Press release

Soybean Oil Prices: Latest News, Price Trend, Monitor, Historical Data and Forecast

𝗦𝗼𝘆𝗯𝗲𝗮𝗻 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗦𝗲𝗰𝗼𝗻𝗱 𝗤𝘂𝗮𝗿𝘁𝗲𝗿 𝟮𝟬𝟮𝟰:• 𝗨𝗸𝗿𝗮𝗶𝗻𝗲: 905 USD/MT

• 𝗖𝗵𝗶𝗻𝗮: 920 USD/MT

The latest report by IMARC Group, titled " 𝗦𝗼𝘆𝗯𝗲𝗮𝗻 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀, 𝗧𝗿𝗲𝗻𝗱, 𝗖𝗵𝗮𝗿𝘁, 𝗗𝗲𝗺𝗮𝗻𝗱, 𝗠𝗮𝗿𝗸𝗲𝘁 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀, 𝗡𝗲𝘄𝘀, 𝗛𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝗮𝗻𝗱 𝗙𝗼𝗿𝗲𝗰𝗮𝘀𝘁 𝗗𝗮𝘁𝗮 𝗥𝗲𝗽𝗼𝗿𝘁 𝟮𝟬𝟮𝟰 𝗘𝗱𝗶𝘁𝗶𝗼𝗻," provides a thorough examination of the price trend. This report delves into the Price of Soybean Oil globally, presenting a detailed analysis, along with informative Price Chart. Through comprehensive Price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the Demand, analyzing how it impacts industry dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this Prices report an invaluable resource for industry stakeholders.

𝗥𝗲𝗽𝗼𝗿𝘁 𝗢𝗳𝗳𝗲𝗿𝗶𝗻𝗴:

• 𝗠𝗼𝗻𝘁𝗵𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

• 𝗤𝘂𝗮𝗿𝘁𝗲𝗿𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

• 𝗕𝗶𝗮𝗻𝗻𝘂𝗮𝗹𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

The study delves into the factors affecting Soybean Oil price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the industry, equipping stakeholders with the latest information on industry fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗙𝗼𝗿 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗖𝗼𝗽𝘆 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁: https://www.imarcgroup.com/soybean-oil-pricing-report/requestsample

𝗞𝗲𝘆 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗼𝗻 𝘁𝗵𝗲 𝗦𝗼𝘆𝗯𝗲𝗮𝗻 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗧𝗿𝗲𝗻𝗱:

The soybean oil prices are influenced by a confluence of factors that shape its dynamics. Primarily, the demand for soybean oil is driven by its extensive use in food products, biodiesel production, and industrial applications. Rising health consciousness among consumers has led to increased consumption of vegetable oils, with soybean oil being favored for its favorable fatty acid profile. Additionally, government mandates and incentives for renewable energy have spurred biodiesel production, further boosting soybean oil demand. Supply-side factors also play a critical role; fluctuations in weather conditions, such as droughts or excessive rainfall in key producing regions like the United States and Brazil, can impact soybean yields and, consequently, oil availability. Furthermore, geopolitical tensions and trade policies can disrupt supply chains and affect global market prices. The interplay of these elements is compounded by speculative trading and investor sentiment in commodities markets, which can lead to price volatility. This, along with technological advancements in extraction and processing methods have improved production efficiency, allowing for better margins, thus affecting market growth.

𝗙𝗮𝗰𝘁𝗼𝗿𝘀 𝗔𝗳𝗳𝗲𝗰𝘁𝗶𝗻𝗴 𝗦𝗼𝘆𝗯𝗲𝗮𝗻 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗔𝗰𝗿𝗼𝘀𝘀 𝗥𝗲𝗴𝗶𝗼𝗻𝘀 𝗶𝗻 𝟮𝟬𝟮𝟰:

𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀: The soybean oil prices in the United States are experiencing significant price volatility, with rising prices due to low inventory levels and increased regional demand. Market participants face challenges related to limited soybean oil supplies, prompting continuous inquiries from regional markets. To navigate this environment, manufacturing units sustain production levels despite increased input costs, particularly due to the scarcity of feed soybeans. Freight charges increased consistently, thereby fostering a positive trading sentiment throughout the quarter.

