Press release

AI in Fintech Market Predicted to Exceed USD 97.7 Billion by 2033, Rising At A CAGR Of 19.9%

Market Overview:The AI in fintech market is experiencing rapid growth, driven by rising ai adoption in banking, regulatory push for ai transparency, and ai-driven personalization boom. According to IMARC Group's latest research publication, "AI in Fintech Market Report by Type (Solutions, Services), Deployment Model (Cloud-based, On-premises), Application (Virtual Assistant (Chatbots), Credit Scoring, Quantitative and Asset Management, Fraud Detection, and Others), and Region 2025-2033," The global AI in fintech market size reached USD 17.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 97.7 Billion by 2033, exhibiting a growth rate (CAGR) of 19.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/ai-in-fintech-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Industry Trends and Drivers:

● Rising AI Adoption in Banking:

The financial technology sector is witnessing a surge in AI adoption as banks and fintech firms leverage machine learning and natural language processing to enhance customer experiences and streamline operations. AI-powered chatbots, fraud detection systems, and personalized financial recommendations are becoming industry standards, driven by the need for efficiency and customer satisfaction. This trend is fueled by increasing demand for real-time insights and the growing volume of financial data, which traditional systems struggle to manage. As competition intensifies, institutions that fail to integrate AI risk falling behind in delivering innovative, data-driven solutions.

● Regulatory Push for AI Transparency:

Governments and regulatory bodies are increasingly focusing on the ethical use of AI in fintech, creating a dynamic where compliance and innovation must coexist. New regulations demand transparency in AI decision-making processes, particularly in credit scoring, loan approvals, and risk assessment. This push is reshaping the market, as fintech companies invest in explainable AI (XAI) technologies to meet regulatory standards while maintaining competitive advantages. The demand for compliant AI solutions is driving collaboration between tech providers and financial institutions, fostering a market environment where trust and accountability are paramount.

● AI-Driven Personalization Boom:

Consumer expectations for hyper-personalized financial services are propelling the demand for AI-driven solutions in fintech. From tailored investment portfolios to customized insurance plans, AI algorithms analyze user behavior and preferences to deliver highly relevant offerings. This trend is particularly prominent among millennials and Gen Z, who prioritize seamless digital experiences. Fintech companies are capitalizing on this by integrating AI into mobile apps and online platforms, creating a competitive edge. As personalization becomes a key differentiator, the market is shifting toward AI tools that can predict customer needs and deliver actionable insights in real time.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4483&method=1670

Leading Companies Operating in the Global AI in Fintech Industry:

● Amazon Web Services Inc. (Amazon.com Inc)

● Google LLC (Alphabet Inc.)

● Inbenta Technologies Inc.

● Intel Corporation

● International Business Machines Corporation

● Microsoft Corporation

● Salesforce.com Inc.

● Samsung Electronics Co. Ltd.

● TIBCO Software Inc.

● Trifacta

● Verint Systems Inc.

AI in Fintech Market Report Segmentation:

Breakup By Type:

● Solutions

● Services

Solutions exhibit a clear dominance in the market attributed to the increasing adoption of AI-driven software and platforms that enhance the efficiency and effectiveness of financial services.

Breakup By Deployment Mode:

● Cloud-based

● On-premises

Cloud-based represents the largest segment owing to its scalability, flexibility, and lower costs.

Breakup By Application:

● Virtual Assistant (Chatbots)

● Credit Scoring

● Quantitative and Asset Management

● Fraud Detection

● Others

Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market due to its advanced technological infrastructure, rising investments in AI innovation, and the presence of major fintech companies.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=4483&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Fintech Market Predicted to Exceed USD 97.7 Billion by 2033, Rising At A CAGR Of 19.9% here

