Press release

Indonesia Coal Market Size, Share, Growth Insights, Trends Analysis & Report 2025-2033

As indicated in the latest market research report published by IMARC Group, titled "Indonesia Coal Market Report by Application (Electricity, Iron and Steel Industry, Others), Region (Java, Sumatra, Kalimantan, Sulawesi, Others) 2025-2033," this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.Market Size & Future Growth Potential:

The Indonesia coal market size reached a volume of 122.7 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach a volume of 192.6 Million Tons by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033.

Latest Market Trends:

The Indonesia coal market continues to demonstrate resilience despite evolving global energy dynamics. The country produced 357.6 million metric tons of coal during the first half of the year, representing roughly 48% of the government's annual production target of 739.7 million tons. As the world's fourth-largest coal producer, Indonesia maintains its strategic position in the global energy landscape, particularly in serving the Asian market where demand remains robust.

The market is experiencing significant transformation driven by infrastructure modernization and logistical improvements. Enhanced port facilities and transportation networks are streamlining coal supply chains, enabling more efficient distribution both domestically and for export purposes. These infrastructure advancements are critical in maintaining Indonesia's competitive edge in the international coal trade, where the country alongside Australia accounts for nearly 60% of seaborne thermal coal trade.

Government policy initiatives are reshaping market dynamics through regulatory frameworks aimed at balancing economic objectives with environmental considerations. The introduction of the Harga Batubara Acuan (HBA) pricing mechanism represents a strategic move to provide greater control over coal pricing and revenue optimization. In February, high-quality Indonesian coal was benchmarked at $124.24 per ton under the HBA system, demonstrating the government's commitment to establishing transparent pricing standards.

The domestic power generation sector remains the primary driver of coal consumption, fueled by Indonesia's population of over 270 million people and ongoing urbanization. The cement, steel, and manufacturing industries continue to rely heavily on coal as an affordable and accessible energy source, supporting the country's industrialization agenda. Electricity demand growth, coupled with infrastructure development projects across the archipelago, sustains strong domestic coal consumption.

Investment in downstream coal industries is gaining momentum as the government encourages value-addition initiatives beyond raw coal exports. Projects focused on coal gasification, liquefaction, and coal-to-chemicals are attracting both domestic and foreign investment. These downstream ventures aim to produce alternative fuels such as dimethyl ether (DME) as a substitute for imported liquefied petroleum gas, thereby strengthening energy security while creating higher-value products from coal resources.

Export markets remain crucial to Indonesia's coal industry, with major Asian economies continuing to import substantial volumes. However, export volumes declined by 6.33% year-on-year to 184.19 million tons in the first half of the year, with revenues falling 21.09% to $11.97 billion. The average export price dropped to $64.99 per ton, reflecting global market conditions characterized by oversupply and moderate demand growth. Despite these challenges, Indonesia's cost-competitive coal production and strategic location continue to support export activities.

Request Free Sample Report: https://www.imarcgroup.com/indonesia-coal-market/requestsample

Market Scope and Growth Factors:

The scope of the Indonesia coal market is expanding as the country leverages its vast coal reserves to support both domestic energy needs and international trade obligations. With coal production consistently reaching record levels in recent years, Indonesia has established itself as a reliable supplier capable of meeting diverse market requirements across thermal and metallurgical coal segments.

Domestic demand fundamentals remain robust, driven by the country's sustained economic growth trajectory and ambitious infrastructure development programs. The power generation sector, which accounts for the largest share of coal consumption, continues to expand capacity to meet rising electricity needs across urban and rural areas. The government's focus on improving electricity access and reliability necessitates continued investment in coal-fired power plants, particularly in regions where alternative energy sources are not yet economically viable or adequately developed.

The industrial sector's coal consumption is supported by the growth of energy-intensive industries including cement manufacturing, iron and steel production, paper mills, and chemical processing facilities. As Indonesia pursues its industrialization agenda, these sectors are expected to maintain strong coal demand to fuel production activities and support economic expansion. The availability of competitively priced domestic coal provides Indonesian manufacturers with a cost advantage, enhancing the country's attractiveness for industrial investment.

Regional development patterns significantly influence coal market dynamics. Kalimantan, as Indonesia's largest coal-producing region, plays a pivotal role in both domestic supply and export activities. Java, as the most populous island, represents the largest consumption center with substantial electricity generation requirements. Sumatra and Sulawesi contribute to both production and consumption, with their coal industries closely integrated with local economic development initiatives. This regional diversity in coal production and consumption creates a complex yet resilient market structure.

