Press release

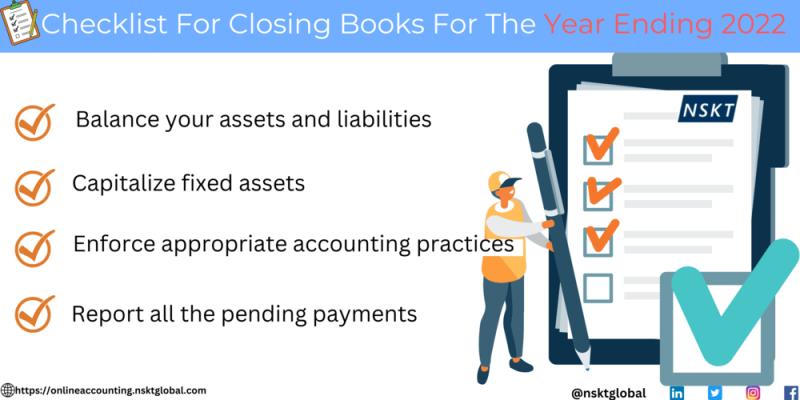

Checklist for closing books for the year ending 2022

As the end of the tax year approaches and the deadline for filing taxes close up on American Taxpayers, they must start planning their tax returns. To do so accurately, taxpayers must gather all their accounts and documents containing information regarding transactions carried out throughout the year. Doing this will allow you to maximize your tax returns and lower your tax bills, therefore ensuring that you are not entitled to fines for inaccurately reporting your finances. Let us cover all the practices you must abide by, by listing them in the form of several checklists.Year-end Balance Sheet checklist:

Balance your assets and liabilities:

You must balance your assets and liabilities before you file your taxes. To ensure that your balance sheet checklist is in order, perform a reconciliation of all bank statements, including credit card, cash, and loan accounts, by the end of the year. It would be best if you accounted for all the ins and outs of your bank account, and business expenses, including the ones that are yet to be processed. It is also essential for your business, in case you carry out business on an accrual basis, that all accounts payable and invoices raised for customers be documented.

Capitalize fixed assets: It is important for taxpayers to ensure that they capitalize on all their fixed assets following the capitalization policy that applies to them. The expenses that fixed assets are capitalized properly and tax returns are maximized, account for expenses such as

The acquisition price

Any commission paid for the acquisition

Legal fees, survey costs

Unpaid taxes for the asset and the cost of removing unwanted elements from the asset

Cost of repairing and maintenance of the property under consideration

Enforce appropriate accounting practices: Ensuring that no transaction is documented twice in the books and accounting for all loan premiums correctly will ensure an accurate representation of a company's finances, ensuring that you clear your tax bills well within the deadline and maximize your tax returns.

Ensure that bad debts are accounted for: To ensure that taxpayers do not end up paying taxes for income that they are yet to receive or about to write off as bad debt, they must also check out the accounts receivable aging. You must report the lousy debt your business has incurred, write it off, or send the debt details to a collection agency before you file your tax returns.

Balance out loans: You need to ensure that your loans are in line with your balance sheet and that you have mentioned all applicable interests and premiums as expenses while filing your tax returns.

Report all the pending payments: If you run your business mostly on cash, it is important that you enter the checks that are written in December but are yet to be cleared before you file for tax returns. However, if your accounting is done on an accrual basis, you should account for all the payable accounts and customer invoices. This ensures that all your expenses and income in a year are accounted for.

Miscellaneous: Record your outstanding PPP loan, and ensure that an accurate balance is established between your payroll liabilities, as well as December Sales taxes and the payments you make in January. While calculating the tax returns you are entitled to, you must remember to account for your receivable Employee Retention credits.

Year-end Profit & Loss checklist for taxpayers;

Ensure appropriate accounting of revenues: Make sure that your revenue accounts are in line, and check for any negative revenues that need to be documented in the individual business expense accounts. One must also consider whether they must be accounted for as a discount or cost of goods sold. You must also account for any grant, income, or receipts related to Covid-19, as they are tax-exempt on all levels.

