Press release

Global Foreign Exchange Market Outlook 2025-2034: Trends, Innovations, And Future Outlook

The Foreign Exchange Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].How Big Is the Foreign Exchange Market Size Expected to Be by 2034?

The size of the foreign exchange market has seen substantial growth in the past few years. The growth is estimated to continue from $792.43 billion in 2024 to approximately $838.54 billion in 2025, a compound annual growth rate (CAGR) of 5.8%. Various factors, including globalization and international trade, discrepancies in interest rates, government strategies and financial interventions, conjecture and investment flows, as well as balance of payments and economic indices have significantly contributed to this upward trend in the historical period.

In the upcoming years, the foreign exchange market is anticipated to grow robustly. By 2029, it is projected to reach a value of $1106.49 billion, registering a compound annual growth rate (CAGR) of 7.2%. Factors contributing to this growth during the forecast period include political and geopolitical shifts, fluctuations in commodity prices and resource exports, the rebound from the pandemic and risk appetite, climbs in inflation, and the kinetics of emerging markets. Key trends that will feature in the forecast period are the growing popularity of retail forex trading, the development of improved risk management strategies, the effects of global economic recuperation, emphasis on ESG (environmental, social, governance), and investments in technological infrastructure.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9225

What Are the Emerging Segments Within the Foreign Exchange Market?

The foreign exchange market covered in this report is segmented -

1) By Counterparty: Reporting Dealers, Other Financial Institutions, Non-Financial Customers

2) By Trade Finance Instruments: Currency Swaps, FX Options

3) By End User: Individuals, Retailers, Corporate Institutes, Government, Other End Users

Subsegments:

1) By Reporting Dealers: Banks, Brokers, Investment Firms

2) By Other Financial Institutions: Hedge Funds, Insurance Companies, Asset Managers

3) By Non-Financial Customers: Corporates, Retail Traders, Government Entities

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9225&type=smp

What Long-Term Drivers Are Shaping Foreign Exchange Market Trends?

The foreign exchange market's expansion is notably influenced by the rise in international transactions. Such transactions encompass interactions involving two or more interrelated businesses, where at least one participant is not a domestic entity. The overall dimension and activities of the foreign exchange market are amplified by escalating global commerce and international transactions. For instance, Convera Corporation, an American Web services firm, has projected that the wholesale cross-border payments market will experience a 54% growth spurt, expanding from $146 trillion in 2023 to $225 trillion by 2030. On the other hand, non-wholesale (retail) payment flows are anticipated to increment by 45%, amounting to $65 trillion by the same year. Hence, increases in international transactions will propel the foreign exchange market forward.

Who Are the Top Competitors in Key Foreign Exchange Market Segments?

Major companies operating in the foreign exchange market include JPMorgan Chase and Co., Citibank N. A., HSBC Holdings plc, BNP Paribas Société Anonyme, The Goldman Sachs Group Inc., UBS Group AG, Deutsche Bank AG, The Bank of Nova Scotia, Barclays plc, State Bank Of India, Standard Chartered plc, State Street Corporation, Royal Bank of Scotland plc, Commonwealth Bank of Australia, Interactive Brokers Group LLC, eToro Group Limited, Saxo Bank A/S, Swissquote Group Holding SA, CMC Markets plc, GAIN Capital Holdings Inc., IG Group Holdings plc, AvaTrade Ltd., City Index Limited, OANDA Corporation, Alpari UK Limited, Admiral Markets Ltd., Pepperstone Group Limited, Dukascopy Bank SA, Octa Markets Incorporated, FxPro UK Limited

What Are the Latest Developing Trends in the Foreign Exchange Market?

The pivotal trend observed in the foreign exchange market is product innovation. Premier companies in the market are keen on introducing unique, creative foreign exchange platforms. For example, EbixCash Limited, a financial and insurance technology corporation based in India, launched a bespoke corporate self-booking tool in July 2022. The tool assists business clients in designing personalized alerts and management information systems (MIS) for all associated activities. It accomplishes this by providing a spectrum of straightforward, uncomplicated foreign exchange services. To bolster efficiency in booking and maintaining foreign exchange services, the Self-Booking Tool includes features like online invoice administration, instantaneous order updates, and an approval matrix setup designed for corporate clients.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/foreign-exchange-global-market-report

Which Regions Are Becoming Hubs for Foreign Exchange Market Innovation?

North America was the largest region in the foreign exchange market in 2024. The regions covered in the foreign exchange market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Foreign Exchange Market?

