Press release

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance offers in digitalization of customer services has had a huge impact on the market. In addition, Italian companies in the Italy B2B2C insurance market are using digital platforms to better understand their customers. This enhances the consumer experience and boosts collaboration effectiveness. Businesses in the B2B2C insurance sector are experimenting with a range of digital tools, including websites and mobile applications, to acquire unmatched knowledge through technological capabilities.

Furthermore, the establishment of transparency in B2B2C insurance transactions is anticipated to be significantly aided by automation. Utility, material-manufacturing, and construction businesses are paying close attention to the growth of omnichannel commerce in Italy. Companies in the B2B2C insurance industry are working with technology providers, e-commerce vendors, and local suppliers to extend their business operations in the market. For instance, in 2022, the parent firm, BNP Paribas SA, and BNP Paribas Securities Services are currently concluding a merger. The business will be able to reinforce the BNP Paribas bonding strategy as a crucial component of its integrated banking model with the aid of this integration.

➡️Request Customization We offer customized report as per your requirement : https://www.alliedmarketresearch.com/request-for-customization/A31484

By application, the corporates/group segment acquired a major share in the Italy B2B2C insurance size in 2021. This is attributed to the awareness among the employees about the group health insurance as a result of developed region which boosts the growth of the market. Furthermore, growing corporate culture and presence of large number of multinational companies in Italy is a major factor for the Italy B2B2C insurance market growth in the region.

The demand for Italy B2B2C insurance industry has increased considerably during the COVID-19 pandemic. However, introduction of new plans to expand the insurance industry created various opportunities for the Italy B2B2C insurance industry. Moreover, increase in awareness and dependency of consumers on insurance services for overall safety, protection, and reliability of life and non-life insurance services drive the growth of the B2B2C insurance market.

The key players operating in the Italy B2B2C insurance market analysis include Allianz Partners, ASSICURAZIONI GENERALI S.P.A., Aviva, Berkshire Hathaway Inc., BNP Paribas Fortis, Munich RE, Prudential Financial, Inc., Swiss Re, The Digital Insurer, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

➡️Trending Reports at Discounted Price:

Reinsurance Market

https://www.alliedmarketresearch.com/reinsurance-market-A06288

WealthTech Solutions Market

https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Smart Finance Hardware Market

https://www.alliedmarketresearch.com/smart-finance-hardware-market-A31798

Insurance Market https://www.alliedmarketresearch.com/insurance-market-A17037

Professional Liability Insurance Market https://www.alliedmarketresearch.com/professional-liability-insurance-market-A120260

US Life Insurance Market https://www.alliedmarketresearch.com/us-life-insurance-market-A324608

US Premium Finance Market https://www.alliedmarketresearch.com/u-s-premium-finance-market-A305149

Pet Insurance Market https://www.alliedmarketresearch.com/pet-insurance-market

India E-commerce Market https://www.alliedmarketresearch.com/india-e-commerce-market-A126917

Private Equity Market https://www.alliedmarketresearch.com/private-equity-market-A06949

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026 here

News-ID: 3983707 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

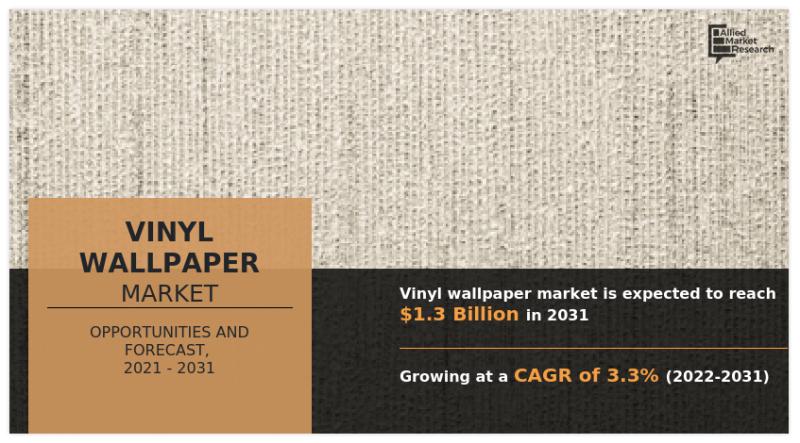

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

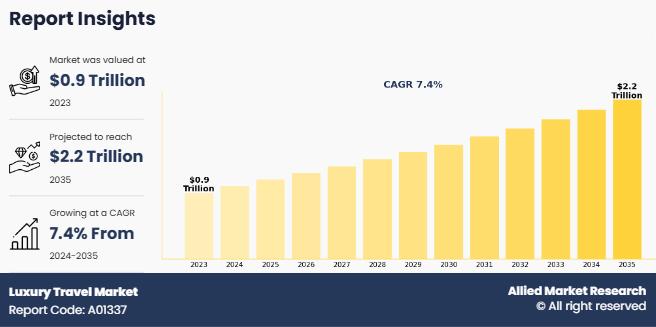

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…

B2B2C Insurance Market to Partake Significant Development during 2030

Transparency Market Research delivers key insights on the global B2B2C insurance market. In terms of revenue, the global B2B2C insurance market is estimated to expand at a CAGR of ~9% during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in the global B2B2C insurance market report.

In the report, TMR predicts that the global B2B2C insurance market would be largely driven by factors such…