Press release

Libya Passenger Car Market Poised for Growth at a 6.1% CAGR Over the Next Decade | Persistence Market Research

The Libya passenger car market has seen gradual but steady growth over the past decade. In 2020, the market accounted for approximately 2.9 million units, and it is forecasted to experience a compounded annual growth rate (CAGR) of 6.1%, reaching a projected 5.5 million units by 2031. Despite facing challenges such as political instability, the Libyan market for passenger vehicles remains buoyed by a combination of favorable factors, including low fuel prices, an increasing preference for personal vehicles, and a growing focus on reducing vehicle emissions. However, the market is primarily dominated by imported used cars, with new passenger vehicles holding a small yet significant share of total sales.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33007

In terms of regional performance, Libya's passenger car market is heavily influenced by imports from key automotive markets like South Korea, China, Germany, the USA, and the UAE. These nations are leading suppliers of vehicles into Libya, offering a wide variety of models that cater to diverse consumer needs. The government's announcement to prohibit cars older than ten years from entering the country starting in 2022 has prompted an expected shift towards newer, more environmentally friendly vehicles. With the country's oil production and political stability recovering, fuel costs remain attractive, further boosting demand for passenger cars, particularly those with lower emissions.

Key Highlights from the Report

• The Libya passenger car market stood at 2.9 million units in 2020.

• A projected CAGR of 6.1% is expected from 2021 to 2031.

• Imported used cars dominate the Libyan passenger car market.

• Strict government emission regulations are expected to boost sales of new cars.

• The government of Libya will prohibit the entry of cars older than ten years starting in 2022.

• Low fuel prices in Libya contribute to the market's growth potential.

Market Segmentation

The Libya passenger car market can be segmented based on several factors such as product type, end-user demographics, and vehicle specifications. The product type segmentation primarily divides the market into new and used cars, with used cars dominating the market by volume due to their affordability and availability. Consumers in Libya tend to favor used vehicles as they offer a more budget-friendly option in a market with relatively low disposable income levels. This trend is expected to continue in the short-to-medium term, although new car sales are likely to grow as emissions regulations tighten and more modern vehicles become available.

Additionally, the market is segmented by vehicle specifications such as compact cars, sedans, SUVs, and luxury vehicles. Among these, compact cars and SUVs are seeing growing demand, with the latter becoming increasingly popular due to their perceived safety benefits and better performance in challenging road conditions. The end-user segmentation includes private buyers and commercial fleets, with the private segment holding the larger share. The adoption of passenger cars for personal use is on the rise, particularly as Libyans seek more freedom in their transportation choices, driven by low fuel prices and improved purchasing power.

Regional Insights

The Libyan passenger car market is heavily influenced by the importation of vehicles from various countries. South Korea, China, Germany, the USA, and the UAE are among the largest exporters to Libya, contributing significantly to the availability of both new and used passenger vehicles. Given Libya's geographical location and its proximity to oil-producing nations, its market dynamics are strongly tied to global automotive trends, with a growing demand for fuel-efficient and eco-friendly vehicles driven by stricter emission regulations.

Regionally, the largest concentration of passenger car sales occurs in urban centers, particularly Tripoli, the capital, and Benghazi. These cities are the economic and political hubs of the country, where purchasing power is higher, and infrastructure development supports the adoption of modern vehicles. The rural areas of Libya, however, still rely largely on used cars, especially due to the high costs associated with new vehicles and limited access to financing options.

Market Drivers

One of the primary drivers of the Libya passenger car market is the country's low fuel prices, which make owning and operating a car highly affordable for consumers. In some cases, the price of petrol is lower than bottled water, making it an attractive proposition for drivers in Libya. This, coupled with the government's ongoing efforts to stabilize the oil industry post-conflict, is expected to keep fuel prices manageable and continue supporting car sales.

Additionally, the government's regulations on vehicle emissions are playing a critical role in shaping market demand. With stricter rules being implemented, new passenger cars with lower emissions are expected to see a rise in popularity. The market's ongoing shift from older vehicles to newer, more fuel-efficient models is expected to fuel the growth of the passenger car market, as consumers look for alternatives that align with the new environmental guidelines.

