Press release

Government Initiatives Fueling Growth In The Microinsurance Market: A Significant Driver Propelling The Microinsurance Market In 2025

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025, with a compound annual growth rate (CAGR) of 6.4%. The substantial growth observed during the historic period has been due to factors such as financial inclusion efforts, the rise of microfinance institutions, government backing and initiatives, participation of NGOs and donors, and market liberalization.

In the upcoming years, the microinsurance market is projected to experience a significant surge in size, with a compound annual growth rate (CAGR) set at 7.8%, reaching a valuation of $137.68 billion in 2029. This predicted growth in the forecast period can be associated with factors such as health pandemics and risks, government's social security measures, rural and agricultural advancements, and regulatory incentives and initiatives promoting inclusivity. The forecast period will also witness major trends including digital transformation and insurtech, partnerships with fintech and telecom businesses, parametric insurance solutions, pay-per-use and on-demand insurance, and the application of blockchain for improved transparency and trust.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=13155

What Are the Major Segments in the Microinsurance Market?

The microinsurance market covered in this report is segmented -

1) By Product Type: Property Insurance, Health Insurance, Life Insurance, Index Insurance, Accidental Death And Disability Insurance, Other Product Type

2) By Model Type: Partner Agent Model, Full-Service Model, Provider Driven Model, Other Model Types

3) By Provider: Microinsurance (Commercially Viable), Microinsurance Through Aid Or Government Support

4) By End-User: Business, Personal

Subsegments:

1) By Property Insurance: Homeowners Insurance, Renters Insurance, Agricultural Insurance

2) By Health Insurance: Outpatient Coverage, Inpatient Coverage, Critical Illness Coverage

3) By Life Insurance: Term Life Insurance, Whole Life Insurance, Burial Insurance

4) By Index Insurance: Weather Index Insurance, Crop Index Insurance

5) By Accidental Death And Disability Insurance: Accidental Death Coverage, Total And Partial Disability Coverage

6) By Other Product Types: Travel Insurance, Community-Based Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13155&type=smp

What Are The Driving Microinsurance Market Evolution?

The microinsurance market is poised for growth, spurred by heightened government initiatives aimed at advocating for microinsurance. Typically, these initiatives include specific activities, strategies, or policies carried out by the government to rectify prevailing issues, drive particular goals, or to catalyze desired outcomes within a sector or the broader society. Microinsurance, known for its myriad advantages, proves considerably beneficial to economically disadvantaged people and small businesses. To illustrate, in October 2022, a public finance institution based in the US, the UN Capital Development Fund (UNCDF), launched a new microinsurance scheme in Vanuatu. Catering to small-scale farmers, fishers, MSMEs, and the disabled, this product was developed as a shield against the harsh economic aftermath of severe weather incidents. It does so by ensuring swift financial assistance within 10-14 days after the occurrence of a natural catastrophe. For these reasons, ongoing government efforts are expected to stimulate the growth of the microinsurance market. There's a surging requirement for microinsurance among end-users, particularly micro-scale and small businesses, fuelling the expansion of the microinsurance market. These small to medium enterprises, marked by their specific employee count and revenue figures, are often susceptible to various risks, including natural calamities, accidents, and unpredictable market shifts. Microinsurance acts as a buffer, covering the costs related to these risks, thereby mitigating financial vulnerabilities. For example, the World Bank, an international financial institution based in the US, and the International Finance Corporation (IFC), a part of the World Bank Group, forecasted in 2023 that about 65 million firms and 40% of formal MSMEs in developing nations require financial assistance amounting to $5.2 trillion annually. This number is 1.4 times the existing level of worldwide MSME lending. Hence, the escalating demand for microinsurance from end-users, such as micro and small enterprises, is driving the microlending market.

Which Firms Dominate The Microinsurance Market Segments?