Government policies supporting responsible mining practices, environmental management, and community development are shaping the long-term sustainability of the coal sector. Regulatory frameworks that balance economic benefits with environmental protection and social considerations are essential for maintaining the industry's social license to operate. The government's energy policies recognize coal's continued importance during the transition period while encouraging development of renewable energy capacity and cleaner coal technologies.

Infrastructure development initiatives are critical enablers of market growth, enhancing the efficiency of coal transportation from mines to consumption centers and export terminals. Investments in railways, roads, ports, and shipping facilities reduce logistics costs and improve supply chain reliability. These infrastructure improvements support Indonesia's ability to serve both domestic markets and international customers with consistent coal deliveries at competitive prices.

The integration of technology and innovation in coal mining and utilization is enhancing operational efficiency and environmental performance. Modern mining techniques, beneficiation processes, and quality control systems enable Indonesian coal producers to meet increasingly stringent specifications demanded by power plants and industrial consumers. Exploration of clean coal technologies and carbon capture initiatives represents forward-looking efforts to align coal use with sustainability objectives.

Comprehensive Market Report Highlights & Segmentation Analysis:

Segmentation by Application:

• Electricity

• Iron and Steel Industry

• Others

Segmentation by Region:

• Java

• Sumatra

• Kalimantan

• Sulawesi

• Others

Recent News and Developments:

• The Indonesian government set an annual coal production target of 739.7 million tons, with production reaching 357.6 million metric tons in the first half of the year, demonstrating steady progress toward meeting national energy supply objectives.

• The Energy and Mineral Resources Ministry continues to monitor production quotas and export allocations to ensure domestic market stability while maintaining Indonesia's position as a major coal exporter to Asian markets.

• The introduction of the Harga Batubara Acuan (HBA) pricing mechanism in March represents a significant policy shift, providing the government with greater control over coal pricing and potentially generating additional revenue, though market acceptance in some importing countries remains under evaluation.

• Regulation 10/2025 was introduced in April, outlining the government's commitment to reducing coal dependence and achieving net-zero emissions by 2060, including provisions for the early retirement of certain coal-fired power plants such as the 660-MW Cirebon-1 facility.

• Major coal mining companies including PT Adaro Energy Tbk, PT Bumi Resources Tbk, PT Bayan Resources Tbk, PT Indo Tambangraya Megah Tbk, and PT Bukit Asam Tbk continue to optimize production operations and explore downstream value-addition opportunities.

• Infrastructure development projects focused on port expansion and transportation network improvements are enhancing coal logistics efficiency, particularly in key producing regions like Kalimantan and Sumatra.

• Investment initiatives in coal gasification and coal-to-chemicals projects are advancing, aimed at diversifying coal utilization beyond traditional power generation and creating higher-value products for domestic and export markets.

• The government implemented new foreign exchange regulations in February requiring commodity exporters to deposit US dollar-denominated export earnings in the domestic financial system, impacting cash flow management for coal exporters.

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=41561&flag=E

Key Highlights of the Report:

• Historical Market Performance

• Future Market Projections

• Impact of COVID-19 on Market Dynamics

• Industry Competitive Analysis (Porter's Five Forces)

• Market Dynamics and Growth Drivers

• SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

• Market Ecosystem and Value Creation Framework

• Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

• This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

• Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

• The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

• Extensive Industry Expertise

• Robust Research Methodology

• Insightful Data-Driven Analysis

• Precise Forecasting Capabilities

• Established Track Record of Success

• Reach with an Extensive Network

• Tailored Solutions to Meet Client Needs

• Commitment to Strong Client Relationships and Focus

• Timely Project Delivery

• Cost-Effective Service Options

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Explore More Research Reports & Get Your Free Sample Now:

Indonesia Ict Market Report: https://www.imarcgroup.com/indonesia-ict-market/requestsample

Indonesia Car Rental Market Report: https://www.imarcgroup.com/indonesia-car-rental-market/requestsample

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Coal Market Size, Share, Growth Insights, Trends Analysis & Report 2025-2033 here

News-ID: 4218183 • Views: …

More Releases from IMARC Group

Saudi Arabia Event Management Market Size to Hit USD 19,561.3 Million by 2033 at …

