Press release

B2B2C Insurance Market Report: Size, Share, Price, Trends, Growth And Detailed Analysis, Forecast To 2033

The B2B2C insurance market size has grown strongly in recent years. It will grow from $3.95 billion in 2023 to $4.29 billion in 2024 at a compound annual growth rate (CAGR) of 8.6%. The growth in the historic period can be attributed to complexity of commercial risks, regulatory compliance requirements, globalization of business operations, industry-specific coverage needs, risk management strategies.The B2B2C insurance market size is expected to see strong growth in the next few years. It will grow to $6.22 billion in 2028 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to environmental and climate-related risks, business continuity planning, employee well-being programs, diversification of insurance products, personalization of coverage. Major trends in the forecast period include digital transformation in distribution channels, insurtech innovations, ecosystem partnerships, usage-based insurance models, integration with digital ecosystems.

Market Overview -

Business-to-business-to-consumer (B2B2C) insurance applies to the sale of life and general insurance products and services through non-insurance mediators other than traditional insurance intermediaries such as brokers, independent financial advisors, and agents. It also includes the direct sale of insurance to consumers. The B2B2C insurance is engaged in providing both life insurance and general insurance services.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=5231&type=smp

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market

The expansion of the automobile industry is expected to propel the growth of the B2B2C insurance market in the coming years. The automotive industry is made up of a diverse group of businesses and organizations that are involved in the design, development, production, marketing, and sale of automobiles. B2B2C insurance protects the policyholder's belongings and assets, such as automobiles, from financial losses and damage. Car insurance is like a long-term contract that covers the price of various damages that may arise because of unanticipated events. According to the Economist Intelligence Unit (The EIU), in 2021, the global automotive sector is expected to grow by double digits, with new car sales increasing by 15% and commercial vehicle sales increasing by 16%. Electric vehicle sales are expected to increase from 2.5 million in 2020 to 3.4 million in 2021. Therefore, the growth in the automobile industry drives the growth of the B2B2C insurance market.

Competitive Landscape -

Major companies operating in the B2B2C insurance market report are UnitedHealth Group Inc., Berkshire Hathaway Inc., Allianz SE, Axa S.A., Japan Post Holdings Co., BNP Paribas S.A., Prudential Financial Inc., Aditya Birla Group, Munich Re Group, Swiss Reinsurance Company Ltd., Zurich Insurance Group Ltd., Porto Seguro S.A., Tata-AIG General Insurance Co. Ltd., ICICI Lombard General Insurance Company Limited, Bolttech Management Limited, Bsurance GmbH, Edelweiss General Insurance Company Limited, BridgeNet Insurance, DriveWealth LLC, ASSICURAZIONI GENERALI S.P.A., China Life Insurance Group, Alpaca VN, Inclusivity Solutions, The Digital Insurer, Wrisk Ltd., Anorak Technologies Limited, Dream Insurance, Assurity Group Inc., Bajaj Allianz Life Insurance Co. Ltd., Afficiency

Innovative Programs Shape The Landscape Of B2B2C Insurance Market

The launch of innovative programs to expand the insurance industry is shaping the B2B2C insurance market. Major companies operating in the B2B2C insurance sector are focusing on launching innovative programs to create solutions by leveraging new-age technologies. For instance, In August 2022, FairPlay, a California-based Fairness-as-a-Service company, launched Input Intelligence. Input Intelligence is a tool for insurance companies to detect bias. This tool assists insurance companies in checking their data for bias and ensuring that it does not represent protected characteristics such as race or gender as a proxy.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/b2b2c-insurance-global-market-report

Key Segments -

The B2B2C insurance market covered in this report is segmented -

1) By Type: Life Insurance, Non-Life Insurance

2) By Distribution Channel: Online, Offline

3) By End Use Industry: Bank And Financial Institutions, Automotive, Utilities, Retailers, Telecom, Other End Use Industries

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Latest Trending Press Releases: https://www.thebusinessresearchcompany.com/press-release.aspx

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market Report: Size, Share, Price, Trends, Growth And Detailed Analysis, Forecast To 2033 here