Major companies operating in the microinsurance market report are Berkshire Hathaway Inc., Ping An Insurance (Group) Company of China Ltd., Allianz SE, China Life Insurance Company Limited, Wells Fargo & Company, MetLife Inc., American International Group Inc., Liberty Mutual Holding Company Inc., Chubb Limited, Zurich Insurance Group, Aviva PLC, Aon PLC, SBI Life Insurance Company Ltd., ICICI Prudential Life Insurance Co. Ltd., Bharti AXA Life Insurance Company Ltd., Munich Re Group, National Insurance Company Limited, Tata AIA Life Insurance Company Limited, Banco do Nordeste Brasil S.A., HDFC Ergo General Insurance Company Limited, The Hollard Insurance Company Pty Ltd., Swiss Re Group, Bajaj Allianz Life Insurance Co. Ltd., Bandhan Bank Ltd., NSIA Insurance Ltd., CLIMBS Life and General Insurance Cooperative, Protecta Insurance New Zealand, MicroEnsure Holdings Limited, MetLife Services and Solutions LLC, afpgen.com.ph

What Trends Are Expected to Dominate the Microinsurance Market in the Next 5 Years?

The microinsurance market is witnessing a transformation as leading companies opt for strategic alliances to extend superior coverage and accessibility to those who are often neglected. The objective is to form a specialized collective emphasis on microinsurance and agricultural insurance. Such initiatives aim at effective resource mobilization, risk management, and retaining premiums within Africa, catering to the specific requirements of agricultural communities that are frequently exposed to financial uncertainty due to climate-induced hazards. An instance of this occurred in October 2024, when the Microinsurance Network (MiN), headquartered in Luxembourg, joined forces with the African Insurance Organisation, based out of Cameroon. This joint effort has given rise to the inception of the AIO Microinsurance Working Group (AIO MWG). With additional resources and expertise offered by the ILO's Impact Insurance Facility, this alliance aims at expanding the availability of feasible insurance products, thereby promoting financial inclusion throughout Africa.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/microinsurance-global-market-report

Which Is The Largest Region In The Microinsurance Market?

Asia-Pacific was the largest region in the microinsurance market in 2024. The regions covered in the microinsurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Microinsurance Market?

2. What is the CAGR expected in the Microinsurance Market?

3. What Are the Key Innovations Transforming the Microinsurance Industry?

4. Which Region Is Leading the Microinsurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Government Initiatives Fueling Growth In The Microinsurance Market: A Significant Driver Propelling The Microinsurance Market In 2025 here

