Press release

Global B2B Payments Market Outlook: Growth Trends, Digital Transformation, and Future Projections (2025-2033)

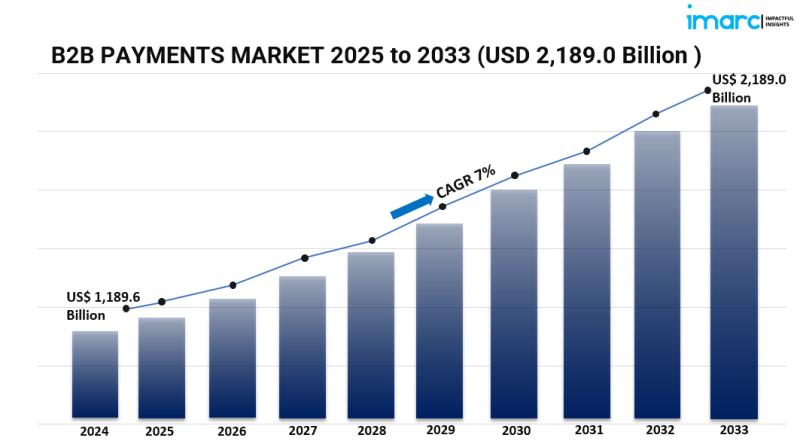

Market Overview:The global B2B payments market has experienced substantial growth, reaching a valuation of USD 1,189.6 billion in 2024. This surge is primarily attributed to the widespread adoption of digital payment solutions, the rapid expansion of e-commerce, and the increasing need for efficient cross-border transactions. Looking ahead, the market is projected to achieve a value of USD 2,189.0 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7% during the forecast period from 2025 to 2033.

Study Assumption Years:

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

B2B Payments Market Key Takeaways:

Market Size and Growth: The B2B payments market was valued at USD 1,189.6 billion in 2024 and is expected to reach USD 2,189.0 billion by 2033, growing at a CAGR of 7% from 2025 to 2033.

Regional Dominance: Asia-Pacific leads the market, holding a 36.7% share in 2024, driven by rapid digitalization and a burgeoning e-commerce sector.

Payment Type: Domestic payments dominate the market, attributed to their higher transaction volumes and simplicity in local business dealings.

Payment Mode: Traditional payment methods currently hold the majority share, reflecting established business practices, though digital modes are rapidly gaining traction.

Enterprise Size: Large enterprises represent the leading market segment due to their complex payment needs and substantial transaction volumes.

Industry Vertical: The manufacturing sector exhibits clear dominance, necessitating efficient B2B payment processes to manage extensive supply chain networks.

Technological Advancements: The integration of advanced technologies like blockchain and AI is enhancing transaction security and efficiency, propelling market growth.

Ask for a sample copy of this report : https://www.imarcgroup.com/b2b-payments-market/requestsample

Market Growth Factors:

Digital Transformation and E-commerce Expansion:

The ongoing digital transformation across industries has revolutionized B2B payment processes. Businesses are increasingly adopting electronic invoicing, digital payment platforms, and real-time transaction tracking to enhance efficiency and reduce operational costs. The rapid expansion of e-commerce has further amplified the need for secure and seamless B2B payment methods, especially for international transactions. This shift towards digitalization is a significant driver of market growth.

Technological Innovations and Security Enhancements:

Advancements in technology have led to the development of innovative payment solutions that offer enhanced security and reporting capabilities. The increasing focus on financial transparency, regulatory compliance, and fraud prevention has compelled businesses to adopt these advanced systems. The integration of technologies like blockchain and artificial intelligence in payment processes is enhancing transaction security and efficiency, thereby propelling market growth.

Demand for Real-Time Payment Processing:

The growing need for faster, more secure, and cost-effective payment options is driving the adoption of real-time payment processing systems. Businesses are seeking solutions that optimize working capital management and strengthen supplier relationships. The heightened demand for real-time payment processing and settlement is contributing to the expansion of the B2B payments market.

Market Segmentation:

Breakup by Payment Type:

Domestic Payments: Transactions conducted within the same country, offering simplicity and compliance with local regulations.

