projections

• Impact of COVID-19 on Market Dynamics

• Industry Competitive Analysis (Porter's Five Forces)

• Market Dynamics and Growth Drivers

• SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

• Market Ecosystem and Value Creation Framework

• Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

• This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

• Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

• The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

• Extensive Industry Expertise

• Robust Research Methodology

• Insightful Data-Driven Analysis

• Precise Forecasting Capabilities

• Established Track Record of Success

• Reach with an Extensive Network

• Tailored Solutions to Meet Client Needs

• Commitment to Strong Client Relationships and Focus

• Timely Project Delivery

• Cost-Effective Service Options

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=30082&flag=C

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1 631 791 1145 | Africa and Europe: +44-702-409-7331 | Asia: +91-120-433-0800

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Neobanking Market 2025 Edition : Industry Size to Reach USD 118.05 Billion by 2033, At a CAGR of 44.80% here

News-ID: 4022424 • Views: …

More Releases from IMARC Group

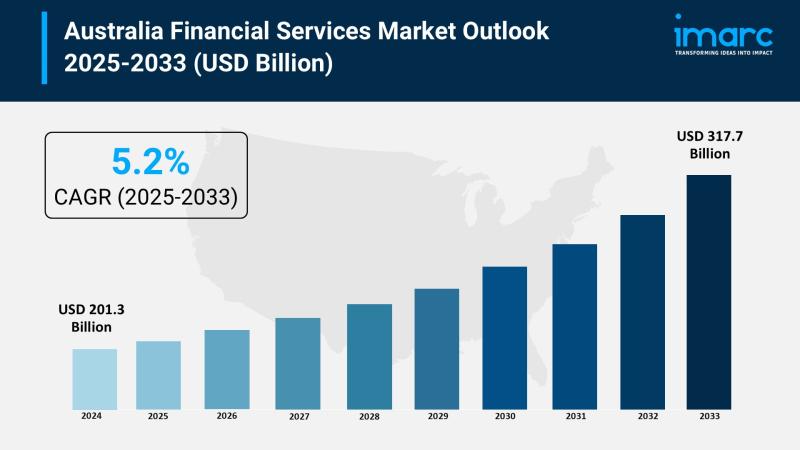

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

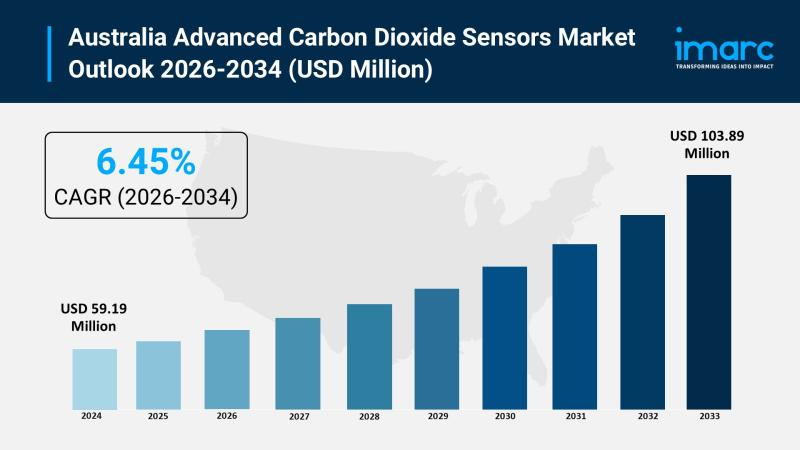

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

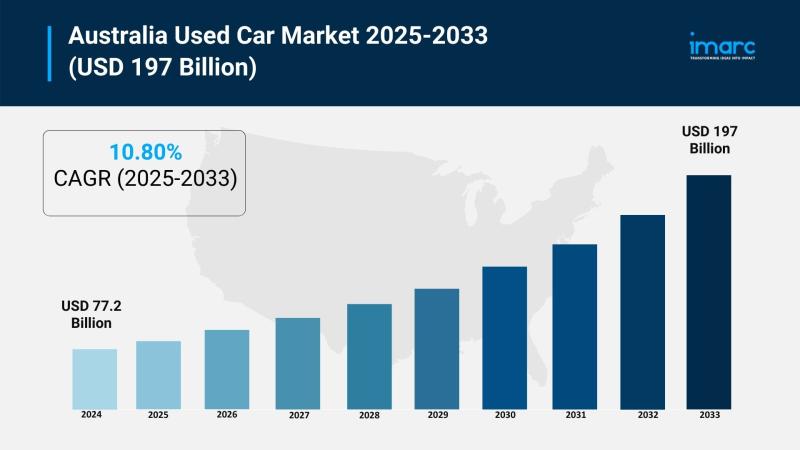

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

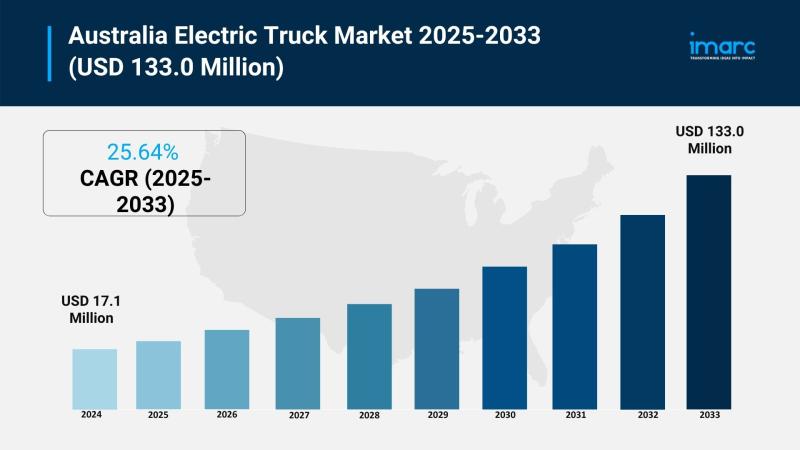

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Neobank

AI-Native Neobank Software Poised to Transform Africa's Digital Banking Landscap …

As Africa's digital economy continues to grow, AI-native neobank software represents a future-ready foundation for inclusive and sustainable banking. By combining artificial intelligence, cloud-native architecture, and mobile-centric design, this technology empowers financial institutions to meet the continent's unique challenges while unlocking new opportunities for growth.

Africa's financial ecosystem is entering a pivotal phase as artificial intelligence reshapes how banking services are built, delivered, and scaled. AI-native neobank software is emerging as…

From Monzo to Revolut, Neobanks Lag on Stablecoin Rails as Digitap ($TAP) Emerge …

