Press release

Fintech-As-A-Service Market Has Been Projected To Expand At 16% CAGR through 2034: Fact.MR

The global fintech-as-a-service (FaaS) market is expected to grow steadily, with a Compound Annual Growth Rate (CAGR) of 16%. Starting from a value of US$ 363.3 billion in 2024, it is forecasted to reach US$ 1,602.7 billion by the conclusion of 2034.The Fintech-as-a-Service Industry sales study offers a comprehensive analysis on diverse features including production capacities, Fintech-as-a-Service demand, product developments, sales revenue generation and Fintech-as-a-Service market outlook across the globe.

market research report by Fact.MR, (Leading business and competitive intelligence provider) on global Fintech-as-a-Service market sales initiates with an outlook of the market, followed by the scrutiny of the demand and consumption volumes and share and size of various end-use segments

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.factmr.com/connectus/sample?flag=S&rep_id=7594

The readability score of the Fintech-as-a-Service market demand report is good as it offers chapter-wise layout with each section divided into a smaller sections.

The report encompasses graphs and tables to show the entire assembling. Pictorial demonstration of the definite and estimated values of key segments is visually appealing to readers.

This Fintech-as-a-Service market outlook report explicates on vital dynamics such as the drivers, restraints and opportunities for key players and competitive analysis of Fintech-as-a-Service along with key stakeholders as well as emerging players associated with the manufacturing of product.

The Key trends Analysis of Extended Fintech-as-a-Service market also provides dynamics that are responsible for influencing the future sales and demand of over the forecast period

𝐆𝐫𝐨𝐰𝐭𝐡 𝐓𝐫𝐞𝐧𝐝𝐬:

The Fintech-as-a-Service (FaaS) market has been experiencing robust growth driven by a confluence of factors reshaping the financial services industry. One prominent trend is the increasing adoption of digital financial solutions by businesses seeking to streamline their operations and enhance customer experiences. FaaS providers offer a suite of services including payments processing, lending platforms, and risk management tools, empowering companies to quickly integrate innovative financial technologies into their existing infrastructure.

Moreover, the rise of cloud computing has been a significant driver of FaaS market growth. Cloud-based Fintech solutions offer scalability, flexibility, and cost-effectiveness, making them particularly appealing to businesses of all sizes. By leveraging cloud infrastructure, FaaS providers can deliver their services globally, enabling seamless access to advanced financial tools without the need for heavy upfront investments in hardware or software.

Another key growth trend in the FaaS market is the increasing focus on regulatory compliance and security. As financial transactions become increasingly digital, regulators are implementing stricter guidelines to protect consumers and ensure the integrity of the financial system. FaaS providers are responding by integrating robust compliance and security features into their platforms, helping businesses navigate complex regulatory landscapes while safeguarding sensitive financial data.

Furthermore, the democratization of financial services is driving demand for FaaS solutions among startups and small to medium-sized enterprises (SMEs). These businesses often lack the resources and expertise to develop proprietary financial technologies, making FaaS an attractive alternative. By partnering with FaaS providers, startups and SMEs can access cutting-edge financial tools on a subscription basis, leveling the playing field and enabling them to compete more effectively in the digital economy.

Looking ahead, the Fintech-as-a-Service market is poised for continued growth as businesses across industries recognize the strategic value of embracing digital financial solutions. With ongoing advancements in technology, regulatory frameworks, and market dynamics, FaaS providers are well-positioned to drive innovation and reshape the future of finance.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐏𝐫𝐨𝐟𝐢𝐥𝐞𝐝

• PayPal Holdings Inc.

• Block Inc.

• Mastercard Incorporated

• Envestnet Inc.

• Braintree

• Upstart Holdings Inc.

• Solid Financial Technologies Inc.

• Railsbank Technology Ltd.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

• In 2023, Fiserv and Equifax announced their alliance. Fiserv and Equifax jointly launch commercial products that use new analytics to improve corporate authentication, accelerate account acquisition, and improve risk assessment.

• In 2023, Mastercard bought Baffin Bay Networks. This strategic acquisition helps Mastercard to improve its capabilities to assist businesses in dealing with the ever-changing threat landscape of cyberattacks.