Cross-Border Payments: Transactions between businesses in different countries, requiring currency conversion and adherence to international regulations.

Breakup by Payment Mode:

Traditional: Conventional methods such as checks and wire transfers, widely used due to established business practices.

Digital: Modern methods including electronic funds transfers, mobile payments, and virtual wallets, offering speed and efficiency.

Breakup by Enterprise Size:

Large Enterprises: Organizations with extensive operations and high transaction volumes, necessitating sophisticated payment systems.

Small and Medium-sized Enterprises (SMEs): Businesses with smaller operations, focusing on cost-effective and efficient payment solutions.

Breakup by Industry Vertical:

BFSI (Banking, Financial Services, and Insurance): Requires secure and efficient payment systems to manage large-scale transactions.

Manufacturing: Involves complex supply chains, necessitating streamlined payment processes for procurement and distribution.

IT and Telecom: Demands rapid and secure transactions to support technological services and infrastructure.

Metals and Mining: Requires robust payment systems to handle large transactions and international trade.

Energy and Utilities: Needs efficient payment processes to manage transactions across various stakeholders.

Others: Encompasses various industries with specific payment requirements.

Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Regional Insights:

Asia-Pacific currently leads the B2B payments market, holding a 36.7% share in 2024.

This dominance is attributed to rapid digitalization, a burgeoning e-commerce sector, and the widespread adoption of electronic payment methods across countries like China, Japan, and India. The region's emphasis on technological innovation and supportive regulatory frameworks further bolster its market position.

Recent Developments & News:

The B2B payments landscape is witnessing significant advancements:

Technological Integration: Companies are increasingly adopting artificial intelligence (AI) and blockchain technologies to enhance transaction security, streamline processes, and reduce operational costs.

Growth of Digital Payment Methods: The use of virtual cards and other digital payment solutions is surging, with projections indicating a growth of over 250% by 2028.

Strategic Partnerships: Financial institutions are forming alliances to expand their payment services. For instance, Credem, an Italian lender, partnered with Worldline to manage merchant payment activities in Italy, aiming to enhance digital payment offerings for retailers.

Key Players:

American Express Company

Bank of America Corporation

Capital One

Citigroup Inc.

JPMorgan Chase & Co.

Mastercard Inc.

Payoneer Inc.

PayPal Holdings Inc.

Paystand Inc.

Stripe Inc.

Visa Inc.

Wise Payments Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5143&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global B2B Payments Market Outlook: Growth Trends, Digital Transformation, and Future Projections (2025-2033) here

News-ID: 3919214 • Views: …

More Releases from IMARC Group

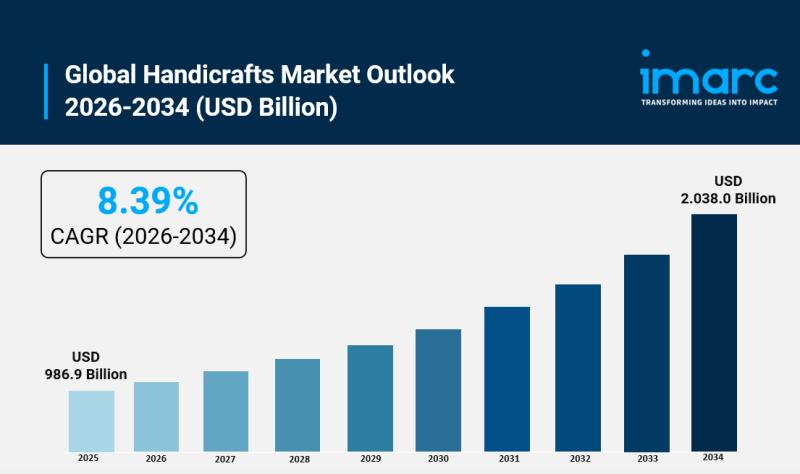

Handicrafts Market to Grow at 8.39% CAGR During 2026-2034, Reaching USD 2,038.0 …

Market Overview:

According to IMARC Group's latest research publication, "Handicrafts Market Report by Product Type (Woodware, Artmetal Ware, Handprinted Textiles and Scarves, Embroidered and Crocheted Goods, Zari and Zari Goods, Imitation Jewelry, Sculptures, Pottery and Glass wares, Attars and Agarbattis, and Others), Distribution Channel (Mass Retailers, Departmental Stores, Independent Retailers, Specialty Stores, Online Stores, and Others), End-Use (Residential, Commercial), and Region 2026-2034", The global handicrafts market size reached USD 986.9 Billion…

Silicone Sealant Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis an …

Setting up a Silicone Sealant manufacturing plant positions investors in one of the most dynamic and high-growth segments of the specialty chemicals and construction materials value chain, backed by sustained global growth driven by rising demand for versatile, high-performance sealants across construction, automotive, electronics, and healthcare industries. As urbanization accelerates, energy-efficient building requirements increase, and electric vehicle production expands, the global silicone sealant industry continues to present compelling opportunities for…

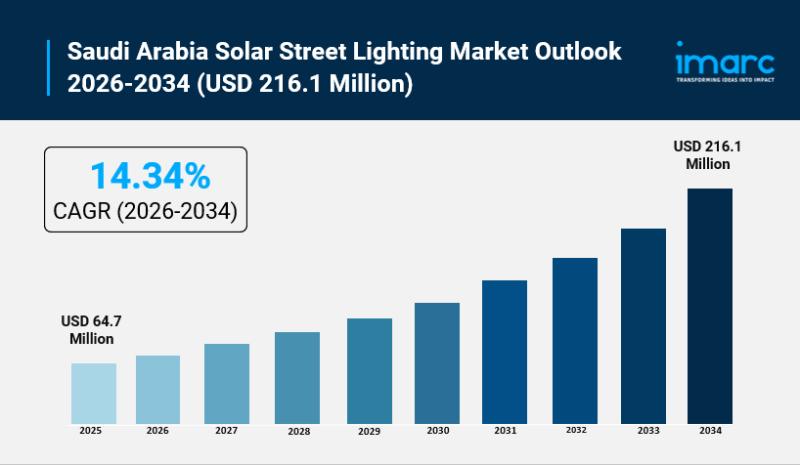

Saudi Arabia Solar Street Lighting Market Size to Reach USD 216.1 Million by 203 …

Saudi Arabia Solar Street Lighting Market Overview

Market Size in 2025: USD 64.7 Million

Market Forecast in 2034: USD 216.1 Million

Market Growth Rate 2026-2034: 14.34%

According to IMARC Group's latest research publication, "Saudi Arabia Solar Street Lighting Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034", the Saudi Arabia solar street lighting market size reached USD 64.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD…

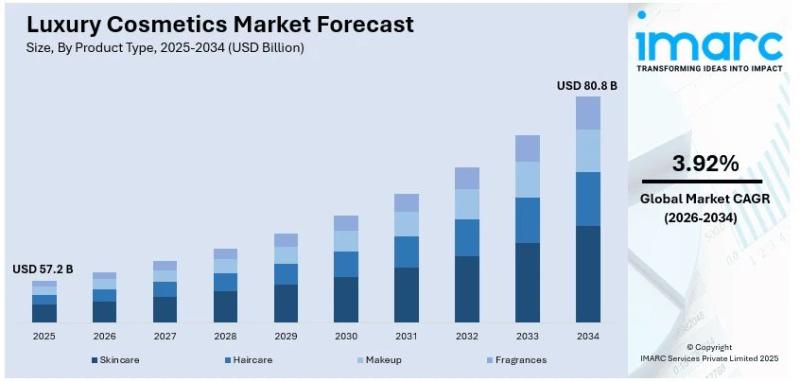

Luxury Cosmetics Market to Grow at 3.92% CAGR During 2026-2034, Reaching USD 80. …

Market Overview:

According to IMARC Group's latest research publication, "Luxury Cosmetics Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, End User, and Region, 2026-2034", The global luxury cosmetics market size was valued at USD 57.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 80.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.92% during 2026-2034.

This detailed analysis primarily encompasses industry…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…