Press release

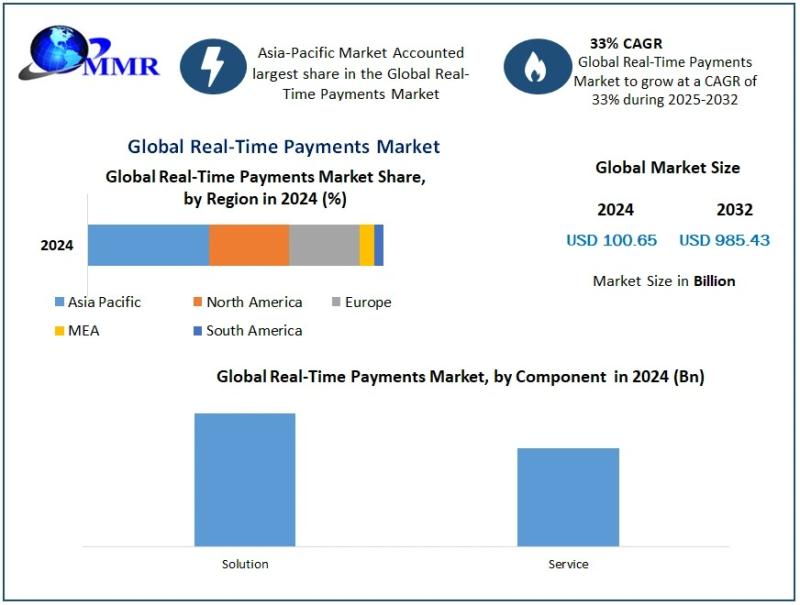

Real-Time Payments Market to Grow at a CAGR of 33% in the Forecast Period of 2025-2032

The Real-Time Payments Market size was valued at USD 100.65 Billion in 2024 and the total Real-Time Payments revenue is expected to grow at a CAGR of 33% from 2025 to 2032, reaching nearly USD 985.43 BillionReal-Time Payments Market Overview:

The global real-time payments market is undergoing a transformative shift, fueled by increasing consumer demand for speed, transparency, and convenience in financial transactions. Real-time payment systems enable the instantaneous transfer of funds between banks and financial institutions, providing end-users with immediate access to transferred money. This market has become especially significant in the context of rising digitalization, where governments, fintech firms, and banks are working together to modernize financial infrastructure. The value proposition lies not just in speed, but also in the ability to reduce fraud, improve cash flow, and streamline accounting for businesses of all sizes.

Download a Free Sample Report Today :https://www.maximizemarketresearch.com/request-sample/18481/

Real-Time Payments Market Dynamics

The rapid advancement of technology and the growing consumer preference for quick and convenient payment methods are key drivers propelling the real-time payments market. Businesses are increasingly investing in real-time payment solutions to improve cash flow, operational efficiency, and customer satisfaction. For instance, in 2024, the solutions segment, encompassing payment gateways and fraud management systems, dominated the market by accounting for over 77% of global revenue.

Moreover, the COVID-19 pandemic has accelerated the shift towards digital payments, as consumers and businesses sought contactless and immediate transaction methods. This trend has led to a significant uptick in real-time payment adoption, with over 130 financial institutions in the United States implementing real-time payment systems by September 2022-a five-fold increase from the previous year.

Real-Time Payments Market Outlook and Future Trends :

Looking ahead, the real-time payments market is poised for continued expansion, driven by the integration of advanced technologies such as artificial intelligence and blockchain. These innovations are expected to enhance the security, speed, and reliability of transactions, further boosting consumer confidence and adoption rates. Additionally, the proliferation of smartphones and the internet in developing regions presents significant opportunities for market growth, as more individuals gain access to digital payment platforms.

Key Recent Developments

Vietnam

In July 2024, AFFIN Group partnered with ACI Worldwide, a real-time payments software provider, to revolutionize the bank's payment capabilities. This collaboration aims to develop new enterprise payment platforms that significantly improve and streamline payment processes for Malaysian businesses.

Thailand

The Bank of Thailand has been actively promoting real-time payment systems to enhance financial inclusion and reduce reliance on cash transactions. Initiatives such as the PromptPay system have seen widespread adoption, facilitating instant transfers between individuals and businesses.

Japan

Japanese financial institutions are investing in real-time payment technologies to modernize their banking infrastructure. Collaborations between banks and fintech companies are fostering the development of innovative payment solutions tailored to the Japanese market.

South Korea

South Korea's financial sector is witnessing a surge in real-time payment adoption, driven by consumer demand for faster and more convenient payment options. The country's advanced technological landscape supports the integration of real-time payment systems across various platforms.