𝐊𝐞𝐲 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐅𝐢𝐧𝐭𝐞𝐜𝐡-𝐚𝐬-𝐚-𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡

• By Type :

o Payment

o Funds Transfer

o Loans

• By Technology :

o API-Based

o AI-Based

o RPA-Based

o Blockchain-Based

• By Application :

o KYC Verification

o Fraud Monitoring

o Compliance & Regulatory Support

• By End Use :

o Banks

o Financial Lending Companies

o Insurance

• By Region :

o North America

o Latin America

o Europe

o East Asia

o South Asia & Oceania

o Middle East & Africa

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=RC&rep_id=7594

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech-As-A-Service Market Has Been Projected To Expand At 16% CAGR through 2034: Fact.MR here

News-ID: 3494003 • Views: …

More Releases from Fact.MR

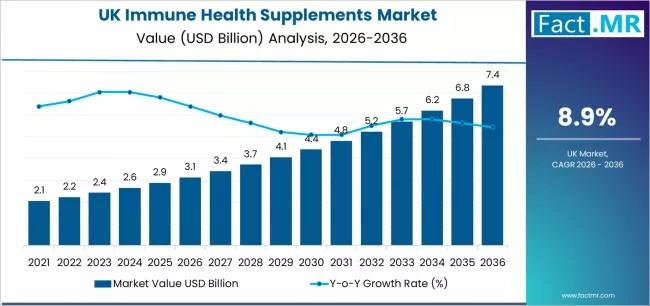

Demand for Immune Health Supplements in UK Forecast 2026-2036: Market to Reach U …

The United Kingdom immune health supplements market is valued at US$ 3.14 billion in 2026 and is projected to reach US$ 7.36 billion by 2036. Expanding at a compound annual growth rate (CAGR) of 8.9%, this growth reflects a profound shift in consumer behavior toward preventive healthcare and self-care management within the British population.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=12664

Market snapshot: Demand for…

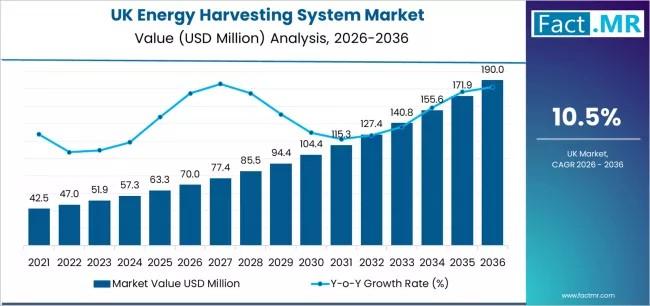

Demand for Energy Harvesting System in UK Forecast 2026-2036: Market to Reach US …

The United Kingdom energy harvesting system market is valued at US$ 70 million in 2026 and is projected to reach US$ 190 million by 2036. This expansion, moving at a compound annual growth rate (CAGR) of 10.5%, marks a significant shift toward self-sustaining power solutions across industrial and consumer sectors in the UK.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=12708

Market snapshot: global Demand for…

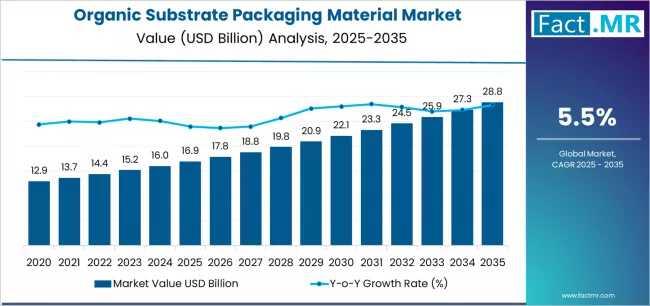

Organic Substrate Packaging Material Market Forecast 2026-2036: Market to Reach …

The global organic substrate packaging material market is projected to grow from USD 16.9 billion in 2025 to approximately USD 28.8 billion by 2035, recording an extraordinary absolute increase of USD 11.9 billion over the forecast period. This translates into a total growth of 70.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The overall market size is expected…

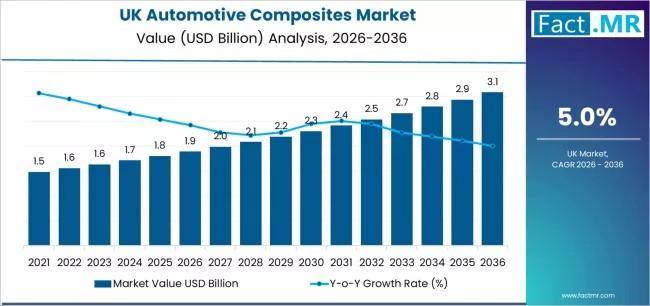

Demand for Automotive Composites in UK Forecast 2026-2036: Market to Reach USD 3 …

The United Kingdom automotive composites market is valued at US$ 1.89 billion in 2026 and is projected to expand to US$ 3.08 billion by 2036. This steady growth, reflected in a compound annual growth rate (CAGR) of 5%, highlights the critical transition toward lightweight materials and high-performance manufacturing in the UK automotive sector.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=12677

Market snapshot: Demand for Automotive…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…