Press release

Microinsurance Market Size Hits US$ 141.6 Billion during 2024-2032 | IMARC Group

According to the latest report by IMARC Group, titled "Microinsurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," provides an extensive analysis of the industry, including microinsurance market size, share, trends, and growth opportunities. The report also covers competitor and regional analysis and the latest advancements in the market. The global microinsurance market size reached US$ 89.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 141.6 Billion by 2032, exhibiting a growth rate (CAGR) of 5.1% during 2024-2032.Get Sample Copy of Report at - https://www.imarcgroup.com/microinsurance-market/requestsample

Factors Affecting the Growth of the Microinsurance Industry:

• Technological Advancements and Digital Platforms:

Mobile technology, in particular, has revolutionized how microinsurance products are distributed and managed. The widespread use of mobile phones, even in remote and low-income areas, has made it possible to reach a larger customer base. Digital platforms enable simpler and more efficient processing of policies and claims, reducing operational costs.

Additionally, technologies such as blockchain and artificial intelligence are being leveraged to improve risk assessment, fraud detection, and enhance overall operational efficiency. These technological advancements make microinsurance products more accessible and affordable, particularly for populations in developing countries.

• Increasing Awareness and Demand for Financial Inclusion:

Financial inclusion efforts are aimed at bringing the unbanked and underbanked segments of society into the formal financial system. Microinsurance plays a crucial role in these efforts by providing affordable and accessible insurance products that cater to the specific needs of these populations.

This increased awareness is often supported by government initiatives and NGO programs, which emphasize the importance of insurance in reducing vulnerability to unexpected financial shocks. By offering products like health, life, property, and agricultural insurance, microinsurance helps in mitigating risks and improving the financial stability of low-income individuals and communities.

• Partnerships Between Various Stakeholders:

The collaboration between different stakeholders, including governments, NGOs, microfinance institutions, and insurance companies, is a key driver for the microinsurance market. These partnerships are essential in designing and distributing microinsurance products effectively. Governments and NGOs often play a role in promoting microinsurance through policy support and awareness campaigns.

Microfinance institutions, with their deep penetration in low-income markets, serve as an effective distribution channel. Meanwhile, insurance companies bring in the technical expertise required to develop suitable products. These collaborative efforts help in overcoming challenges related to distribution, premium collection, and claims processing, thereby facilitating market growth.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/microinsurance-market

Microinsurance Market Trends:

Governmental regulatory support and policy initiatives are crucial in facilitating the growth of the microinsurance market. Many governments in developing countries are implementing policies and regulatory frameworks to promote microinsurance. These policies often include measures, including simplified regulatory requirements for microinsurance products, tax incentives, and subsidies to make insurance more affordable for low-income populations.

Additionally, some governments are actively partnering with insurance providers to launch large-scale microinsurance programs. This regulatory support helps in creating a conducive environment for the growth of the microinsurance market and ensures that the products offered are aligned with the needs and rights of the target population.

Microinsurance Market Report Segmentation:

By Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Life insurance emerged as the largest segment in the microinsurance market, as it addresses a fundamental need for financial security and protection, making it a key focus for providers and customers alike.

By Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Microinsurance offered by commercially viable providers took the largest share, indicating the importance of sustainability and profitability in delivering insurance solutions to low-income populations.

By Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

The partner agent and full-service model types collectively constituted the largest market share, offering a range of distribution channels and service levels to cater to diverse customer preferences.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

The Asia Pacific region stood as the largest market for microinsurance, driven by its vast population, increasing awareness of insurance, and efforts to extend financial inclusion to underserved communities in the region.

Competitive Landscape:

The report has also analysed the competitive landscape of the market along with the profiles of the key players.

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Browse More Reports:

• https://www.imarcgroup.com/report/ja/ceiling-tiles-market

• https://www.imarcgroup.com/report/ja/prefeasibility-report-chocolate-manufacturing-plant

• https://www.imarcgroup.com/report/ja/cod-liver-oil-market

• https://www.imarcgroup.com/report/ja/cold-chain-logistics-market

• https://www.imarcgroup.com/report/ja/crane-market

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Who we are:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market Size Hits US$ 141.6 Billion during 2024-2032 | IMARC Group here

News-ID: 3357728 • Views: …

More Releases from IMARC Group

India Bottled Water Market 2026: Explosive Growth, Key Players & Future Opportun …

Introduction:

According to the latest research report titled "India Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Bottled Water Market Overview:

The India bottled water market size was valued at USD 10.71 Billion in 2025 and is projected to reach USD 29.70 Billion by 2034, growing at…

India E-Bike Market 2026: Explosive Growth, Top Brands & Investment Opportunitie …

Introduction:

According to the recent data, the report titled "India E-Bike Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Power, Application, and Region, 2026-2034" offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India E-bike Market Overview:

The India E-bike market attained a valuation of USD 1,420.78 Million in 2025 and is forecasted to reach USD 3,007.19 Million by 2034, demonstrating a robust compound…

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

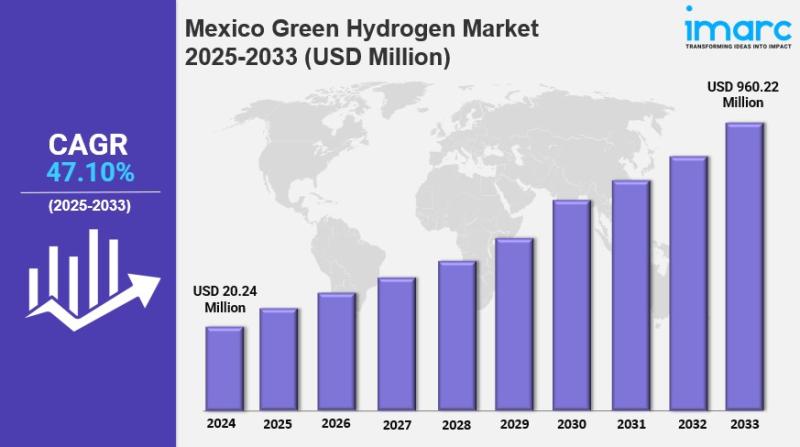

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…