Neobanks have reshaped retail banking in the last decade. Apps like Monzo and Revolut have proved that a slick mobile UX beats high-street branches, and now consumers are happy to hold salaries and savings with digital-only institutions. And this will only accelerate as Gen Z and Millennials become the more dominant demographics.

But while neobanks have improved the UX, they still run almost entirely on legacy rails. Stablecoins are shaking up…

Neobanking Services Market Revenue, Insights, Overview, Outlook, Analysis | Valu …

Neobanking Services Market

The global market for Neobanking Services was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Download Free Sample Data: https://reports.valuates.com/request/sample/QYRE-Auto-37V15417/Global_Neobanking_Services_Market?utm_source=Openpr&utm_medium=Referral

North American market for Neobanking Services is estimated to increase from $ million in 2024 to reach $ million by 2031, at a CAGR of % during the…

Fintech Market Growth Accelerates, Fueled by Digital Payments, Blockchain & Neob …

Global Fintech Market reached USD 140.1 billion in 2022 and is expected to reach USD 610.0 billion by 2031 and is expected to grow with a CAGR of 20.3% during the forecast period 2024-2031. The demand for fintech solutions is increasing due to the growth of digital transformation and the need for innovative financial services.

The new report on the Fintech Market, published by DataM Intelligence provides a detailed analysis…

Digital Neobank Market 2024 and Industry Segments Exploration and By Key Players …

"The Global Digital Neobank Market Size is projected to reach at a CAGR of 52.5% during 2024-2032."

Global Digital Neobank market Size, Status, and Forecast for the 2024-2032. In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Digital Neobank Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides…

PayRate42´s Customer Satisfaction Index (CSI) Report: Neobank Branch

Neobanks, also known as digital banks or challenger banks, are fintechs that operate entirely online without physical branches. They offer lower fees, innovative services, and a user-friendly experience. This report evaluates how satisfied customers are with neobanks, using customer feedback from surveys and Trustpilot reviews. It also highlights the top five and bottom five rated neobanks on Trustpilot, noting that some reviews may be manipulated. Pros, cons, and the number…