Press release

Data Loss Prevention Market Size to Surpass USD 12.29 Billion by 2033 | Industry CAGR of 18.9%

Market Overview:The data loss prevention market is experiencing rapid growth, driven by Stringent Regulatory Compliance Driving DLP Adoption, IoT Proliferation Amplifying DLP Demand and AI Integration Enhancing DLP Capabilities. According to IMARC Group's latest research publication, "Data Loss Prevention Market Size, Share, Trends and Forecast by Type, Services, Size, Deployment Type, Application, and Region, 2025-2033", The global data loss prevention market size was valued at USD 2.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.29 Billion by 2033, exhibiting a CAGR of 18.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/data-loss-prevention-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Data Loss Prevention Industry:

● Stringent Regulatory Compliance Driving DLP Adoption:

The Data Loss Prevention (DLP) Market is booming based on the stringent data protection norms such as GDPR, Canada's CPPA, and Quebec's Bill. Such regulations are bound to produce high levels of privacy protection, quick breach notifications, and established consent rules, forcing companies to adopt modern DLP systems to remain compliant and prevent huge financial penalties. An example is GDPR, which has led to increased use of DLP technology where it comes to data management by organizations because of potential annual penalties of $1.5 billion in compliance failures worldwide (2023 reports). Large and mid-size businesses are implementing individualized security measure and classification systems to accommodate potential threats. Constant introduction of Privacy oriented Regulations by Governments across the globe is increasing the demand for DLP Systems that would be capable of monitoring and protecting data in the cloud, the end user devices and as well throughout the network, which is helping to drive more market entry and the evolution of security solutions with focus on compliance.

● IoT Proliferation Amplifying DLP Demand:

The Internet of Things (IoT) is driving the growth of the DLP market, as the numbers of global IoT devices are projected to grow to 16.6 billion in 2023 according to IoT Analytics and at 6 billion connections by 2028 according to Ericsson. The spike in the number of IoT devices adds extra threat to data security as it introduces new vectors of cyberattack. Enterprises are placing DLP measures in order to protect data on myriad connected platforms from illicit access and cyber threats. For instance, Proofpoint's Sigma platform integrates content classification with analysis of user behavior in order to counter balance threats posed by IoT devices. With more sophisticated IoT ecosystems, and with the problems of data-related privacy issues becoming more critical, DLP tools supporting real-time monitoring and advanced analytics solutions are increasingly sought after. As IoT continues to explode, market opportunities are growing since DLP solutions become more critical in protecting data in the interconected digital world.

● AI Integration Enhancing DLP Capabilities:

The deployment of artificial intelligence (AI) in DLP solutions is elevating the sector giving better data protection and threat detection. Enter Proofpoint's release of ADAPTIVE EMAIL DLP in April 2024 which is augmented with AI which provides organizations with the benefit of utilizing machine learning to quickly identify and Emergence of AI, big data and cloud computing will further complicated the data management thereby creating a need for more advanced DLP systems to support efficient classification and monitoring. Small and medium-sized organizations are adopting AI-driven DLP technologies like that of the Nightfall firm with its 2022 partnership with Asana in cloud-based data protection. With a specialization on advanced cybersecurity, the use of AI within the context enables predictive analytics and automates threat response, reducing human errors and enhancing productivity. This growth trend drives the development of new DLP solutions responding to the rapidly changing needs of digital ecosystems.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4899&method=1670

Leading Companies Operating in the Global Data Loss Prevention Industry:

● Absolute Software Corporation

● Broadcom Inc.

● Cisco Systems Inc.

● Digital Guardian (HelpSystems LLC)

● Forcepoint

● Gtb Technologies Inc.

● McAfee Corp.

● Proofpoint Inc.

● Thales Group

● Trend Micro Inc.

● Trustwave Holdings (Singapore Telecommunications Limited)

● Zecurion

Data Loss Prevention Market Report Segmentation:

Breakup By Type:

● Data Center DLP

● Endpoint DLP

● Network DLP

Network DLP exhibits a clear dominance in the market attributed to its ability to monitor and protect data in transit.

Breakup By Services:

● Managed Security Services

● Training and Education

● Consulting

● System Integration and Installation

● Threat and Risk Assessment

Based on the services, the market has been divided into managed security services, training and education, consulting, system integration and installation, and threat and risk assessment.

Breakup By Size:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises represent the largest segment owing to their ability to handle vast amounts of sensitive data, which requires robust DLP solutions to ensure data security and compliance.

