Press release

Global Tax Preparation Services Market Size is projected to reach of US$ 44.7 Billion by 2033

The global tax preparation services market is expected to be worth US$ 28.2 billion in fiscal year 2023, up from US$ 27.0 billion in fiscal year 2022. From 2022 to 2032, the market is expected to grow at a 4.7% CAGR, reaching a value of US$ 44.7 billion by the end of 2033.The Tax Preparation Services Market is a vital component of the financial services industry, providing individuals and businesses with assistance in navigating the complexities of tax regulations. This report aims to provide a comprehensive overview of the market, including key trends, challenges, and opportunities.

Tax preparation services involve the process of preparing and filing tax returns on behalf of individuals and businesses. As tax regulations continue to evolve and become more complex, the demand for professional assistance in tax preparation has grown significantly.

Download Sample Copy of This Report@ https://www.factmr.com/connectus/sample?flag=S&rep_id=8353

Top Key Players are:

415 Group, A Dowl Knight CPA, BDO USA, LLP, CapActix Business Solutions, Deloitte, Entigrity Solutions LLC, Ernst & Young, Franchise Group, Inc., H&R Block, Invensis Inc., Jackson Hewitt Tax Services, KPMG, PwC, RSM US, Ryan LLC, TurboTax Live

Market Dynamics:

Market Drivers:

Increasing Complexity of Tax Regulations: Continuous changes in tax laws necessitate professional assistance for accurate and compliant filings.

Growing Number of Small Businesses: The rise of entrepreneurship has led to an increased demand for tax services among small and medium-sized enterprises.

Technological Advancements: The adoption of technology in tax preparation services has improved efficiency and accuracy.

Market Challenges:

Regulatory Compliance: Keeping abreast of changing tax laws and ensuring compliance poses a significant challenge.

Competition: The market is highly competitive, with numerous players vying for market share.

Security Concerns: With the handling of sensitive financial information, security is a paramount concern for both service providers and clients.

Looking for A customization report click here@ https://www.factmr.com/connectus/sample?flag=RC&rep_id=8353

Market Segmentation:

By Service Type:

Individual Tax Preparation

Business Tax Preparation

Estate and Trust Tax Preparation

Other Specialized Services

By End User:

Individuals

Small and Medium-sized Enterprises (SMEs)

Large Enterprises

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Competitive Landscape:

The Tax Preparation Services Market is highly fragmented, with numerous local and global players. Key players include established accounting firms, independent tax professionals, and software-based service providers. Market competition is driven by factors such as reputation, service offerings, and pricing.

Technology Trends:

Automation and Artificial Intelligence (AI):

Automation of routine tasks such as data entry and calculations enhances efficiency.

AI-powered tools assist in analyzing tax codes and optimizing deductions.

Cloud-based Solutions:

Cloud platforms enable secure storage and easy access to financial data, fostering collaboration between clients and service providers.

Get Full Access of This Premium Report@ https://www.factmr.com/checkout/8353

Future Outlook:

The Tax Preparation Services Market is expected to witness sustained growth due to ongoing changes in tax regulations, the rise of digitalization, and the increasing complexity of financial transactions. The adoption of advanced technologies and the incorporation of data analytics are likely to shape the future of the market.

In conclusion, the Tax Preparation Services Market plays a crucial role in facilitating compliance with ever-changing tax regulations. As businesses and individuals seek professional assistance to navigate the complexities of taxation, the market is poised for continuous growth. Adapting to technological advancements and addressing challenges such as regulatory compliance and security concerns will be essential for stakeholders in this dynamic industry.

About Fact.MR:

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Tax Preparation Services Market Size is projected to reach of US$ 44.7 Billion by 2033 here

News-ID: 3289599 • Views: …

More Releases from Fact.MR

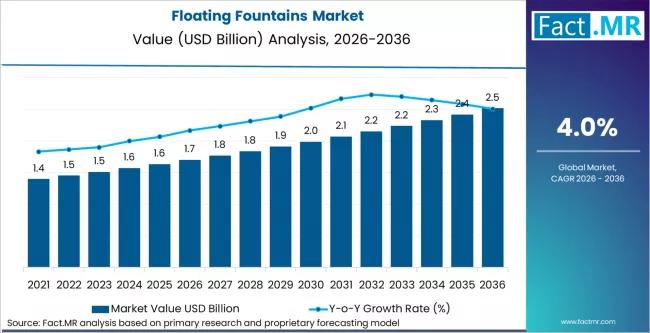

Floating Fountains Market is Projected to Grow to USD 1.7 billion in 2026 and US …

The global Floating Fountains Market is poised for steady expansion over the next decade as demand rises for experiential urban landscapes, recreational water features, and architectural enhancements in commercial and public spaces.

