Press release

Microinsurance Market 2023-2028: Industry Size, Growth, Trends, Future Outlook, and Forecast

According to the latest report by IMARC Group, titled "Microinsurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028," provides an extensive analysis of the industry, including microinsurance market size, share, trends, and growth opportunities. The report also covers competitor and regional analysis and the latest advancements in the global market. The global microinsurance market size reached US$ 83.7 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 118.8 Billion by 2028, exhibiting a growth rate (CAGR) of 5.80% during 2023-2028.Get Sample Copy of Report at - https://www.imarcgroup.com/microinsurance-market/requestsample

Microinsurance Market Overview:

Microinsurance is a specialized financial service designed to provide protection for low-income individuals and small businesses against specific risks. It is tailored to meet the needs of underserved communities. It offers coverage for health, life, agriculture, and other essential areas at an affordable cost. It is developed with simpler terms and conditions to accommodate the unique needs of those who may need access to traditional insurance products. By safeguarding against unforeseen events and financial shocks, microinsurance enables vulnerable populations to maintain stability and continue their economic activities. It is increasingly utilized in developing regions, empowering people to invest in their futures without the fear of devastating loss. Microinsurance represents a critical tool for financial inclusion, bridging the gap between conventional insurance and the requirements of low-income sectors.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/microinsurance-market

Microinsurance Market Demand:

The global microinsurance market is witnessing robust growth, driven by the increased awareness of financial protection among marginalized populations and the strong governmental push for financial inclusion. Moreover, the growing collaboration between microfinance institutions, insurance companies, and governmental bodies has enhanced the availability and accessibility of these products, further boosting market expansion. Along with this, technology also plays a pivotal role, with mobile banking and digital platforms simplifying the acquisition and management of microinsurance. In addition, the rise in natural disasters and climate-related risks has elevated the need for affordable insurance solutions in vulnerable regions, propelling market growth. Apart from this, the emergence of innovative, customized products that align with local needs and cultural sensibilities is fostering acceptance and adoption. Furthermore, significant advancement in financial services, offering protection and empowerment, is creating a positive market outlook.

Key Market Segmentation:

Breakup by Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Breakup by Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Breakup by Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

Breakup by Region:

• North America (United States, Canada)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Competitive Landscape:

The report has also analyzed the competitive landscape of the market along with the profiles of the key players.

Key Highlights of the Report:

• Market Performance

• Market Outlook

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Browse More Reports:

• Low GWP Refrigerant Market: https://www.imarcgroup.com/low-gwp-refrigerant-market

• Green Packaging Market: https://www.imarcgroup.com/green-packaging-market

• Smart Lock Market: https://www.imarcgroup.com/smart-lock-market

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market 2023-2028: Industry Size, Growth, Trends, Future Outlook, and Forecast here

News-ID: 3175807 • Views: …

More Releases from IMARC Group

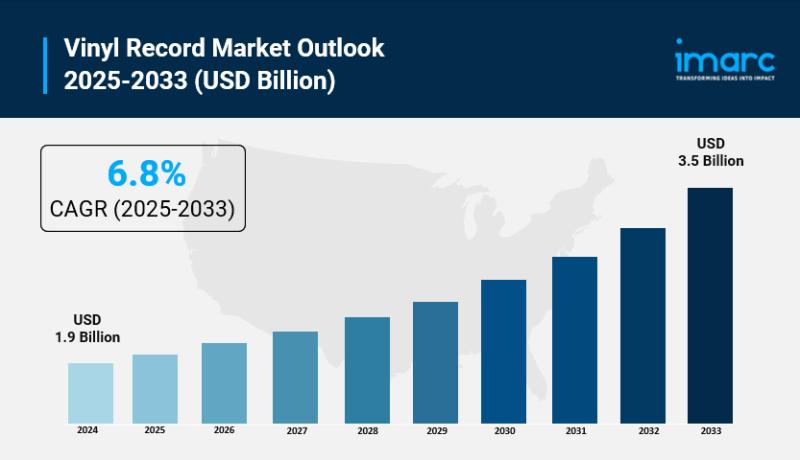

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

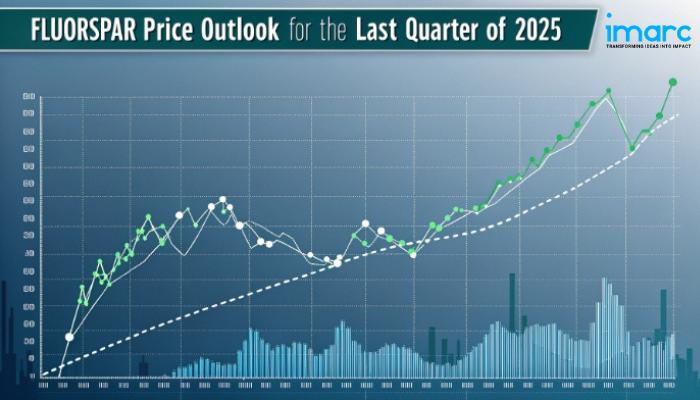

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

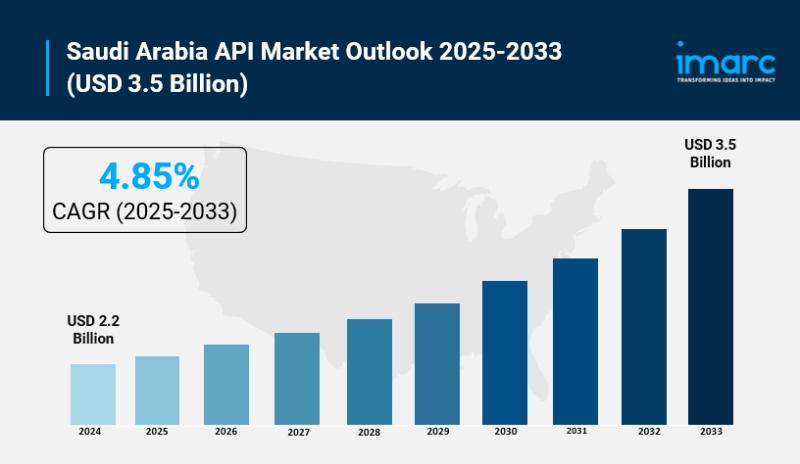

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…