Press release

Credit Card Payments Market Secured Transactions, Seamless Payments: The Future of the Credit Card Payments Market

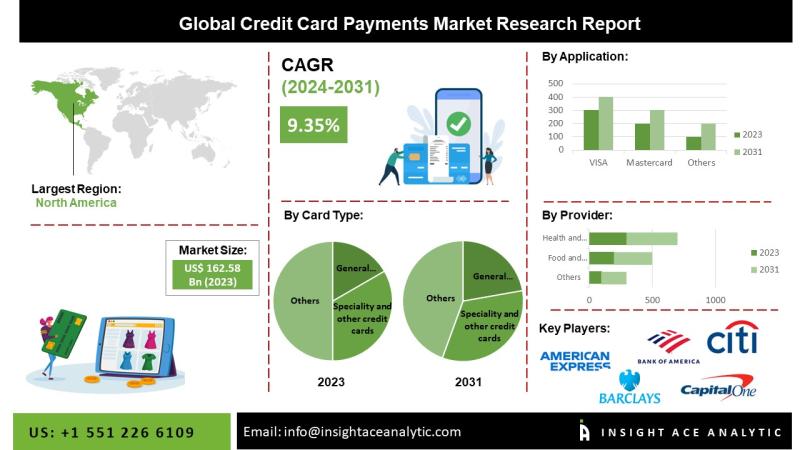

Credit Card Payments MarketCredit Card Payments Market to reach over USD 327.68 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Credit Card Payments Market Size, Share & Trends Analysis Report By Card Type (General Purpose Credit Cards and Specialty & Other Credit Cards), Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism and Others), and Provider (Visa, MasterCard, and Others)- Market Outlook And Industry Analysis 2031"

The global credit card payments market is estimated to reach over USD 327.68 billion by 2031, exhibiting a CAGR of 9.16% during the forecast period.

Request for free Sample Pages: https://www.insightaceanalytic.com/request-sample/1600

Credit Card Market: Growth Drivers and Challenges

Credit cards allow cardholders to make purchases and access funds based on a predetermined credit limit. They offer a convenient and secure way to pay for goods and services, contributing to the rising demand for credit cards globally.

Several factors are driving the growth of the credit card market worldwide:

• Increased Demand for Cashless Payments: Consumers are increasingly opting for cashless payment methods due to their convenience and speed. Credit cards provide a secure alternative to cash for transactions.

• Wider Availability of Affordable Cards: The growing availability of competitively priced credit cards is attracting new users, particularly in developing economies.

• Rising Credit Card Usage Among Young Adults: As younger generations enter the workforce and establish financial independence, their credit card usage is expected to rise, further propelling market growth.

However, the market also faces some challenges:

• Credit Card Theft: The increasing incidence of credit card theft globally can deter potential users and hinder market expansion.

Technological Advancements and Future Potential

The credit card industry is embracing technological advancements to address security concerns and enhance user experience. The integration of blockchain technology, for example, holds promise for creating even more secure and transparent credit card transactions. These innovations are expected to unlock lucrative market expansion opportunities in the coming years.

List of Prominent Players in the Credit Card Payments Market:

• American Express

• Bank of America Corporation

• Barclays PLC

• Capital One

• Citigroup Inc.

• JPMorgan Chase & Co

• MasterCard

• Synchrony

• The PNC Financial Services Group, Inc.

• United Services Automobile Association

• Visa Inc.

Market Dynamics:

Drivers-

One of the major forces influencing the market is the increased need for non-cash alternatives to cash for the down payment and emergency funding. Additionally, there is a rise in the use of credit cards to pay for TVs, laptops, cell phones, travel packages, and jewelry.

This is encouraging the market expansion of credit card payments and the accessibility of affordable credit cards globally. Additionally, the market is benefiting from technical developments in blockchain that will increase database security. In addition, some businesses give their staff unique credit cards to track their travel, meals, lodging, and goods, providing end users and market investors with profitable growth potential.

Challenges:

The increasing need for alternatives to funds for down payments and emergencies However, the increased cost of these products and individuals' needs for knowledge of the advantages of utilizing credit cards are some factors limiting the market's growth throughout the projection period.

The COVID-19 effect on a new credit card is anticipated to impede the expansion of the credit card sector. Because there are fewer opportunities to spend money due to the economic slump, consumers are lowering their credit card debts and registering for fewer new cards.

Regional Trends:

The North America credit card payments market is expected to register a major market share because more people use credit cards to make internet purchases. The Pay packet Protection Initiative, a program of the US government to encourage digital payments, is also anticipated to boost the expansion of the North American industry.