Breakup By Deployment Type:

● On-premises

● Cloud Data Loss Protection

On-premises holds the biggest market share due to the enhanced control and customization it offers, especially important for organizations with stringent data security requirements.

Breakup By Application:

● Cloud Storage

● Encryption

● Policy Standards and Procedures

● Web and Email Protection

● Others

On the basis of the application, the market has been classified into cloud storage, encryption, policy standards and procedures, web and email protection, and others.

Breakup By Industry:

● Healthcare

● Retail and Logistics

● Defense and Intelligence

● Public Utilities and Government Bodies

● BFSI

● IT and Telecom

● Others

IT and telecom account for the majority of the market share, as these industries prioritize data security to protect intellectual property and maintain regulatory compliance.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market, driven by strict data protection regulations, high awareness about data security, and rising investment in cybersecurity technologies.

Ask Analyst fore Sample Report: https://www.imarcgroup.com/request?type=report&id=4899&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Data Loss Prevention Market Size to Surpass USD 12.29 Billion by 2033 | Industry CAGR of 18.9% here

News-ID: 4010841 • Views: …

More Releases from IMARC Group

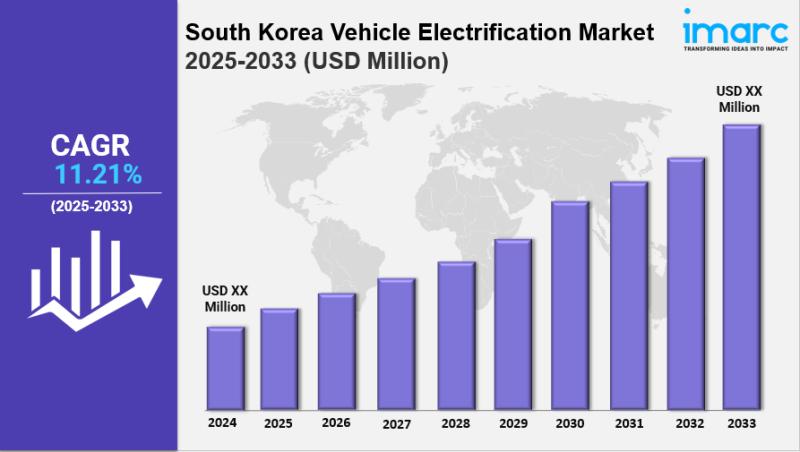

South Korea Vehicle Electrification Market Size, Growth, Key Players, Latest Tre …

IMARC Group has recently released a new research study titled "South Korea Vehicle Electrification Market Report by Product Type (Starter Motor, Alternator, Electric Car Motors, Electric Water Pump, Electric Oil Pump, Electric Vacuum Pump, Electric Fuel Pump, Electric Power Steering, Actuators, Start/Stop System), Vehicle Type (Internal Combustion Engine (ICE) and Micro-Hybrid Vehicle, Plug-in Hybrid Electric Vehicle (PHEV) and Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), Sales Channel (Original Equipment…