Compare your new statement with the old ones: You must compare the old profit and loss statements to the current one to ensure that they are accurate and the ratios are balanced. It would help if you also compared the cost of goods sold for the current year and different months within the year with older ones to ensure that they are reasonable. Calculate business expenses as a percentage of the revenue and observe if the percentages seem somewhat comparable. If they vary vastly, you must check your calculations or your cash flow for errors. A comparison of statements can help you detect anomalies, that can help you obtain the tax returns you are eligible for.

Miscellaneous: While closing your books, you must remember that a purchase expense over $2,500 counts as a fixed asset. If you buy three pieces of equipment, and none are individually worth over $2,500, they still count as expenses. It is also suggested that you skim through your uncategorized and miscellaneous incomes and expenses to code them appropriately unless they are minuscule enough to be ignored.

Review your charitable donations: You need to review your sponsorships and promotional expenses and categorize them under advertisement expenses, as they are not charitable deductions. Only when you donate to a qualifying NGO can you mention your donations as a deductible while filing your taxes. You cannot list advertisement expenses, considered business expenses, as tax-deductible!

Handle your forms correctly:

Gather all the 1099 forms you have received, and compare the amount mentioned on them, with your revenue accounts. In case there are vendors that are eligible for a 1099 from you, make sure that you have a 1099-S. Get your W-2s and W-3s that are to be copied and sent to your Social Security Administrator, and employees.

Checklist for Year-end data if you use accounting software:

Back your data up, off the grid: If you use accounting software to calculate and file your taxes, it would be wise to back up your data off the internet if you still need to back up your data throughout the year. Losing your account data can be a big issue if you have yet to file your tax returns.

Set up a closing account password: If your accounting software requires you to close your accounts manually, you must set a closing account password to ensure that your previous year's records and revenue accounts cannot be modified without authorization.

Retain your documents for the future: It is a good practice to retain a digital and a physical copy of all your documents related to income and expenses so that you can refer to them if clarification is needed. Filing amended tax returns also becomes more convenient for taxpayers if they retain digital copies of their documents.

It is suggested that you follow these checklists, to ensure that everything is accounted for and that you are not missing out on possible deductions or tax returns. If you fail to report an income, that you have not recorded in your books either, you might have to pay penalty charges to the IRS as well. Therefore, it is very important for you to close your financial books accurately. However, you can take this burden off your shoulder by hiring professionals to handle your accounts. NSKT Global specializes in providing accounting and tax services to its clients. NSKT Global houses a skilled and experienced workforce, guaranteed to perform accurate accounting and tax filing practices for their clients. Click here, and learn how you could benefit by letting NSKT Global handle your taxes and accounts!

Charlotte City Center 25 North Tryon Street Suite 1600, Charlotte North Carolina, 28202

NSKT Global, is a Global consulting firm with a team of certified public accountants, certified fraud examiners (CFE), certified Sarbanes Oxley experts (CSOE), Business Advisers, Internal Auditors, Data Scientist and IT experts. We extend all kinds of help to our clients and assist them at all possible junctures of their business. We love to work collaboratively with like-minded people who challenge the process and make a difference.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Checklist for closing books for the year ending 2022 here