Saudi Arabia Event Management Market Overview

Market Size in 2024: USD 9,450.2 Million

Market Size in 2033: USD 19,561.3 Million

Market Growth Rate 2025-2033: 8.42%

According to IMARC Group's latest research publication, "Saudi Arabia Event Management Market Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the Saudi Arabia event management market was valued at USD 9,450.2 Million in 2024 and is projected to reach USD 19,561.3 Million by 2033, growing at a CAGR…

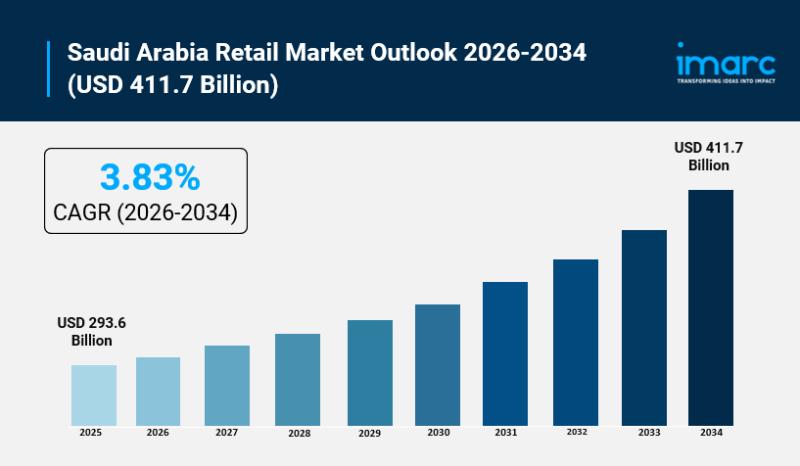

Saudi Arabia Retail Market Size to Surge to USD 411.7 Billion by 2034 | CAGR of …

Saudi Arabia Retail Market Overview

Market Size in 2025: USD 293.6 Billion

Market Size in 2034: USD 411.7 Billion

Market Growth Rate 2026-2034: 3.83%

According to IMARC Group's latest research publication, "Saudi Arabia Retail Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by 2034, exhibiting a…

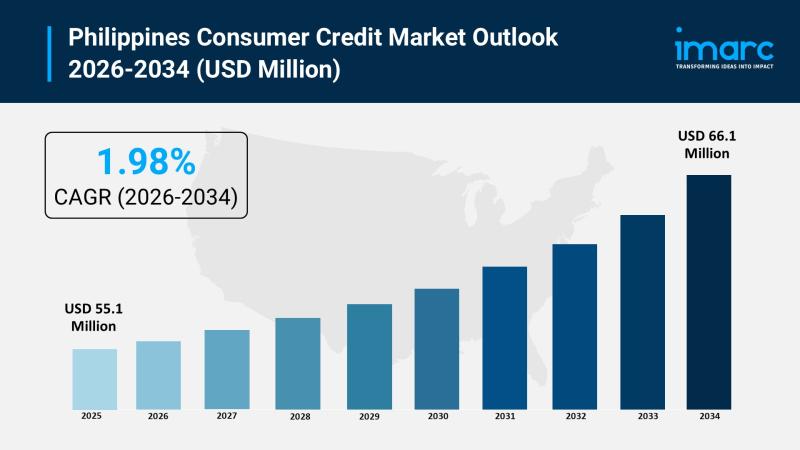

Philippines Consumer Credit Market 2026 | Worth USD 66.1 Million by 2034

Philippines Consumer Credit Market Overview:

The Philippines consumer credit market size reached USD 55.1 Million in 2025. The market is projected to reach USD 66.1 Million by 2034, exhibiting a growth rate (CAGR) of 1.98% during 2026-2034. The market is expanding steadily as rising financial inclusion, mobile-first lending platforms, and Buy Now Pay Later adoption bring formal credit to previously underserved Filipinos. Fintech innovation, neobank growth, and supportive BSP regulatory frameworks…