2. What is the CAGR expected in the Foreign Exchange Market?

3. What Are the Key Innovations Transforming the Foreign Exchange Industry?

4. Which Region Is Leading the Foreign Exchange Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Foreign Exchange Market Outlook 2025-2034: Trends, Innovations, And Future Outlook here

News-ID: 4012191 • Views: …

More Releases from The Business Research Company

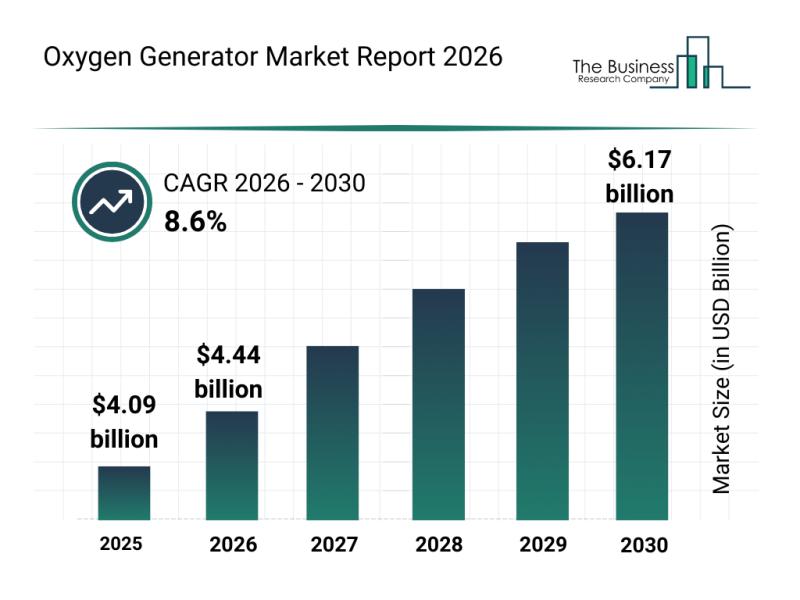

Worldwide Insights: The Rapid Development of the Oxygen Generator Market

"The oxygen generator market is positioned for significant expansion over the coming years, driven by diverse industrial and healthcare demands. With advancements in technology and increasing applications across various sectors, this market is set to witness robust growth as it adapts to evolving needs and innovations.

Projected Expansion and Market Size of Oxygen Generators Through 2030

The oxygen generator market is anticipated to grow steadily, reaching a value of $6.17 billion…

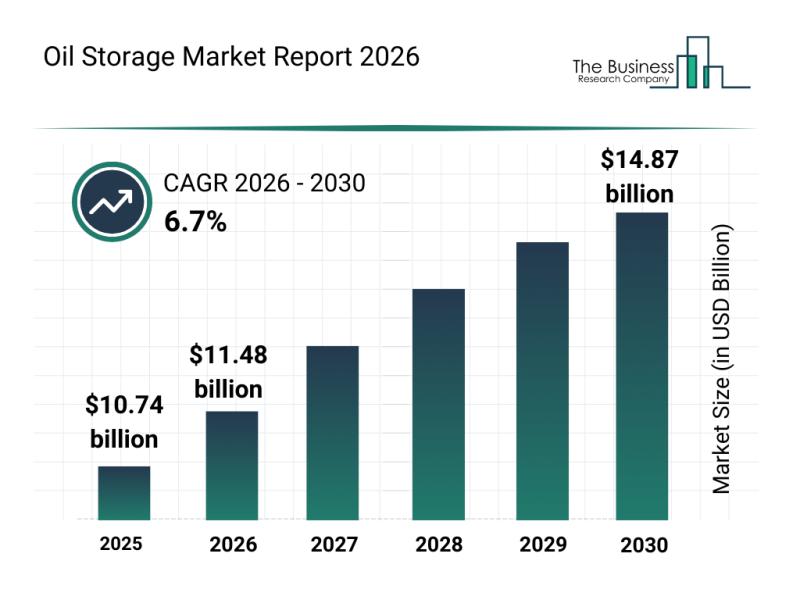

Segmentation, Major Trends, and Competitive Overview of the Oil Storage Market

"The oil storage sector is poised for notable expansion in the coming years, driven by increasing global energy needs and infrastructure development. As demand for efficient and secure storage solutions grows, the market is evolving with advanced technologies and strategic initiatives designed to meet the challenges of modern oil consumption and reserves management. Here's an overview of the market size, key players, emerging trends, and segmentation that define this industry's…

Worldwide Trends Examination: The Fast-Paced Development of the Motion Control M …

The motion control market is poised for significant expansion as industries increasingly adopt advanced automation technologies. With rising investments and technological breakthroughs, this sector is set to transform manufacturing and related fields by 2030. Let's explore the market's size, leading companies, emerging trends, and segment forecasts to understand its evolving landscape.