News-ID: 4027413 • Views: …

More Releases from The Business Research Company

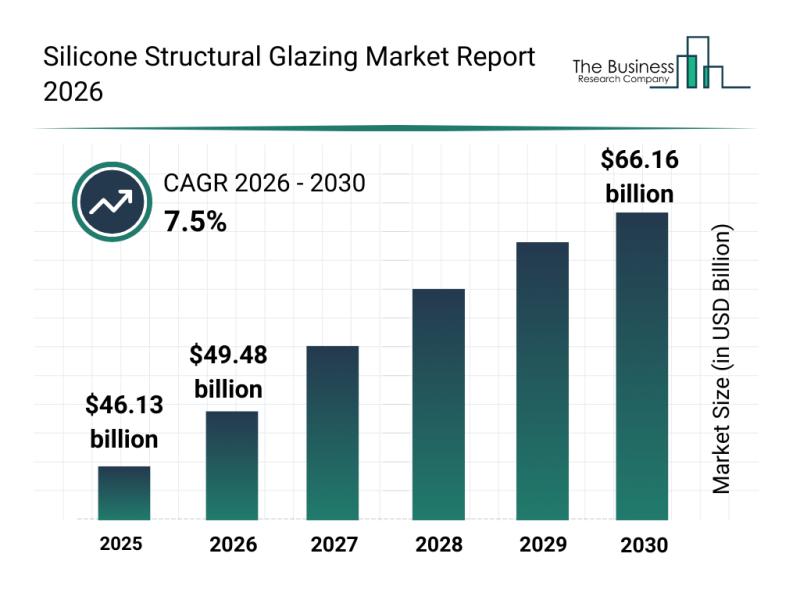

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

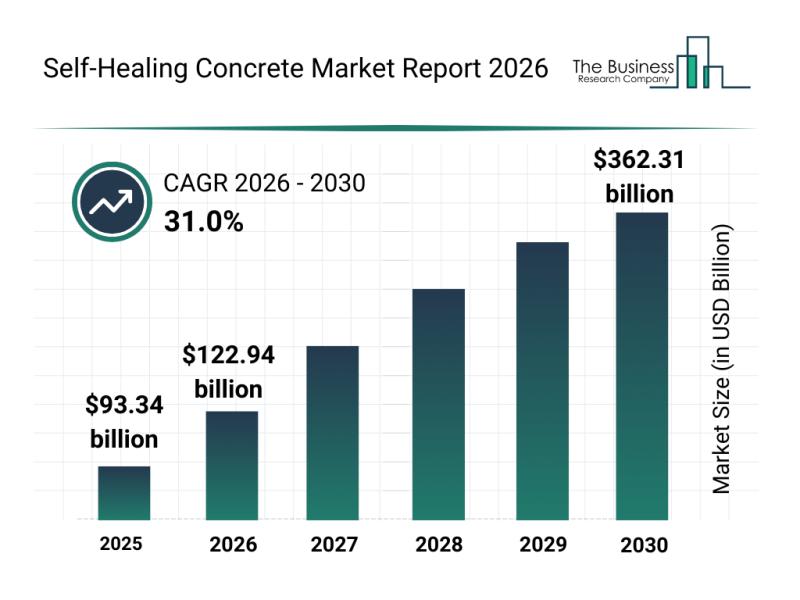

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

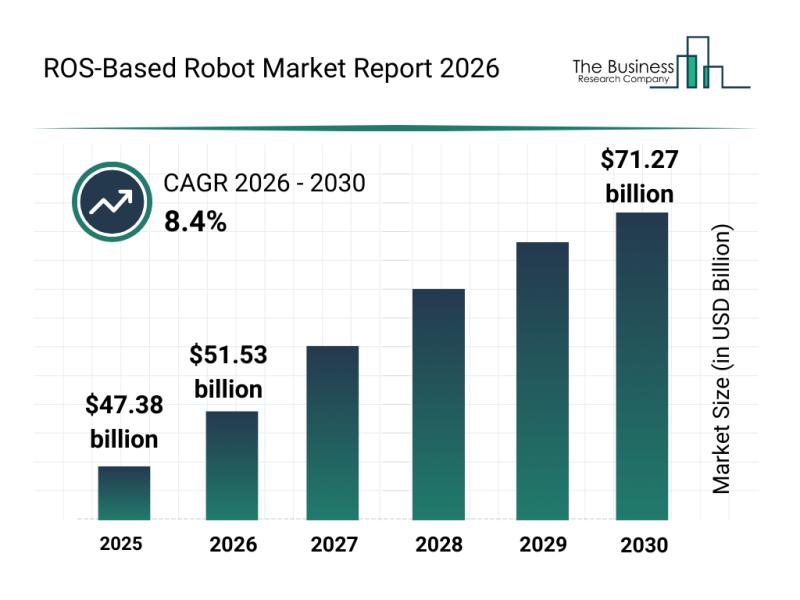

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

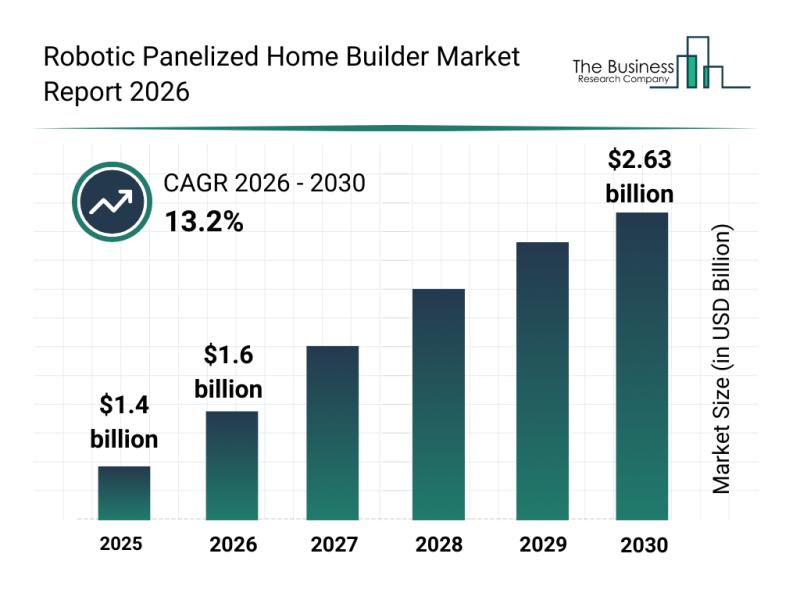

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…