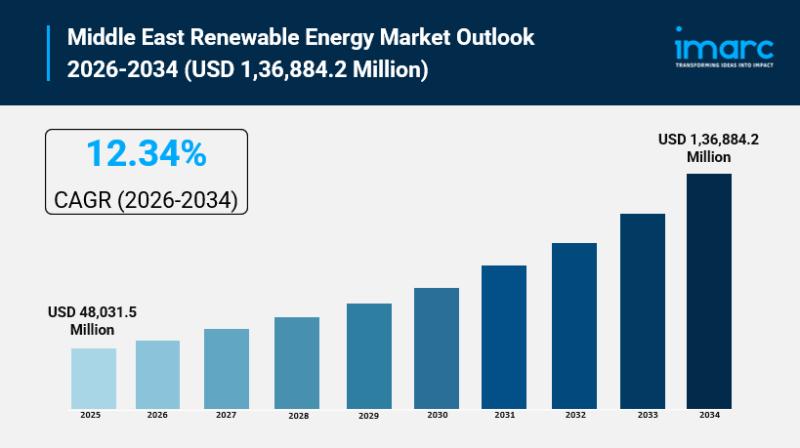

Middle East Renewable Energy Market Size to Hit USD 1,36,884.2 Million by 2034 | …

Middle East Renewable Energy Market Overview

Market Size in 2025: USD 48,031.5 Million

Market Size in 2034: USD 1,36,884.2 Million

Market Growth Rate 2026-2034: 12.34%

According to IMARC Group's latest research publication, "Middle East Renewable Energy Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East renewable energy market size was valued at USD 48,031.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,36,884.2 Million by…

More Releases for Indo

Indocia Unveils $2,000 Monthly Bonus Top 50 $INDO Holders

The new initiative rewards long-term commitment by distributing $2,000 monthly among the top 50 token holders, boosting investor confidence and ecosystem stability.

An exclusive monthly incentive program has been launched by Indocia, a rising star in the decentralized arena, which directly benefits its most devoted and devoted fans. Starting this month, the top 50 INDO token holders will split a $2000 monthly pool of staking prizes, supporting the community's primary goal…

Indocia Officially Launches Presale Website for the INDO Token

Indocia proudly announces the launch of its presale website for the INDO token, a transformative move in the decentralized finance realm. Indocia.org ushers in a new age of crypto investment, characterized by substantial community involvement and the empowerment of its members.

The newly launched website offers detailed insights into the INDO token, emphasizing its role in advancing decentralized finance and promoting a more inclusive financial ecosystem. It simplifies the user journey…

Ashish Jain Announces New Indo-Fusion Restaurant in London

Dubai - 29 October, 2024 - Ashish Jain, a globally renowned finance innovator and one of the Top 25 Fund Managers in the World (2023), is taking his expertise to new heights. Jain has announced the launch of the Alieus Hedge Fund, a groundbreaking venture focused on high-growth sectors and alternative assets. In a surprising twist, Jain also revealed his latest business venture outside the finance industry-a new Indo-Fusion restaurant…

ZKSciences exhibiting at Indo Expo 2020 in Denver

ZKSciences is excited to be exhibiting at Indo Expo on January 25th and 26th in Denver, CO. ZKSciences representatives will be at booth #513, and eager to discuss with Indo Expo attendees the yield and growth enhancement capabilities offered by zeolites. Stop by to learn about the ZK GrowFactor(TM) family of zeolite soil amendments and how these bring additional yield increases over existing zeolite amendments. Professional growers are invited to…

Indo–UAE Business & Social Forum 2018–19

Press Release

Contact: Anam Kumar, Chief Editor, AsiaOne Magazine

Phone: 011-40236308; 9718885718

Email: anam@asiaone.co.in

india@asiaone.co.in

Date: 2nd May 2019

Venue: J W Marriott Hotel, Dubai

11th Edition of Asian Business & Social Forum,

Indo–UAE Business & Social Forum 2018–19

&

5th Edition – World’s Greatest Brands & Leaders 2018–19

In addition to the coveted

Knight of Honour Awards,

AsiaOne Person of the Year Awards,

Guest of Honour Awards,

AsiaOne 40 Under 40 Most Influential Leaders 2018–19 Asia & GCC,

World’s Greatest CXOs Awards 2018–19,

India’s Fastest…

Indo–UAE Business & Social Forum 2018–19

11th Edition of Asian Business & Social Forum,

Indo–UAE Business & Social Forum 2018–19

&

5th Edition – World’s Greatest Brands & Leaders 2018–19

In addition to the coveted

Knight of Honour Awards,

AsiaOne Person of the Year Awards,

Guest of Honour Awards,

AsiaOne 40 Under 40 Most Influential Leaders 2018–19 Asia & GCC,

World’s Greatest CXOs Awards 2018–19,

World’s Greatest CSR Awards,

India’s Fastest Growing Brands & Leaders Awards,

Bangladesh’s Fastest Growing Brands & Leaders Awards,

Eminent Jury Awards,

AsiaOne Eminent Guest…