News-ID: 3452105 • Views: …

More Releases from The Business research company

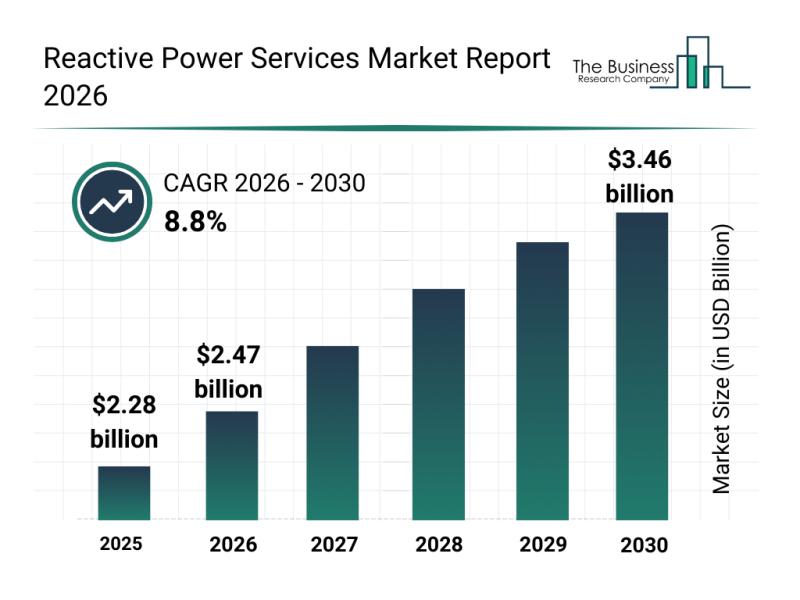

Future Perspective: Key Trends Shaping the Reactive Power Services Market up to …

The reactive power services market is set for significant expansion in the coming years as the energy sector evolves to meet modern demands. With increasing renewable energy adoption and advancements in grid technologies, this market is becoming a critical component in ensuring power system reliability and efficiency. Let's explore the market size forecast, key companies involved, influential trends, and the various segments shaping this industry.

Projected Growth and Market Size of…

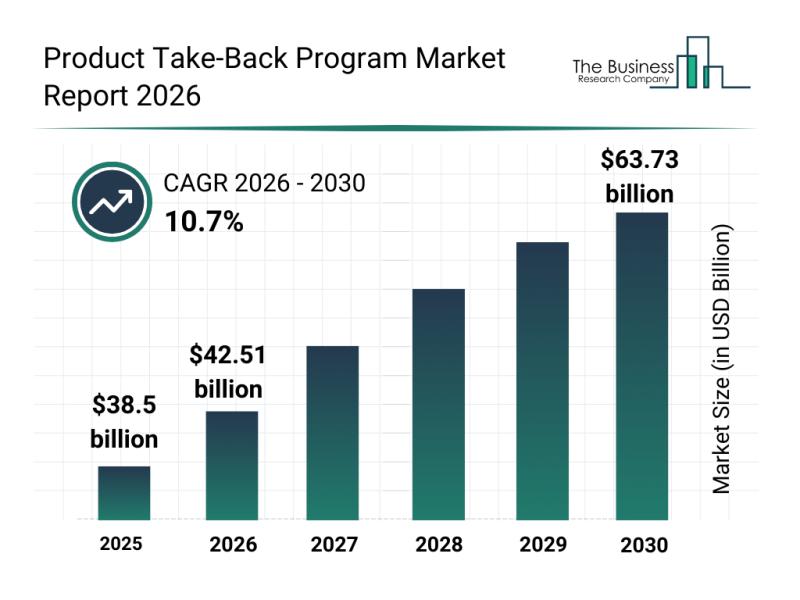

Analysis of Key Market Segments Driving the Product Take-Back Program Market

The product take-back program market is gaining significant attention as sustainability becomes a higher priority for businesses and consumers alike. With increasing efforts to promote circular economy models, this sector is set for impressive growth and innovation over the coming years. Let's explore the market's size projections, major players, key drivers, notable trends, and segmentation details to better understand its evolving landscape.