Market Restraints

Despite the market's positive outlook, several factors present challenges for growth. The political instability in Libya has long been a barrier to economic development, creating uncertainty in consumer spending and investment. This has slowed the pace of infrastructure development and hindered the availability of financing options for consumers looking to purchase new cars. The limited availability of financing has kept car ownership largely out of reach for a significant portion of the population.

Additionally, the reliance on used car imports means that the Libyan market is vulnerable to fluctuations in global trade and economic conditions. The ongoing challenge of sourcing high-quality, low-emission used cars at affordable prices can constrain the market's ability to meet rising demand, particularly in light of government restrictions on older vehicles.

Market Opportunities

The Libya passenger car market presents several opportunities for growth in the coming years. As the country's political situation stabilizes and oil production resumes, Libya's oil wealth will likely continue to fuel economic recovery, offering greater opportunities for purchasing new vehicles. Furthermore, the government's commitment to reducing emissions opens up the potential for manufacturers to introduce more environmentally friendly vehicles tailored to the Libyan market.

There is also an opportunity for increased investment in infrastructure, which could drive the demand for new passenger cars. Better roads, improved urban planning, and expanded financing options would enhance car ownership rates, especially for new cars. Additionally, the growing middle class in Libya is likely to contribute to a rise in demand for a wider range of vehicle types, including luxury and high-performance models.

Reasons to Buy the Report

✔ Gain an in-depth understanding of the Libyan passenger car market and its growth trajectory.

✔ Understand the key factors driving the market, including low fuel prices and emissions regulations.

✔ Access detailed market segmentation and regional insights to better navigate opportunities.

✔ Identify market restraints and opportunities that may impact future growth.

✔ Explore competitive dynamics and key players shaping the future of the market.

Frequently Asked Questions

1. How Big is the Libya Passenger Car Market?

2. Who are the Key Players in the Global Passenger Car Market?

3. What is the Projected Growth Rate of the Libya Passenger Car Market?

4. What is the Market Forecast for the Libya Passenger Car Market in 2031?

5. Which Region is Estimated to Dominate the Libya Passenger Car Market through the Forecast Period?

Company Insights

Key players in the Libya passenger car market include major automotive manufacturers such as Hyundai, Toyota, Volkswagen, and Ford, which are actively involved in supplying both new and used vehicles to the Libyan market. These companies play a crucial role in meeting the demand for passenger cars in the region.

Recent Developments

1. In 2022, Toyota launched a new fleet of vehicles tailored for the Libyan market, focusing on fuel efficiency and reduced emissions to comply with the country's regulatory standards.

2. Hyundai announced an expansion of its operations in Libya, including the opening of new service centers to cater to the growing demand for both new and used passenger vehicles in urban centers.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Libya Passenger Car Market Poised for Growth at a 6.1% CAGR Over the Next Decade | Persistence Market Research here

