Press release

Crude Oil Price Trend: A Comprehensive Analysis

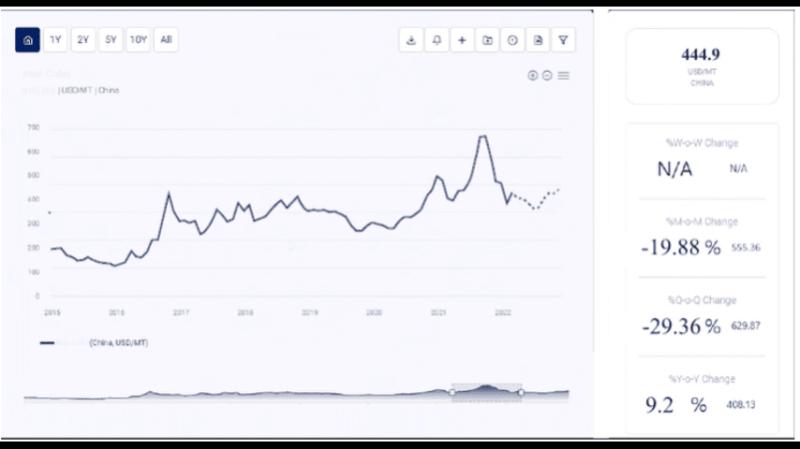

Crude oil is a vital energy source that powers a wide range of industries, from transportation and electricity generation to manufacturing and agriculture. As one of the most traded commodities in the world, the price of crude oil has a profound effect on the global economy, influencing inflation rates, trade balances, and consumer prices. Fluctuations in crude oil prices are often driven by a complex mix of economic, geopolitical, and environmental factors.Crude Oil Price Trend:- https://shorturl.at/MiBlM

This article explores the historical trends, recent developments, and future projections for crude oil prices. Understanding these trends is essential for businesses, investors, and policymakers as they navigate the complexities of the energy market.

Historical Trends in Crude Oil Prices

1970s: Oil Shocks and Price Spikes

In the 1970s, crude oil prices experienced dramatic increases due to geopolitical events. The 1973 oil embargo by the Organization of the Petroleum Exporting Countries (OPEC) resulted in a quadrupling of oil prices as OPEC reduced production in response to Western support for Israel. This oil shock caused global economic turmoil, and the price of crude oil jumped from around $3 per barrel to nearly $12 per barrel.

Enquire For Regular Prices: https://shorturl.at/THA2y

A second oil crisis occurred in 1979 following the Iranian Revolution, which led to another sharp increase in prices, reaching nearly $40 per barrel by 1980. These oil shocks highlighted the dependence of the global economy on stable oil supplies and underscored the impact of geopolitical events on crude oil prices.

1980s-1990s: Price Decline and Market Liberalization

In the 1980s, crude oil prices gradually declined as new oil supplies came online, particularly from non-OPEC countries like the North Sea and Alaska. Additionally, OPEC increased production, leading to an oversupply that drove prices down. By 1986, crude oil prices had fallen to around $10 per barrel, marking a significant shift from the highs of the previous decade.

In the 1990s, crude oil prices remained relatively stable, fluctuating between $15 and $25 per barrel. Market liberalization and advancements in drilling technology, such as offshore drilling and enhanced oil recovery, helped stabilize supplies. This period of relative price stability allowed global economies to grow without the disruptive impact of oil price volatility.

2000s: Demand Surge and Price Volatility

In the early 2000s, crude oil prices began a steady upward trend, driven by surging demand from emerging markets, particularly China and India. Rapid economic growth in these countries fueled demand for energy, and crude oil prices rose from around $25 per barrel in 2003 to over $140 per barrel in 2008.

The 2008 financial crisis, however, led to a sharp decline in oil prices as global demand plummeted. Prices dropped from their peak of $147 per barrel in July 2008 to around $40 per barrel by the end of the year. The volatility of this period underscored the sensitivity of crude oil prices to economic conditions and demand fluctuations.

2010-2014: Recovery and Production Boom

From 2010 to 2014, crude oil prices gradually recovered as the global economy rebounded from the financial crisis. Prices stabilized around $100 per barrel, driven by steady demand and geopolitical tensions in oil-producing regions. During this period, technological advancements in hydraulic fracturing and horizontal drilling led to a boom in U.S. shale oil production, making the United States a major oil producer and influencing global supply dynamics.

Despite increased U.S. production, geopolitical tensions in the Middle East and North Africa, such as the Arab Spring, contributed to price stability at high levels. However, by 2014, the oil market was set to experience another significant shift.

2014-2016: Price Collapse and OPEC Response

In 2014, crude oil prices experienced a sharp decline due to an oversupply in the market. Increased U.S. shale production, coupled with OPEC's decision not to reduce output, led to a supply glut. By early 2016, crude oil prices had fallen to below $30 per barrel, marking a dramatic shift from the high prices of the previous decade.