Singapore

Singapore-based Nium Pte. Ltd. has emerged as a key player in the real-time payments market, offering innovative solutions that facilitate instant cross-border transactions. The company's expansion efforts are contributing to Singapore's position as a fintech hub in the region.

United States

In January 2024, Mastercard partnered with The Clearing House to enhance real-time payment capabilities for businesses, consumers, and the government. This collaboration leverages The Clearing House's RTP network to develop real-time account-to-account technologies for Mastercard's financial institution clients.

Europe

In June 2024, Bitpanda, a financial technology company, partnered with Deutsche Bank to deliver a real-time payment solution for Bitpanda users' transactions across Germany. This initiative provides access to German International Bank Account Numbers (IBAN), enhancing user experience with improved speed and efficiency.

These developments underscore the dynamic nature of the real-time payments market, as stakeholders across various regions collaborate to enhance payment infrastructures and meet the evolving demands of consumers and businesses alike.

Real-Time Payments Market Segmentation

by Type

24x7x365

Bank Operating time

by Component

Solution

Service

by Enterprise Size

Small and Medium Enterprises

Large Enterprises

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/request-sample/18481/

Some of the current players in the Real-Time Payments Market are:

1. ACI Worldwide

2. FIS, Fiserv

3. MasterCard

4. World line

5. PayPal

6. Visa, Apple

7. Ant Financial

8. INTELLIGENT PAYMENTS

9. Wire card

10. Global Payments

For additional reports on related topics, visit our website:

♦ Printed & Flexible Sensors Market https://www.maximizemarketresearch.com/market-report/global-printed-and-flexible-sensors-market/36362/

♦ Photo Printing Market https://www.maximizemarketresearch.com/market-report/global-photo-printing-market/55004/

♦ Global X-ray Inspection Systems Market https://www.maximizemarketresearch.com/market-report/global-x-ray-inspection-systems-market/65625/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real-Time Payments Market to Grow at a CAGR of 33% in the Forecast Period of 2025-2032 here

News-ID: 3957530 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

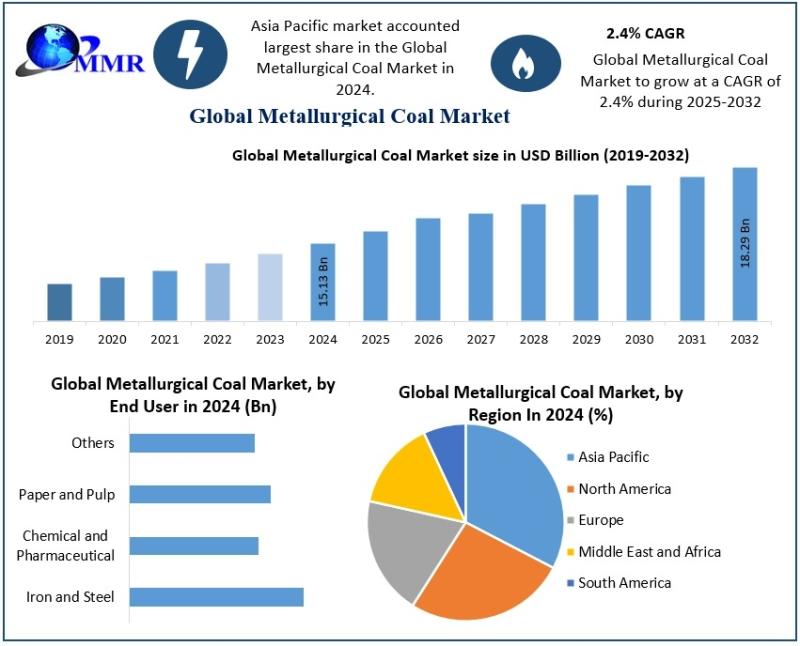

Metallurgical Coal Market Trends Shaping the Future of Steel and Infrastructure

The Metallurgical Coal Market size was valued at USD 15.13 Billion in 2024 and the total Metallurgical Coal revenue is expected to grow at a CAGR of 2.4% from 2025 to 2032, reaching nearly USD 18.29 Billion.

