Press release

Saudi Arabia Edtech Market Size, Share, Growth & Forecast 2025-2033

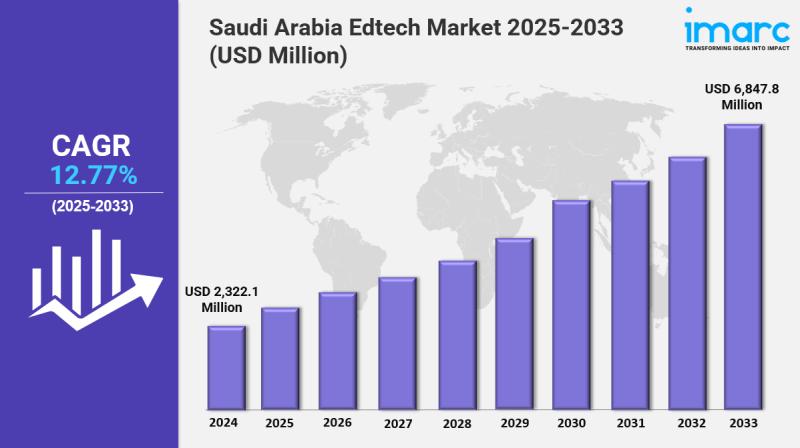

Market Overview 2025-2033Saudi Arabia edtech market size reached USD 2,322.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,847.8 Million by 2033, exhibiting a growth rate (CAGR) of 12.77% during 2025-2033. The market is experiencing rapid growth, driven by increasing digital adoption, urbanization, and rising disposable incomes. Key trends include the demand for interactive and personalized learning solutions, with major players focusing on sustainability and innovative technological platforms.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand for digital learning solutions and remote education

✔️ Rising adoption of AI-powered platforms and personalized learning tools

✔️ Expanding government initiatives to modernize the education sector under Vision 2030

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-edtech-market/requestsample

Saudi Arabia Edtech Market Trends and Drivers:

The Saudi Arabia Edtech market is shaped by the government's Vision 2030. This plan aims to diversify the economy and reduce reliance on oil. A key part of Vision 2030 is reforming the education system. This reform focuses on innovation, digital literacy, and preparing the workforce. In 2024, the Ministry of Education increased investments in smart classrooms, AI learning platforms, and digital infrastructure. These efforts provide quality education access, even in rural areas. Programs like the "Future Skills Initiative" and partnerships with global Edtech companies, such as Coursera and Udacity, support Arabic content for over 10 million students.

Also, regulatory changes have made online degree accreditation simpler and offered incentives for Edtech startups. This attracted ₤200 million in venture capital. However, challenges remain. Traditional institutions resist changes in teaching methods, and internet access is still uneven. By mid-2024, Saudi Arabia became the largest Edtech adopter in the MENA region. User growth reached 35% year-on-year, fueled by hybrid learning models post-pandemic and a rising need for skills in cybersecurity and renewable energy. Private companies are tapping into Saudi Arabia's Edtech boom. This surge is driven by a young, tech-savvy population, with 60% under 35, and increasing disposable incomes. Startups like Noon Academy and Elm Company have gained popularity through gamified K-12 solutions and corporate training platforms. They secured ₤150 million in Series B funding by Q2 2024.

International brands, such as Byju's and Khan Academy, are localizing their services. They partner with Saudi universities to add adaptive learning technologies. Venture capitalists are focusing on AI-powered tutoring systems and VR classrooms. These saw a 50% adoption increase in private schools during 2024. Corporate learning platforms are also thriving. Companies like Aramco and NEOM are investing in upskilling programs to meet Vision 2030's employment goals. However, competition is growing. Market fragmentation and high customer acquisition costs are leading to consolidation. This is shown by mergers like Nafham's acquisition of Saudi Tutor in early 2024.

Saudi learners are focusing more on culturally relevant, Arabic-first content. This shift is pushing Edtech firms to move beyond just translating Western curricula. In 2024, platforms like Abjadiyat and iStoria stood out by including local history, Islamic studies, and AI-driven speech recognition for dialects. There's also a growing demand for STEM education. Coding bootcamps, such as Misk Academy, and robotics kits are now common in classrooms. At the same time, blockchain-based credentialing systems are gaining trust, helping to tackle fraud in online certifications. The rise of the metaverse is changing vocational training, too.

NEOM's "Smart Schools" are piloting immersive simulations for engineering and healthcare. Still, challenges remain. Low digital literacy among older educators and data privacy concerns limit growth. As a result, firms are forming zero-rating partnerships with telecom providers like STC to improve data access. The Saudi Edtech scene is changing fast due to digital growth, a young population, and supportive regulations. After the pandemic, hybrid learning became standard. As of 2024, 72% of schools still use blended models. A major trend is personalized learning, where AI looks at student performance to adjust lessons.

This is now common on platforms like Noon Academy. Another trend is gamification, especially for K-12 students, thanks to Saudi Arabia's 94% smartphone use. Microlearning apps that offer quick 10-minute lessons in coding or languages saw a 40% rise in users in 2024. Government-backed initiatives, such as the "Education Hubs" in Riyadh and Jeddah, cluster Edtech firms, universities, and accelerators to spur R&D. Meanwhile, the 2024 launch of the National E-Learning Platform consolidated fragmented resources into a single portal, used by 8 million students.

Sustainability education is also rising, aligning with Vision 2030's green goals, with courses on carbon management and solar energy design proliferating Challenges remain, including the digital divide-only 65% of rural households have reliable internet-and skepticism toward online degrees. However, partnerships with global MOOC providers and subsidies for low-income families aim to bridge gaps. Looking ahead, the market is poised to exceed ₤1 billion₤1 billion by 2026, driven by AI, VR, and a youth population eager to lead the region's knowledge economy.

Checkout Now: https://www.imarcgroup.com/checkout?id=20715&method=1315

Saudi Arabia Edtech Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Sector:

• Preschool

• K-12

• Higher Education

• Others

Breakup by Type:

• Hardware

• Software

• Content

Breakup by Deployment Mode:

• Cloud-based

• On-premises

Breakup by End User:

• Individual Learners

• Institutes

• Enterprises

Breakup by Region:

• Northern and Central Region

• Western Region

• Eastern Region

• Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Edtech Market Size, Share, Growth & Forecast 2025-2033 here

News-ID: 3963338 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

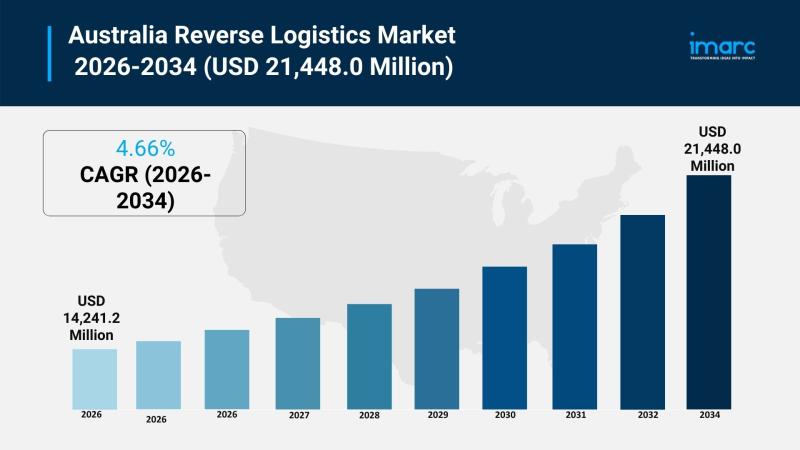

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…