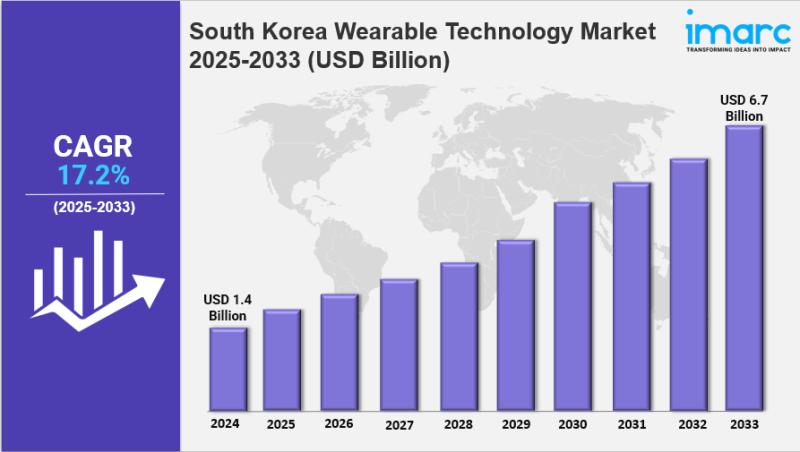

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

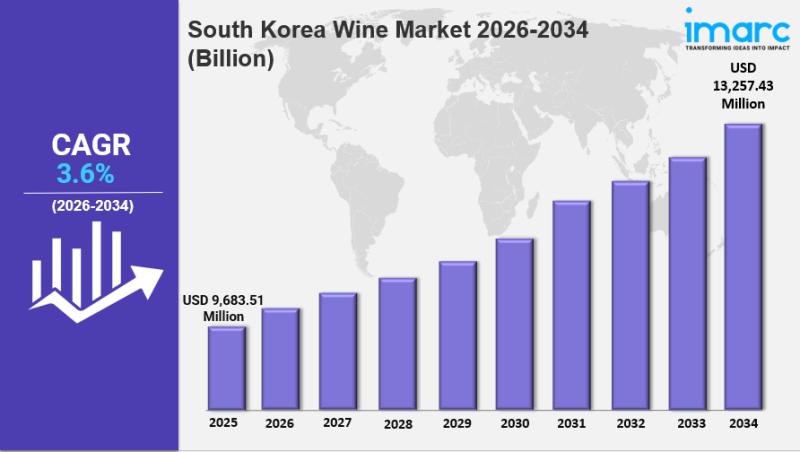

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

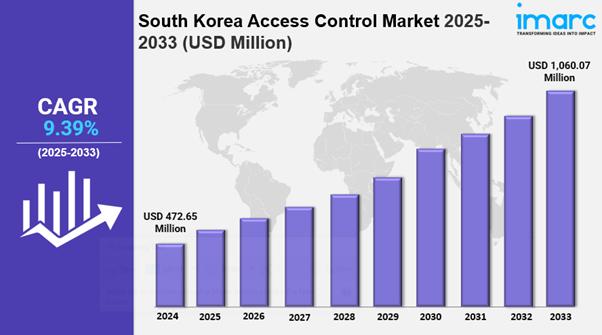

South Korea Access Control Market Size, Share, Industry Overview, Trends and For …

IMARC Group has recently released a new research study titled "South Korea access control market Size, Share, Trends and Forecast by Component, Deployment Mode, SMS Traffic, Application, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Access Control Market Overview

The South Korea access control market size was valued at USD…

More Releases for DLP

Data Loss Prevention Market by Offering (Solution, Services), Solution Type (Net …

"Rising compliance and regulatory requirements across the globe are the key factors driving the growth of the DLP market."

The Data Loss Prevention market is expected to grow from USD 3.4 billion in 2023 to USD 8.9 billion by 2028, at a CAGR of 21.2%, according to MarketsandMarkets. DLP solutions help businesses prevent data breaches by classifying and monitoring data in motion, at rest, and the endpoint. This information is used…

Global DLP Projector Market Analysis by 2020-2025

Scope of the Report:

The global DLP Projector market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of -0.1%% in the forecast period of 2020 to 2025 and will expected to reach USD 2976.4 million by 2025, from USD 2987.9 million in 2019.

Market segmentation

DLP Projector market is split by Type and by Application. For the period 2015-2025, the growth among segments…

Global Data-Loss Prevention (DLP) Market Intelligence Report For Comprehensive I …

Description:

This report presents the worldwide Data-Loss Prevention (DLP) market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The Data-Loss Prevention (DLP) market was valued at Million US$ in 2017…

Global Data Loss Prevention Solutions Market Consumption 2017 (Network DLP, Stor …

This report studies the Global Data Loss Prevention Solutions Market 2017, analyzes and researches the Data Loss Prevention Solutions development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Symantec

Digital Guardian

Trend Micro

CA Technologies

Trustwave

Code Green Network

Zecurion

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast Asia

Download sample copy of this report at http://globalqyresearch.com/download-sample/152344

Market segment by Type, Data Loss Prevention…

DLP Projector : Global Market Snapshot by 2022

DLP is an abbreviation used for digital light processing, a display device works on optical micro electromechanical technology using digital micro mirrors. Digital light processing works on ‘reflection’ phenomenon instead of passing light through liquid crystal material like in LCD. In DLP, light is reflected from panels called digital micro mirror devices or DMDs. These DMDs consist of thousands of very tiny reflective mirrors, each tiny mirror reflects a single…

Global DLP Projector Market key trend is the tremendous increment in the demand …

DLP projector is becoming popular over the LCD one because of the specialty and advantages provided by DLP projector and which are; portability, higher contrast, reduced pixilation, reliability and durability are some of them. Hence DLP projector is capturing a bigger part of the projector market and is expected to gain special attention in the upcoming future as well.

Request for TOC @ http://www.persistencemarketresearch.com/toc/9689

DLP is an abbreviation used for digital light…