OPEC and non-OPEC producers responded by reaching an agreement to cut production in late 2016, which helped stabilize prices. This period highlighted the growing influence of U.S. shale production on global oil markets and the challenges OPEC faced in managing supply.

2020: Pandemic-Induced Price Crash

The COVID-19 pandemic in 2020 led to an unprecedented crash in crude oil prices. Lockdowns and travel restrictions around the world resulted in a collapse in demand, causing prices to plummet. In April 2020, the price of West Texas Intermediate (WTI) crude briefly turned negative, reaching -$37 per barrel, as storage facilities reached capacity and traders were forced to pay buyers to take barrels off their hands.

OPEC and its allies responded by implementing record production cuts to stabilize the market. By the end of 2020, crude oil prices had recovered to around $40-$50 per barrel, reflecting a gradual return of demand as economies reopened.

Current Crude Oil Price Trends (2021-Present)

2021: Recovery and Demand Surge

In 2021, crude oil prices experienced a strong recovery, driven by a rebound in global demand as economies reopened and vaccination campaigns progressed. Increased demand for transportation fuels and industrial energy, combined with limited production increases by OPEC+, led to a rapid rise in prices. By mid-2021, prices had reached over $70 per barrel.

Additionally, rising natural gas prices in Europe and Asia drove some power generators to switch to oil-based fuels, further supporting demand. Concerns about supply constraints and geopolitical tensions, particularly in the Middle East, contributed to continued price volatility.

2022: Geopolitical Tensions and Supply Chain Disruptions

In 2022, crude oil prices surged to multi-year highs due to geopolitical tensions following Russia's invasion of Ukraine. Russia is one of the world's largest oil producers, and the conflict raised concerns about potential supply disruptions. Sanctions imposed on Russia by Western nations contributed to a spike in oil prices, which reached over $100 per barrel in early 2022.

In addition to geopolitical factors, rising inflation and interest rate hikes by central banks worldwide created economic uncertainty. Energy prices remained volatile as supply chain disruptions, labor shortages, and logistical challenges affected oil production and transportation.

Factors Influencing Crude Oil Price Trends

1. Supply and Demand Dynamics

The balance between supply and demand is a primary driver of crude oil prices. Increased production or reduced demand leads to lower prices, while supply shortages or demand surges result in higher prices. Factors influencing supply include production decisions by OPEC, technological advancements, and geopolitical events. Demand is driven by economic growth, industrial activity, and changes in consumer behavior.

2. Geopolitical Events and Conflicts

Geopolitical tensions, particularly in major oil-producing regions like the Middle East, Russia, and North Africa, can lead to supply disruptions and price spikes. Conflicts, sanctions, and political instability can restrict oil exports, affecting global supply and driving prices higher. Major events, such as the Iran-Iraq War, the Gulf War, and Russia's invasion of Ukraine, have historically caused price volatility.

3. OPEC Policies and Production Quotas

OPEC, along with its allies (OPEC+), plays a significant role in managing oil prices by setting production quotas. OPEC's production decisions can influence global supply and impact prices. For example, production cuts can raise prices by reducing supply, while increases in output can lead to lower prices.

4. Technological Advancements in Oil Production

Advancements in drilling technology, such as hydraulic fracturing and deepwater drilling, have transformed the oil industry. The U.S. shale boom, enabled by fracking, significantly increased global oil supply and influenced price trends. Technological improvements reduce production costs and allow access to previously inaccessible reserves, impacting supply and price dynamics.

5. Environmental Regulations and the Energy Transition

Environmental policies and the shift toward renewable energy are reshaping the oil industry. As countries adopt carbon reduction targets and invest in renewable energy, long-term demand for oil may decline. Additionally, stricter regulations on emissions and drilling practices can increase production costs, potentially influencing prices.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Procurement Resource is a premier market research firm dedicated to delivering in-depth insights and analysis on the procurement and production costs of a wide range of commodities and products. Backed by a team of experienced industry professionals, Procurement Resource provides detailed reports that encompass every aspect of the supply chain-from sourcing raw materials to final product manufacturing. Their services are tailored to help businesses enhance their procurement strategies, minimize costs, and improve overall efficiency. With robust market intelligence and proprietary cost models, Procurement Resource empowers clients to make well-informed decisions, remain competitive, and foster sustainable growth in today's dynamic market environment.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crude Oil Price Trend: A Comprehensive Analysis here

News-ID: 3682410 • Views: …

More Releases from Procurement Resource

Cocoa Butter Price Trend: Market Drivers, Supply Dynamics, and Global Outlook fo …

The Cocoa Butter Price Trend has become a strategic point of attention for confectionery manufacturers, personal care brands, food processors, commodity traders, and procurement leaders across global supply chains. As cocoa butter remains one of the most essential raw materials in chocolate production and a core ingredient in cosmetics, pharmaceuticals, and nutraceuticals, fluctuations in its price directly influence cost structures, profit margins, and retail pricing strategies across multiple industries.