News-ID: 3944454 • Views: …

More Releases from Persistence Market Research

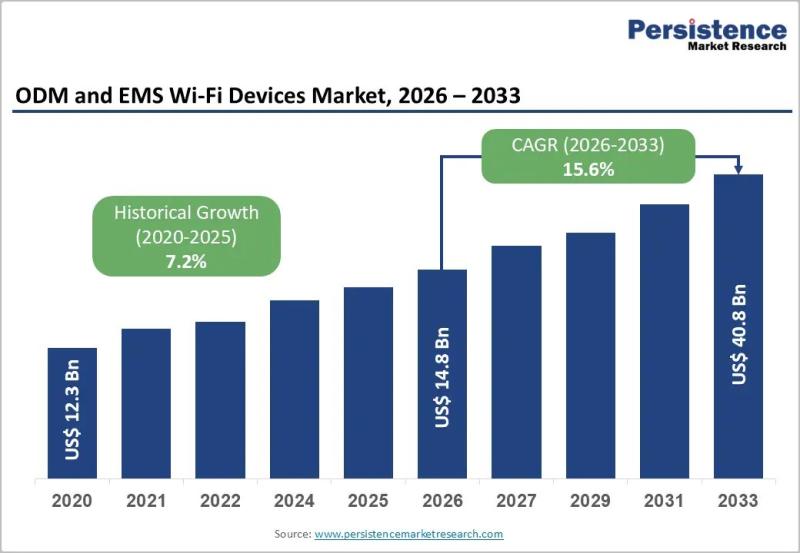

ODM and EMS Wi-Fi Devices Market to Reach US$ 40.8 Billion by 2033 at 15.6% CAGR

The global ODM and EMS Wi-Fi devices market is projected to be valued at US$ 14.8 billion in 2026 and is forecast to surge to US$ 40.8 billion by 2033, registering a robust CAGR of 15.6% between 2026 and 2033. This rapid growth reflects the accelerating demand for advanced wireless connectivity solutions across residential, enterprise, and industrial environments. The expansion of 5G infrastructure, enterprise digital transformation strategies, and large-scale IoT…

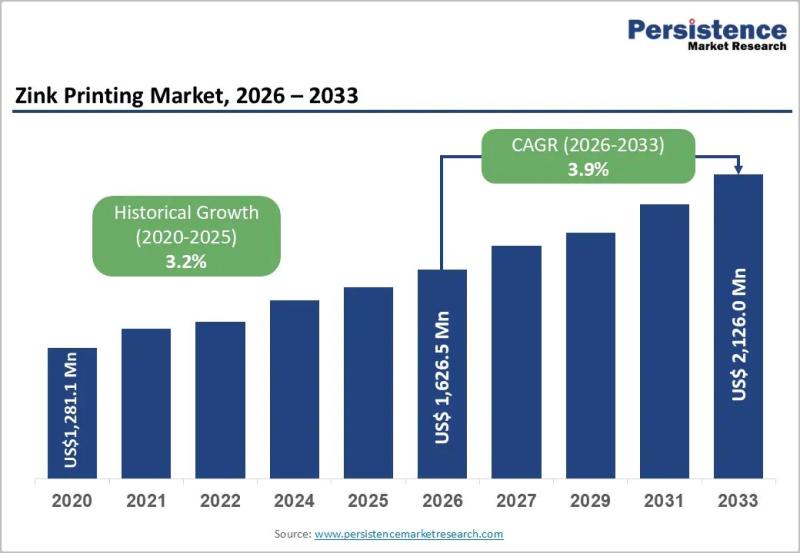

Zink Printing Market to Reach US$ 2,126.0 Million by 2033 at 3.9% CAGR

Zink Printing Market Size and Trends Analysis

The global Zink printing market is projected to be valued at US$ 1,626.5 million in 2026 and is expected to reach US$ 2,126.0 million by 2033, expanding at a CAGR of 3.9% between 2026 and 2033. Zink (Zero Ink) printing technology eliminates the need for ink cartridges by using heat-activated color crystals embedded within specialized paper. This innovation has positioned Zink printers as a…

