Press release

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driving Engine Behind B2B2C Insurance Market Evolution in 2025

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate (CAGR) of 8.1%. Factors contributing to this growth trend in the historic period include the intricacy of commercial risks, requirements for regulatory compliance, the expansion of business operations on a global scale, the specialized needs for industry coverage, and strategic planning for risk management.

How Will the B2B2C Insurance Market Size Evolve and Grow by 2029?

The size of the b2b2c insurance market is predicted to experience significant expansion in the future years. The market volume is set to reach $6.89 billion by 2029, with a compound annual growth rate (CAGR) of 10.6%. This expected growth during the forecast period can be linked to factors such as environmental and climate threats, strategic planning for business continuity, employee health initiatives, development of diverse insurance products, and tailored coverage plans. Major emerging trends within this period are the digital revolution within the distribution channels, technological advancements in insurtech, alliances within the ecosystem, insurance models based on usage, and merging with digital ecosystems.

View the full report here:

https://www.thebusinessresearchcompany.com/report/b2b2c-insurance-global-market-report

What Drivers Are Propelling the Growth of B2B2C Insurance Market Forward?

The rise in the auto industry is projected to boost the B2B2C insurance market in the coming years. The automobile industry comprises a varied collection of businesses and organizations engaged in the design, development, manufacturing, marketing, and sales of cars. B2B2C insurance provides financial protection for the insured's assets like cars against losses and damage. Auto insurance is akin to a long-term agreement that safeguards against potential damages due to unforeseen incidents. For instance, from April 2023 to March 2024, as reported by the Indian government, there was an increase in Passenger Vehicle Exports from 6,62,891 to 6,72,105 units, signaling a positive growth of 13.8%. Thus, the progression in the auto industry motivates the expansion of the B2B2C insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5231&type=smp

What Long-Term Trends Will Define the Future of the B2B2C Insurance Market?

The initiation of inventive strategies to broaden the scope of the insurance industry is moulding the B2B2C insurance market. The key businesses in this sector are concentrating their efforts on launching creative programs that use modern technologies to devise solutions. For example, in August 2022, FairPlay, a company based in California that specializes in Fairness-as-a-Service, introduced 'Input Intelligence'. This tool aids insurance firms in identifying any biases in their data, ensuring it doesn't misrepresent protected traits such as race or gender by mistake.

What Are the Key Segments in the B2B2C Insurance Market?

The b2b2c insurancemarket covered in this report is segmented -

1) By Type: Life Insurance, Non-Life Insurance

2) By Distribution Channel: Online, Offline

3) By End Use Industry: Bank And Financial Institutions, Automotive, Utilities, Retailers, Telecom, Other End Use Industries

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Group Life Insurance

2) By Non-Life Insurance: Health Insurance, Property Insurance, Liability Insurance, Motor Insurance, Travel Insurance, Business Interruption Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=5231&type=smp

Who Are the Key Players Shaping the B2B2C Insurance Market's Competitive Landscape?

Major companies operating in the B2B2C insurance market include UnitedHealth Group Inc., Berkshire Hathaway Inc., Allianz SE, Axa S.A., Japan Post Holdings Co., BNP Paribas S.A., Prudential Financial Inc., Aditya Birla Group, Munich Re Group, Swiss Reinsurance Company Ltd., Zurich Insurance Group Ltd., Porto Seguro S.A., Tata-AIG General Insurance Co. Ltd., ICICI Lombard General Insurance Company Limited, Bolttech Management Limited, Bsurance GmbH, Edelweiss General Insurance Company Limited, BridgeNet Insurance, DriveWealth LLC, ASSICURAZIONI GENERALI S.P.A., China Life Insurance Group, Alpaca VN, Inclusivity Solutions, The Digital Insurer, Wrisk Ltd., Anorak Technologies Limited, Dream Insurance, Assurity Group Inc., Bajaj Allianz Life Insurance Co. Ltd., Afficiency

What Geographic Markets Are Powering Growth in the B2B2C Insurance Market?

Asia-Pacific was the largest region in the B2B2C insurance market in 2024. The regions covered in the B2B2C insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5231

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

"

#Reach Out to Us#

Speak With Our Expert:

Saumya Sahay

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email: saumyas@tbrc.info

The Business Research Company - www.thebusinessresearchcompany.com

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

The Business Research Company provides in-depth research and insights through a vast collection of 15,000+ reports spanning 27 industries and over 60 geographies. Backed by 1,500,000 datasets, extensive secondary research, and expert insights from industry leaders, we equip you with the knowledge needed to stay ahead in the market.