Inquire for…

Dichloromethane Price Trend Analysis Report By Procurement Resource

Dichloromethane (DCM), also known as methylene chloride, is a volatile, colorless liquid primarily used as a solvent in various industrial processes. It plays a critical role in paint stripping, pharmaceuticals, adhesives, and metal cleaning. With increasing demand and changing dynamics across global supply chains, the Dichloromethane price trend has become a key point of interest for stakeholders across industries.

Dichloromethane Price Trend Analysis Report: https://www.procurementresource.com/resource-center/dichloromethane-price-trends

This article explores a comprehensive overview of…

Ammonium Nitrate Production Cost Analysis

Ammonium nitrate is a widely used inorganic chemical compound with significant applications in fertilizers, explosives, mining, construction, and industrial blasting. Due to its high nitrogen content and strong oxidizing properties, ammonium nitrate plays a crucial role in global agriculture and industrial development. Understanding the ammonium nitrate production cost structure is essential for manufacturers, investors, and procurement professionals operating in fertilizer and chemical markets.

Request a Free Sample:- https://www.procurementresource.com/production-cost-report-store/ammonium-nitrate/request-sample

This article provides a…

Naphthalene Sulfonic Acid Price Trend: Cost Drivers, Supply Dynamics, and Global …

The Naphthalene Sulfonic Acid Price Trend has become an increasingly important indicator for manufacturers, procurement teams, and industrial planners operating across construction chemicals, textiles, dyes, agrochemicals, and specialty chemical segments. As a key intermediate used in the production of concrete admixtures, dispersants, dye intermediates, and surfactants, fluctuations in naphthalene sulfonic acid pricing have a direct impact on downstream cost structures and profit margins.

Inquire for Latest Market Prices :- https://www.procurementresource.com/resource-center/naphthalene-sulfonic-acid-price-trends/pricerequest

In 2025,…

More Releases for OPEC

CBRN Protection Suits Market Size, Share Projections 2031 by Key Manufacturer-CQ …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global CBRN Protection Suits Market size was valued at USD 6.1 Billion in 2023 and is projected to reach USD 10.4 Billion by 2030, growing at a CAGR of 5.7% during the forecasted period 2024 to 2031.

What is the current outlook for the CBRN Protection Suits Market?

The CBRN (Chemical, Biological, Radiological, and Nuclear) Protection Suits Market is expected to experience…

Lightweight Protective CBRN Oversuit Market Report 2023 | In Depth Analysis With …

The latest competent intelligence report published by SMI with the title "An increase in demand and Opportunities for Lightweight Protective CBRN Oversuit Market 2023″ provides a sorted image of the Lightweight Protective CBRN Oversuit industry by analysis of research and information collected from various sources that have the ability to help the decision-makers in the global market to play a significant role in making a gradual impact on the global…

UXO Detection Market Advanced Technologies with Growth Trends by 2027 - Vallon G …

Rise in military technology development to safeguard the lives of troops deployed in active combat zones is significantly driving the growth of the UXO detection market across the world. Technologies such as AI and detection through drones, etc. are being deployed to increase the scanning efficiency of detectors.

UXO Detection Market Forecast to 2027 - COVID-19 Impact and Global Analysis By System Type (Hardware, Software) and Geography

Get Sample PDF Copy at…

An Overview on Global Oil and Gas Market 2019-2025| Prominent Players Exxon Mobi …

The oil and gas sector, which is considered the world's largest sector in terms of dollar value globally, is a global powerhouse that employs hundreds of thousands of workers globally and earns billions of dollars annually worldwide. In regions with major NOCs, these oil and gas companies are so important that they often donate significant amounts to national GDP.

Leading Players of Global Oil and Gas Market:

• OPEC

• Exxon Mobil

• Petro China

• Chevron

• Total

• Sinopec

• Royal Dutch Shell

• Gazprom

• Rosneft

Request…

Oil & Gas Pumps Market - The demand for OPEC crude is projected to increase to n …

Definition

Oil & gas pumps are used in process of extracting oil and gas resources, in processing or in delivering as per the requirement. The centrifugal pump is the most common type of pump used in the oil & gas industry. Other types of oil & gas pumps including positive displacement pumps, petrochemical pumps, oil transfer pumps, etc., are also finding large application in the oil and gas industry.

About the Report

The…

Europe’s Markets to Remain under Pressure, As Investors Await the G20 Summit a …

Europe’s investors’ eyes are on the G20 summit to be held from November 30 to December 1 in Argentina. Investors expect that some new arrangements might be worked out by the US and China that would hopefully help to break the trade impasse. The positive expectations are driven by the US President Donald Trump’s saying earlier that he intends to discuss the situation with the Chinese leader on the sidelines.

Another…