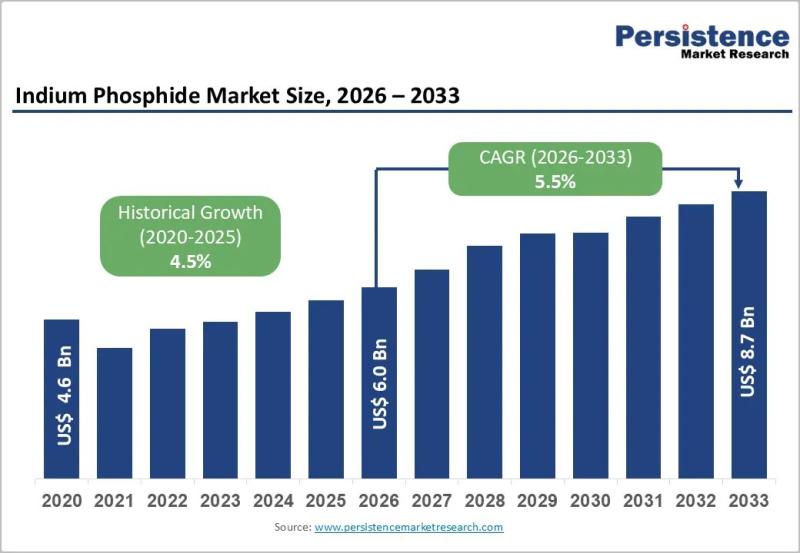

Indium Phosphide Market to Reach US$ 8.7 Billion by 2033 at 5.5% CAGR

The global Indium Phosphide (InP) market is poised for steady expansion, with its valuation expected to reach US$ 6.0 billion by 2026 and further grow to US$ 8.7 billion by 2033, registering a CAGR of 5.5% between 2026 and 2033. Indium phosphide, a high-performance compound semiconductor material, is widely used in optoelectronics, high-frequency electronics, and photonic integrated circuits (PICs). The market growth is largely fueled by the accelerating deployment of…

Roasted Corn Market to Reach $5.5B by 2033 Driven by Rising Snack Demand

The global roasted corn market is poised for steady expansion, driven by rising consumer preference for convenient, ready-to-eat snacks and increasing awareness of healthier alternatives to traditional fried snack options. Current market estimates indicate that the roasted corn market is valued at approximately US$ 3.8 billion in 2026 and is projected to reach US$ 5.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.4% between 2026 and…

More Releases for Libya

Libya Passenger Car Market - Future Scenario, Key Insights, Top Companies 2031

The Libya passenger market is projected to expand at a volume CAGR of 6.1% over the forecast period of 2021-2031 to reach sales of more than 5.5 Mn units by 2031. The fleet on roads is dominated by used cars that are imported from S. Korea, Europe, China, and the U.S., among many more countries.

In the last fifty years, Libya's urban population has grown at a rapid pace. Every year,…

Libya Passenger Car Market Size, Share, Growth Drivers, Analysis & Forecast

Report Overview

The Libya passenger market is projected to expand at a volume CAGR of 6.1% over the forecast period of 2021-2031 to reach sales of more than 5.5 Mn units by 2031.

This report provides in depth study of "Libya Passenger Car Market" using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Libya Passenger Car Market report also provides an in-depth survey of key players in the…

Libya Agriculture Market | Libya Agriculture Industry | Libya Agriculture Market …

Libya Agriculture is that the second-largest sector within the economy, Libya depends on imports in most foods. Atmospheric condition and poor soils limit farm output, and domestic food production meets nearby 25% of demand. Domestic conditions limit output, whereas income and population increase have exaggerated food consumption. Due to low rainfall, agricultural projects like the Kufra Oasis admit on underground water sources. Libya's primary agricultural water supply remains the Great…

Libya Crude Oil Refinery Outlook to 2022

Market Research Hub (MRH) has recently publicized a new study to its vast repository, which is titled as “Libya Crude Oil Refinery Outlook to 2022”. Libya Crude Oil Refinery Outlook to 2022 is a comprehensive report on crude oil refinery industry in Libya. The report also provides details on oil refineries such as name, type, operational status, operator apart from capacity data for the major processing units, for all active…

Libya Western Libya Gas Project (Wafa and Bahr Essalam) Project Panorama - Oil a …

"The Report Libya Western Libya Gas Project (Wafa and Bahr Essalam) Project Panorama - Oil and Gas Upstream Analysis Report provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

Libya Western Libya Gas Project (Wafa and Bahr Essalam) Project Panorama, GlobalDatas latest release, presents a comprehensive overview of the asset. This upstream report includes detailed qualitative and quantitative information on the…

DEMIRA - Current situation of medical care in Libya

Munich, 02/08/2011. The German non-governmental organisation DEMIRA e.V. is in Benghazi assessing the supply situation on the ground in order to organise a further shipment of aid. On the 29th July DEMIRA programme manager Marcia Hamzat accompanied a medical aid delivery which was then distributed from the central medical storage facility to hospitals and clinics in the area. Our DEMIRA staff member was able to gain a first-hand overview of…