Metallurgical Coal Market Overview:

The Metallurgical Coal Market is deeply connected to the performance of the global steel sector, as metallurgical coal is an essential raw material used in blast furnace operations. Steel remains indispensable…

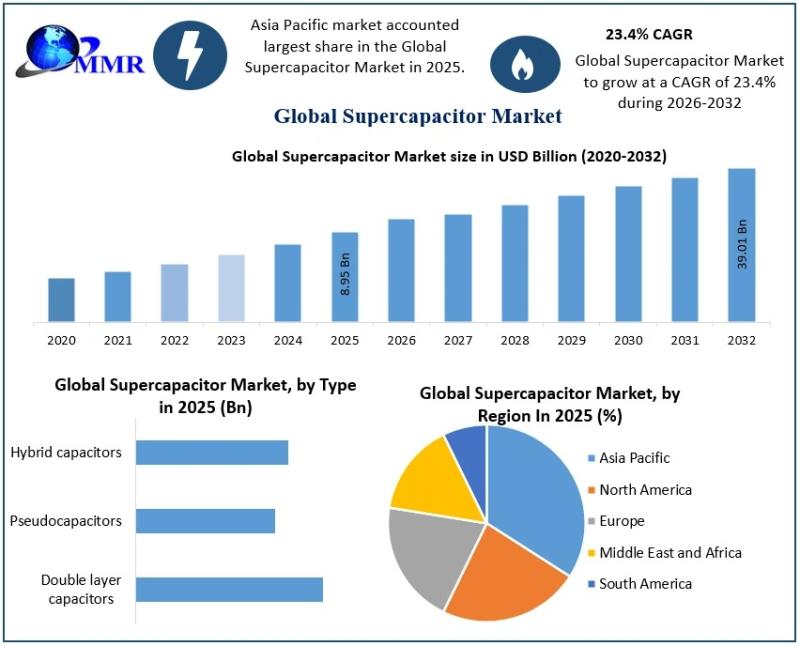

Supercapacitor Market Shows Strong Momentum as Energy Storage Innovation Acceler …

The Supercapacitor Market size was valued at USD 8.95 Billion in 2025 and the total Supercapacitor revenue is expected to grow at a CAGR of 23.4% from 2025 to 2032, reaching nearly USD 39.01 Billion by 2032.

Supercapacitor Market Overview:

The Supercapacitor Market is gaining significant attention as industries worldwide seek efficient, reliable, and sustainable energy storage solutions. Supercapacitors, also known as ultracapacitors, bridge the gap between conventional capacitors and batteries by…

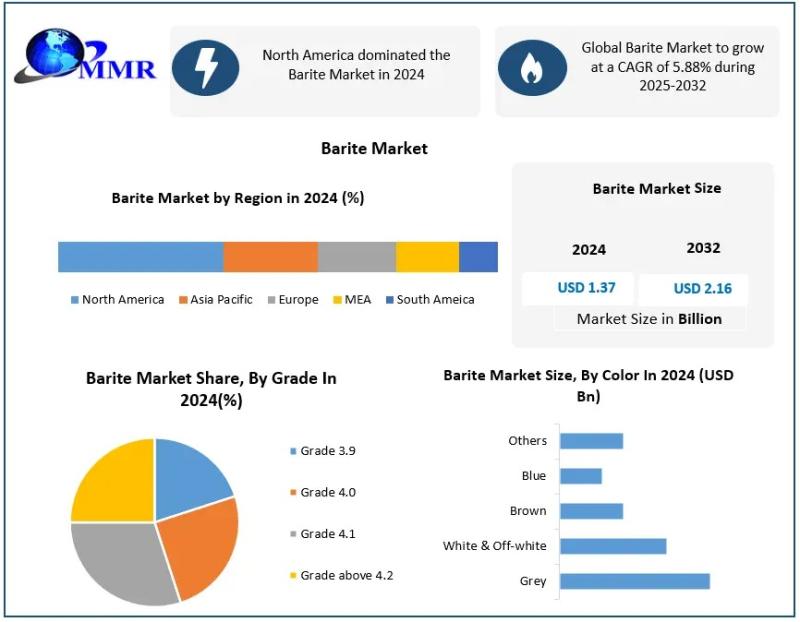

Barite Market Shows Strong Momentum Amid Industrial Expansion and Energy Demand

The Barite Market was valued at USD 1.37 billion in 2024, and total global Barite Market revenue is expected to grow at a CAGR of 5.88% from 2025 to 2032, reaching nearly USD 2.16 billion. Rising demand from the oil & gas industry.

