Press release

Australia Travel Insurance Market 2025 Edition: Industry Size, Share, Growth and Competitor Analysis

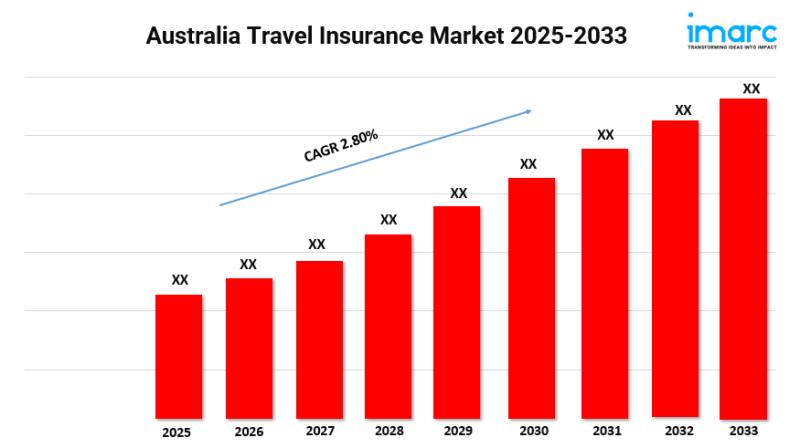

Australia Travel Insurance Market OverviewBase Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 2.80% (2025-2033)

The Australia travel insurance market is a dynamic and growing sector, driven by increasing international and domestic travel, evolving consumer needs, and a heightened awareness of travel-related risks. According to the latest report by IMARC Group, The Australia travel insurance market size was valued at USD 352.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach a projected revenue of USD 451.8 Million by 2033, exhibiting a CAGR of 2.80% from 2025-2033.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-travel-insurance-market/requestsample

Australia Travel Insurance Industry Trends and Drivers:

More travelers in Australia are aware of risks linked to travel. These include medical emergencies, trip cancellations, and lost luggage. This awareness boosts demand for travel insurance. Global events like pandemics and natural disasters raise uncertainty in travel. As a result, many travelers now see insurance as essential when planning trips. The digitalization of insurance makes buying easier. User-friendly online platforms and comparison sites help more people access travel insurance. More people are seeking adventure travel and high-risk activities. This trend leads travelers to find policies that cover these specific risks. Travelers want comprehensive policies that cover a wider range of issues. This includes pre-existing medical conditions and unexpected disruptions. As they learn more about policy details, demand for these comprehensive options grows. Insurtech innovations help customers and boost efficiency. For example, AI claims processing makes things faster. Personalized policy suggestions also enhance the overall experience. Travel providers like airlines and tour operators partner with insurance companies. This makes it easy to add insurance options when booking. The market shows a clear trend. Consumers are becoming more aware and want better access online. They also need personalized and complete coverage options.

The rising cost of overseas medical treatment drives many Australians to buy travel insurance. Expenses for unexpected health issues abroad can be very high without proper coverage. More people are traveling abroad for fun and work. This grows the customer base for travel insurance companies. The global travel environment is unstable due to geopolitical issues, weather events, and health crises. This highlights the need for financial protection against trip disruptions. Regulatory bodies and government recommendations also encourage consumers to consider travel insurance. Insurance companies and travel agents market potential risks and benefits. This helps educate consumers and increases demand. As more travelers book their trips online, they are likely to seek their own insurance. They prefer not to rely on packages that may or may not include it. Many Australians seek peace of mind and financial security when they travel. So, they often buy insurance, even for low-risk trips. A wide range of policy options is available, from basic emergency medical coverage to comprehensive plans. This allows travelers to choose coverage that fits their needs and budgets.

Buy Full Report: https://www.imarcgroup.com/checkout?id=21979&method=929

Australia Travel Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Insurance Type:

● Single-Trip Travel Insurance

● Annual Multi-Trip Insurance

● Long-Stay Travel Insurance

Analysis by Coverage:

● Medical Expenses

● Trip Cancellation

● Trip Delay

● Property Damage

● Others

Analysis by Distribution Channel:

● Insurance Intermediaries

● Banks

● Insurance Companies

● Insurance Aggregators

● Insurance Brokers

● Others

Analysis by End User:

● Senior Citizens

● Education Travelers

● Business Travelers

● Family Travelers

● Others

Regional Analysis:

● Australia Capital Territory & New South Wales

● Victoria & Tasmania

● Queensland

● Northern Territory & Southern Australia

● Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

● Market Performance (2019-2024)

● Market Outlook (2025-2033)

● COVID-19 Impact on the Market

● Porter's Five Forces Analysis

● Strategic Recommendations

● Historical, Current and Future Market Trends

● Market Drivers and Success Factors

● SWOT Analysis

● Structure of the Market

● Value Chain Analysis

● Comprehensive Mapping of the Competitive Landscape

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=21979&flag=C

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Travel Insurance Market 2025 Edition: Industry Size, Share, Growth and Competitor Analysis here

News-ID: 3987949 • Views: …

More Releases from IMARC Group

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

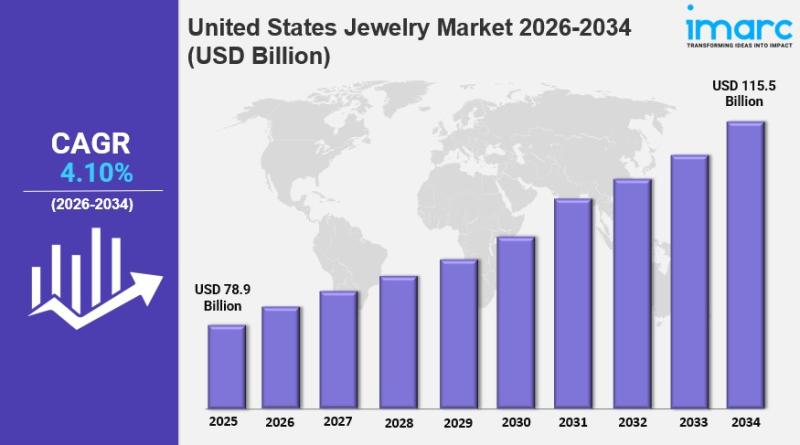

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…