Expected Growth and Market Size of the Motion Control Market by 2030

The motion control market is on track for…

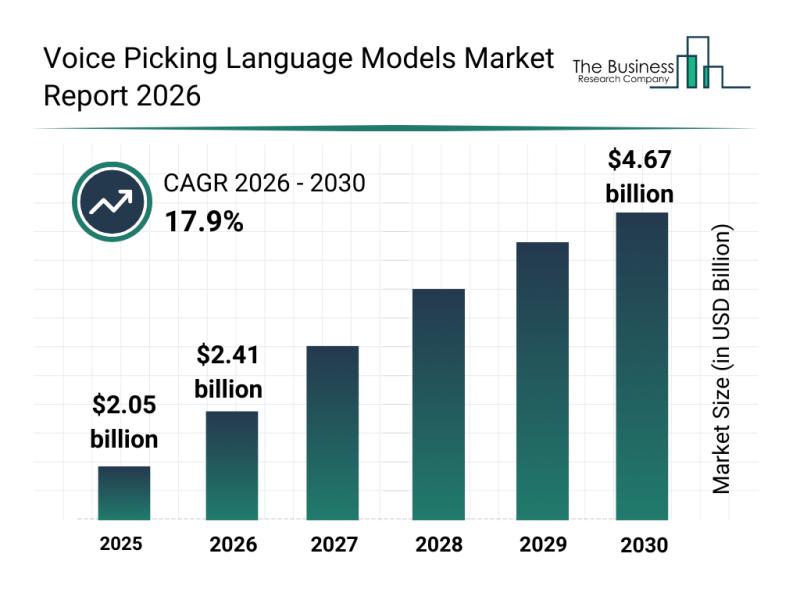

Global Trends Overview: The Rapid Evolution of the Voice Picking Language Models …

The voice picking language models market is poised for significant expansion in the coming years, driven by technological advancements and increasing adoption in logistics and warehouse environments. This sector is rapidly evolving as businesses prioritize efficiency and accuracy in their operations. Let's explore the market's size, growth factors, key companies, segmentation, and emerging trends shaping its future.

Projected Market Size and Growth Trajectory for the Voice Picking Language Models Market …

More Releases for Foreign

New York City Foreign Investment Lawyer Natalia Sishodia Explains Property Optio …

Natalia Sishodia (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), a New York City foreign investment lawyer and the managing attorney at Sishodia PLLC, has recently published a comprehensive blog post titled, "What Type of Property Can a Foreigner Buy in New York?" This insightful article provides a detailed overview of the various types of properties available for purchase by foreign investors in New York, a subject that is increasingly relevant in today's globalized real estate market.

As…

New York State Foreign Investment Attorney Natalia A. Sishodia Releases Comprehe …

New York State foreign investment attorney Natalia A. Sishodia (https://sishodia.com/step-by-step-guide-for-foreigners-buying-real-estate-in-new-york-city/) of Sishodia PLLC has released a pivotal article aimed at clarifying the complex process of purchasing real estate in New York City for foreign investors. The detailed guide provides invaluable insights and a clear path for international buyers navigating the bustling New York real estate market.

The real estate landscape in New York presents a unique set of opportunities and challenges,…

China courts concluded 295,000 foreign-related civil, commercial and foreign-rel …

Wang Shumei, the President of the Fourth Civil Trial Division of the Supreme People's Court of China, reported at a press conference on the 27th that from January 2013 to June 2022, China's courts at all levels concluded 295000 foreign-related civil, commercial and maritime cases in the first instance.

At the meeting, when introducing the main achievements of foreign-related commercial maritime trials in the new era, Wang Shumei talked about "the…

FOREIGN INVESTMENT IN SAUDI ARABIA

The Saudi Arabian government, in recent years, have taken steps to make company set up and operating in the Kingdom easier. Through economic reforms, the government have created a market that’s welcoming to foreign investors. The introduction of online portals, easing of processes and implementing new licenses have all contributed to the rapid increase in foreign investment in the Kingdom.

We created this whitepaper to give insight into setting up a…

A Foreign Exchange Solution to optimize the foreign currency value and control

The transaction of foreign exchange greatly depends on the current exchange rates. To ensure the stability of the currency value, our Sweden-based client required a Foreign Exchange Solution that administered the transaction of the various currencies in an organization. TatvaSoft had developed a Windows-based Application that controls the currency sell and buy, current currency value, and administer ledger by imposing the branch specific validations and rules.

A large amount of foreign…

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

With Foreign Staffing’s global presence expanding each month, clients have been growing as well. They have not only been seeking a solution to find new staff in other countries but they have also been seeking an efficient and compliant way to quickly employee this staff without having to establish a legal entity in the foreign country.

Foreign Staffing has spent the last…