𝗜𝗻 𝘁𝗵𝗲 𝗔𝗣𝗔𝗖 𝗥𝗲𝗴𝗶𝗼𝗻: In the Asia Pacific region, soybean oil prices increased, particularly in China, due to supply chain disruptions caused by adverse weather in major soybean-producing regions, rising production costs for inputs like fertilizers and labor, and the demand from downstream sectors, especially biofuels and food industries. In China, substantial price fluctuations occurred due to strong demand from end-user sectors amid constrained supply.

𝗘𝘂𝗿𝗼𝗽𝗲 𝗥𝗲𝗴𝗶𝗼𝗻𝘀: The European soybean oil prices experienced a notable increase in prices, driven by a significant reduction in regional inventories and sustained demand from downstream sectors. The depreciation of the Euro against the US dollar weakened market supplies and allowed competitive pricing from South American producers to influence the upward price trajectory. Heavy rainfall in March and April delayed harvesting in several countries, diminishing oilseed supplies and supporting price increases.

𝗟𝗮𝘁𝗶𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: In Latin America, particularly Argentina, soybean oil export prices surged during the second quarter of 2024 due to adverse weather conditions impacting harvest timelines, trade disputes, and rising global quotations. Argentina faces increasing competition from Brazil and the US in the global market, where prices remain elevated.

𝗦𝗽𝗲𝗮𝗸 𝘁𝗼 𝗔𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝘁: https://www.imarcgroup.com/request?type=report&id=22325&flag=C

𝗢𝘃𝗲𝗿𝗮𝗹𝗹, 𝗣𝗿𝗶𝗰𝗲 𝗧𝗿𝗲𝗻𝗱 𝗮𝗻𝗱 𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

• 𝗔𝘀𝗶𝗮 𝗣𝗮𝗰𝗶𝗳𝗶𝗰: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

• 𝗘𝘂𝗿𝗼𝗽𝗲: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

• 𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: United States and Canada

• 𝗟𝗮𝘁𝗶𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

• 𝗠𝗶𝗱𝗱𝗹𝗲 𝗘𝗮𝘀𝘁 & 𝗔𝗳𝗿𝗶𝗰𝗮: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

𝗡𝗼𝘁𝗲: 𝗧𝗵𝗲 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗰𝗼𝘂𝗻𝘁𝗿𝘆 𝗹𝗶𝘀𝘁 𝗶𝘀 𝘀𝗲𝗹𝗲𝗰𝘁𝗶𝘃𝗲, 𝗱𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗶𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗶𝗻𝘁𝗼 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗼𝘂𝗻𝘁𝗿𝗶𝗲𝘀 𝗰𝗮𝗻 𝗯𝗲 𝗼𝗯𝘁𝗮𝗶𝗻𝗲𝗱 𝗳𝗼𝗿 𝗰𝗹𝗶𝗲𝗻𝘁𝘀 𝘂𝗽𝗼𝗻 𝗿𝗲𝗾𝘂𝗲𝘀𝘁.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝘂𝘀:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

𝗘𝗺𝗮𝗶𝗹: sales@imarcgroup.com

𝗧𝗲𝗹 𝗡𝗼:(𝗗) +91 120 433 0800

𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀: +1-631-791-1145

𝗔𝗯𝗼𝘂𝘁 𝗨𝘀:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soybean Oil Prices: Latest News, Price Trend, Monitor, Historical Data and Forecast here