News-ID: 3921235 • Views: …

More Releases from IMARC Group

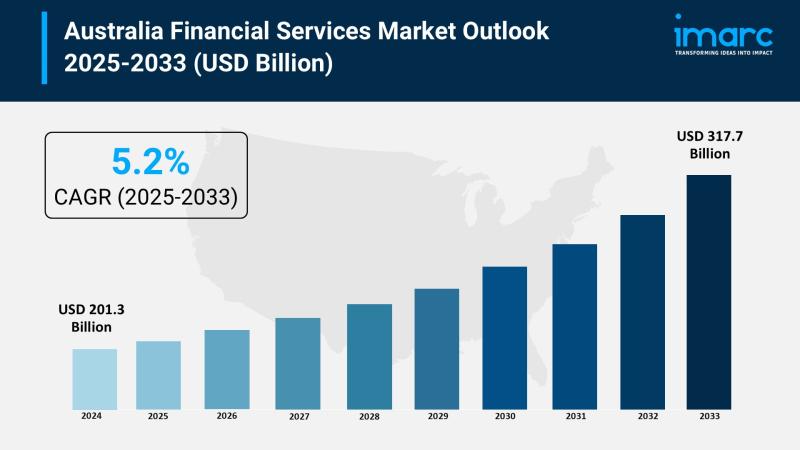

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

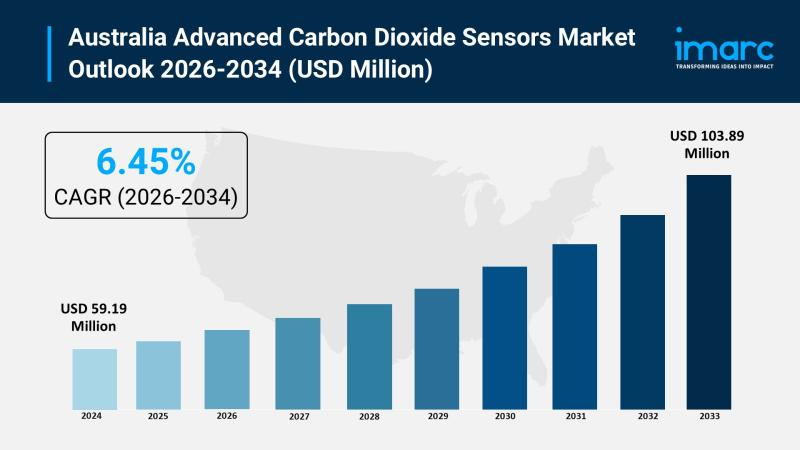

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

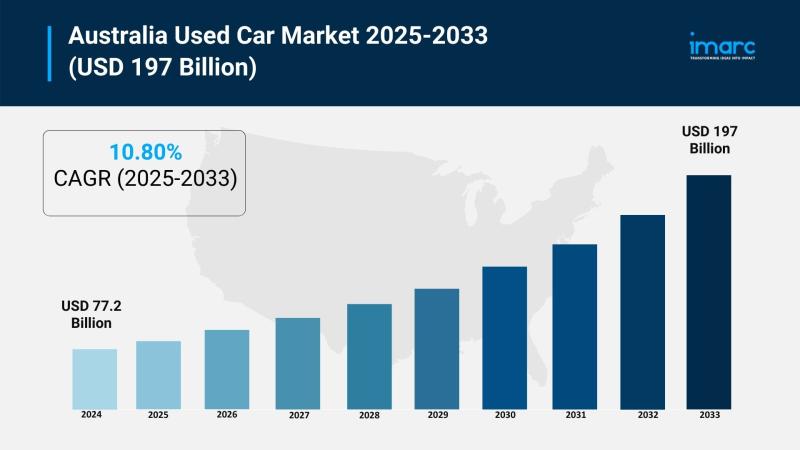

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

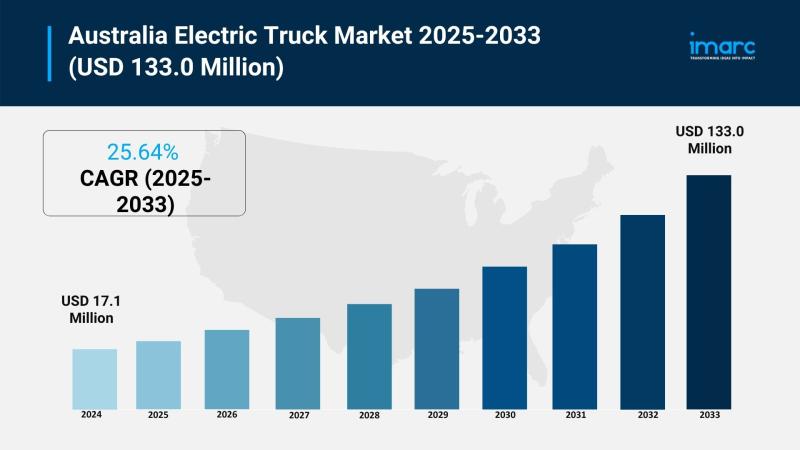

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…