Press release

BRAZILIAN ETHANOL FUTURES TRADE DOWN 56% IN 2007

Ethanol futures trade on the Brazilian Mercantile and Futures Exchange (BM&F) is down 56% in 2007 compared to the same period in 2006, a recent study of Ethanol Statistics shows. From January through July, approximately 212,610 cubic metres of ethanol was traded on the exchange, compared to 485,430 cubic metres in 2006.Because of the harvest season in Brazil’s main production region, the centre-south, the months May through September are historically a strong trading period. The first three months of this period, however, show unpromising results: 3,325 contracts traded, compared to 11,213 in 2006.

Ethanol Statistics provides more background on this story in its exclusive news section. Please click the link below to read the full article.

http://www.ethanolstatistics.com/Ethanol_News/Exclusive/Brazilian_Ethanol_Futures_Trade_Down_02102007.aspx

Ethanol Statistics

Tweelingenstraat 135

3318BT Dordrecht

The Netherlands

Contact:

Rob Penne

r.penne@ethanolstatistics.com

+31 6 5432 5588

Ethanol Statistics is a market research and business information publisher established in the Netherlands. It offers the industry a new online source of reliable and comprehensive information on the ethanol industry and industries related to it. On a daily basis, it provides important industry insights through its products and services. Features include global ethanol news, global commodity prices, industry reports and several other features.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BRAZILIAN ETHANOL FUTURES TRADE DOWN 56% IN 2007 here

News-ID: 29670 • Views: …

More Releases from Ethanol Statistics

European fuel ethanol association eBIO assesses the most controversial biofuel i …

In its bi-monthly market commentary at Ethanol Statistics, European fuel ethanol association eBIO tackles the most controversial issues in the decision-making process on EU biofuels legislation.

The debate in the European Union on crucial legislation for the biofuel industry is entering a decisive phase. A number of sensitive issues still need to be resolved. Putting aside all the nitty-gritty there are 2 major items left, according to eBIO, which are…

Ethanol Statistics now offers a 15% discount on the Monthly Market Review

Companies and professionals that are active in the Ethanol Industry, whether it is in production, R&D, financial services, chemicals, storage and transportation or otherwise, can now get a 15% introductory discount if they subscribe to the Ethanol Statistics – Monthly Market Review before June 1st.

The Monthly Market Review (or MMR) provides professionals in the ethanol industry with the latest industry news, conveniently sorted by region; comprehensive price analyses of…

Cellulosic ethanol development is partly underfunded

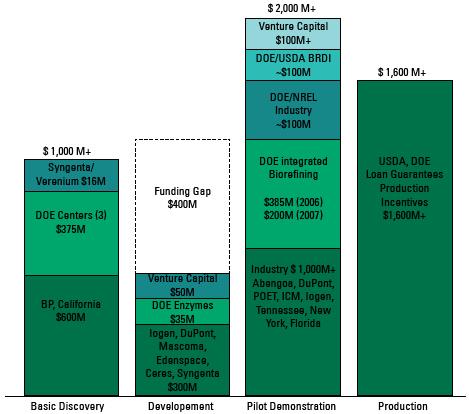

The product development phase in cellulosic ethanol research and development is relatively underfunded compared to other phases. That is the conclusion of the cellulosic ethanol focused analysis section in the march edition of the Ethanol Statistics – Monthly Market review.

The analysis identifies roughly three development stages prior to commercial-scale production: (1) Basic discovery and R&D, (2) Product development and (3) Pilot/Demonstration plants. Figure 1 visualizes the funding gap that…

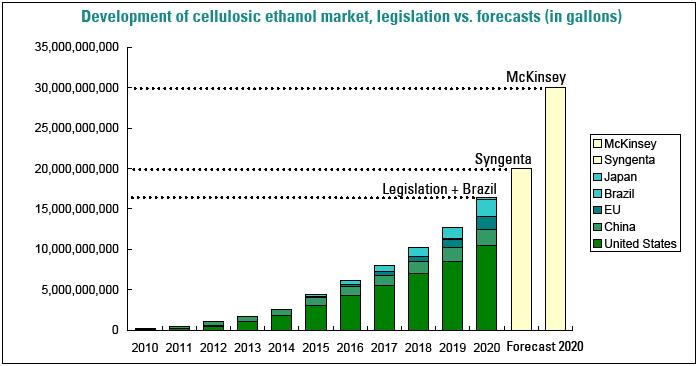

Worldwide cellulosic ethanol production in 2020 at least 16.5 billion gallons

The worldwide production of cellulosic ethanol will amount to at least 16.5 billion gallons in 2020, if the targets set in the United States, China, Europe, Japan and Brazil are achieved.

Based on currently proposed and signed legislation, the United States would account for over 63.9% of that market, while the EU and China would account for 10.4 and 11.5% respectively. Although Brazil doesn’t have any official legislation on cellulosic…

More Releases for Brazilian

Brazilian Real Estate Soars Globally

Obelisk International News, Marbella, Spain, January 24 2012. On the back of strong economic growth and big demand drivers, Brazilian real estate ranks among global leaders for foreign investors. Brazilian property is placed as top emerging market for investment and second for capital appreciation.

The 20th annual survey from the Association of Foreign Investors in Real Estate (AFIRE) finds that “globally, Brazil soars”. For survey respondents, investment in Brazilian real estate…

The Power of Brazilian Investment

Obelisk International News, Marbella, January 17 2012. 2012 gets off to a flying start for investments in Brazil. The news that Brazil now ranks as the world’s sixth largest economy confirms the potential for Brazilian investment opportunities.

Strong economic growth over the last two years has pushed Brazil up global rankings during 2010 and 2011. This coupled with a poor performance in many European countries means Brazil has overtaken the UK…

Brazilian Investment Beats Crisis

Obelisk International News, Marbella, Spain, October 24 2011. With most of Europe in financial and economic straits, Brazil beckons as the place for investment opportunities. The country is well set to weather the global crisis and may even benefit from it, a huge plus for Brazilian investments.

Based on Moody’s latest comments on the Brazilian economy, the Financial Times (FT) blog beyondbrics claims Brazil is the best place to beat the…

Brazilian Investment Confidence Grows

Confidence in Brazilian investments continues to grow. Both Brazilian executives and foreign investors are bullish on the prospects for investment in Brazil.

Ernst & Young’s latest Capital Confidence Barometer for Brazil finds the majority of survey respondents optimistic about the immediate future for investments in Brazil. Published last month, the Barometer summarises survey replies from over 1,000 executives.

More Pluses Than Minuses

In the Perspectives section, the Barometer lists the reasons behind the…

Middle Classes Dominate Brazilian Investments

The changing face of the Brazilian middle class brings new challenges to domestic and foreign investment in Brazil. Once content with cheap promotions, the middle class is now more discerning and looking for quality.

This search for better products affects consumer goods across the board. From laptops to real estate, Brazilian middle class (known as Class C) is going for quality over price. Until now, they were content with cheap offers,…

Brazilian Investment Figures for 2010

Official economic figures for last year show key areas for investment in Brazil were civil construction, household consumption and agriculture. All three registered high growth, confirming the potential for Brazilian investment.

GDP growth in Brazil during 2010 reached 7.5%, the highest level since 1985. This translates into an average increase in GDP of 4.5% a year since 2002 and confirms that Brazil has left the worldwide economic crisis far behind. In…