Our flagship offering, the Global Market Model, is a leading market intelligence platform that delivers comprehensive and up-to-date forecasts to support strategic decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driving Engine Behind B2B2C Insurance Market Evolution in 2025 here

News-ID: 4192265 • Views: …

More Releases from The Business Research Company

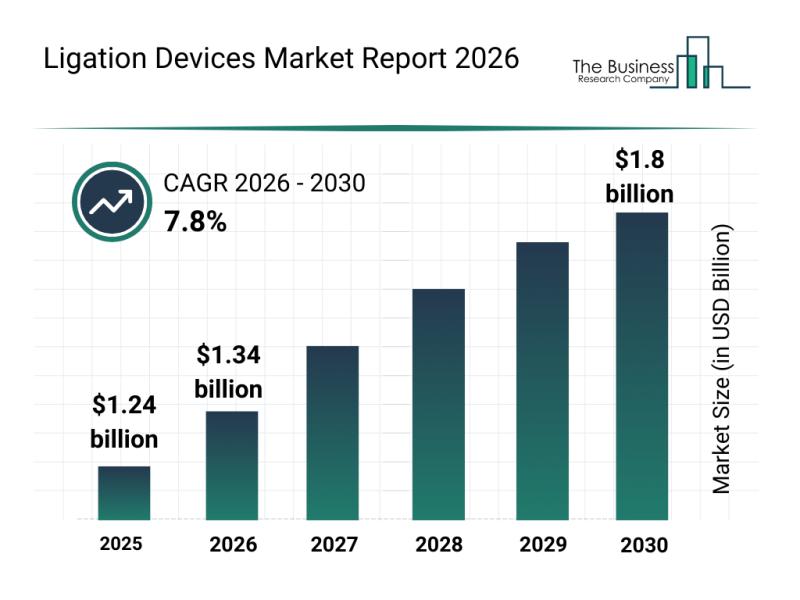

Analysis of Segments and Major Growth Areas in the Ligation Devices Market

The ligation devices market is on track for significant growth over the coming years, driven by advances in surgical technology and increasing demand for less invasive procedures. As healthcare providers seek to improve patient outcomes and procedural efficiency, this sector is poised for notable expansion through 2030. Let's explore the market's size trajectory, key players, emerging trends, and segmentation to understand the full landscape.

Future Market Size Outlook for Ligation Devices…

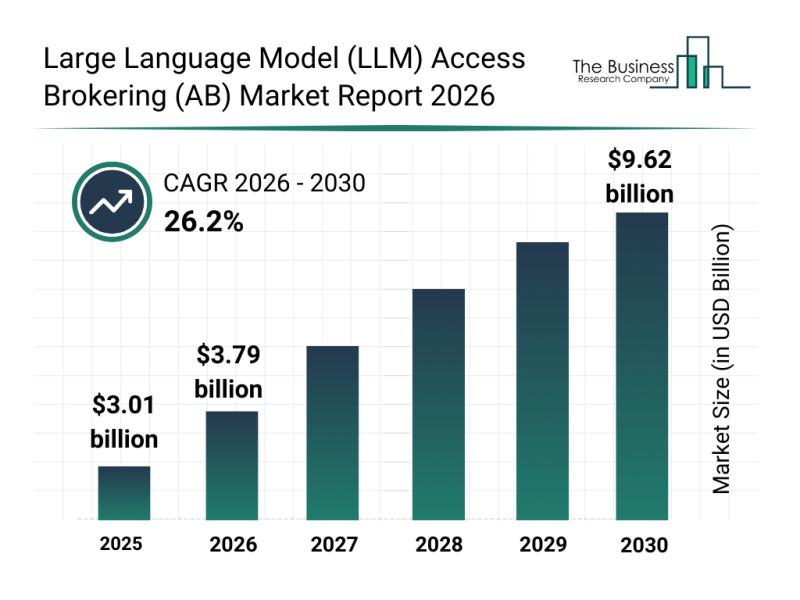

Key Factors and Emerging Trends Shaping the Large Language Model (LLM) Access Br …

The large language model (LLM) access brokering (AB) market is positioned for remarkable expansion in the coming years. As enterprises increasingly deploy large language models, the need for efficient management and oversight grows, driving significant demand in this sector. Let's explore the market's size, key players, driving forces, latest trends, and the main segments shaping its development through 2030.