Forecasted Growth and Market Size of the Product Take-Back…

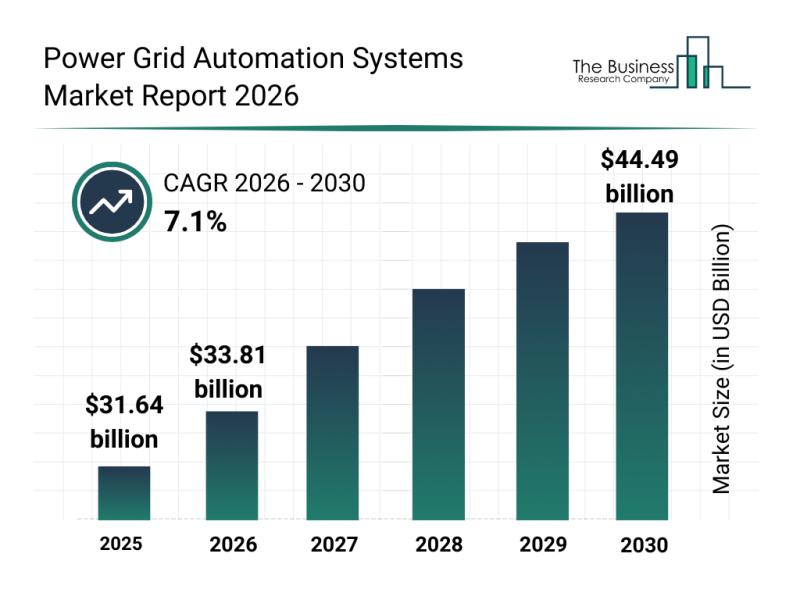

Global Drivers Analysis: The Rapid Evolution of the Power Grid Automation System …

The power grid automation systems market is on the verge of significant expansion, driven by technological advancements and increasing demands for smarter, more resilient energy networks. This sector is evolving rapidly as utilities and energy providers adopt innovative solutions to manage and optimize power grids more effectively. Below, we explore the market's projected value, key industry players, emerging trends, and the detailed segmentation shaping its future.

Projected Growth and Valuation of…

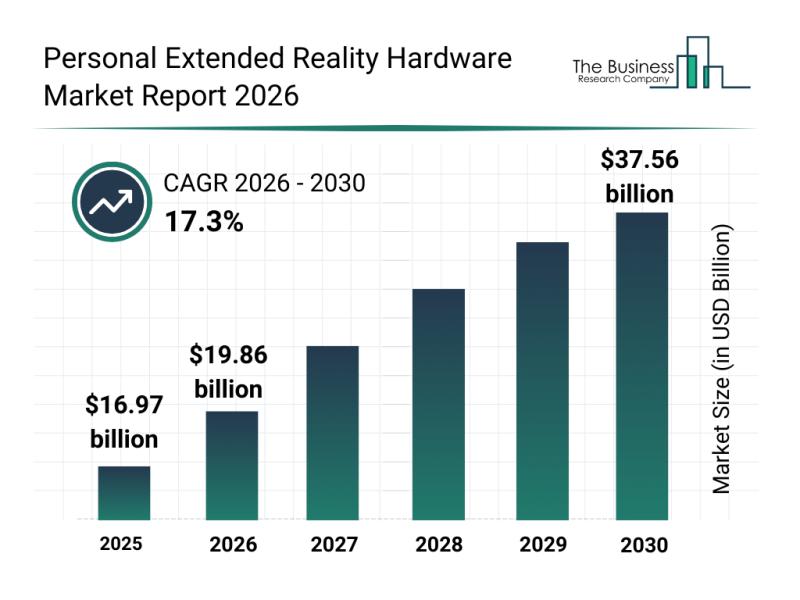

Leading Companies Consolidating Their Roles in the Personal Extended Reality Har …

The personal extended reality hardware market is on the cusp of remarkable expansion, driven by technological advancements and growing user demand. As industries and consumers increasingly embrace extended reality (XR) technologies, this market is expected to experience significant growth in the coming years. Let's delve into the anticipated market size, the key players shaping the landscape, current trends, and important segmentation within this evolving sector.

Projected Growth Trajectory of the Personal…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…