Additionally, the growing consumer usage of smartphones and tablets will support the currency's growth in North America. Besides, Europe had a substantial market share due to the developed economy and growing product adoption. This is due to the increased adoption of new strategies by the major players in the credit card payments market. Moreover, the existence of key market players and developing collaboration among major players for market penetration in the region provides the opportunity to grow the global Credit Card Payments market.

Curious about this latest version of the report? @ https://www.insightaceanalytic.com/enquiry-before-buying/1600

Credit cards allow cardholders to make purchases and access funds based on a predetermined credit limit. They offer a convenient and secure way to pay for goods and services, contributing to the rising demand for credit cards globally.

Several factors are driving the growth of the credit card market worldwide:

• Increased Demand for Cashless Payments: Consumers are increasingly opting for cashless payment methods due to their convenience and speed. Credit cards provide a secure alternative to cash for transactions.

• Wider Availability of Affordable Cards: The growing availability of competitively priced credit cards is attracting new users, particularly in developing economies.

• Rising Credit Card Usage Among Young Adults: As younger generations enter the workforce and establish financial independence, their credit card usage is expected to rise, further propelling market growth.

However, the market also faces some challenges:

• Credit Card Theft: The increasing incidence of credit card theft globally can deter potential users and hinder market expansion.

Technological Advancements and Future Potential

The credit card industry is embracing technological advancements to address security concerns and enhance user experience.

The integration of blockchain technology, for example, holds promise for creating even more secure and transparent credit card transactions. These innovations are expected to unlock lucrative market expansion opportunities in the coming years.

Recent Developments:

• In March 2022-Fintech unicorn Razor pay revealed that it had paid an undisclosed sum to acquire IZealiant Technologies, a top startup that offers banks payment technology solutions. The acquisition of Azealia will assist Razor pay's division of banking solutions to grow and enable it to develop cutting-edge payment banking technology for associate banks.

• In September 2021-Wizi was purchased by M2P, an Indian provider of digital infrastructure, for a $5 million transaction fee. With this merger, the businesses will oversee the credit card industry and benefit their clients. An Indian company called Wizz offers credit cards.

Segmentation of Credit Card Payments Market-

By Card Type

• General Purpose Credit Cards

• Specialty & Other Credit Cards

By Application

• Food & Groceries

• Health & Pharmacy

• Restaurants & Bars

• Consumer Electronics

• Media & Entertainment

• Travel & Tourism

• Others

By Provider

• Visa

• Mastercard

• Others

•

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/report/credit-card-payments-market/1600

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Payments Market Secured Transactions, Seamless Payments: The Future of the Credit Card Payments Market here

News-ID: 3575377 • Views: …

More Releases from InsightAce Analytic Pvt.Ltd

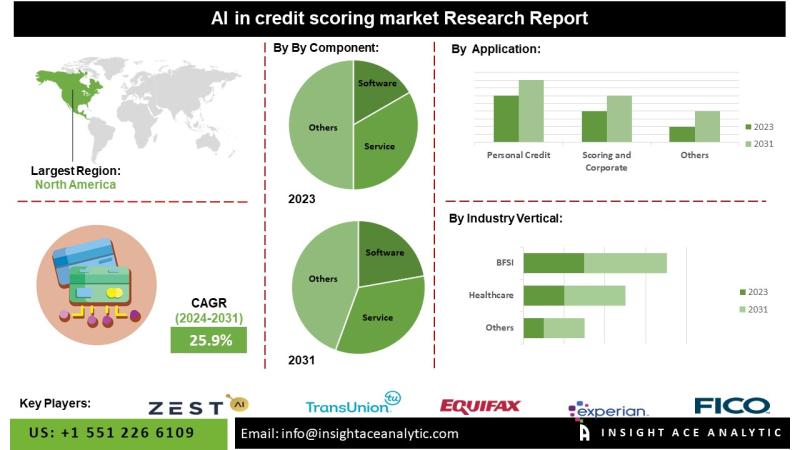

AI In The Credit-Scoring Market Smarter Credit Decisions: How AI is Transforming …

