Press release

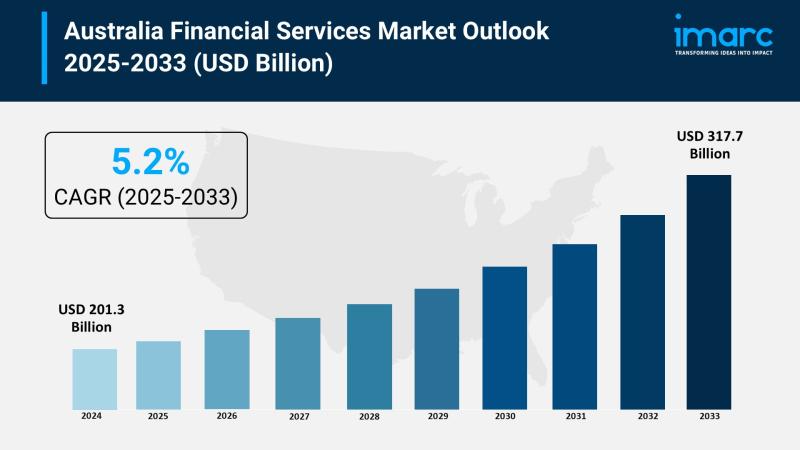

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market OverviewThe Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer awareness leading to greater adoption of financial technology services.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-financial-services-market/requestsample

How AI is Reshaping the Future of Australia Financial Services Market:

• AI enables hyper-personalized financial solutions by leveraging Open Banking data, allowing institutions to tailor product recommendations and optimize pricing strategies for improved customer satisfaction.

• Machine learning algorithms enhance credit risk assessments, enabling more accurate and faster decision-making for lending and payments.

• AI-powered cybersecurity systems strengthen fraud detection and real-time threat mitigation, addressing increasing risks such as phishing and identity theft.

• Automation and AI-integrated advisory services support the rising demand for personalized financial advice, improving client engagement and portfolio management.

• AI facilitates efficient regulatory compliance through regtech solutions, helping institutions manage anti-money laundering (AML), Know Your Customer (KYC), and data protection obligations with reduced operational costs.

• Australian fintech firms backed by AI innovations, such as Macquarie Group's digital infrastructure initiatives, are driving advancements in blockchain technology and digital payments, supported by over $2 billion in investments.

Market Growth Factors

Australia's financial services market is propelled by a robust superannuation and wealth management sector. The country's mandatory superannuation system has accumulated one of the world's largest pension fund pools, providing strong momentum to the market. This growing retirement savings pool fuels demand for expert financial guidance on portfolio diversification, investment planning, and wealth preservation. Financial advisors and wealth management firms are increasingly delivering personalized services catering to different life stages and risk appetites. This has fostered innovation in financial products such as managed funds and retirement income solutions, solidifying wealth management as a cornerstone of the financial services sector in Australia.

The market also benefits from high financial inclusion and consumer engagement. A significant majority of the Australian population accesses banking, credit, insurance, and investment services. Coupled with increasing financial literacy, consumers actively manage finances using online tools, apps, and websites. The shift towards proactive money management fuels demand for tailored, user-friendly financial solutions. Providers innovate with seamless digital experiences and diverse financial products that meet evolving consumer needs. This high engagement strengthens competition, improves product accessibility, and adapts services to lifestyle and economic changes, driving ongoing market growth.

A strong regulatory framework further supports the Australia's financial services sector. Oversight by key bodies such as the Australian Securities and Investments Commission (ASIC) and Australian Prudential Regulation Authority (APRA) ensures transparency, accountability, and ethical conduct. Recent reforms include tighter lending standards, enhanced disclosure requirements, and strengthened governance protocols, boosting investor confidence and market stability. Although compliance costs have increased, the more resilient financial ecosystem has attracted domestic and international investment. This regulatory environment fosters sustainable growth and maintains Australia's appeal as a stable financial services hub.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/australia-financial-services-market

Market Segmentation

Type Insights:

• Lending And Payments

• Insurance

• Reinsurance And Insurance Brokerage

• Investments

• Foreign Exchange Services

Size of Business Insights:

• Small And Medium Business

• Large Business

End User Insights:

• Individuals

• Corporates

• Government

• Investment Institution

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• Macquarie Group

• Commonwealth Bank

• Amazon

• NAB

Recent Developement & News

• February 2025: The New South Wales government selected Commonwealth Bank to deliver financial services and assistance including liquidity management, transaction banking, merchant acquisition, foreign exchange, cross-border payments, and transit transaction services. The bank's technology support aims to improve travel planning, payment, and information access for the state.