Projected Size and Growth Trajectory of the Large Language Model Access Brokering…

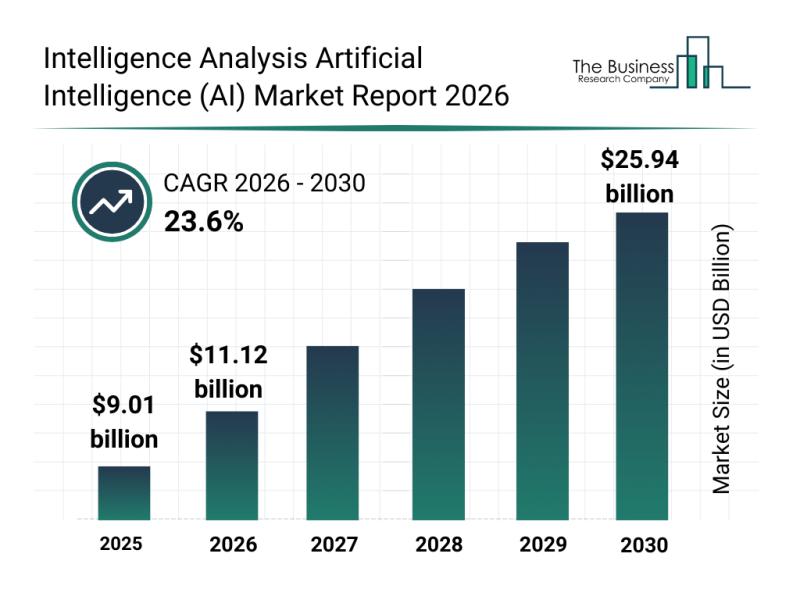

Emerging Sub-Segments Transforming the Intelligence Analysis Artificial Intellig …

The intelligence analysis artificial intelligence (AI) sector is on the brink of remarkable expansion, driven by rapid technological advancements and increasing demand for smarter decision-making tools. As organizations across industries look to leverage AI for enhanced intelligence capabilities, this market is set to experience significant growth over the coming years. Let's explore the current market size, key players, influential trends, and the main segments shaping this evolving industry.

Forecasted Market Value…

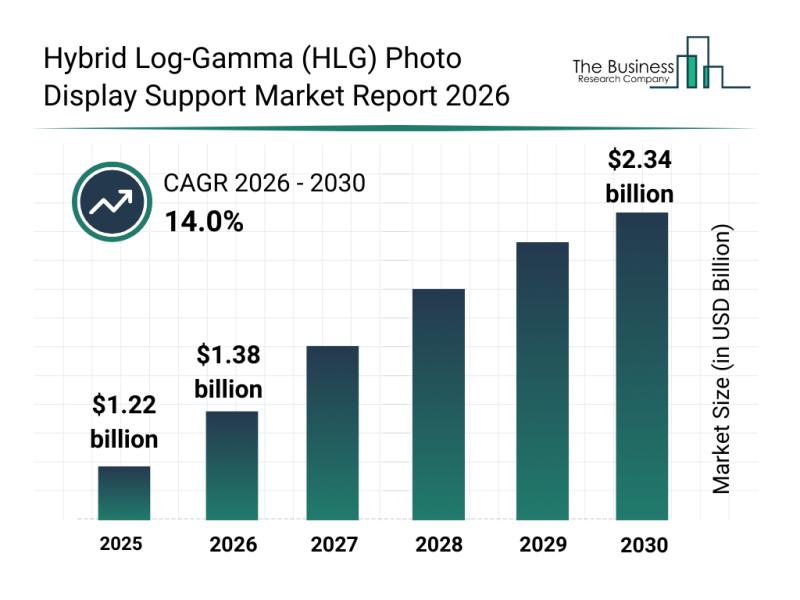

Emerging Growth Patterns Driving Expansion in the Hybrid Log-Gamma (HLG) Photo D …

The hybrid log-gamma (HLG) photo display support market is poised for substantial expansion as the demand for enhanced visual experiences continues to rise. With technological advancements and increasing adoption of high dynamic range (HDR) content, this market is set to attract significant attention from various industries over the coming years. Here, we explore the market's size, key players, emerging trends, and growth segments shaping its future.

Projected Market Value and Growth…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…