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare,

Telecommunications, Utilities, and Real Estate)), Trends,…

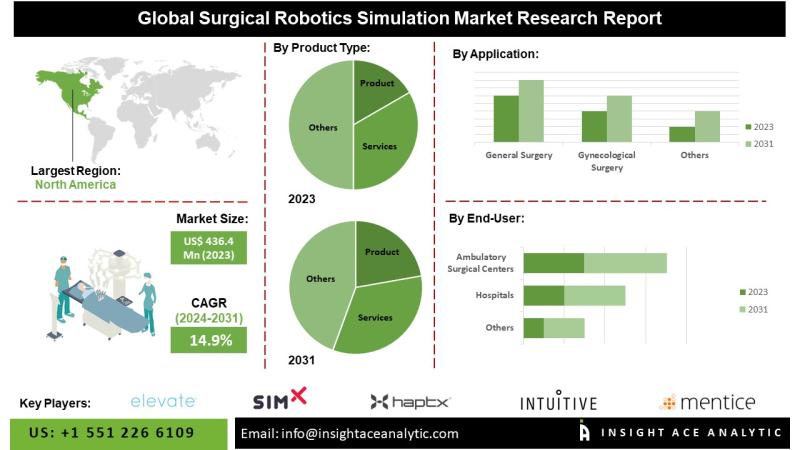

Surgical Robotics Simulation Market Guiding the Next Generation of Surgeons: Gro …

Surgical Robotics Simulation Market Worth $1,283.6 Mn by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Surgical Robotics Simulation Market Size, Share & Trends Analysis Report By Product Type (Product, Services), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurological Surgery (Head and Neck Surgery), Cardiological Surgery, Orthopedic Surgery, Others), By End User (Hospitals, Ambulatory Surgical Centers,…

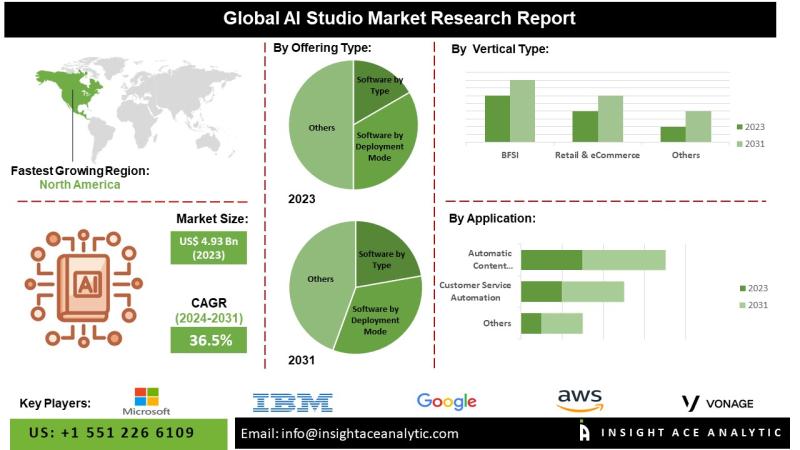

AI Studio Market Accelerating Innovation: The Benefits of AI Studios for Busines …

Global AI Studio Market Worth $57.89 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI Studio Market- (By Application (Sentiment Analysis, Customer Service Automation, Image Classification & Labelling, Synthetic Data Generation, Predictive Modelling & Forecasting, Automatic Content Generation, and Others), By Offering, By Vertical, By Region, Trends, Industry Competition Analysis, Revenue and Forecast…

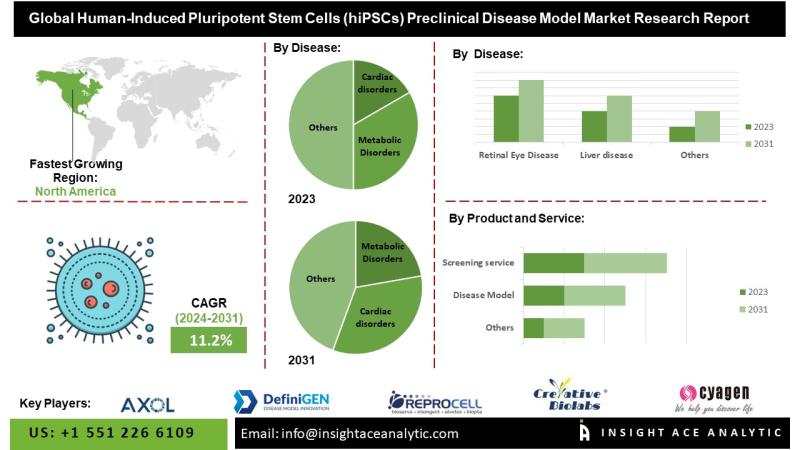

Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market G …

Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market- (Disease (Neurological Disorders and Dystrophies, Cardiac disorders, Retinal Eye Disease, Metabolic Disorders, Liver disease, Others), Products and Services (Disease Model,

Reprogramming service, Differentiation…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…