Market analysts estimate that the floating fountains market, valued at approximately USD 410 million in 2025, is expected to reach nearly USD 780 million by 2035, exhibiting a compound annual growth rate (CAGR) of around 6.8% during the…

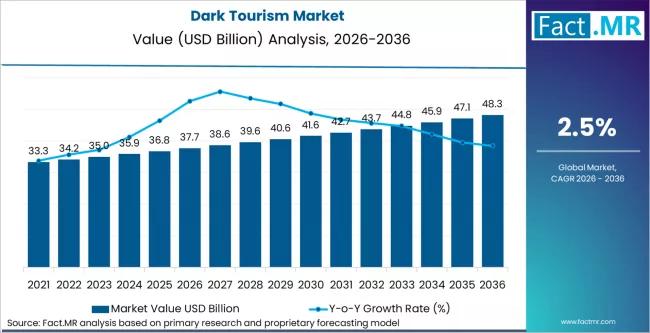

Dark Tourism Market is Estimated to Grow to USD 37.7 Billion in 2026 and USD 46. …

The global dark tourism market is projected to grow from USD 31.8 billion in 2026 to approximately USD 42.1 billion by 2036. This growth reflects a compound annual growth rate (CAGR) of 2.8% over the ten-year forecast period.

The market is being driven by a shift in traveler psychology toward "transformative" and educational experiences, moving away from traditional leisure to engage with history, tragedy, and human resilience.

Get Access of Report…

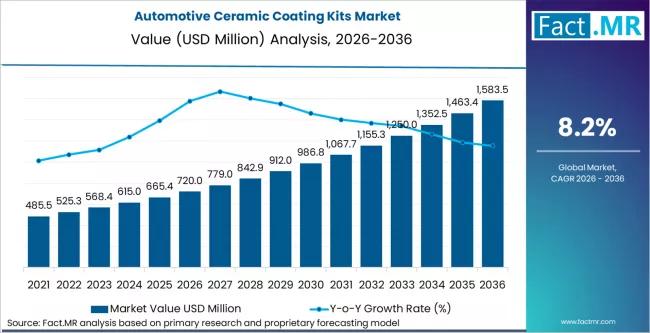

Automotive Ceramic Coating Kits Market CAGR Projected at a 8.2% by

The global Automotive Ceramic Coating Kits Market is poised for steady expansion over the next decade as vehicle owners increasingly adopt advanced surface protection solutions for aesthetics, durability, and long-term maintenance.

Market analysts estimate that the automotive ceramic coating kits market, valued at approximately USD 710 million in 2025, is projected to reach nearly USD 1.55 billion by 2035, registering a compound annual growth rate (CAGR) of about 8.1% during…

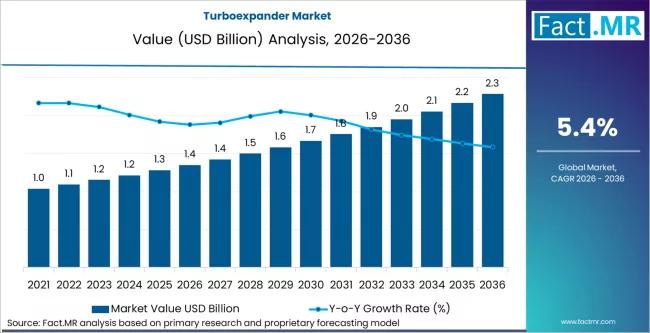

Turboexpander Market is estimated to reach Around USD 1.35 Billion in 2026 | Fac …

The global turboexpander market is projected to grow from USD 1.37 billion in 2026 to approximately USD 2.32 billion by 2036. This growth reflects a steady compound annual growth rate (CAGR) of 5.4% over the ten-year forecast period.

The market is increasingly driven by the expansion of Liquefied Natural Gas (LNG) infrastructure and a global industrial pivot toward energy recovery and waste-heat monetization.

Get Access of Report Sample: https://www.factmr.com/connectus/sample?flag=S&rep_id=14350

Quick Stats:

Market size…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…