News-ID: 3681719 • Views: …

More Releases from IMARC Group

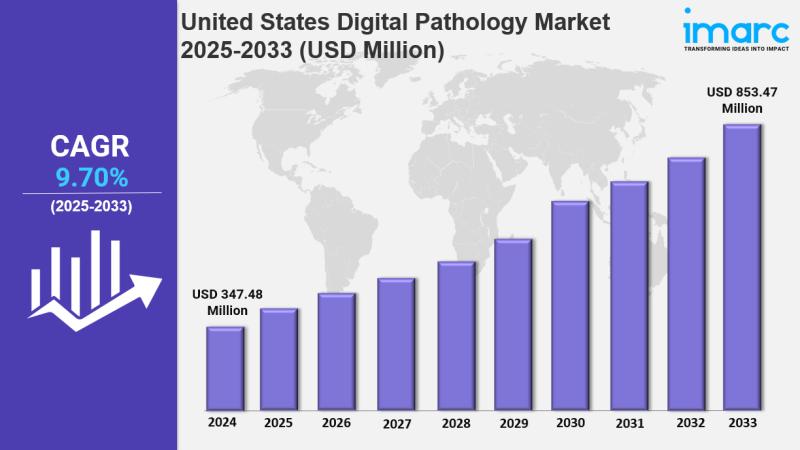

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

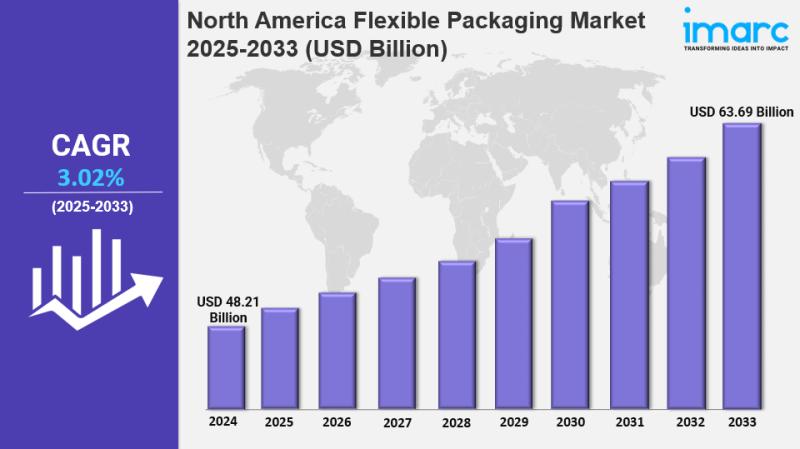

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

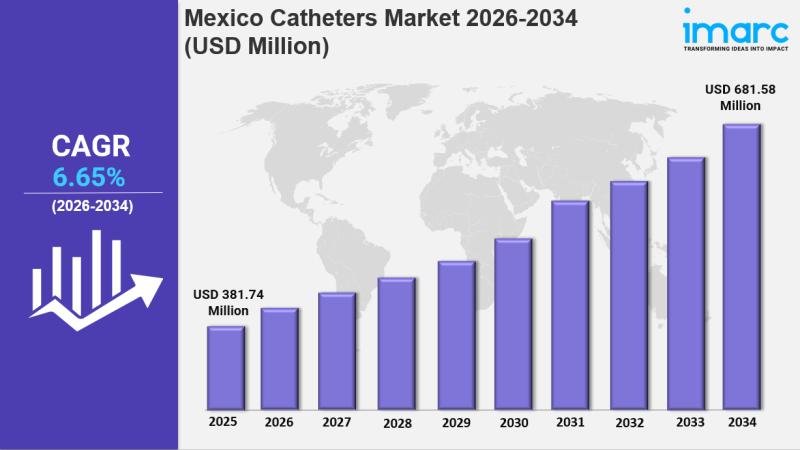

Mexico Catheters Market Size, Growth, Latest Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled "Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58…

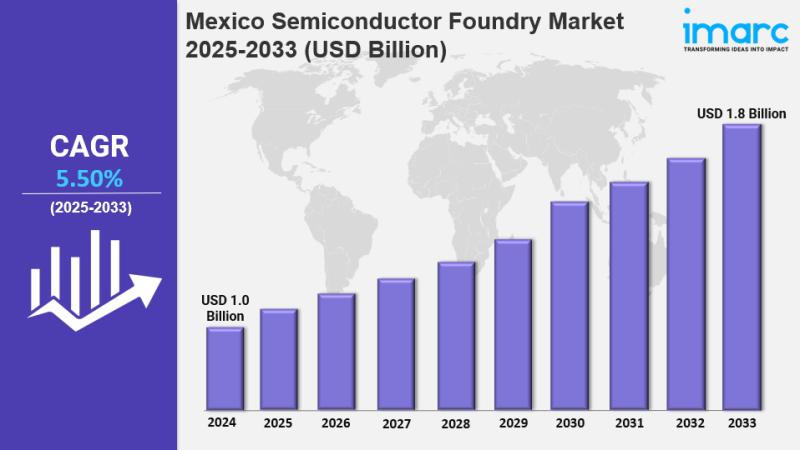

Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 20 …

IMARC Group has recently released a new research study titled "Mexico Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico semiconductor foundry market size reached USD 1.0 Billion in 2024. It is projected to grow to USD…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…