Barite Market Overview:

The Barite Market is structured around diverse applications that depend on the mineral's exceptional physical properties. Barite is primarily used as a weighting agent in drilling…

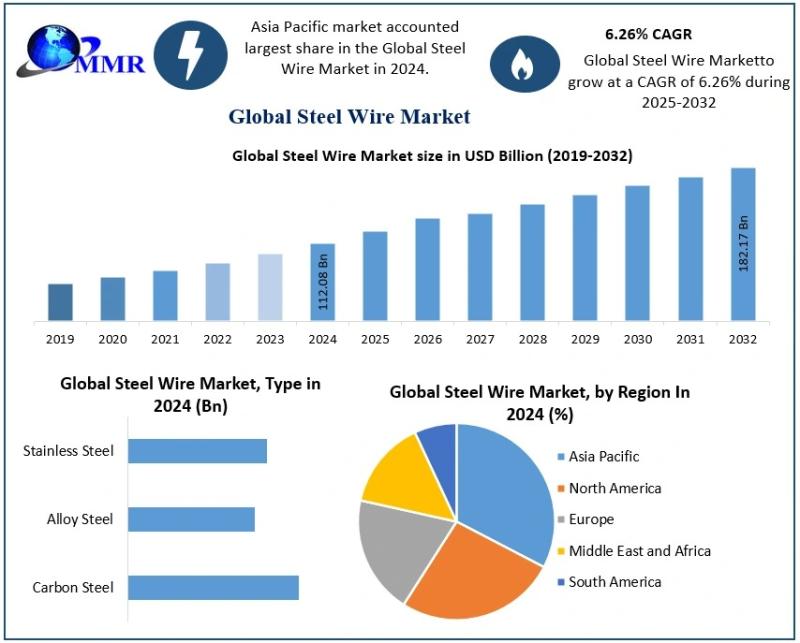

Steel Wire Market Analysis: Key Trends, Dynamics, and Future Outlook

The Steel Wire Market size was valued at USD 112.08 Billion in 2024 and the total Steel Wire revenue is expected to grow at a CAGR of 6.26% from 2025 to 2032, reaching nearly USD 182.17 Billion.

Steel Wire Market Overview:

The Steel Wire Market represents a highly diversified and application-driven industry, supplying essential materials for both heavy and light industrial operations. Steel wire is produced in various forms, including carbon steel…

More Releases for Payments

Credit Card Payments Market Secured Transactions, Seamless Payments: The Future …

Credit Card Payments Market

Credit Card Payments Market to reach over USD 327.68 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Credit Card Payments Market Size, Share & Trends Analysis Report By Card Type (General Purpose Credit Cards and Specialty & Other Credit Cards), Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars,…

Unveiling QuickBooks Payments Gateway WHMCS Module for Securing Payments

Discover seamless payment security with the QuickBooks Payments Gateway WHMCS Module. Safeguard your transactions and streamline payment processes effortlessly.

Feature News

Summers & Zim's Expands Services with Tommy's Electric Acquisition, Enhancing Electrical Offerings in Lancaster and Chester

Relief Allergy & Sinus Institute Welcomes Dr. Griffith Hsu to the Team, Expanding Best ENT and Allergy Care Locations

Watch the first major AI music video generated by Runway Artificial Intelligence

The Beer Connoisseur® Magazine & Online…

Payments Landscape Market Analysis 2023 Global Future Outlook 2029, Key Applicat …

The research looks at factors like segmentation, description, and applications in the Payments Landscape Market. It derives accurate insights to provide a comprehensive view of the dynamic features of the business, such as shares and profit generation, directing attention to the critical aspects of the business. Market methodologies adopted in the report offer precise data analysis and provide a tour of the entire market. Both primary and secondary approaches to…

Payments Landscape in Russia Industry, Mobile Proximity Payments, Bill Payments, …

Market Research Hub (MRH) has actively included a new research study titled Payments Landscape in Russia: Opportunities and Risks to 2022 to its wide online repository. The concerned market is discoursed based on a variety of market influential factors such as drivers, opportunities and restraints. This study tends to inform the readers about the current as well as future market scenarios extending up to the period until forecast period limit;…

Top Players in India Mobile Payments Market forecasts 2025: Transaction Services …

Mobile payments are payment methods that use mobile phones. India's Mobile Payment Forum (MPFI) is an umbrella organization responsible for mobile payments in India. India is the world's largest mobile payment market.

A mobile payment is money paid for a product or service through a portable electronic device such as a tablet or cell phone. Mobile payment technology can also be used to send money to friends or family members. Mobile…

The Russian Consumer Payments Country Snapshot : Payment cards, Online payments, …

"The Report Consumer Payments Country Snapshot: Russia 2016 provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

The Russian payments market is showing significant change as it slowly moves towards digital payments. In spite of cash playing a dominant role, new payment technologies will progressively gain in importance, with mobile payments and online commerce expected to contribute to increasing the level…