Press release

Real-Time Payments Market Demand, Insights and Forecast Up to 2032

The real-time payments market is expected to garner a market value of US$ 16 Billion in 2022, and is likely to register a positive CAGR of 33% in the forecast period 2022-2032 and reach a value of US$ 277.09 Billion.Real-time payments, characterized by instantaneous, 24/7 electronic fund transfers, have transformed the financial landscape globally. This market's rapid growth is fueled by the need for faster, more efficient payment solutions in an increasingly digitalized economy. This research report provides a comprehensive analysis of the Real-Time Payments Market, exploring key trends, drivers, challenges, and future prospects.

Download Sample Copy of This Report@ https://www.factmr.com/connectus/sample?flag=S&rep_id=7091

Real-time payments represent a paradigm shift in the way individuals, businesses, and financial institutions conduct transactions. Enabled by advanced payment systems and technologies, real-time payments offer speed, convenience, and enhanced customer experiences. The global Real-Time Payments Market is driven by factors such as the digitization of financial services, changing consumer expectations, and regulatory initiatives promoting faster payments.

This research aims to analyze the Real-Time Payments Market, examining factors influencing its growth, key market players, and emerging trends. The report provides insights into market dynamics, challenges, and opportunities, catering to financial institutions, payment service providers, and other stakeholders in the financial technology sector.

Market Dynamics

Drivers

Consumer Demand for Instantaneous Transactions: Changing consumer expectations and the desire for instant gratification drive the demand for real-time payment solutions.

Advancements in Payment Technologies: Ongoing advancements in payment technologies, including blockchain and application programming interfaces (APIs), contribute to the growth of real-time payments.

Regulatory Initiatives: Regulatory bodies globally are pushing for faster and more efficient payment systems to promote financial inclusion and innovation.

Looking for A customization report click here@ https://www.factmr.com/connectus/sample?flag=RC&rep_id=7091

Restraints

Security Concerns: The need to ensure robust security measures and compliance with regulatory standards poses challenges for real-time payment providers.

Infrastructure Readiness: The implementation of real-time payment systems requires significant infrastructure upgrades, which can be a barrier for some financial institutions.

Opportunities

Cross-Border Real-Time Payments: The expansion of real-time payment systems to facilitate cross-border transactions presents lucrative opportunities for market players.

Integration with Emerging Technologies: Integration with emerging technologies such as artificial intelligence and the Internet of Things (IoT) opens new avenues for innovation in real-time payments.

Market Segmentation

The Real-Time Payments Market can be segmented based on the type of payment, end-user, and geography.

By Type

Person-to-Person (P2P) Payments

Person-to-Business (P2B) Payments

Business-to-Person (B2P) Payments

Business-to-Business (B2B) Payments

By End-User

Financial Institutions

Payment Service Providers

Businesses

Consumers

By Geography

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Get Full Access of This Premium Report@ https://www.factmr.com/checkout/7091

Competitive Landscape

Key players in the Real-Time Payments Market include Visa Inc., Mastercard Incorporated, PayPal Holdings, Inc., and various financial technology startups. The competitive landscape is marked by strategic partnerships, mergers and acquisitions, and a focus on enhancing the security and efficiency of real-time payment systems.

Future Outlook

The Real-Time Payments Market is poised for continued expansion as digital transformation reshapes the financial services landscape. The future may see increased collaboration between traditional financial institutions and fintech companies, further innovation in payment technologies, and the development of standardized global real-time payment networks.

About Fact.MR:

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real-Time Payments Market Demand, Insights and Forecast Up to 2032 here

News-ID: 3287774 • Views: …

More Releases from Fact.MR

Citrus Fiber Market is Expanding at a 5.7% of CAGR by 2034 | Fact.MR Report

The global Citrus Fiber Market is projected to experience substantial growth over the next decade, driven by rising demand for clean-label ingredients, functional food components, and sustainable fiber sources.

Market analysts estimate that the market, valued at approximately USD 350 million in 2025, is expected to reach around USD 720 million by 2035, expanding at a compound annual growth rate (CAGR) of about 7.5% during the forecast period.

Get Access of…

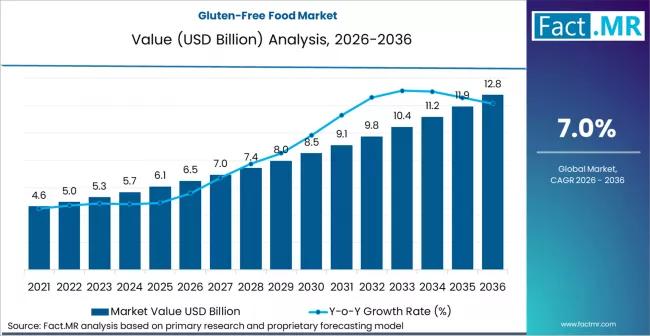

Gluten-Free Food Market is Predicted to Grow to USD 6.5 Billion in 2026 and USD …

The global gluten-free food market is entering a phase of mainstream consolidation, projected to grow from a valuation of USD 7.4 billion in 2026 to approximately USD 15.2 billion by 2036. This represents a steady compound annual growth rate (CAGR) of 7.5% over the ten-year forecast period.

While initially driven by medical necessity for celiac disease patients, the market is now being propelled by "lifestyle consumers" who perceive gluten-free products…

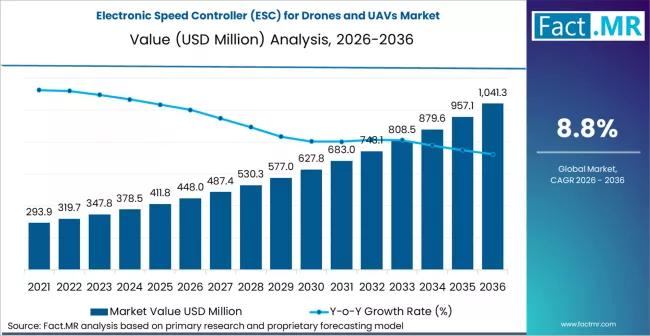

Electronic Speed Controller for Drones and UAVs Market is Valued USD 448.0 milli …

The global electronic speed controller (ESC) for drones and UAVs market is experiencing a rapid technological surge, projected to grow from a valuation of USD 1.8 billion in 2026 to approximately USD 5.1 billion by 2036. This represents a strong compound annual growth rate (CAGR) of 11.0% over the ten-year forecast period.

The market is being propelled by the proliferation of long-endurance commercial drones, the militarization of small FPV (First…

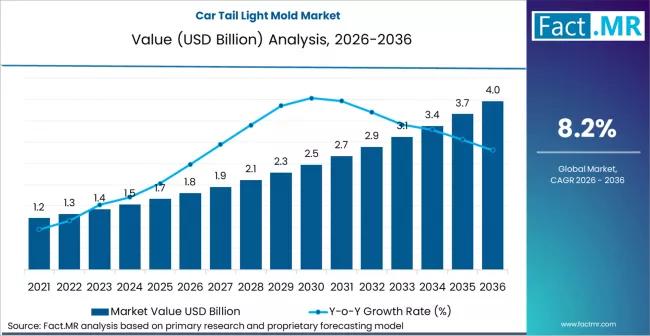

Car Tail Light Mold Market is Hoped-for USD 3.6 billion by 2036 | Fact.MR Report

The global car tail light mold market is navigating a high-design era, projected to grow from a valuation of USD 1.4 billion in 2026 to approximately USD 2.6 billion by 2036. This represents a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The market is being fundamentally reshaped by the transition from simple bulbs to complex LED and OLED signatures, requiring high-precision multi-color and multi-material injection molding…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…