• January 2025: Amazon and NAB introduced the PayTo payment method, allowing Amazon.com.au customers to make safe and convenient one-time or recurring purchases directly from their bank accounts via online banking authorization, enhancing payment options in the e-commerce segment.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to an analyst for a customized report sample: https://www.imarcgroup.com/request?type=report&id=32704&flag=C

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033 here

News-ID: 4347545 • Views: …

More Releases from IMARC Group

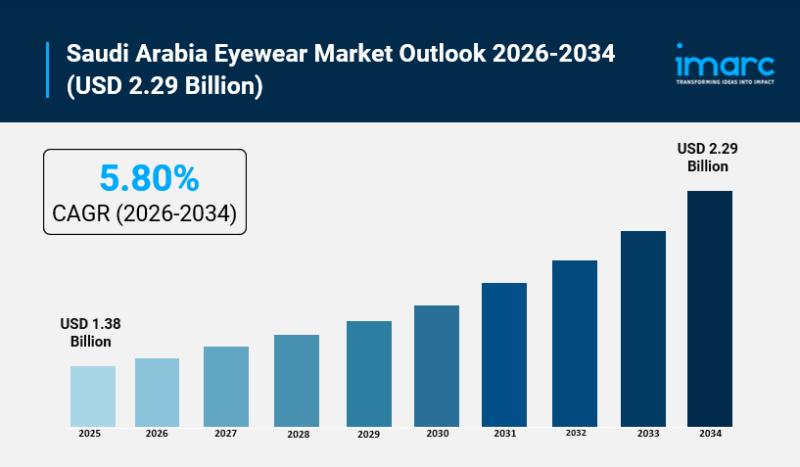

Saudi Arabia Eyewear Market Eyes USD 2.29 Billion by 2034 Already Hits USD 1.38 …

Saudi Arabia Eyewear Market Overview

Market Size in 2025: USD 1.38 Billion

Market Forecast in 2034: USD 2.29 Billion

Market Growth Rate 2026-2034: 5.80%

According to IMARC Group's latest research publication, "Saudi Arabia Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034", The Saudi Arabia eyewear market size was valued at USD 1.38 Billion in 2025 and is projected to reach USD 2.29 Billion by 2034, growing at…

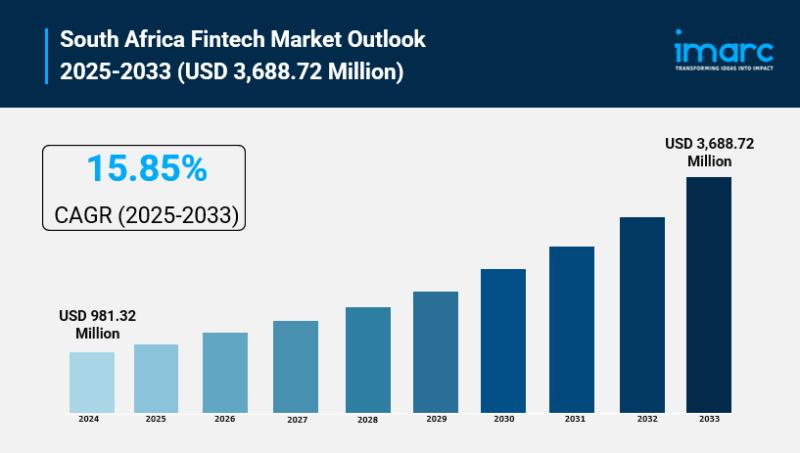

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

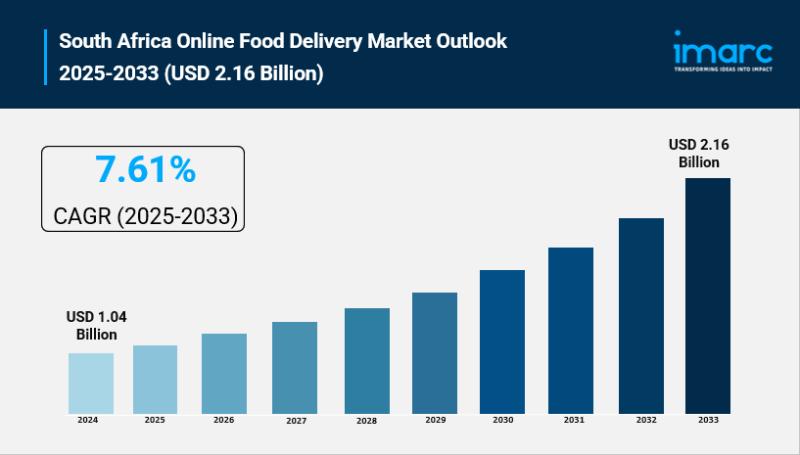

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

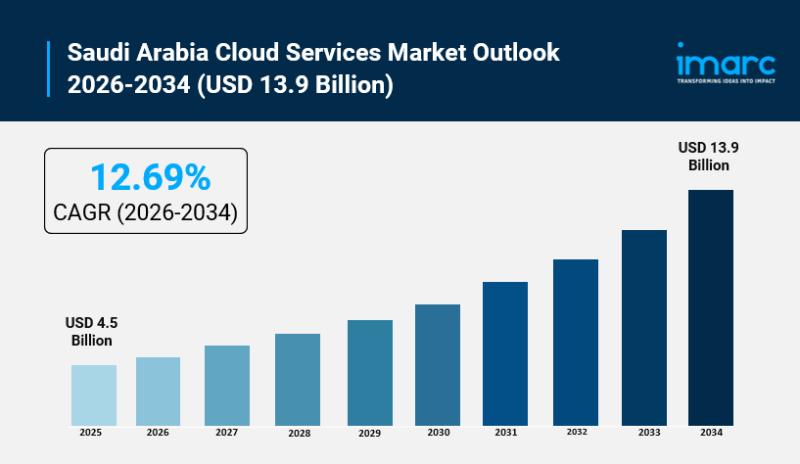

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…