Press release

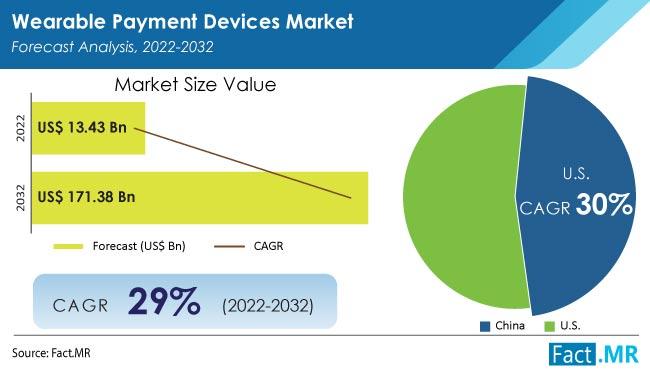

Wearable Payment Devices Market on Track for 29% CAGR, Reaching US$ 171.38 Billion

Over the projection period of 2022 to 2032, the worldwide wearable payment devices market is likely to grow at an excellent compound annual growth rate (CAGR) of over 29%, with an estimated market value of US$ 171.38 billion by the conclusion of the aforementioned timeframe.Thanks to developments in payment method technology during the past few years, the industry has been expanding quickly. The global adoption of cashless transactions is credited with driving industry growth.

Download a Sample Copy Of Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=5795

The usage of wearable payment devices increased historically at a CAGR of almost 27% between 2017 and 2021. Their advantages over conventional payment methods, such card and cash payments, were a key contributing factor in this rise. For instance, wearable payment devices enable no-contact payments, which is rather helpful given the COVID-19 epidemic at the moment. Due to the lack of wearable payment devices, credit card and smart device payments have become increasingly common in recent years. However, this is set to change.

The industry is predicted to expand at a CAGR of almost 29% during the next 10 years. Preference for contactless payments is the main factor affecting growth, as hygiene concerns become more widespread globally.

Key Providers of Wearable Payment Devices

• Apple, Inc.

• Barclays PLC

• Gemalto NV

• Google LLC

• Mastercard

• Nymi

• PayPal Holdings Inc.

• Samsung Electronics

• Visa Inc.

• Wirecard

Payments made via wearable devices that are linked to wireless technologies like NFC and RFID are referred to as wearable payments. In addition to offering customers a straightforward and contactless method of payment, wearable payment devices also ensure cleanliness and safety, especially in the wake of the COVID-19 outbreak.

Because of COVID-19, customers prefer cashless purchases for hygienic reasons. For instance, Mastercard had a 40% surge in contactless transactions during the initial quarter of 2020. In a similar vein, 60% of VISA holders who are not US citizens have made contactless payments using tap-to-pay technology.

Consequently, a number of banks, financial institutions, and payment service providers have started implementing the digital payment agenda; nevertheless, these payment devices need to be outfitted with improved security features to ensure customer satisfaction.

Issues with Battery Usage in Wearable Payment Devices Could Prevent Growth

To ensure smooth functioning, the device must be regularly recharged; if it runs out of power, it will immediately disconnect the user. This might impact the payment process by causing data insufficiency or a missing data cluster.

Better form factors and technology have allowed wearable payment gadgets to get smaller than before, which means less batteries are needed to power the payment features.

Furthermore, a sizable battery backup is necessary to ensure uninterrupted operation when a wearable device runs sophisticated operating systems. Conversely, wearable device batteries run out fast when the device is directly connected to the mobile network. It might negatively impact the lifespan of the battery.

Using Smart Technology to Open Up New Opportunities for Growth

Numerous wearable and contactless payment devices employ NFC, RFID, and host card emulation (HCE) technologies. The wearable payment device market has a lot of potential to grow since several wearable device manufacturers, including Apple, Samsung, and Huawei, are integrating NFC and RFID technologies into their wearable devices and payment platforms.

In a similar vein, businesses are using host card emulation technology to provide consumers instant access to any items by displaying product details on their smartphones.

Read More: https://www.factmr.com/report/wearable-payment-devices-market

Competitive Landscape

The majority of participants in the extremely fragmented worldwide market for wearable payment devices are focused on product development and cooperation. Among the noteworthy advancements are:

In order to give cardholders quick and easy payment choices, Mastercard partnered with Bank of Baroda Financial Solution (BFSL) to release ConQR, a Mastercard QR on Card Solution, in 2021. SMEs may now take cashless payments because of this technology's special features.

Key Segments Covered in Wearable Payment Devices Industry Report

• By Device Type

o Fitness Trackers

o Payment Wristbands

o Smart Watches

• By Technology

o Barcodes

o Contactless Point of Sale Terminals

o Near Field Communication (NFC Wearable Payment Devices)

o Quick Response (QR) Codes

o Radio Frequency Identification (RFID Wearable Payment Devices)

• By Application

o Wearable Payment Devices for Festivals & Life Events

o Fitness Wearable Payment Devices

o Healthcare Wearable Payment Devices

o Retail Wearable Payment Devices

o Wearable Payment Devices for Transportation

o Others

rapid expansion underscores the increasing consumer preference for convenient, contactless payment solutions integrated into everyday wearable items such as smartwatches, fitness trackers, and rings. The demand is fueled by advancements in technology, rising adoption of digital wallets, and the need for secure, fast, and seamless transactions.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wearable Payment Devices Market on Track for 29% CAGR, Reaching US$ 171.38 Billion here

News-ID: 3582482 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

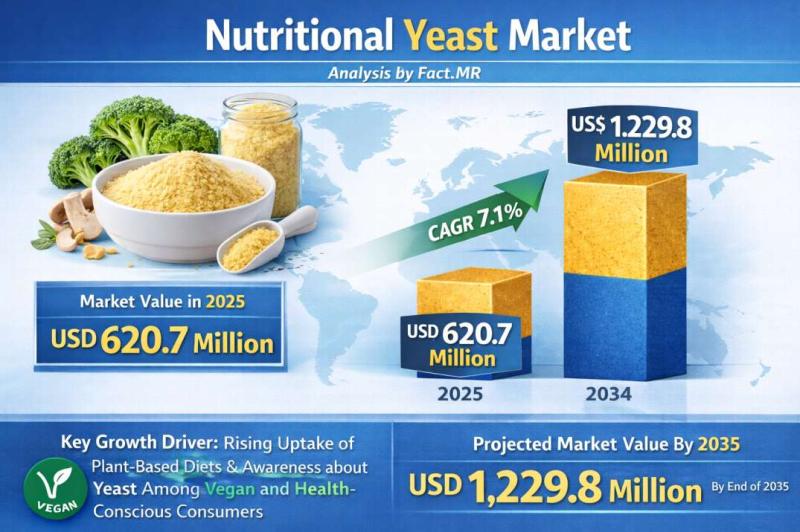

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

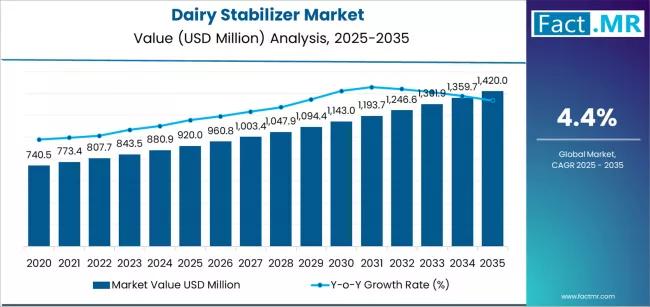

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…