News-ID: 2831932 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

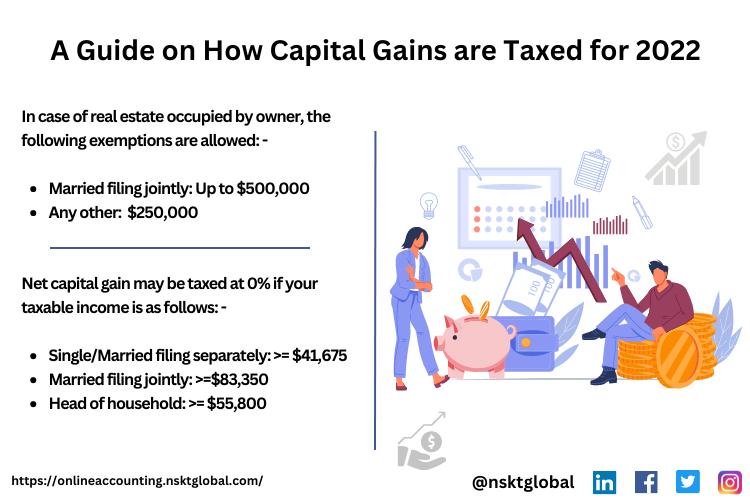

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

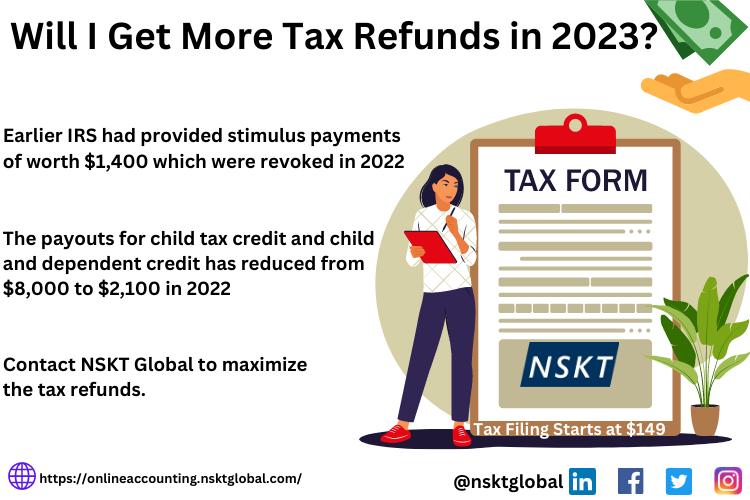

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Balance

True Relief Blood Balance

True Relief Blood Balance is an all-natural supplement formulated to support healthy blood sugar levels. It's made with a blend of herbs, minerals, and nutrients known for their ability to regulate blood sugar, improve metabolism, and boost overall energy levels.

The supplement claims to target the root causes of blood sugar imbalances rather than just masking the symptoms. By taking True Relief Blood Balance regularly, users are encouraged to experience improved…

Key Balance Shafts Market Trend for 2025-2034: Emergence Of Specialized Balance …

"What Is the Future Outlook for the Balance Shafts Market's Size and Growth Rate?

The balance shafts market has grown strongly in recent years, expected to expand from $14 billion in 2024 to $14.9 billion in 2025, with a CAGR of 6.4%. Growth has been driven by the automotive industry's expansion, a focus on engine performance, stringent emission standards, consumer demand for a smooth driving experience, and increased implementation in high-performance…

VitaFlow Blood Sugar Balance

Managing blood sugar levels is crucial for a balanced life, yet it can be challenging with modern diets and lifestyle. That's where VitaFlow Blood Sugar Balance steps in. This supplement aims to offer a natural way to keep blood sugar levels in check, supporting your body's ability to maintain a healthy range. But does it really work? This in-depth review explores VitaFlow Blood Sugar Balance, including its benefits, ingredients, how…

Tire Balance Global Market Report 2024 - Tire Balance Market Size And Share By 2 …

"The Business Research Company recently released a comprehensive report on the Global Tire Balance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The tire balance market…

Inner Balance Wear Launches Groundbreaking Wellness Device: The Inner Balance Wa …

Image: https://www.getnews.info/wp-content/uploads/2024/06/1719499445.png

Founded initially as a wellness apparel company, Inner Balance Wear has evolved and rebranded as a leading innovator in wearable technology. Our innovative product, the Inner Balance Watch, utilizes vibrational frequencies. These frequencies, which are unique to each individual, can be adjusted to enhance well-being and manifest personal and professional goals.

Toronto - June 27, 2024 - Inner Balance Wear Inc. is excited to announce the launch of the Inner…

Blood Balance Australia Reviews [Fraud Exposed Warning 2023] Check Truth Blood S …

Blood Balance is a nutritional supplement developed by Botanicals that helps manage sugar and blood pressure and improves blood flow. It is a Blood Balance supplement that has gained a lot of popularity in recent times.

(Special Discount) Purchase Blood Balance for a low Cost -https://bit.ly/BotanicalsBloodBalanceChemistWarehouse

It is however sold in a variety of countries, including the US, CA, UK Australia, and many more.

What exactly is Blood Balance?

It is the Blood Balance…